Indiana Asset Purchase - Letter of Intent

Description

How to fill out Asset Purchase - Letter Of Intent?

US Legal Forms - one of many greatest libraries of authorized forms in the United States - offers a variety of authorized papers layouts you are able to acquire or produce. While using website, you will get a huge number of forms for organization and specific reasons, sorted by classes, claims, or keywords and phrases.You can find the latest variations of forms such as the Indiana Asset Purchase - Letter of Intent in seconds.

If you currently have a subscription, log in and acquire Indiana Asset Purchase - Letter of Intent from the US Legal Forms library. The Obtain button can look on each and every form you view. You have access to all in the past saved forms inside the My Forms tab of the bank account.

If you wish to use US Legal Forms the very first time, here are basic directions to get you started off:

- Make sure you have chosen the correct form for your city/region. Go through the Preview button to review the form`s content. Browse the form outline to actually have selected the appropriate form.

- When the form doesn`t satisfy your specifications, use the Search area at the top of the monitor to find the one who does.

- Should you be pleased with the form, verify your option by simply clicking the Acquire now button. Then, select the prices prepare you prefer and give your qualifications to register on an bank account.

- Process the purchase. Utilize your Visa or Mastercard or PayPal bank account to accomplish the purchase.

- Select the formatting and acquire the form on your own product.

- Make changes. Load, edit and produce and sign the saved Indiana Asset Purchase - Letter of Intent.

Each and every format you included with your bank account lacks an expiration day and it is the one you have forever. So, if you would like acquire or produce an additional duplicate, just visit the My Forms segment and then click in the form you want.

Obtain access to the Indiana Asset Purchase - Letter of Intent with US Legal Forms, the most substantial library of authorized papers layouts. Use a huge number of professional and express-certain layouts that meet up with your small business or specific needs and specifications.

Form popularity

FAQ

Keep it brief Similar to a cover letter or letter of interest, a letter of intent follows a business letter format. It should be a few paragraphs that introduce you as a candidate, outline your intentions, and encourage the reader to follow up. Letter of Intent: What Is It & How to Write One (with Examples) BetterUp ? blog ? letter-of-intent BetterUp ? blog ? letter-of-intent

A letter of intent (LOI) is a document written in business letter format that declares your intent to do a specific thing. It's usually, but not always, nonbinding, and it states a preliminary commitment by one party to do business with another party. Letter of intent: What is an LOI and formats | Adobe Acrobat Sign adobe.com ? acrobat ? business ? resources adobe.com ? acrobat ? business ? resources

Use the first one or two sentences of your letter to formally introduce yourself. This section can include your name, a brief explanation of your current experience level and your reason for writing. For example, if you're a recent graduate, include information about your degree and areas of study. How To Write a Letter of Intent (With Template and Tips) - Indeed Indeed ? Career Guide ? Finding a job Indeed ? Career Guide ? Finding a job

Components of a LOI Opening Paragraph: Your summary statement. ... Statement of Need: The "why" of the project. ( ... Project Activity: The "what" and "how" of the project. ( ... Outcomes (1?2 paragraphs; before or after the Project Activity) ... Credentials (1?2 paragraphs) ... Budget (1?2 paragraphs) ... Closing (1 paragraph) ... Signature.

Tips for writing an effective letter of intent Use a professional business letter format. ... Place your contact information at the end. ... Highlight your level of experience. ... Mention a reference who works at the company. ... Include strong verbs and adjectives. ... Focus on relevant information. ... Keep it brief. ... Proofread.

Follow these steps when writing an LOI: Write the introduction. ... Describe the transaction and timeframes. ... List contingencies. ... Go through due diligence. ... Include covenants and other binding agreements. ... State that the agreement is nonbinding. ... Include a closing date. Letter of Intent (LOI) for Business Transactions (With Tips) | Indeed.com indeed.com ? career-development ? letter-of... indeed.com ? career-development ? letter-of...

