The Indiana Model Asset Purchase and Sale Agreement is a legal document that outlines the terms and conditions for the purchase and sale of assets in the state of Indiana. It is a standardized template provided by the Indiana government to ensure consistency and efficiency in business transactions involving asset transfers. This agreement is widely used by businesses and individuals engaged in various industries, including manufacturing, agriculture, technology, and services. It encompasses the transfer of tangible and intangible assets, such as real estate property, equipment, inventory, intellectual property rights, customer contracts, and goodwill. The Indiana Model Asset Purchase and Sale Agreement is designed to protect the rights and interests of both parties involved in the transaction. It provides a comprehensive framework that covers essential elements, including the purchase price, payment terms, representations and warranties, rights and obligations, and closing conditions. One key benefit of using the Indiana Model Asset Purchase and Sale Agreement is its flexibility to accommodate customization based on the specific needs and requirements of the parties involved. This allows for negotiation and inclusion of additional clauses or terms to reflect the unique aspects of the transaction. In Indiana, there are various types of Model Asset Purchase and Sale Agreements available, tailored to different business scenarios. These agreements include but are not limited to: 1. Standard Asset Purchase and Sale Agreement: This is the most commonly used agreement for the sale and purchase of assets in Indiana. It covers the transfer of a wide range of assets and provides a comprehensive framework for the transaction. 2. Real Estate Asset Purchase and Sale Agreement: This agreement is specifically designed for the sale and purchase of real estate assets in Indiana. It includes provisions related to property inspections, title searches, zoning, and environmental compliance. 3. Intellectual Property Asset Purchase and Sale Agreement: This agreement focuses on the transfer of intellectual property rights, such as patents, copyrights, trademarks, and trade secrets. It contains specific provisions addressing the assignment and ownership of these valuable intangible assets. 4. Business Acquisition Asset Purchase and Sale Agreement: This type of agreement is used when the transaction involves the acquisition of an entire business, including its assets, liabilities, contracts, and workforce. It requires comprehensive due diligence and covers various aspects of the business acquisition process. It is important to note that while the Indiana Model Asset Purchase and Sale Agreement provides a solid foundation for asset transactions, it is crucial to consult with legal professionals and tailor the agreement to meet the specific needs of individual transactions.

