Indiana Flood Insurance Authorization

Description

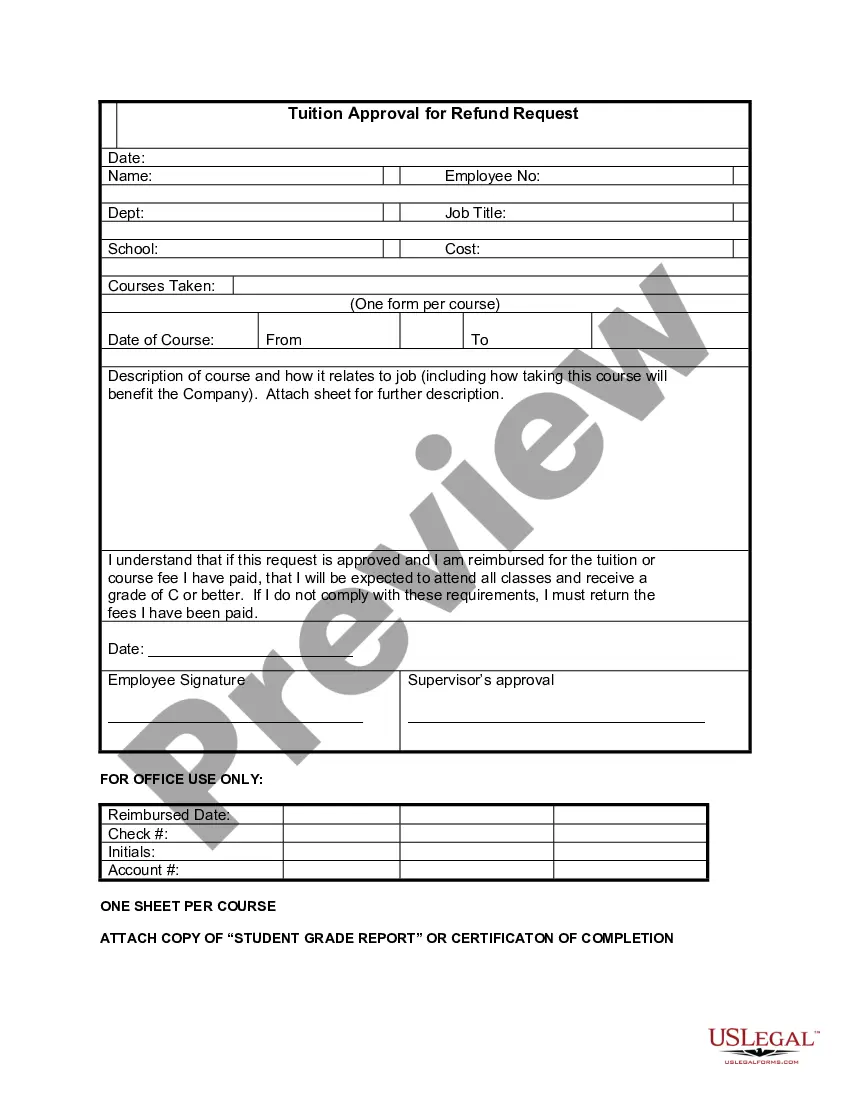

How to fill out Flood Insurance Authorization?

Are you currently within a place that you need to have paperwork for either organization or personal functions just about every time? There are plenty of legal file layouts available on the net, but locating ones you can depend on isn`t effortless. US Legal Forms delivers a large number of kind layouts, much like the Indiana Flood Insurance Authorization, that happen to be composed to satisfy state and federal needs.

If you are already acquainted with US Legal Forms web site and possess an account, merely log in. Next, you may download the Indiana Flood Insurance Authorization web template.

Unless you provide an bank account and need to start using US Legal Forms, abide by these steps:

- Get the kind you will need and make sure it is for that correct town/county.

- Take advantage of the Preview key to examine the form.

- See the description to actually have selected the right kind.

- When the kind isn`t what you`re trying to find, use the Research field to discover the kind that fits your needs and needs.

- When you get the correct kind, click Buy now.

- Opt for the rates prepare you would like, fill out the specified details to produce your account, and pay for the order utilizing your PayPal or Visa or Mastercard.

- Pick a handy file format and download your backup.

Locate all of the file layouts you might have purchased in the My Forms menus. You can aquire a more backup of Indiana Flood Insurance Authorization any time, if necessary. Just click on the essential kind to download or print out the file web template.

Use US Legal Forms, probably the most considerable assortment of legal varieties, to save time and avoid blunders. The service delivers professionally made legal file layouts that you can use for a selection of functions. Generate an account on US Legal Forms and start creating your lifestyle a little easier.

Form popularity

FAQ

A standard homeowner's and renter's insurance policy does not automatically include flood insurance protection. Homes in high-risk flood areas with mortgages from federally regulated or insured lenders are required to have flood insurance. Flood Insurance: Home - IN.gov in.gov ? floodinsurance in.gov ? floodinsurance

The average cost of flood insurance in Indiana is $1,142 per year. The cost of insurance varies ing to individual property risks and your proximity to a flood zone. Residents living in or near flood-prone areas can expect to pay higher premiums than those who live in lower-risk areas. Average Flood Insurance Cost and Coverage in Indiana (2023) moneygeek.com ? insurance ? indiana-flood... moneygeek.com ? insurance ? indiana-flood...

Ing to the NFIP, the following kinds of damage are not covered by flood insurance: Damage caused by moisture, mildew, or mold that could have been avoided by the property owner or which is not attributable to the flood. Damage caused by earth movement, even if the earth movement is caused by flood.

If you live in a high-risk flood area, you have a one in four chance of experiencing a flooding event during the course of your 30-year mortgage. Because of this likelihood of damage, your lender will generally require you to purchase a flood insurance policy.

Defining AE flood zones AE flood zones are areas that present a 1% annual chance of flooding and a 26% chance over the life of a 30-year mortgage, ing to FEMA. These regions are clearly defined in Flood Insurance Rate Maps and are paired with detailed information about base flood elevations. What is an AE flood zone? - Amica Mutual Insurance amica.com ? products ? what-is-an-ae-flood... amica.com ? products ? what-is-an-ae-flood...

The average flood insurance cost in Indiana is $1,142 per year. This is significantly higher than the national average of around $767 per year. Those living in Henderson County tend to pay the highest monthly premiums at around $4,856 per year, while those living in Cook County pay the cheapest at around $338 per year.

The insured (the property owner) pays an annual premium based on the property's flood risk and the deductible they choose. If the property or its contents are damaged or destroyed by flooding caused by an external event like rain, snow, storms, collapsed or failed infrastructure, the homeowner is covered. Flood Insurance: Definition, How It Works, Coverage, and Example investopedia.com ? terms ? flood-insurance investopedia.com ? terms ? flood-insurance

AE flood zones are areas that present a 1% annual chance of flooding and a 26% chance over the life of a 30-year mortgage, ing to FEMA. These regions are clearly defined in Flood Insurance Rate Maps and are paired with detailed information about base flood elevations.