Indiana Property Claimed as Exempt - Schedule C - Form 6C - Post 2005

Description

How to fill out Property Claimed As Exempt - Schedule C - Form 6C - Post 2005?

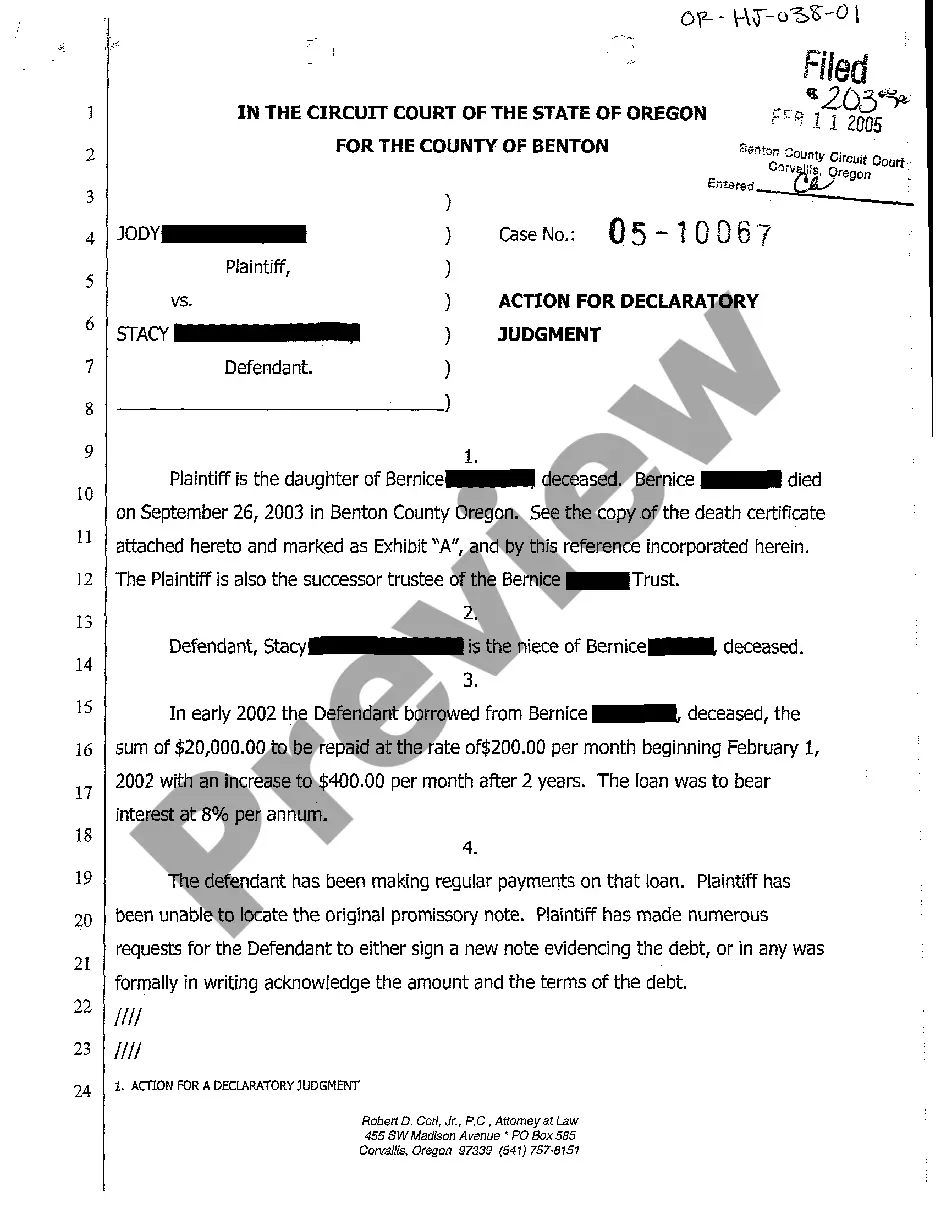

Finding the right legitimate file design could be a have difficulties. Naturally, there are a variety of templates accessible on the Internet, but how do you get the legitimate kind you want? Utilize the US Legal Forms site. The services offers a huge number of templates, for example the Indiana Property Claimed as Exempt - Schedule C - Form 6C - Post 2005, that can be used for enterprise and private requires. All the types are inspected by specialists and satisfy state and federal specifications.

If you are presently signed up, log in to your account and click on the Acquire option to get the Indiana Property Claimed as Exempt - Schedule C - Form 6C - Post 2005. Use your account to check with the legitimate types you might have purchased previously. Proceed to the My Forms tab of the account and get yet another version of the file you want.

