Indiana Order Confirming Plan - Form 15 - Pre and Post 2005 Act

Description

How to fill out Order Confirming Plan - Form 15 - Pre And Post 2005 Act?

Are you in a place that you will need files for both company or personal purposes just about every day time? There are plenty of legal papers layouts available on the Internet, but finding versions you can trust isn`t straightforward. US Legal Forms gives a huge number of form layouts, much like the Indiana Order Confirming Plan - Form 15 - Pre and Post 2005 Act, which can be created to fulfill federal and state requirements.

If you are currently informed about US Legal Forms internet site and have your account, basically log in. Afterward, it is possible to obtain the Indiana Order Confirming Plan - Form 15 - Pre and Post 2005 Act web template.

Unless you provide an account and want to start using US Legal Forms, follow these steps:

- Find the form you want and make sure it is to the correct metropolis/region.

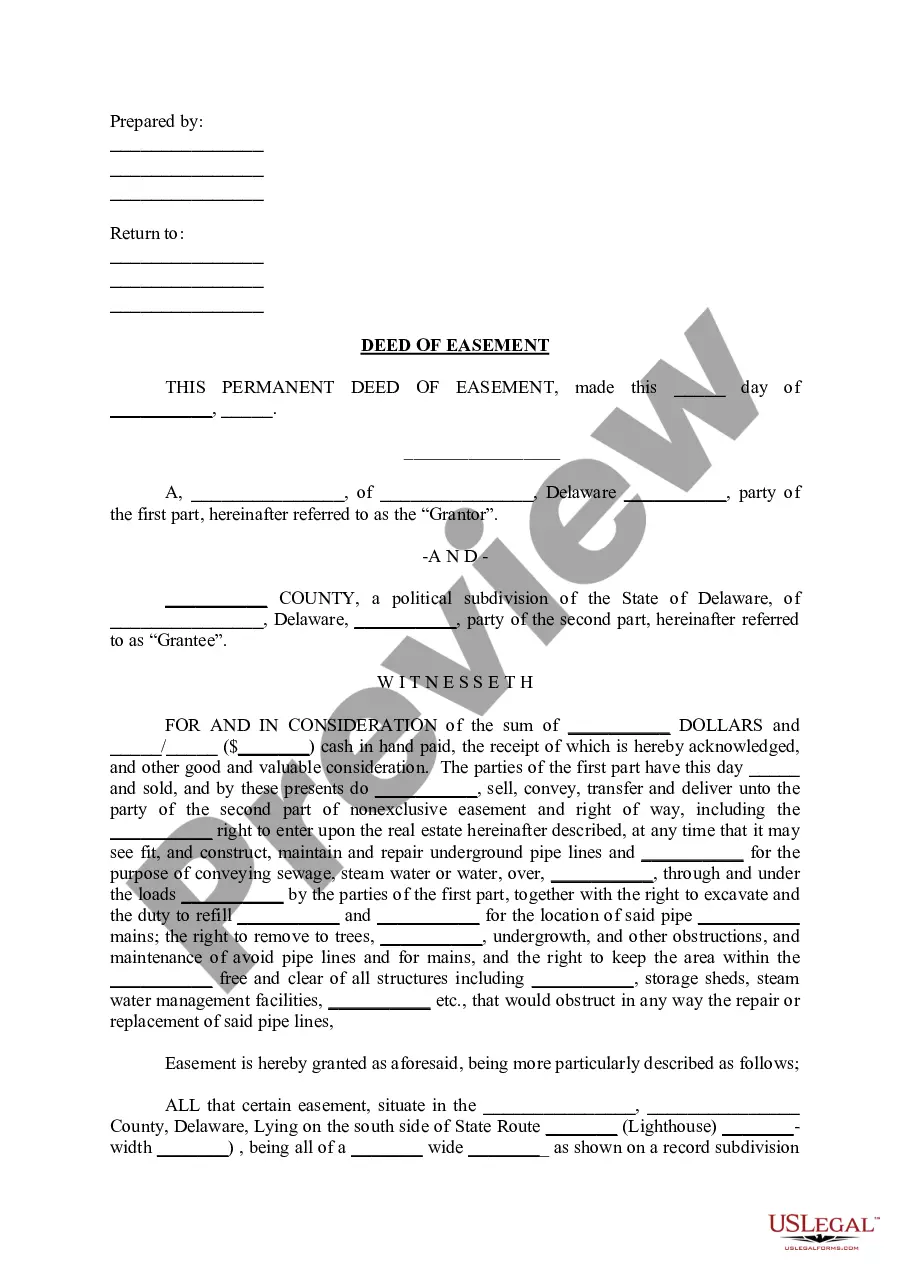

- Use the Review key to check the form.

- Browse the outline to ensure that you have selected the proper form.

- When the form isn`t what you are seeking, take advantage of the Research field to find the form that meets your requirements and requirements.

- When you find the correct form, simply click Get now.

- Pick the pricing plan you want, fill in the necessary information to make your bank account, and pay money for an order utilizing your PayPal or credit card.

- Choose a handy file formatting and obtain your backup.

Get all of the papers layouts you have bought in the My Forms food list. You may get a extra backup of Indiana Order Confirming Plan - Form 15 - Pre and Post 2005 Act anytime, if necessary. Just go through the necessary form to obtain or print out the papers web template.

Use US Legal Forms, probably the most substantial assortment of legal types, in order to save time and stay away from blunders. The service gives expertly manufactured legal papers layouts which can be used for an array of purposes. Create your account on US Legal Forms and begin producing your lifestyle easier.