Indiana Waiver of Qualified Joint and Survivor Annuity - QJSA

Description

How to fill out Waiver Of Qualified Joint And Survivor Annuity - QJSA?

You can invest hours on-line trying to find the authorized file design that suits the state and federal requirements you require. US Legal Forms gives thousands of authorized varieties which are evaluated by professionals. It is possible to obtain or print the Indiana Waiver of Qualified Joint and Survivor Annuity - QJSA from your services.

If you currently have a US Legal Forms bank account, you are able to log in and click on the Down load key. After that, you are able to full, revise, print, or sign the Indiana Waiver of Qualified Joint and Survivor Annuity - QJSA. Every single authorized file design you acquire is the one you have permanently. To have yet another duplicate for any purchased develop, visit the My Forms tab and click on the corresponding key.

Should you use the US Legal Forms internet site initially, follow the simple guidelines below:

- Initial, make sure that you have chosen the proper file design to the county/city of your choosing. Look at the develop information to ensure you have selected the right develop. If accessible, take advantage of the Preview key to check through the file design too.

- If you would like locate yet another edition of the develop, take advantage of the Look for area to discover the design that suits you and requirements.

- After you have discovered the design you want, just click Acquire now to move forward.

- Select the costs plan you want, enter your accreditations, and sign up for a free account on US Legal Forms.

- Complete the transaction. You can use your bank card or PayPal bank account to fund the authorized develop.

- Select the formatting of the file and obtain it for your product.

- Make adjustments for your file if possible. You can full, revise and sign and print Indiana Waiver of Qualified Joint and Survivor Annuity - QJSA.

Down load and print thousands of file web templates while using US Legal Forms Internet site, which offers the most important selection of authorized varieties. Use skilled and status-distinct web templates to handle your company or person requirements.

Form popularity

FAQ

When the participant dies, the spouse will receive lifetime payments in the same or reduced amount. The participant may waive the Qualified Joint and Survivor Annuity with spousal consent and elect to receive another form of payment.

life annuity provides the largest monthly payment but pays only during your lifetime. It's a poor choice if your spouse will need income from your pension to pay routine expenses. A jointandsurvivor annuity pays you during your lifetime and then continues to pay your spouse or other named beneficiary.

Qualified Joint and Survivor Annuity (QJSA) includes a level monthly payment for your lifetime and a survivor benefit for your spouse after your death equal to the percentage designated of that monthly payment.

A QJSA is when retirement benefits are paid as a life annuity (a series of payments, usually monthly, for life) to the participant and a survivor annuity over the life of the participant's surviving spouse (or a former spouse, child or dependent who must be treated as a surviving spouse under a QDRO) following the

This special payment form is often called a qualified joint and survivor annuity or QJSA payment form. This benefit is paid to the participant each year and, on the participant's death, a survivor annuity is paid to the surviving spouse.

A joint and survivor annuity is an insurance product designed for couples that continues to make regular payments as long as one spouse lives. A joint and survivor annuity has the advantage of providing income if one or both people live longer than expected. This is not a good choice for a younger couple.

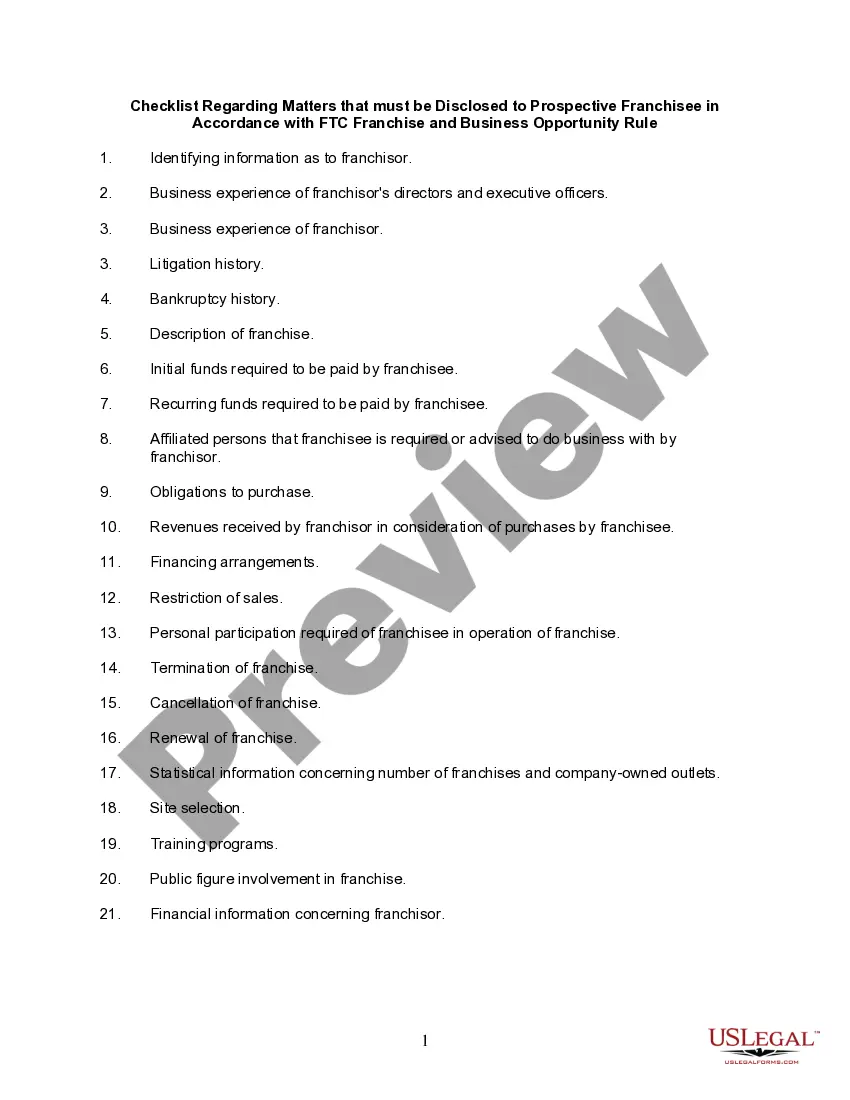

QJSA rules apply to money-purchase pension plans, defined benefit plans, and target benefits. They can also apply to profit-sharing and 401(k) and 403(b) plans, but only if so elected under the plan.

This benefit provides payments to the participant's spouse for his or her lifetime equal to a percentage (as specified in the Pension Plan) not less than one-half of the annuity that would have been payable during their joint lives. The participant may waive the Qualified Preretirement Survivor Annuity.

This benefit provides payments to the participant's spouse for his or her lifetime equal to a percentage (as specified in the Pension Plan) not less than one-half of the annuity that would have been payable during their joint lives. The participant may waive the Qualified Preretirement Survivor Annuity.

Qualified Joint and Survivor AnnuityIf your spouse consents to change the way the Plan's retirement benefits are paid, your spouse gives up his or her right to the QJSA payments. This is referred to as a waiver of the QJSA payment form.