Keywords: Indiana, self-employed, independent contractor agreement, types A self-employed independent contractor agreement in Indiana is a legal document that establishes the terms and conditions of a working relationship between a business or individual hiring a self-employed contractor. It outlines the rights, responsibilities, and obligations of both parties involved, ensuring clarity and protection for all. The primary purpose of the Indiana self-employed independent contractor agreement is to distinguish the contractor's status as self-employed rather than an employee. The agreement clarifies that the contractor operates as an independent entity responsible for managing their own business operations, taxes, and benefits. It also specifies that the contractor is not entitled to certain employment benefits, such as minimum wage, overtime pay, or employee benefits. There are different types of self-employed independent contractor agreements in Indiana, each designed to suit specific industries or project requirements. Some common types include: 1. General Independent Contractor Agreement: This agreement covers various self-employed contractors and outlines the general terms and conditions applicable to their engagement. It includes provisions related to project scope, payment terms, responsibilities, and termination clauses. 2. Consulting Agreement: This agreement is specifically tailored for professional consultants who offer their expertise and advice to businesses. It outlines the scope of consulting services, project timelines, fees, confidentiality, and any intellectual property rights involved. 3. Freelance Agreement: This agreement is suitable for independent contractors providing creative or specialized services such as graphic design, writing, web development, photography, or videography. It specifies the deliverables, payment terms, revisions, ownership of intellectual property, and use of work samples. 4. Construction Contractor Agreement: This agreement is designed for independent contractors operating in the construction industry. It includes key provisions related to timelines, project milestones, payment schedules, compliance with building codes, and safety requirements. When drafting or entering into a self-employed independent contractor agreement in Indiana, it is crucial to consult with legal counsel or use a reliable template to ensure compliance with state laws and regulations. Additionally, both parties should ensure that the agreement accurately reflects their intentions, duties, and obligations to avoid any future disputes or misunderstandings.

