Indiana Memo on Company Relocation including Relocation Pay for Employees

Description

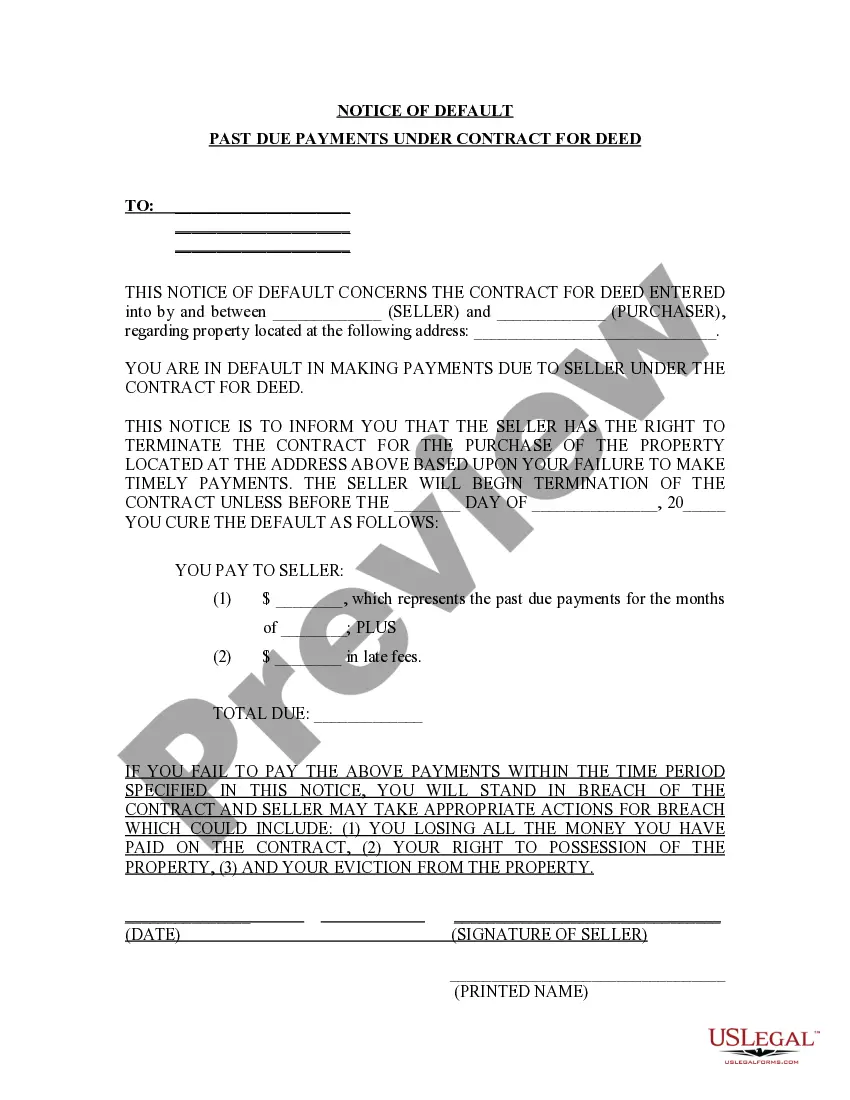

How to fill out Memo On Company Relocation Including Relocation Pay For Employees?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a vast selection of legal template documents that you can download or print.

By utilizing the website, you can access thousands of forms for both business and personal purposes, organized by categories, states, or keywords.

You can find the latest versions of forms such as the Indiana Memo on Company Relocation, including Relocation Compensation for Employees, in just seconds.

Review the form description to confirm that you have selected the right document.

If the document doesn't meet your needs, use the Search field at the top of the page to find one that does.

- If you have a subscription, Log Into your account and retrieve the Indiana Memo on Company Relocation including Relocation Compensation for Employees from the US Legal Forms library.

- The Download button will be available on each form you view.

- You can access all previously obtained forms in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow these simple instructions to get started.

- Make sure you have chosen the correct form for your city/state.

- Click the Preview button to review the form's details.

Form popularity

FAQ

When a company pays for your relocation, it is typically referred to as relocation assistance or relocation pay. This support can be detailed in an Indiana Memo on Company Relocation including Relocation Pay for Employees, outlining what expenses are covered. Understanding this can ease the moving process and help employees plan their transition more confidently.

To announce an office relocation, begin by sharing the official date of the move, new address, and the rationale behind the decision. Include details from the Indiana Memo on Company Relocation including Relocation Pay for Employees, providing clear information on the benefits employees can expect. This approach not only informs but also engages employees in the transition.

Announcing a business move starts with a well-structured communication that highlights the reasoning behind the relocation, and the new location. You can reference the Indiana Memo on Company Relocation including Relocation Pay for Employees to assure employees of the assistance available to them. Make sure to express excitement about the new opportunities the move presents, fostering a positive outlook.

When emailing employees about an office move, clearly state the subject as 'Office Relocation Announcement'. Start with a warm greeting, then outline the details including the Indiana Memo on Company Relocation including Relocation Pay for Employees to ensure they are aware of support options. Encourage them to reach out with any questions or concerns, showing that management cares about their comfort during this transition.

To write a letter of relocation for an employee, address the individual by name and clearly state the move, including the date and the new location. Incorporate the Indiana Memo on Company Relocation including Relocation Pay for Employees to detail any financial support available for their moving expenses. State your willingness to discuss any questions they may have, fostering open communication throughout the process.

Writing a relocation notice involves stating the date of the move, the new address, and any changes in work contracts that may arise. Ensure it emphasizes the Indiana Memo on Company Relocation including Relocation Pay for Employees so employees understand the support they can expect. Provide details on how to obtain further information or assistance, ensuring a smooth transition for everyone.

To inform your employees about the office relocation, start by crafting an official communication that highlights the reasons for the move, the benefits it brings, and the timeline. Use the Indiana Memo on Company Relocation including Relocation Pay for Employees to outline how this transition will positively impact everyone involved. Be clear and direct, while also offering support and guidance during the transition.

Yes, relocation payments can be classified as supplemental wages under the Indiana Memo on Company Relocation including Relocation Pay for Employees. Supplemental wages generally include any payment to an employee outside of regular compensation, such as bonuses or relocation reimbursements. Proper classification is important for tax treatment and reporting purposes. If you have questions about managing these payments, using platforms like uslegalforms can simplify the process.

The Indiana headquarters relocation credit is a tax incentive designed to encourage companies to move their headquarters to Indiana. This credit, as outlined in the Indiana Memo on Company Relocation including Relocation Pay for Employees, provides financial benefits to businesses that meet certain conditions. Companies may benefit from reduced tax liabilities, making it easier to invest in employees and infrastructure. Engaging with this credit can significantly enhance a company's relocation strategy.

Under the Indiana Memo on Company Relocation including Relocation Pay for Employees, relocation costs are typically not included in regular employee wages. These costs often cover moving expenses, temporary housing, or travel costs, which can be reimbursed separately. It's crucial for employers to understand the tax implications, as relocation reimbursements may need to be reported differently than standard wages. Therefore, documenting these expenses correctly helps maintain compliance with state and federal regulations.