Indiana Approval for Relocation Expenses and Allowances

Description

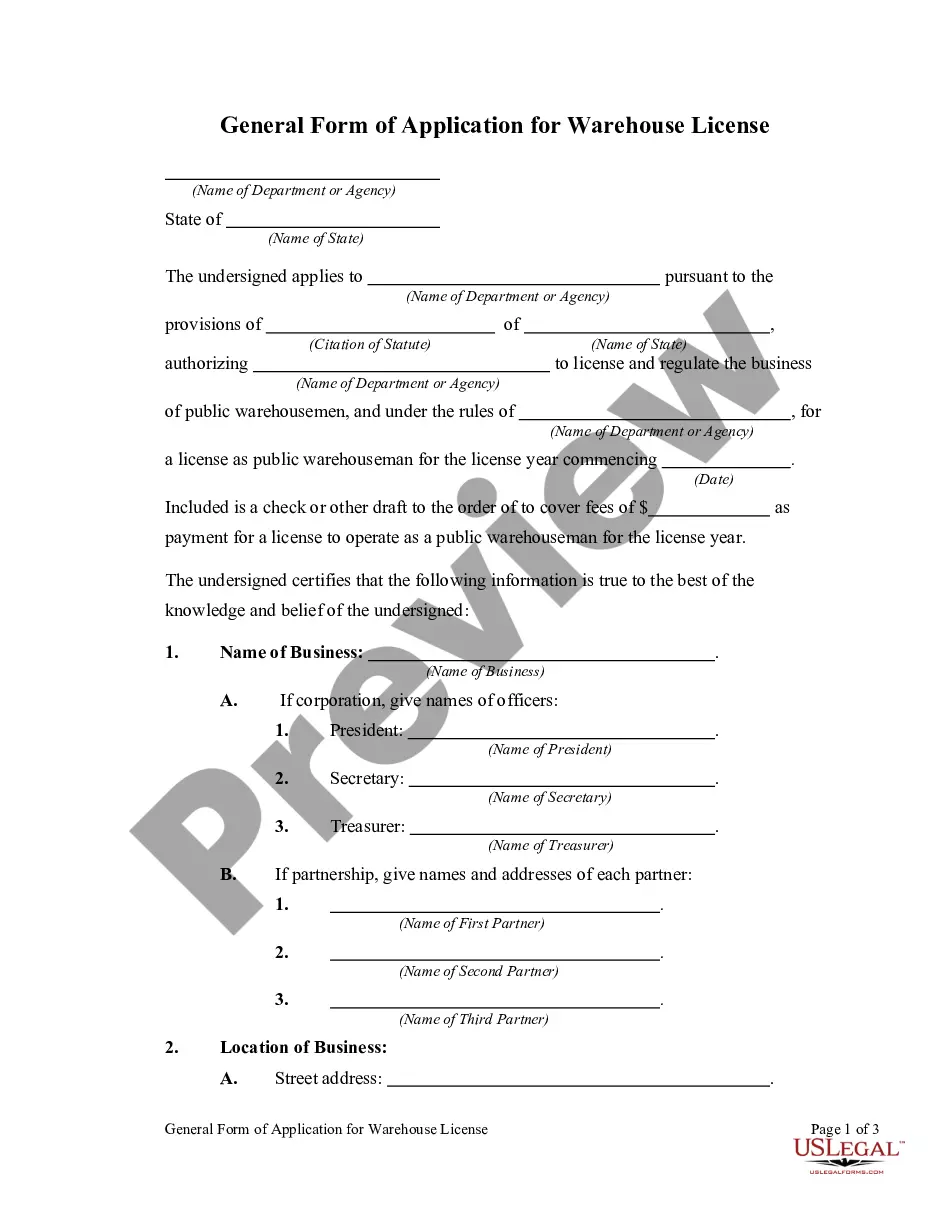

How to fill out Approval For Relocation Expenses And Allowances?

It is feasible to dedicate time online seeking the sanctioned document template that aligns with the federal and state requirements you require.

US Legal Forms provides a vast array of legal documents that are assessed by professionals.

You can easily download or print the Indiana Approval for Relocation Expenses and Allowances from the service.

To find an additional version of the form, use the Lookup field to discover the template that fulfills your needs and requirements.

- If you already have a US Legal Forms account, you can Log In and click the Obtain button.

- After that, you can complete, modify, print, or sign the Indiana Approval for Relocation Expenses and Allowances.

- Each legal document template you purchase is yours indefinitely.

- To retrieve an additional copy of a purchased form, go to the My documents tab and click the corresponding button.

- If you are visiting the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure you have selected the correct document template for the state/city you choose.

- Check the form details to confirm you have selected the appropriate type.

Form popularity

FAQ

For example, a company may be willing to pay $5,000 to each employee to help with moving costs. Another common strategy is that the company simply offers to reimburse employees for certain moving expenses, such as the cost of hiring movers, renting a storage unit and living in temporary housing.

Reimbursement. Reimbursement relocation packages allow transferees to pay for all moving expenses with the notion in mind that their employer will reimburse them with a specific amount of money after they have relocated. In doing this, a company covers most if not all moving expenses.

Travelling between the old home and the temporary living accommodation. travelling between the new home and the temporary living accommodation (where the house move takes place before the job transfer) travelling from the old home to the new home when the move takes place.

Relocation Income Tax Allowance The RITA is designed to reimburse most of the federal and state income tax paid as a result of a PCS transfer. The RITA is taxable.

The Indiana Worker's Compensation Act bases the mileage rate on what the State of Indiana pays to its employees who have to travel. It fluctuates over time. As of June 25, 2020, the reimbursement rate is $. 38 per mile.

Relocation expenses for employees paid by an employer (aside from BVO/GBO homesale programs) are all considered taxable income to the employee by the IRS and state authorities (and by local governments that levy an income tax).

Like all salary packaged items, you can't claim an income tax deduction on packaged relocation expenses.

Key Takeaways. A settling-in allowance is money provided as part of relocation expenses to a person who has transferred locations or moved for a new job. Settling-in allowances can include costs related to temporary lodging, meals, and storage of personal belongings.

The employer pays a lump sum directly to the employee to use in any way they need for their relocation. The employee is then required to file that amount as income.

The short answer is yes. Relocation expenses for employees paid by an employer (aside from BVO/GBO homesale programs) are all considered taxable income to the employee by the IRS and state authorities (and by local governments that levy an income tax).