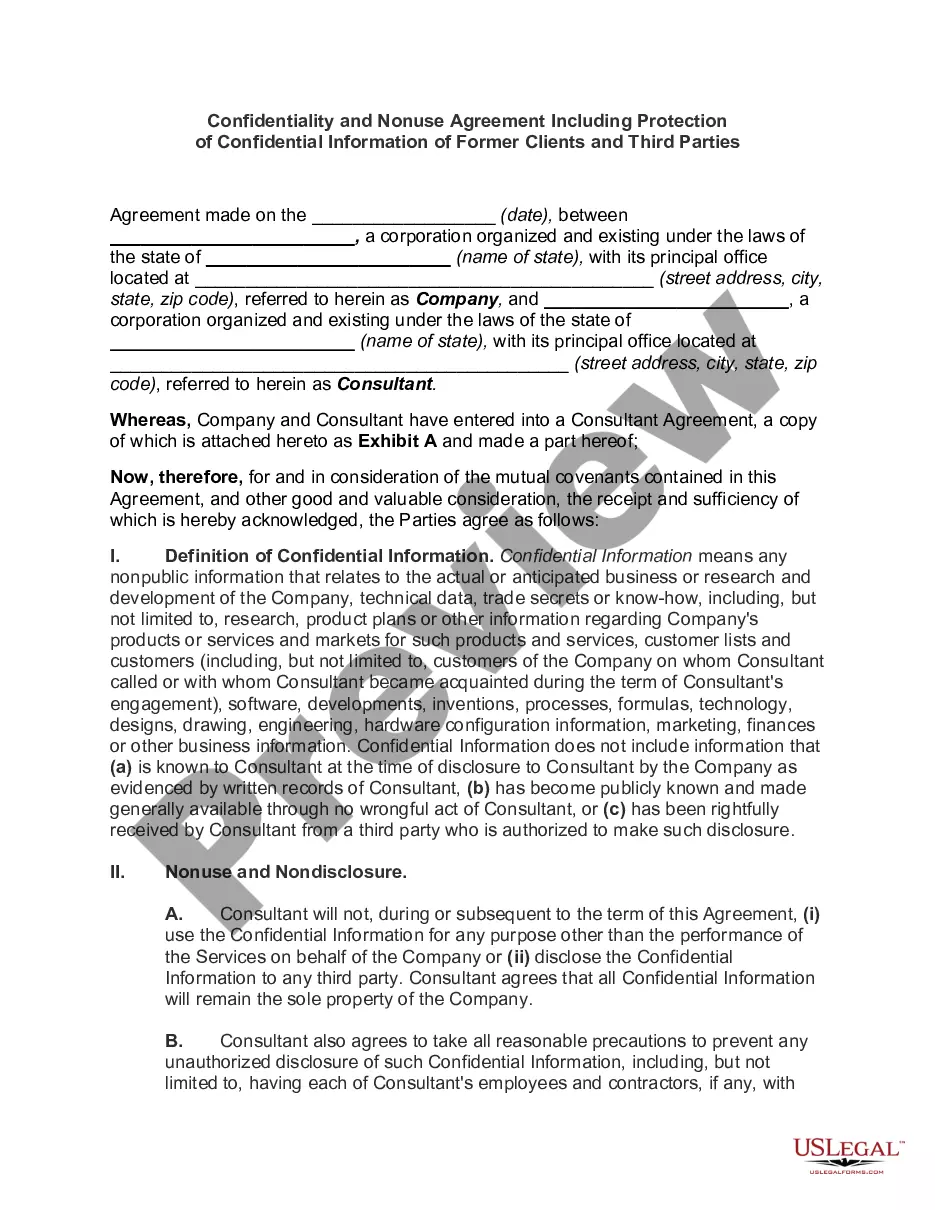

Indiana Self-Employed Independent Contractor Agreement

Description

How to fill out Indiana Self-Employed Independent Contractor Agreement?

If you have to complete, down load, or produce legal record templates, use US Legal Forms, the greatest variety of legal forms, that can be found on the web. Make use of the site`s basic and practical research to obtain the files you will need. Various templates for business and personal functions are categorized by classes and claims, or search phrases. Use US Legal Forms to obtain the Indiana Self-Employed Independent Contractor Agreement in a handful of clicks.

If you are presently a US Legal Forms customer, log in in your bank account and click the Obtain option to get the Indiana Self-Employed Independent Contractor Agreement. You can also access forms you in the past saved from the My Forms tab of your bank account.

If you use US Legal Forms the very first time, follow the instructions under:

