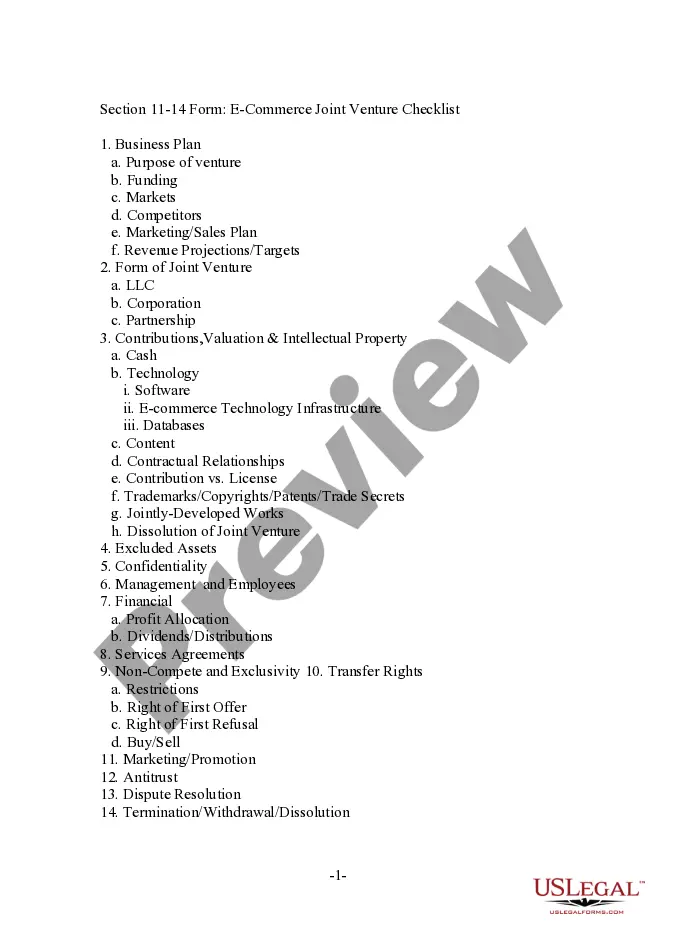

The Indiana Agreement of Merger is a legal document that outlines the terms and conditions of the merger between two entities — Barber Oil Corporation and Stock Transfer Restriction Corporation. This agreement serves as a comprehensive guide, ensuring a smooth and lawful transition between the two companies. Key Terms and Provisions: 1. Parties Involved: The agreement identifies Barber Oil Corporation and Stock Transfer Restriction Corporation as the primary parties involved in the merger. 2. Merger Intent: The document clearly states the intention of both companies to merge their operations, assets, and liabilities into a single entity. It highlights the purpose of the merger, such as increased market share, operational efficiency, or synergy between the businesses. 3. Effective Date: The agreement specifies the effective date of the merger, which marks the commencement of joint operations and the legally binding nature of the agreement. 4. Merger Structure: The document outlines the structure of the merger, whether it is a statutory merger, an acquisition, or another type of combination. It covers the legal and financial aspects involved in consolidating the entities. 5. Consideration: The agreement details the consideration exchanged between the two entities, which may involve cash, stocks, or a combination of both. It highlights the valuation methods used to determine the fair value of each company's assets and the shareholding ratio in the merged entity. 6. Governance and Management: The agreement defines the management structure of the merged entity, including the composition of the board of directors and the appointment of key executives. It also outlines the decision-making process and any special rights or restrictions imposed on major shareholders. 7. Assets and Liabilities: This section covers the transfer and consolidation of assets and liabilities from both companies, including intellectual property, real estate, contracts, and financial obligations. It ensures a comprehensive and accurate inventory of what is included or excluded in the merger. 8. Employee Transition: The document outlines the treatment of employees during and after the merger, including their transfer to the new entity, compensation, benefits, and employment terms. It may address issues such as redundancies, severance packages, and the integration of existing employee benefit plans. Different Types of Indiana Agreement of Merger: 1. Statutory Merger: This type of agreement involves the consolidation of two or more entities into one surviving entity, with one company's assets and liabilities transferring to the other. 2. Stock Acquisition Merger: Here, one company acquires the outstanding shares of the other company's stock, usually through a stock exchange or purchase agreement. The acquiring company becomes the majority shareholder and gains control over the merged entity. 3. Asset Acquisition Merger: In this form, one company acquires the assets of the other company, while the target company continues to exist independently or is dissolved post-transaction. The acquiring company assimilates the assets into its own operations. In conclusion, the Indiana Agreement of Merger between Barber Oil Corporation and Stock Transfer Restriction Corporation is a comprehensive legal document that governs the merger process. It covers various aspects, including intent, structure, consideration, governance, assets, liabilities, and employee transition. Different types of merger structures exist, including statutory merger, stock acquisition merger, and asset acquisition merger, each with specific characteristics and implications.

