Indiana Model Notice of Blackout Periods under Individual Account Plans

Description

How to fill out Model Notice Of Blackout Periods Under Individual Account Plans?

Choosing the best legitimate file design might be a have a problem. Obviously, there are tons of templates available on the net, but how can you obtain the legitimate type you will need? Make use of the US Legal Forms internet site. The support offers a huge number of templates, such as the Indiana Model Notice of Blackout Periods under Individual Account Plans, that can be used for business and personal requires. All the varieties are checked out by pros and meet up with federal and state needs.

If you are presently registered, log in for your account and then click the Download switch to obtain the Indiana Model Notice of Blackout Periods under Individual Account Plans. Use your account to check through the legitimate varieties you possess ordered earlier. Check out the My Forms tab of your respective account and have one more copy of your file you will need.

If you are a whole new consumer of US Legal Forms, listed here are basic recommendations so that you can follow:

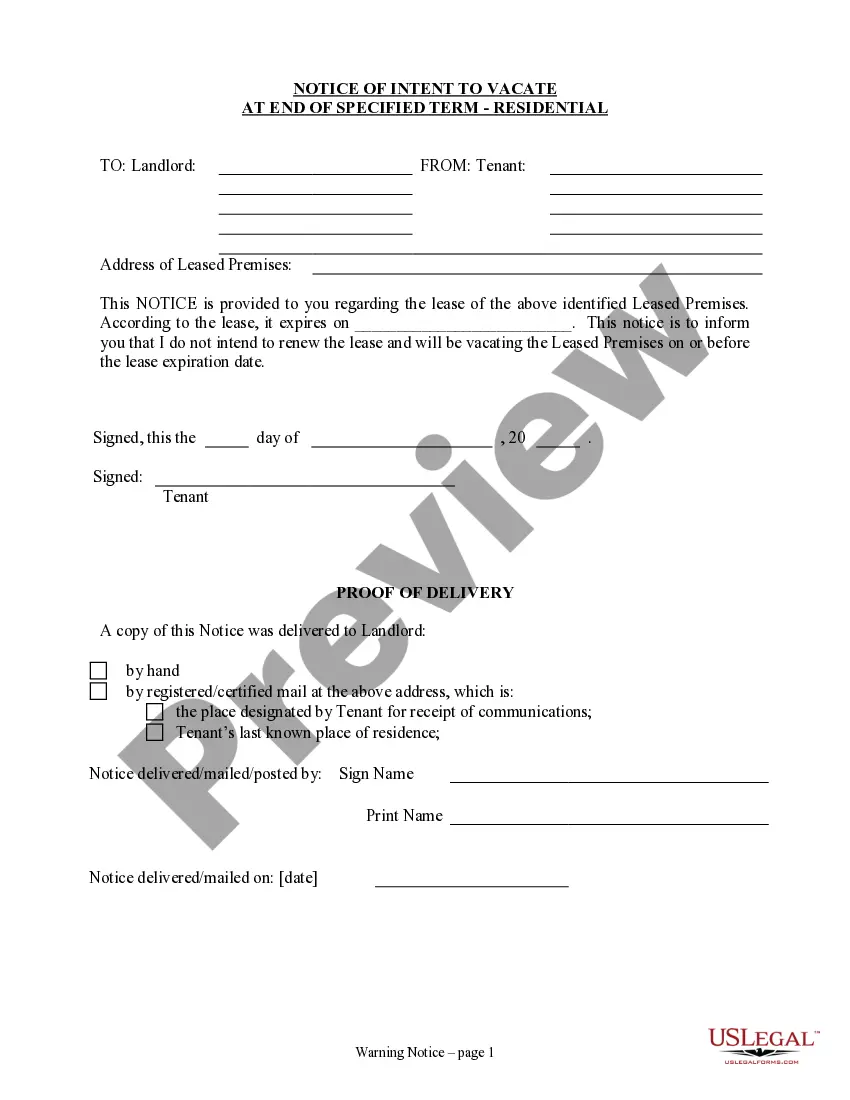

- Initial, make sure you have selected the right type to your town/county. You may look over the form making use of the Review switch and study the form information to guarantee this is the best for you.

- In case the type will not meet up with your requirements, utilize the Seach area to discover the appropriate type.

- Once you are positive that the form is suitable, click the Get now switch to obtain the type.

- Pick the costs plan you need and enter in the needed information and facts. Build your account and pay money for an order utilizing your PayPal account or Visa or Mastercard.

- Opt for the data file formatting and acquire the legitimate file design for your device.

- Total, edit and produce and indicator the received Indiana Model Notice of Blackout Periods under Individual Account Plans.

US Legal Forms will be the biggest local library of legitimate varieties where you can see various file templates. Make use of the company to acquire professionally-produced paperwork that follow state needs.

Form popularity

FAQ

Blackout List means a list of Securities in which personal trading is prohibited. Generally, the Securities included on the list are ETFs.

Black-out periods. occur when the ability of plan participants to take certain actions is temporarily. suspended. Sarbanes-Oxley requires that participants receive advance written. notice of certain black-out periods, and restricts the ability of insiders to trade in.

A blackout notice should contain information on the expected beginning and end date of the blackout. The notice should also provide the reason for the blackout and what rights will be restricted as a result. The notice must specify a plan contact for answering any questions about the blackout period.

How long does a blackout period last? A blackout period usually lasts about 10 business days. However, it may need to be extended due to unforeseen circumstances, which are rare; but there is no legal maximum limit for a blackout period.

A blackout period is a temporary interval during which access to certain actions is limited or denied. The primary purpose of blackout periods in publicly traded companies is to prevent insider trading. A blackout period for an employee retirement plan temporarily prevents participants from modifying their plans.

The new law says that written notice must be given to participants and beneficiaries at least 30 days before the blackout period begins and not more than 60 days before. Failure to issue notification of a blackout period may result in severe penalties.

A blackout period in financial markets is a period of time when certain peopleeither executives, employees, or bothare prohibited from buying or selling shares in their company or making changes to their pension plan investments. With company stock, a blackout period usually comes before earnings announcements.

A blackout period is a temporary interval during which access to certain actions is limited or denied. The primary purpose of blackout periods in publicly traded companies is to prevent insider trading. A blackout period for an employee retirement plan temporarily prevents participants from modifying their plans.

There is a mandatory 2 week blackout period for all employees of the Company prior to the release of quarterly and annual financial statements which shall continue until two trading days after the time such information has been released to the public.