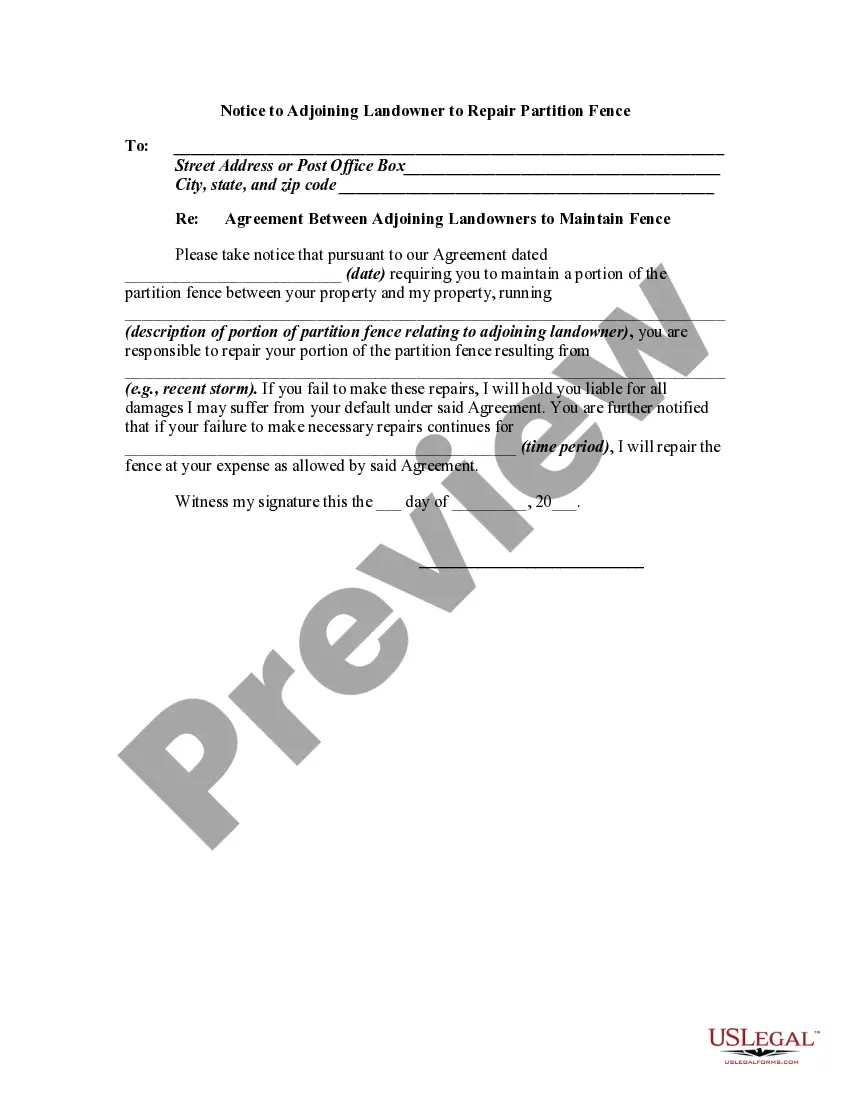

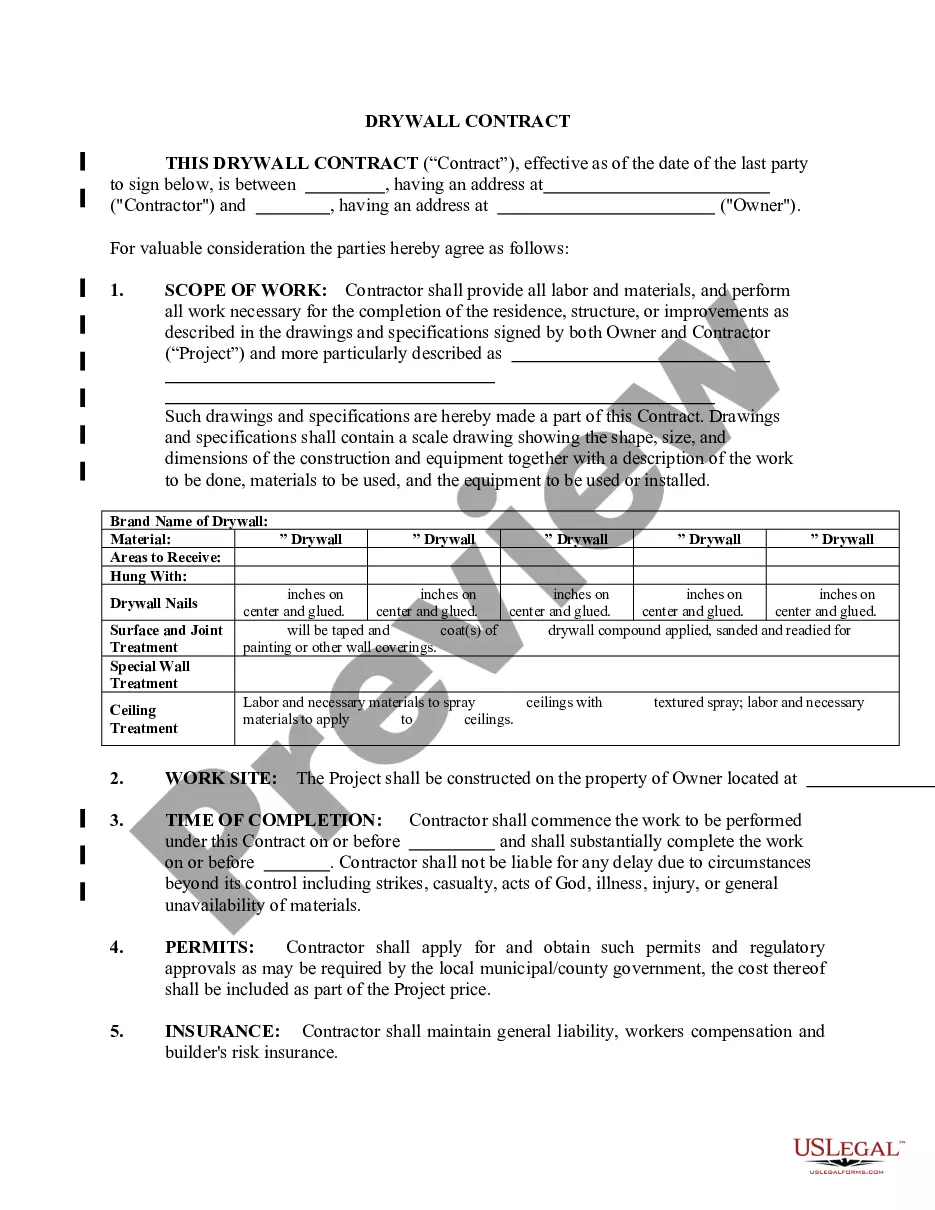

- Step 1. Ensure you have chosen the shape to the appropriate area/nation.