Indiana Agreement of Merger between Barber Oil Corporation and Stock Transfer Restriction Corporation

Description

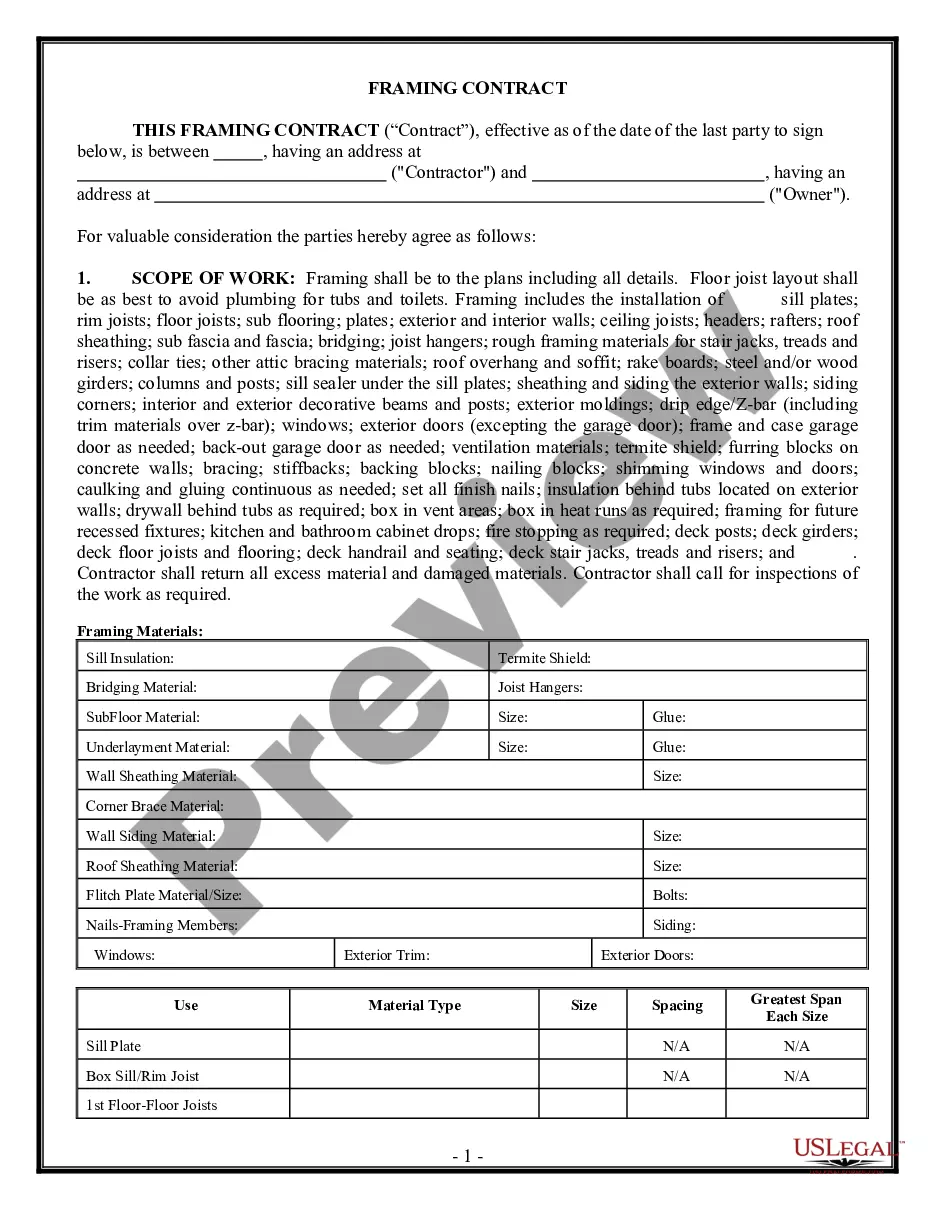

How to fill out Indiana Agreement Of Merger Between Barber Oil Corporation And Stock Transfer Restriction Corporation?

US Legal Forms - one of several biggest libraries of legitimate types in the USA - gives a wide range of legitimate document layouts you can acquire or print. While using web site, you can get a large number of types for enterprise and individual uses, sorted by classes, says, or keywords and phrases.You will find the latest versions of types like the Indiana Agreement of Merger between Barber Oil Corporation and Stock Transfer Restriction Corporation in seconds.

