The Indiana Plan of Reorganization and Merger between CP National Corp. and All tel Corp. is a strategic process wherein both companies collaborate to combine their operations, assets, and resources to form a single entity. This process involves a comprehensive assessment of each company's financial, legal, and operational aspects, ensuring a smooth transition and maximizing the benefits to all stakeholders involved. Keywords: Indiana Plan of Reorganization, Merger, CP National Corp., All tel Corp., collaboration, operations, assets, resources, single entity, financial, legal, operational, stakeholders. There are several types of Indiana Plan of Reorganization and Merger between CP National Corp. and All tel Corp., each with its own focus and objectives. Some of these types may include: 1. Strategic Merger: This type of merger focuses on aligning the operations and strategies of both CP National Corp. and All tel Corp. to enhance their market position, expand product offerings, and achieve economies of scale. 2. Technological Integration: In this type of merger, the primary goal is to merge the technological infrastructure and capabilities of both companies. This would lead to improved operational efficiency, enhanced customer experience, and increased innovation. 3. Market Expansion Merger: This type of merger aims to consolidate CP National Corp. and All tel Corp.'s market presence by combining their customer bases, sales networks, and distribution channels. The objective is to leverage these combined resources to enter new markets, reach a wider audience, and increase market share. 4. Financial Restructuring: This type of merger entails a comprehensive evaluation of CP National Corp. and All tel Corp.'s financial standing, with the goal of enhancing financial stability, reducing costs, and optimizing capital structure. It may involve debt consolidation, asset divestment, or refinancing strategies. 5. Cultural Integration: When companies merge, there is a need to align their cultures, values, and work practices to foster a harmonious working environment. Cultural integration focuses on creating a shared corporate culture that promotes collaboration, teamwork, and employee engagement. These different types of Indiana Plan of Reorganization and Merger between CP National Corp. and All tel Corp. demonstrate the various aspects and objectives that can be considered when devising a merger strategy. The chosen type of merger will depend on the specific goals and requirements of both companies involved.

Indiana Plan of Reorganization and Merger between CP National Corp. and Alltel Corp.