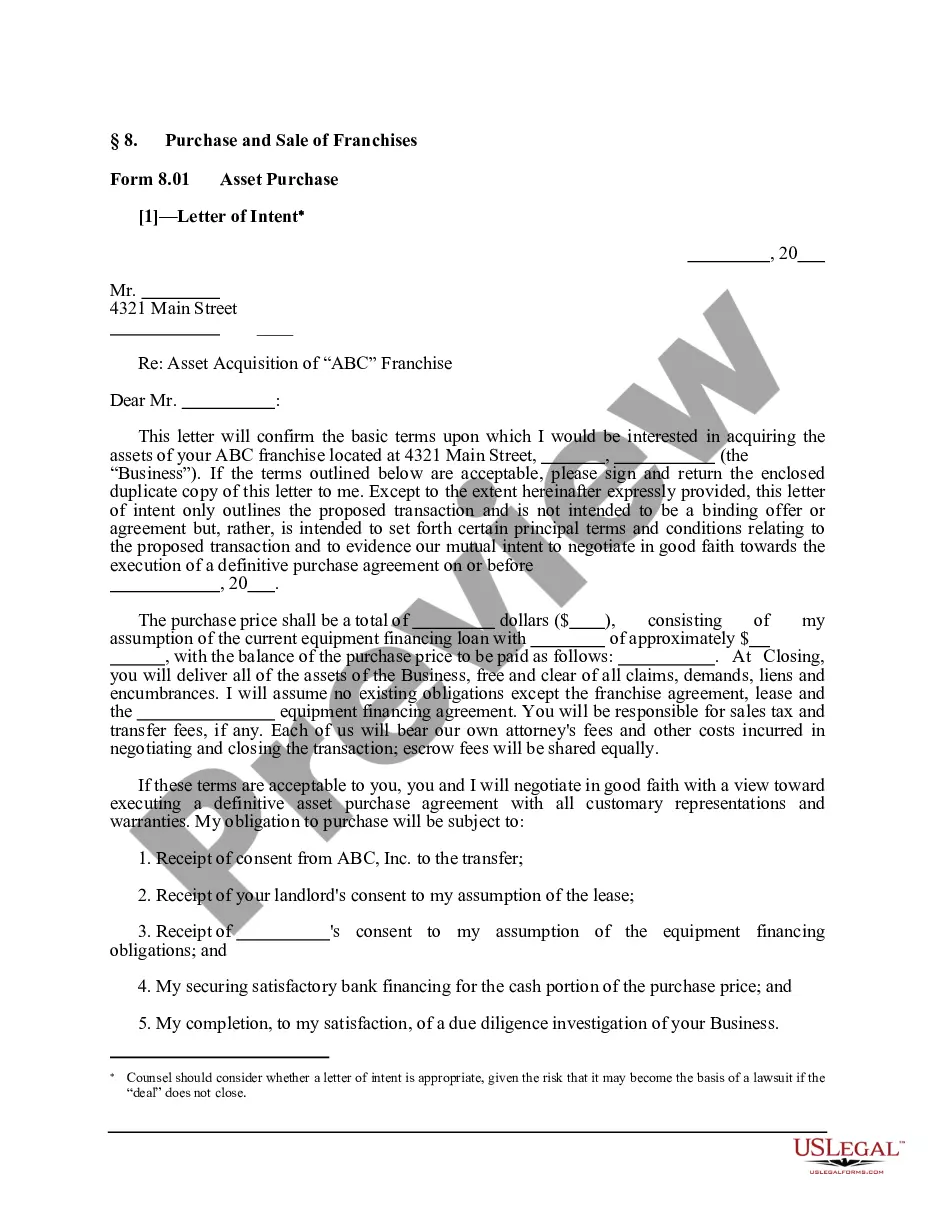

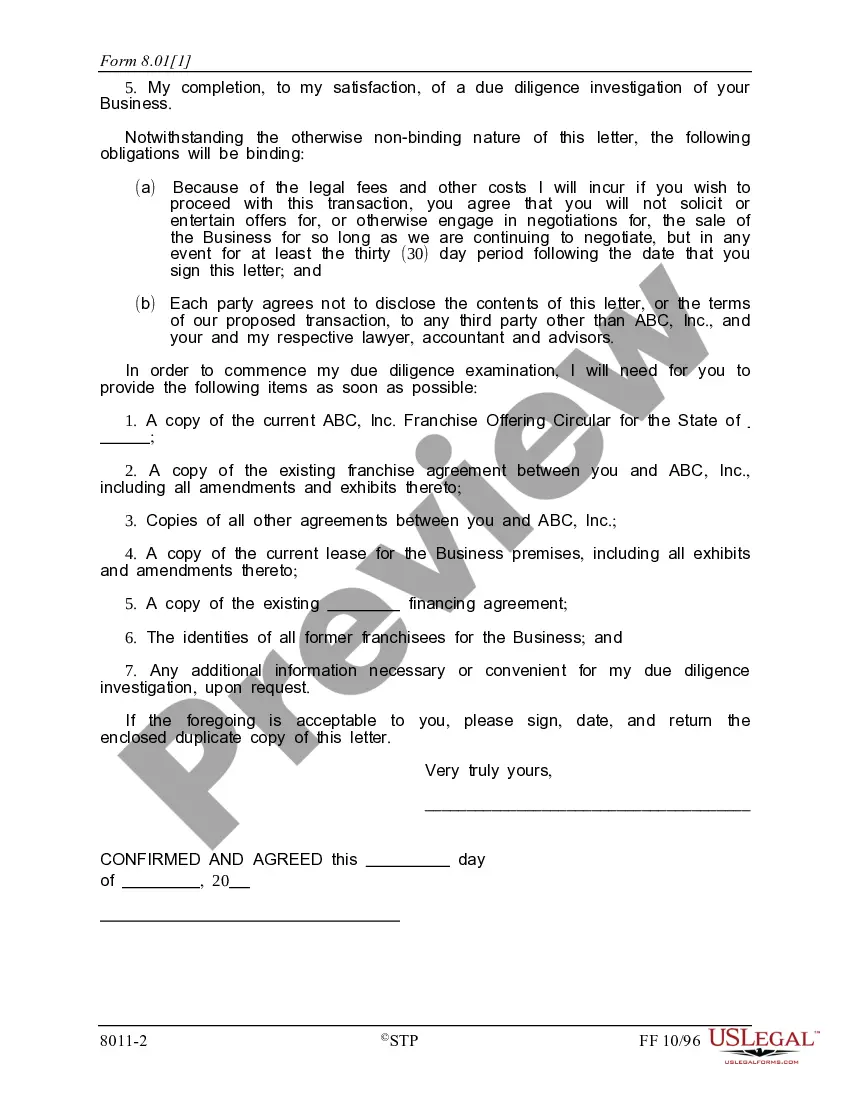

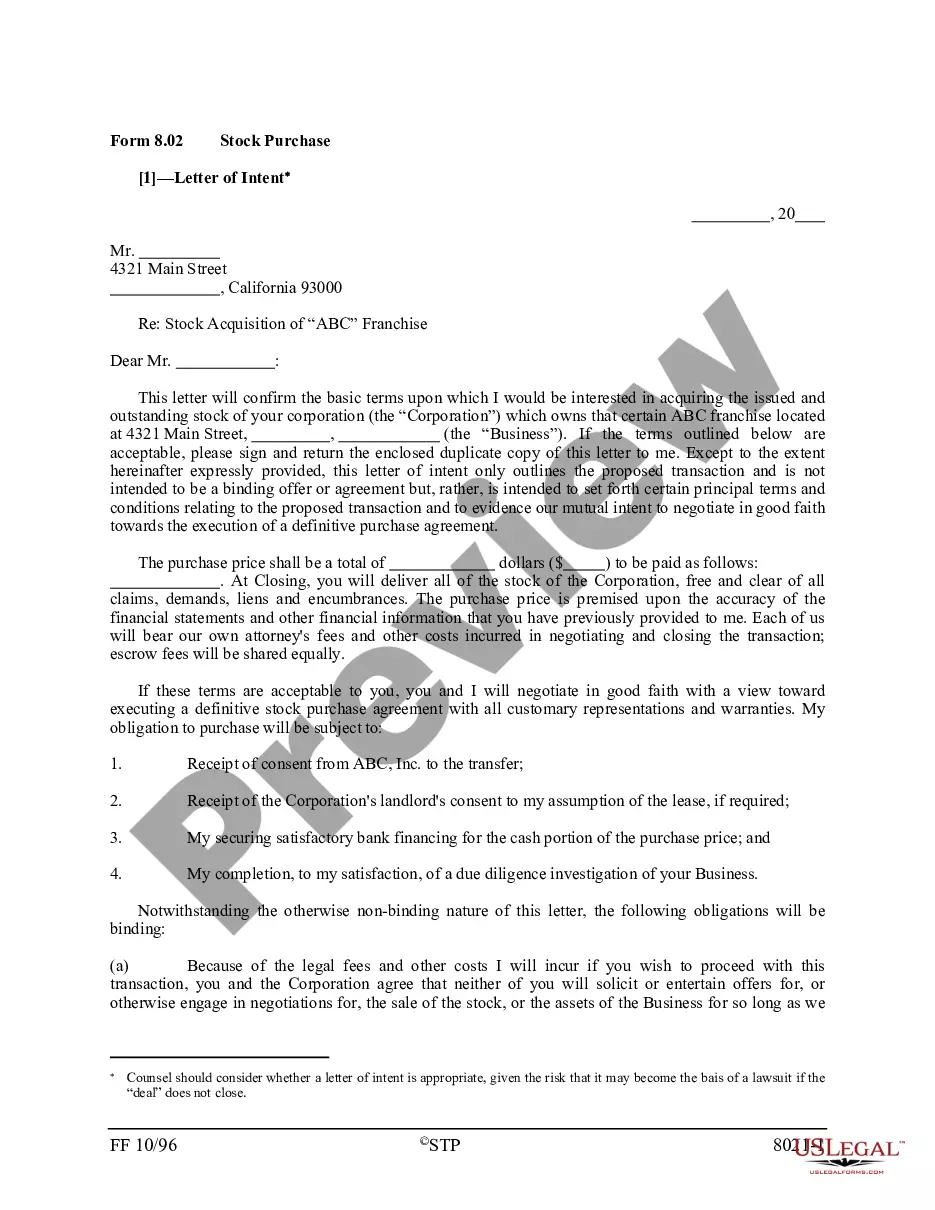

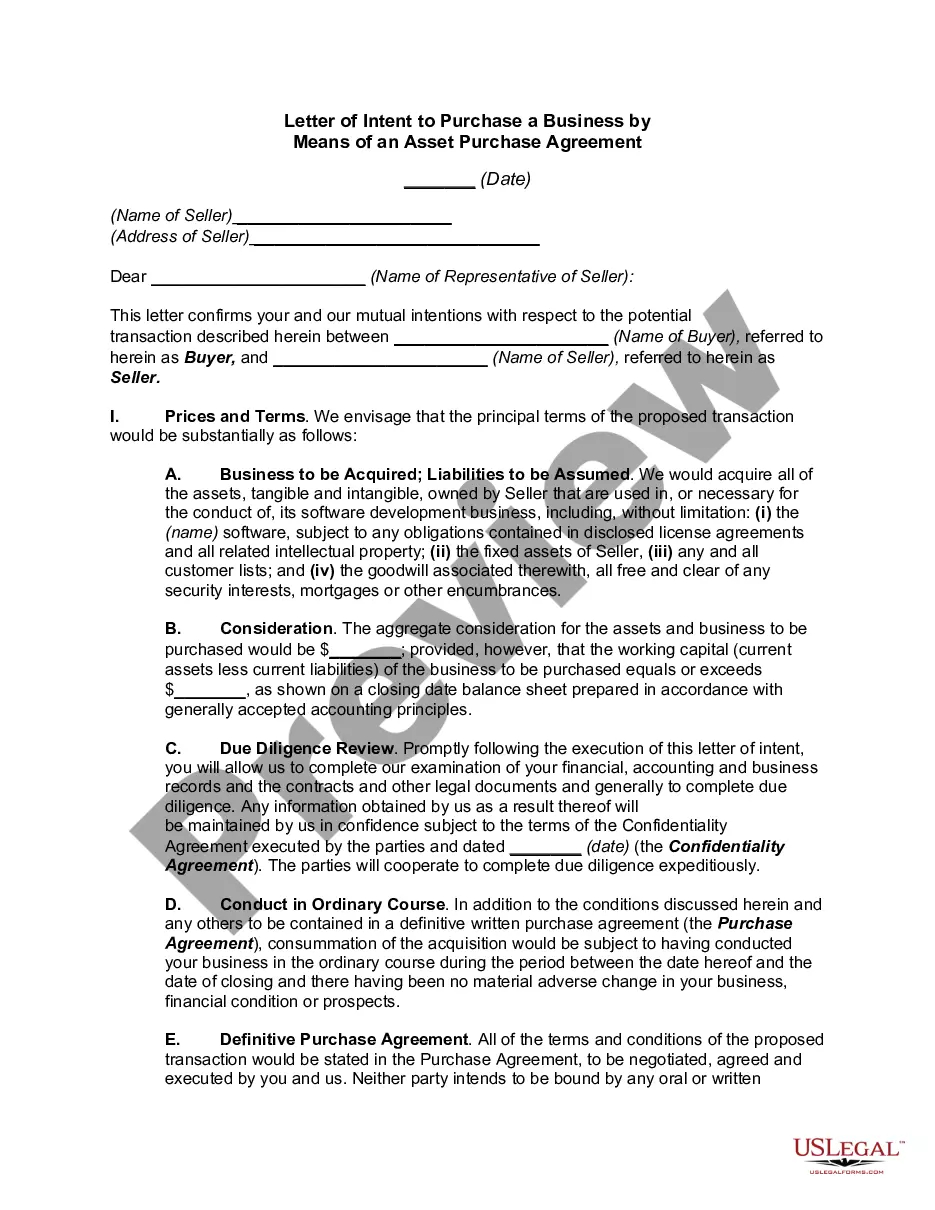