If you have a registration, log in and acquire Indiana Agreement of Merger between Barber Oil Corporation and Stock Transfer Restriction Corporation from the US Legal Forms collection. The Download button will appear on every type you look at. You get access to all earlier delivered electronically types within the My Forms tab of your own bank account.

If you would like use US Legal Forms the first time, here are basic guidelines to get you started out:

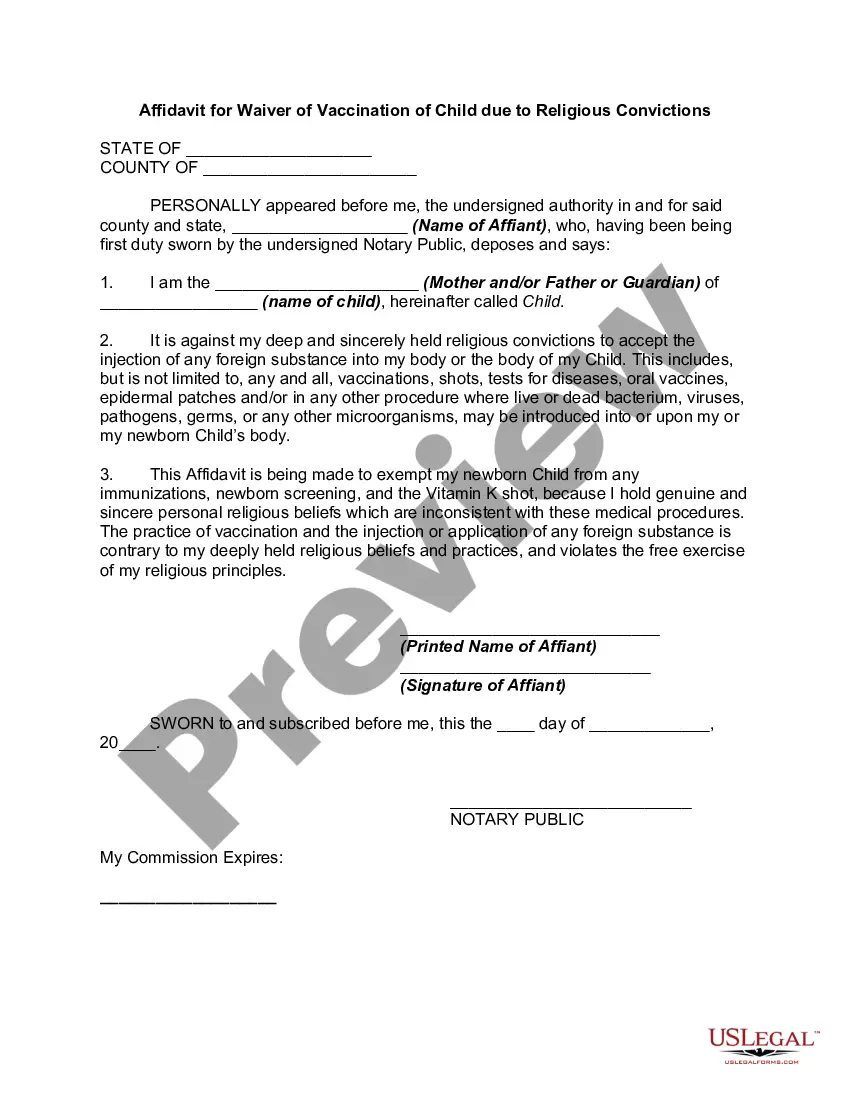

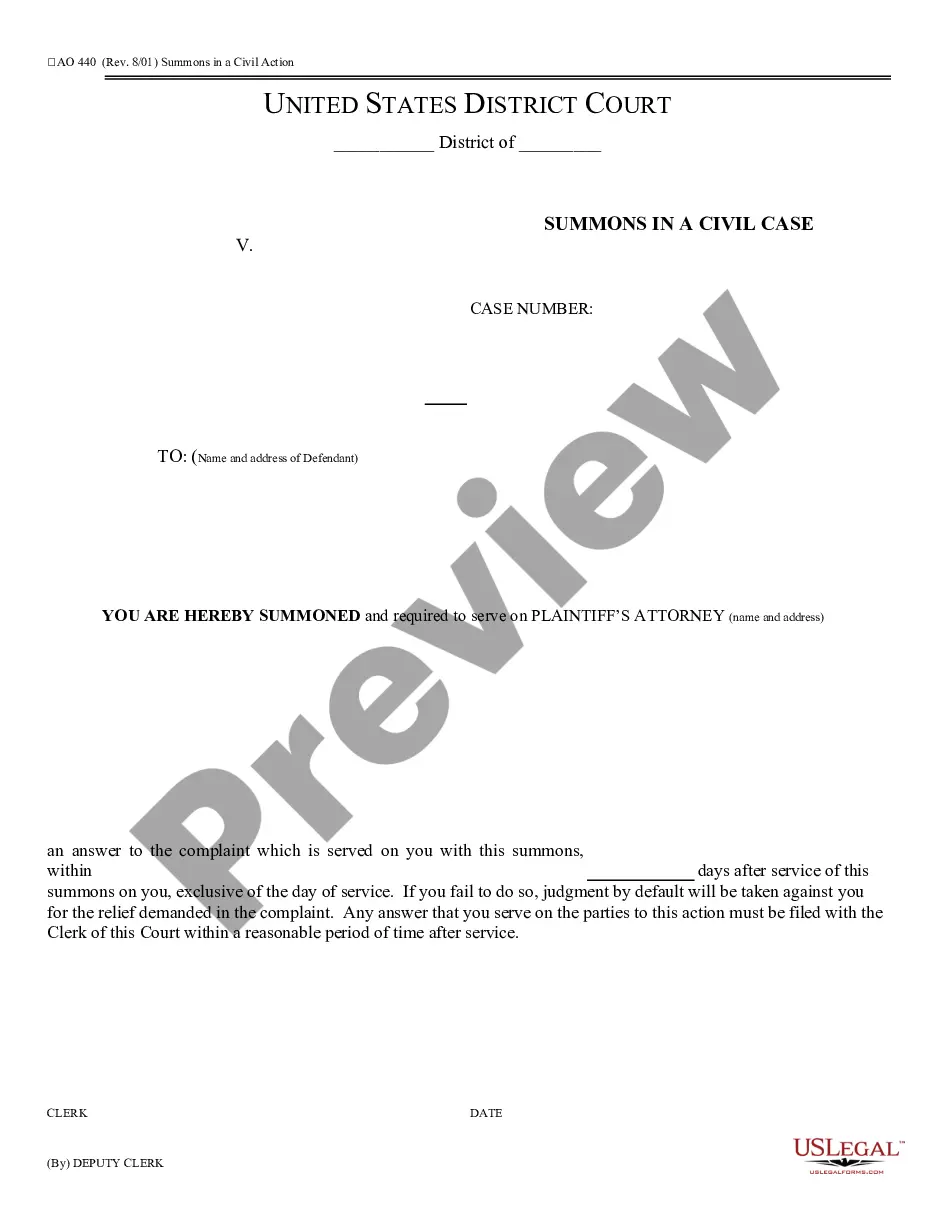

- Be sure you have chosen the proper type for your personal town/state. Go through the Preview button to analyze the form`s content material. See the type information to actually have selected the right type.

- In the event the type does not match your needs, take advantage of the Search field towards the top of the display screen to get the one who does.

- In case you are happy with the form, verify your selection by simply clicking the Buy now button. Then, pick the prices plan you favor and give your qualifications to register for an bank account.

- Procedure the deal. Make use of your Visa or Mastercard or PayPal bank account to accomplish the deal.

- Find the file format and acquire the form on your gadget.

- Make alterations. Complete, revise and print and indication the delivered electronically Indiana Agreement of Merger between Barber Oil Corporation and Stock Transfer Restriction Corporation.

Each and every template you included in your bank account lacks an expiry time and is also your own for a long time. So, if you want to acquire or print one more backup, just check out the My Forms area and then click on the type you need.