Indiana Model Asset Purchase and Sale Agreement

Description

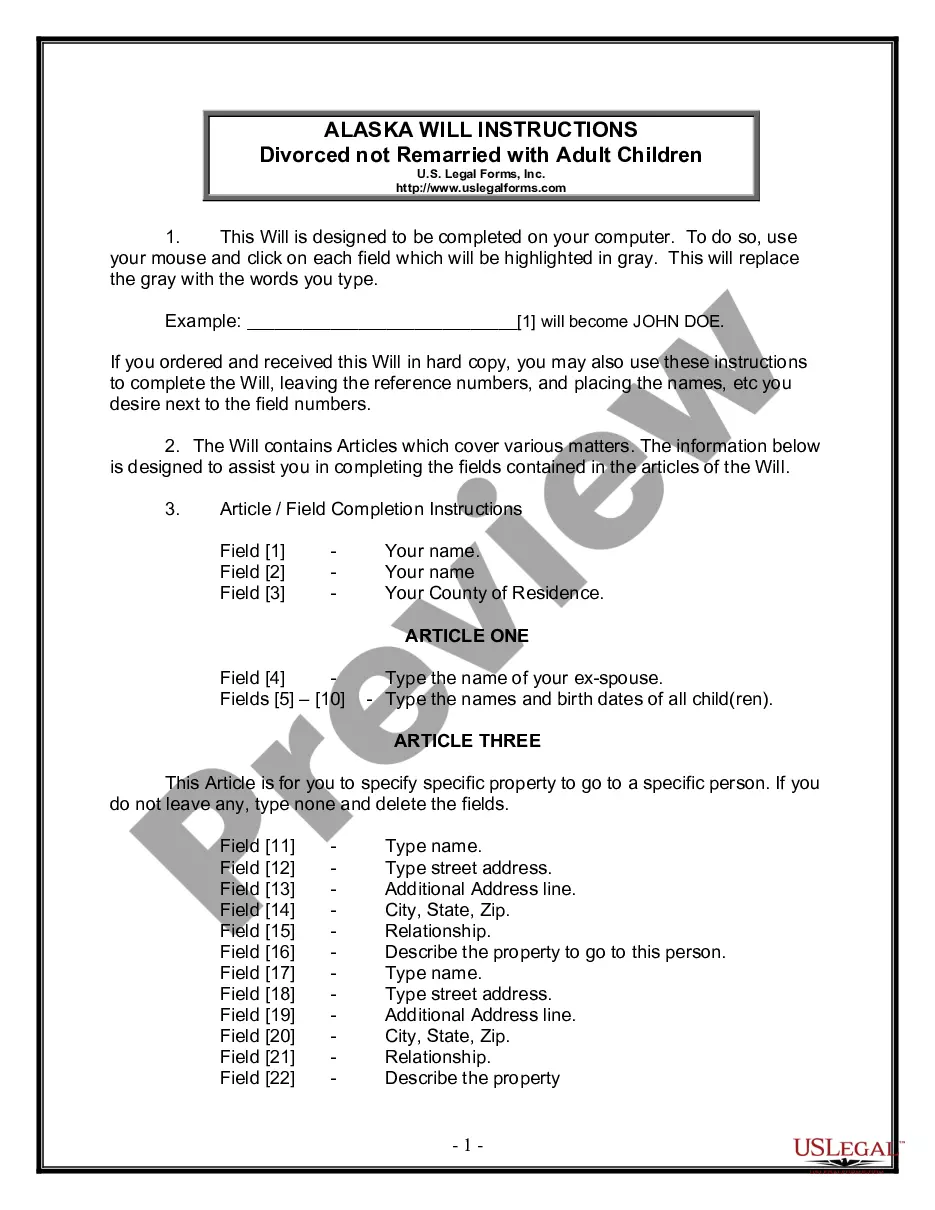

How to fill out Indiana Model Asset Purchase And Sale Agreement?

Have you been in a place where you require documents for both company or individual uses just about every time? There are plenty of legitimate papers web templates available online, but locating types you can rely on is not effortless. US Legal Forms gives a huge number of develop web templates, much like the Indiana Model Asset Purchase and Sale Agreement, that are written to meet state and federal needs.

When you are previously acquainted with US Legal Forms website and get an account, simply log in. Following that, you may download the Indiana Model Asset Purchase and Sale Agreement format.

Unless you offer an accounts and want to begin using US Legal Forms, abide by these steps:

- Get the develop you want and make sure it is to the proper metropolis/state.

- Utilize the Review key to examine the form.

- Look at the explanation to ensure that you have chosen the correct develop.

- When the develop is not what you are looking for, use the Research field to get the develop that suits you and needs.

- Once you obtain the proper develop, just click Acquire now.

- Choose the costs strategy you need, complete the required information to make your account, and buy the transaction making use of your PayPal or Visa or Mastercard.

- Pick a hassle-free paper format and download your version.

Locate every one of the papers web templates you have bought in the My Forms menu. You can obtain a additional version of Indiana Model Asset Purchase and Sale Agreement at any time, if possible. Just click on the essential develop to download or print out the papers format.

Use US Legal Forms, probably the most comprehensive selection of legitimate varieties, to conserve time and avoid blunders. The assistance gives professionally made legitimate papers web templates that can be used for a range of uses. Produce an account on US Legal Forms and initiate producing your daily life easier.

Form popularity

FAQ

In an asset purchase, the buyer agrees to purchase specific assets and liabilities. This means that they only take on the risks of those specific assets. This could include equipment, fixtures, furniture, licenses, trade secrets, trade names, accounts payable and receivable, and more.

At its most basic, a purchase agreement should include the following: Name and contact information for buyer and seller. The address of the property being sold. The price to be paid for the property. The date of transfer. Disclosures. Contingencies. Signatures.

Among the terms typically included in the agreement are the purchase price, the closing date, the amount of earnest money that the buyer must submit as a deposit, and the list of items that are and are not included in the sale.

Asset Sale Checklist List of Assumed Contracts. List of Liabilities Assumed. Promissory Note. Security Agreement. Escrow Agreement. Disclosure of Claims, Liens, and Security Interests. List of Trademarks, Trade Names, Assumed Names, and Internet Domain Names. Disclosure of Licenses and Permits.

An asset acquisition is the purchase of a company by buying its assets instead of its stock. In most jurisdictions, an asset acquisition typically also involves an assumption of certain liabilities.

Definitions of the words and terms to be used in the legal instrument. Terms and conditions of the sale and purchase of the assets, including purchase price and terms of the purchase (full payment at close, down payment, subsequent payments, etc.) Terms and conditions of the closing of the agreement, if any.

At its most basic, a purchase agreement should include the following: Name and contact information for buyer and seller. The address of the property being sold. The price to be paid for the property. The date of transfer. Disclosures. Contingencies. Signatures.

No matter the format, an option to purchase must: 1) state the option fee, 2) set the duration of the option period, 3) outline the price for which the tenant will purchase the property in the future, and 4) comply with local and state laws.