If you are a brand new consumer of US Legal Forms, listed below are straightforward directions so that you can adhere to:

- Initially, make sure you have chosen the appropriate kind for the city/county. You may check out the form utilizing the Preview option and look at the form outline to make certain it will be the right one for you.

- In case the kind will not satisfy your preferences, utilize the Seach industry to get the proper kind.

- When you are positive that the form is suitable, select the Get now option to get the kind.

- Select the prices program you need and enter the required info. Create your account and buy the transaction using your PayPal account or bank card.

- Opt for the submit formatting and acquire the legitimate file design to your system.

- Full, modify and print and indicator the received Indiana Property Claimed as Exempt - Schedule C - Form 6C - Post 2005.

US Legal Forms will be the most significant collection of legitimate types where you can discover a variety of file templates. Utilize the company to acquire expertly-produced files that adhere to express specifications.

Form popularity

FAQ

Indiana Homestead Exemption You can protect up to $19,300 of equity in real estate or tangible personal property. Indiana's homestead exemption applies to residential property or tangible personal property (such as a mobile home) that constitutes your personal or family residence.

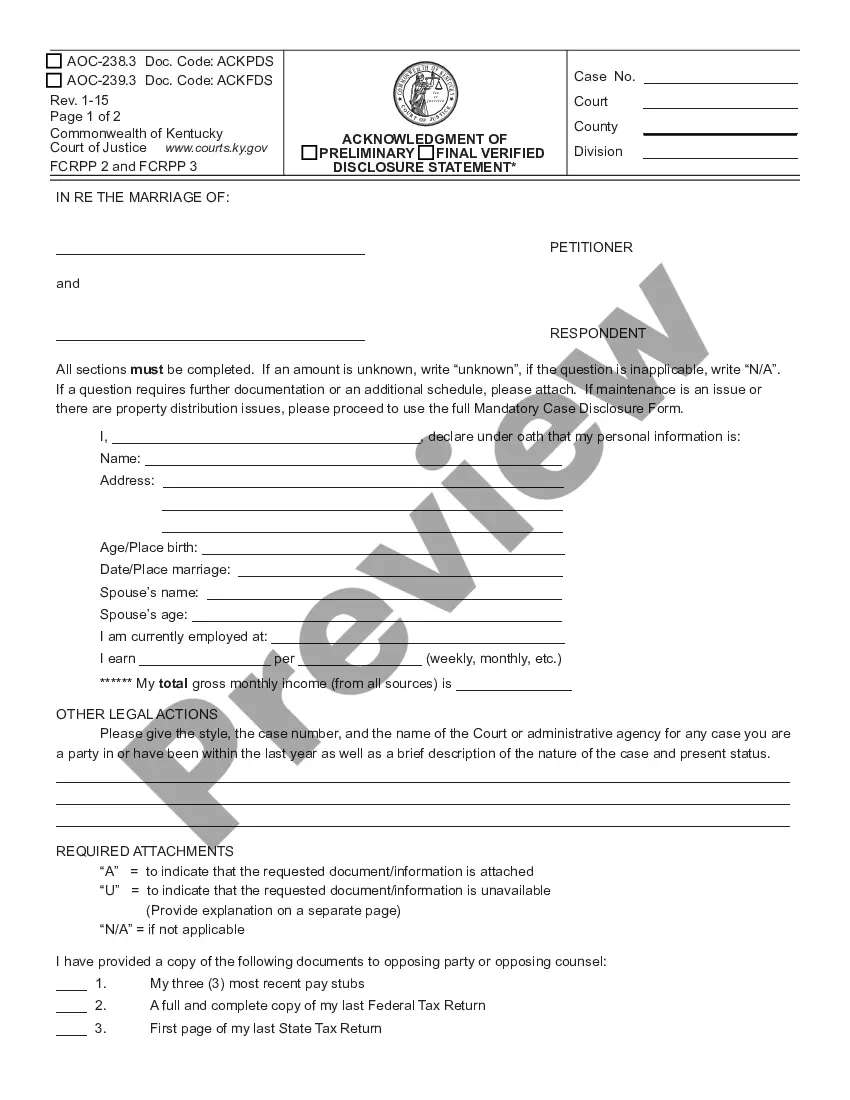

(Official Form 106C) lists the property that you believe you are entitled to keep. If you do not claim the property on this form, it will not be exempted, despite your rights under the law. Before filling out this form, you have to decide whether you will use your state exemptions or the federal exemptions.