Get access to the Indiana Agreement of Merger between Barber Oil Corporation and Stock Transfer Restriction Corporation with US Legal Forms, probably the most considerable collection of legitimate document layouts. Use a large number of specialist and condition-particular layouts that satisfy your small business or individual demands and needs.

Form popularity

FAQ

Hear this out loud PauseIf the merger or acquisition requires a vote by shareholders, the agreement will be available in the proxy document, Schedule 14A (or sometimes an information statement, Schedule 14C). The proxy will include the terms of the merger and what shareholders can expect to receive as proceeds.

Hear this out loud PauseAn agreement of merger is a legal document that establishes the terms and conditions to combine two or more businesses into one new entity. The business owners of the merging companies agree to sell all their stock and assets to the newly formed company for an agreed upon price.

Every M&A transaction involves at least one purchaser, or buyer, the party that will be making the acquisition. This is the person (i.e., individual or company) that signs the purchase agreement, pays the purchase price and which, after closing, directly or indirectly, owns or controls the target company or its assets.

Hear this out loud PauseMerger Parties means, individually and collectively, the Company, the Shareholders, Merger Sub and Buyer.

A merger typically occurs when one company purchases another company by buying a certain amount of its stock in exchange for its own stock. An acquisition is slightly different and often does not involve a change in management.