Description

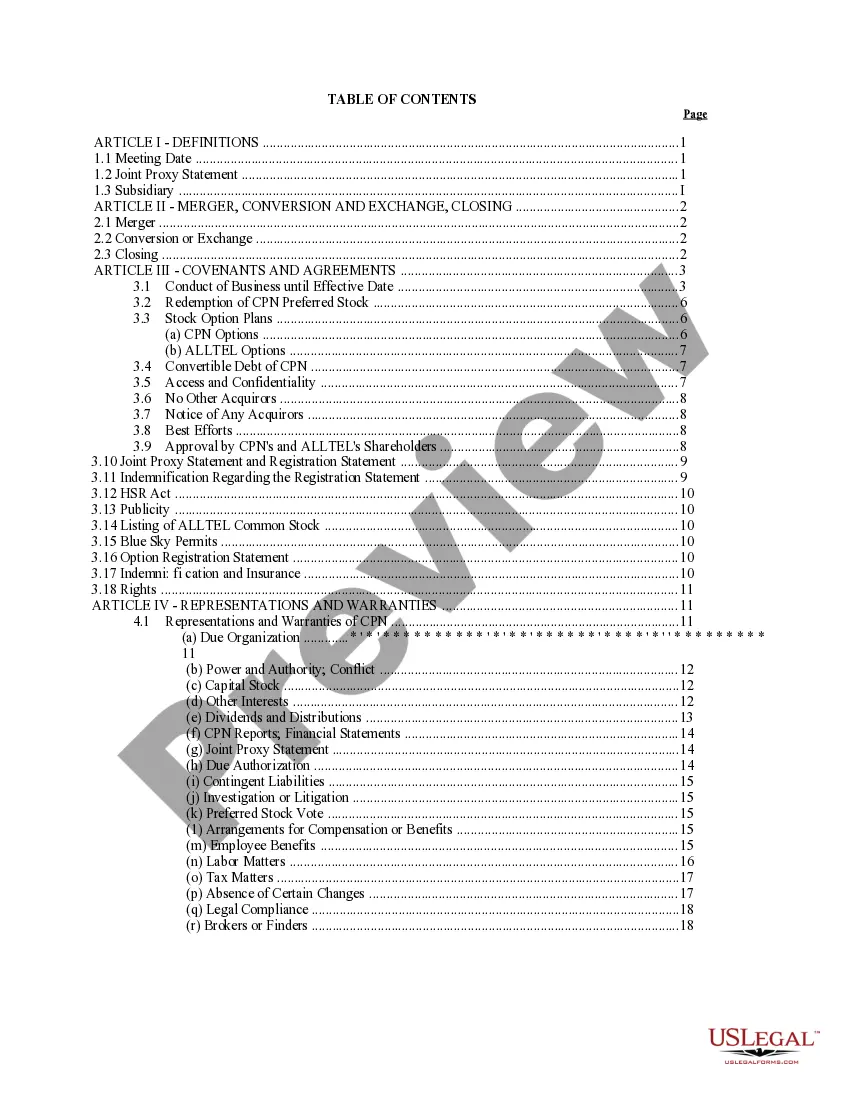

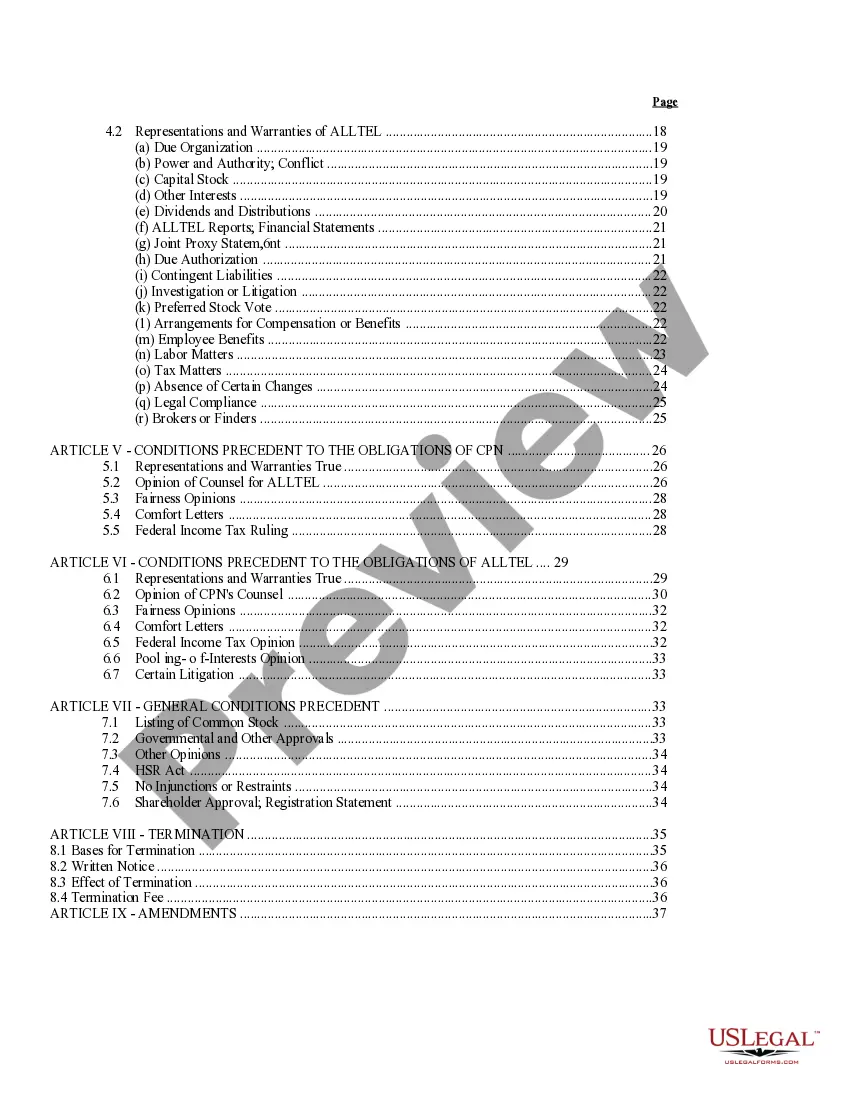

How to fill out Indiana Plan Of Reorganization And Merger Between CP National Corp. And Alltel Corp.?

If you wish to comprehensive, down load, or print authorized record layouts, use US Legal Forms, the largest collection of authorized varieties, which can be found on-line. Utilize the site`s simple and convenient research to get the papers you want. A variety of layouts for company and personal functions are sorted by groups and says, or search phrases. Use US Legal Forms to get the Indiana Plan of Reorganization and Merger between CP National Corp. and Alltel Corp. in a handful of click throughs.

Should you be presently a US Legal Forms buyer, log in in your account and click on the Acquire key to find the Indiana Plan of Reorganization and Merger between CP National Corp. and Alltel Corp.. You can also access varieties you in the past delivered electronically inside the My Forms tab of your respective account.

If you use US Legal Forms initially, refer to the instructions below:

- Step 1. Make sure you have chosen the shape for your appropriate city/region.

- Step 2. Utilize the Review solution to look over the form`s articles. Don`t overlook to see the information.

- Step 3. Should you be not happy together with the develop, use the Research field on top of the screen to discover other variations of your authorized develop format.

- Step 4. After you have identified the shape you want, click the Purchase now key. Select the prices program you prefer and include your credentials to register for the account.

- Step 5. Method the deal. You can utilize your credit card or PayPal account to accomplish the deal.

- Step 6. Select the structure of your authorized develop and down load it on the gadget.

- Step 7. Total, modify and print or sign the Indiana Plan of Reorganization and Merger between CP National Corp. and Alltel Corp..

Each authorized record format you acquire is the one you have forever. You might have acces to every develop you delivered electronically inside your acccount. Select the My Forms section and pick a develop to print or down load once more.

Compete and down load, and print the Indiana Plan of Reorganization and Merger between CP National Corp. and Alltel Corp. with US Legal Forms. There are millions of specialist and status-particular varieties you may use for your company or personal demands.