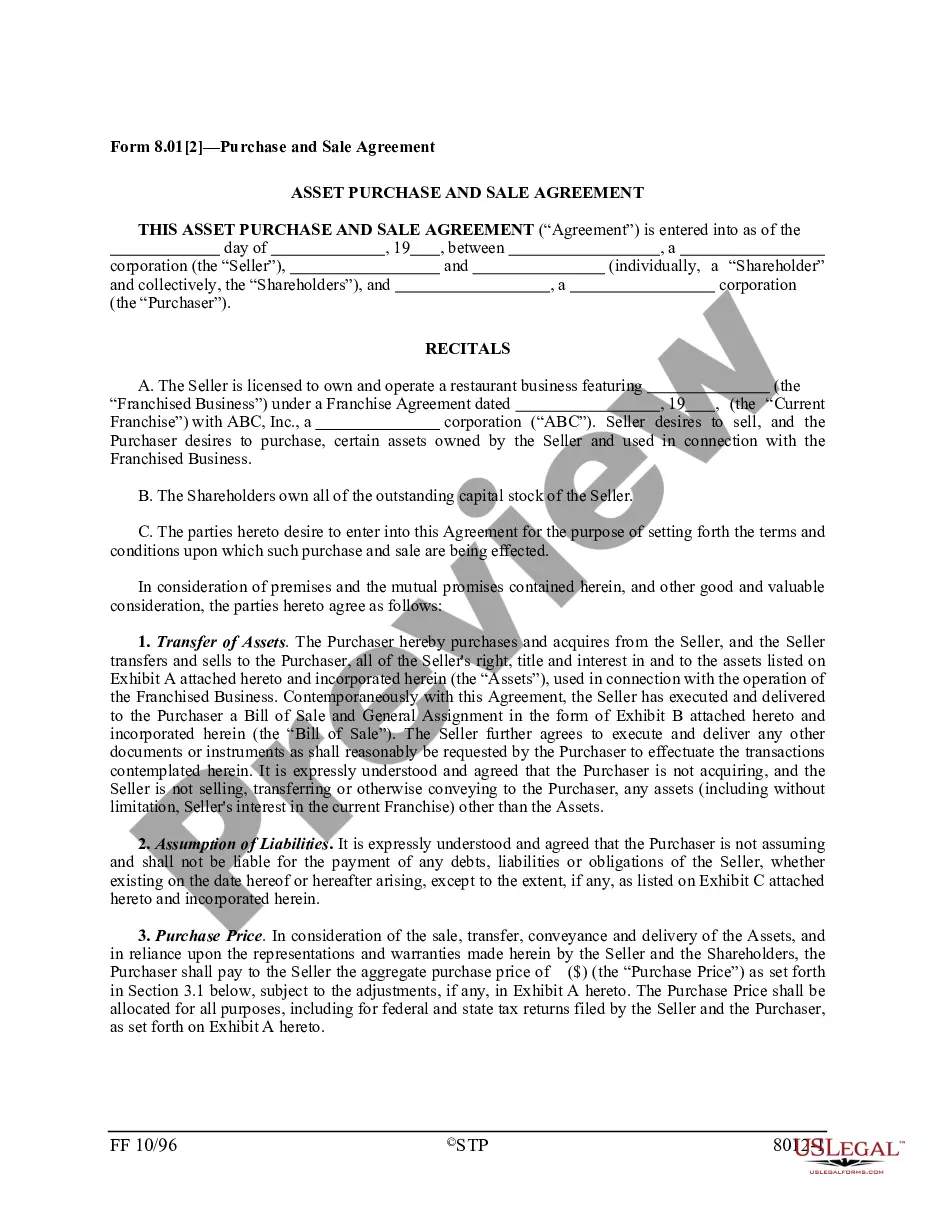

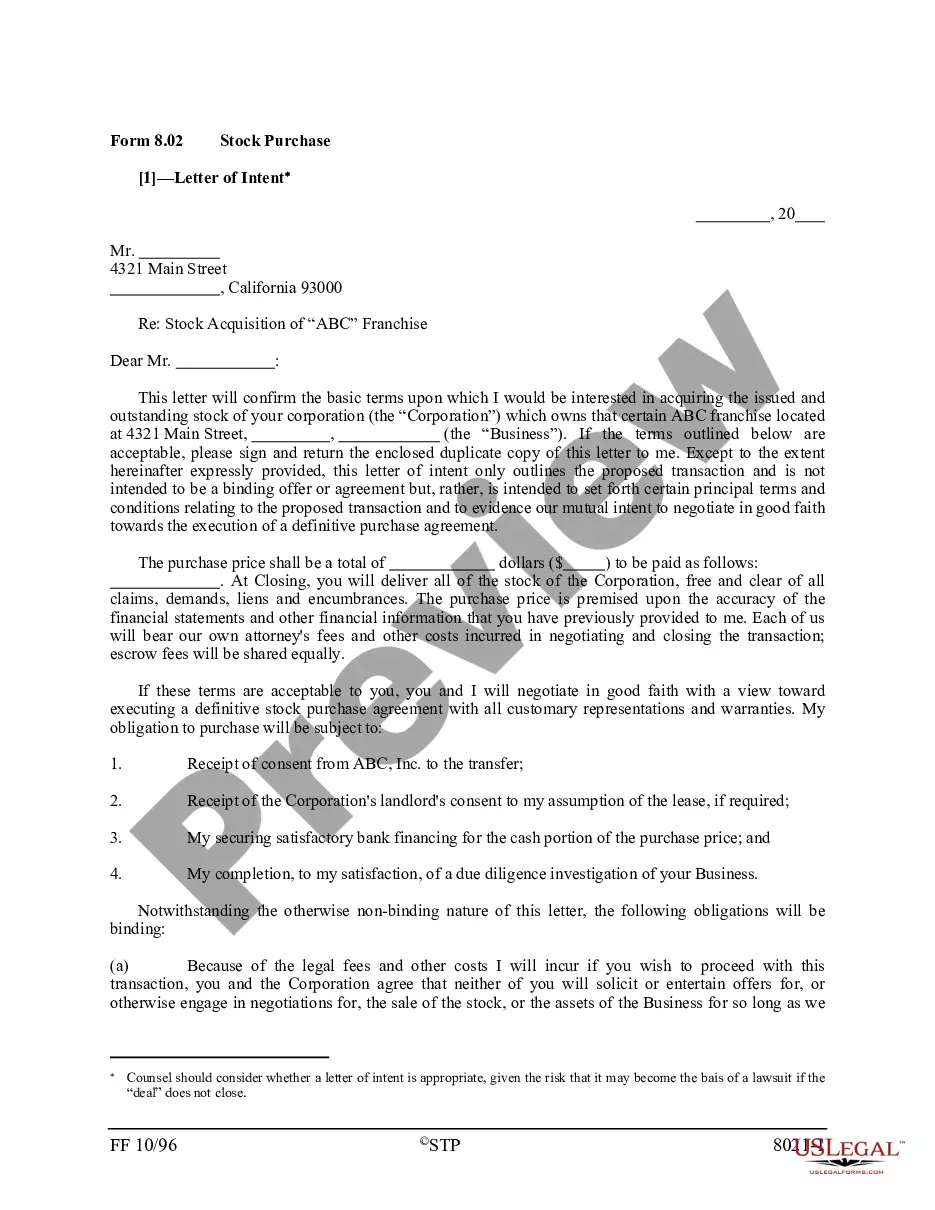

This free template Letter of Intent for an Asset Purchase Agreement is a non-binding document outlining the general terms and price by which a buyer proposes to purchase the assets of a particular business. If signed by the seller, it indicates that both parties intend to move forward in completing the transaction.

What to include in letters of intent to purchase. Name and contact information of the buyer. Name and contact information of the seller. Detailed description of the items or property being sold. Any relevant disclaimers or liabilities. The total purchase price. Method of payment and other payment terms, including dates.