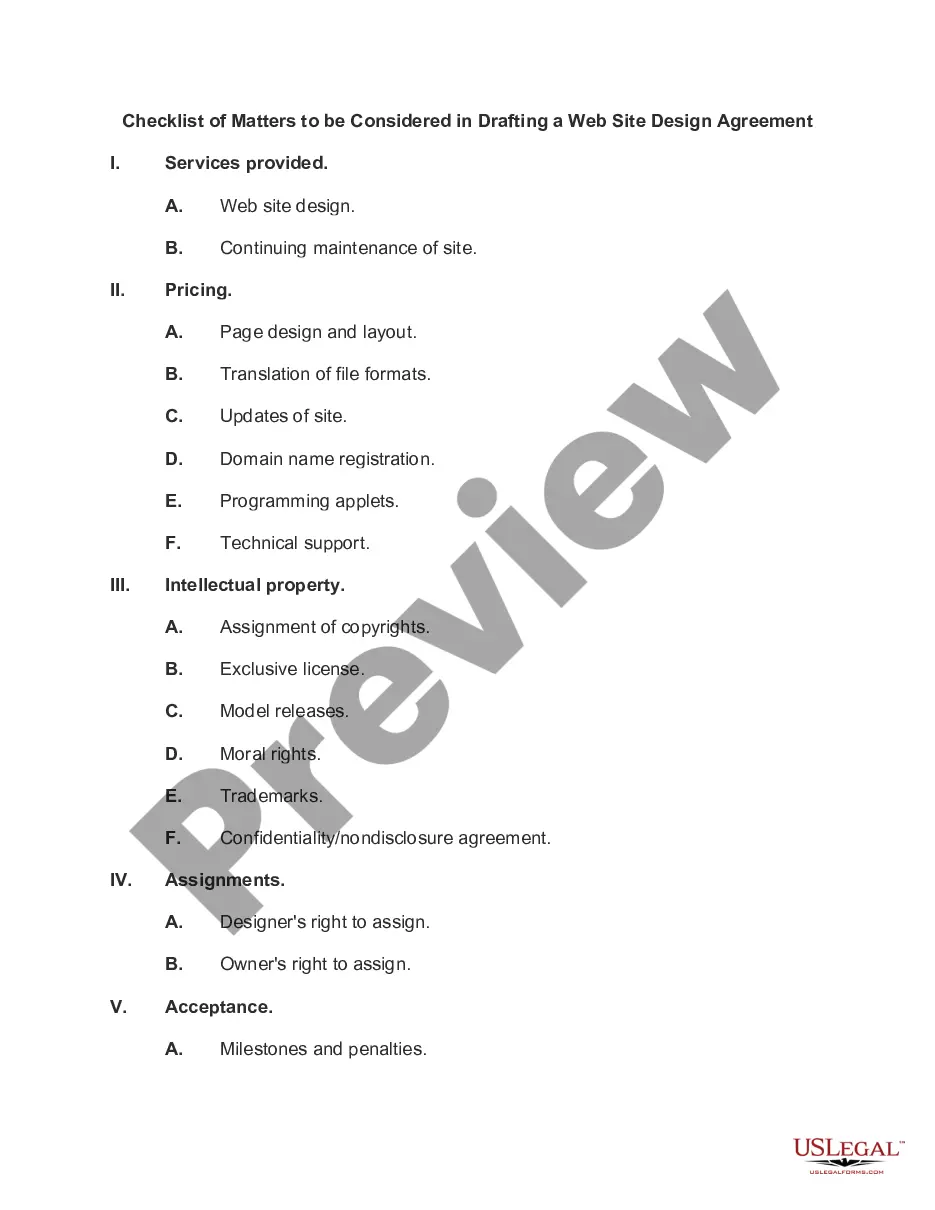

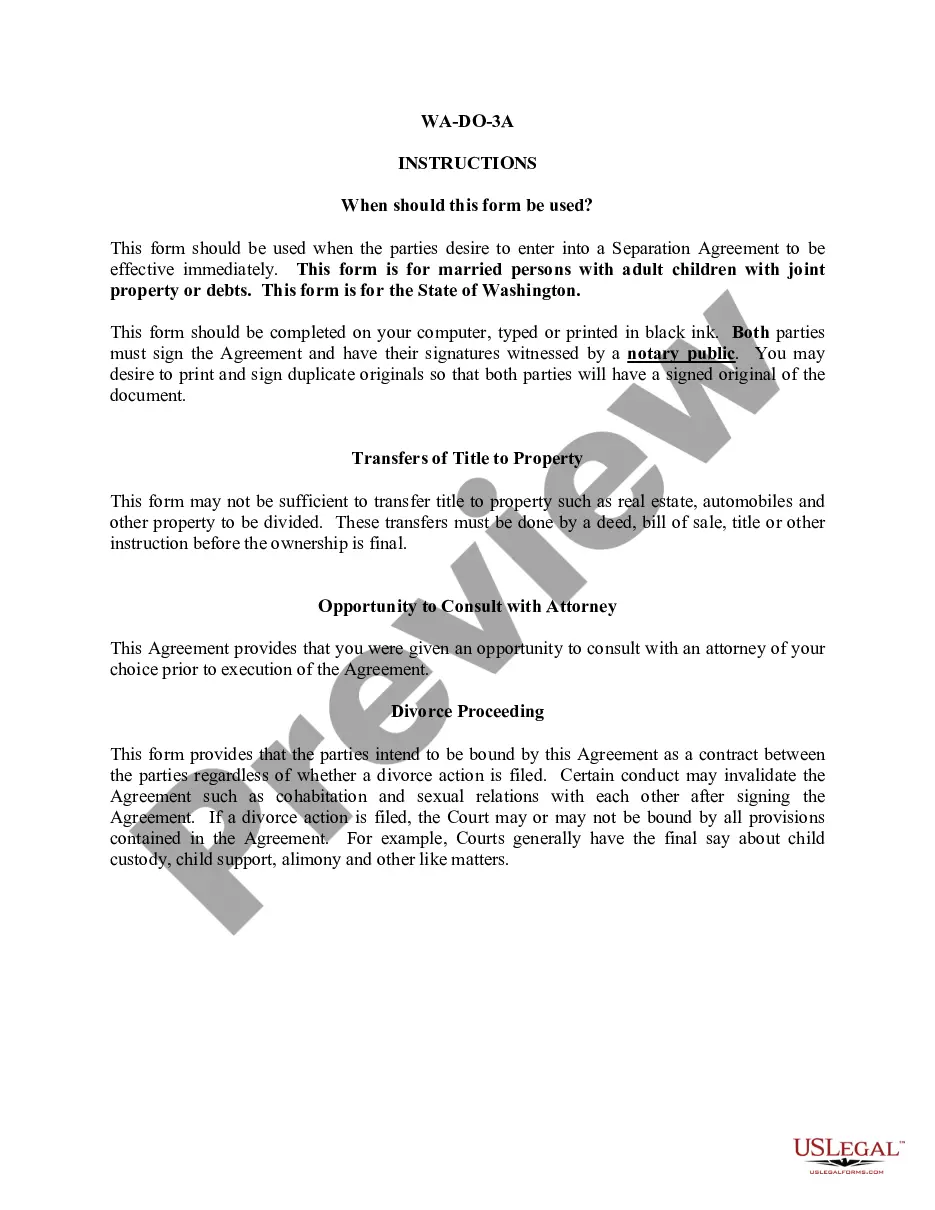

- Step 2. Make use of the Preview option to examine the form`s content. Do not neglect to read through the description.

- Step 3. If you are unsatisfied with all the develop, take advantage of the Look for industry towards the top of the display screen to discover other models of the legal develop web template.

- Step 4. Once you have found the shape you will need, select the Buy now option. Choose the costs strategy you favor and include your references to register to have an bank account.

- Step 5. Procedure the purchase. You can use your credit card or PayPal bank account to complete the purchase.

- Step 6. Pick the format of the legal develop and down load it on the gadget.

- Step 7. Full, revise and produce or signal the Indiana Self-Employed Independent Contractor Agreement.

Each and every legal record web template you get is yours forever. You possess acces to each develop you saved in your acccount. Click the My Forms section and select a develop to produce or down load once more.

Be competitive and down load, and produce the Indiana Self-Employed Independent Contractor Agreement with US Legal Forms. There are thousands of expert and condition-distinct forms you can use to your business or personal requirements.

Form popularity

FAQ

Independent contractors doing business in the State of Indiana are required to file a statement and documentation with the Indiana Department of Revenue (DOR) stating independent contractor status. There is a five dollar filing fee and the certificate is valid for one year.

Ten Tips for Making Solid Business Agreements and ContractsGet it in writing.Keep it simple.Deal with the right person.Identify each party correctly.Spell out all of the details.Specify payment obligations.Agree on circumstances that terminate the contract.Agree on a way to resolve disputes.More items...

As a contractor, this is most likely you. This means that you run your own business as an individual and you are self-employed. Being a sole trader gives you both complete control and responsibility. Your business assets and liabilities are not separate from your personal ones.

How do I create an Independent Contractor Agreement?State the location.Describe the type of service required.Provide the contractor's and client's details.Outline compensation details.State the agreement's terms.Include any additional clauses.State the signing details.

How To Become a Licensed Contractor in Indiana. Unlike plumbers, in Indiana contractor licensing is not regulated at the state level. Instead, contractors are required to register or obtain a license through the various municipal governments throughout the state.

Simply put, being an independent contractor is one way to be self-employed. Being self-employed means that you earn money but don't work as an employee for someone else.

Here are some steps you may use to guide you when you write an employment contract:Title the employment contract.Identify the parties.List the term and conditions.Outline the job responsibilities.Include compensation details.Use specific contract terms.Consult with an employment lawyer.Employment.More items...?

The most common business organizations for Independent Contractors include C-corporation, S-Corporation, Partnership, Limited Partnership (LP), Limited Liability Partnership (LLP), Limited Liability Company (LLC), and Sole Proprietorship.

The law defines a worker as an independent contractor if he/she meets the guidelines of the IRS (See statute quote above in section 2). Senate Enrolled Act 576, (Public Law 168), provides that all independent contractors, not just those in the construction trades, may now obtain a clearance certificate.