A promissory note is a legally binding document that outlines the terms and conditions of a loan agreement between a lender and a borrower. In Indiana, a Promissory Note serves as evidence of the debt owed by the borrower to the lender. It is crucial to have a well-drafted promissory note to protect the rights of both parties involved in the loan transaction. The Indiana Promissory Note typically contains vital information such as the names and addresses of the borrower and lender, the principal loan amount, the interest rate, repayment schedule, late payment penalties, and any other terms agreed upon by both parties. By clearly defining these terms, a promissory note helps mitigate any potential conflicts or misunderstandings that may arise in the future. There are different types of promissory notes used in Indiana, depending on the nature of the loan. Some common types include: 1. Secured Promissory Note: This type of note involves the borrower providing collateral, such as real estate or personal property, to secure the loan. In the event of default, the lender can seize the collateral to recover the outstanding debt. 2. Unsecured Promissory Note: Unlike a secured note, an unsecured promissory note does not require any collateral. This type of note relies solely on the borrower's promise to repay the loan as agreed upon. 3. Installment Promissory Note: An installment note outlines a repayment plan where the borrower agrees to repay the loan in fixed installments over a specific period. Each installment consists of both principal and interest. 4. Demand Promissory Note: With a demand note, the lender has the right to request full repayment of the outstanding debt at any time they choose. The borrower must repay the loan promptly after receiving the demand. 5. Balloon Promissory Note: A balloon note involves regular payments (often smaller installments) for a specified period, with a large lump sum payment due at the end of the term. This type of note can be suitable for borrowers who expect a significant inflow of funds in the future. It is important for parties involved in lending transactions in Indiana to understand the intricacies of different promissory note types and consult legal professionals when necessary to ensure compliance with state laws. Creating a clear, detailed, and well-drafted Indiana Promissory Note helps protect the rights and interests of both borrowers and lenders throughout the loan duration.

Indiana Promissory Note

Description

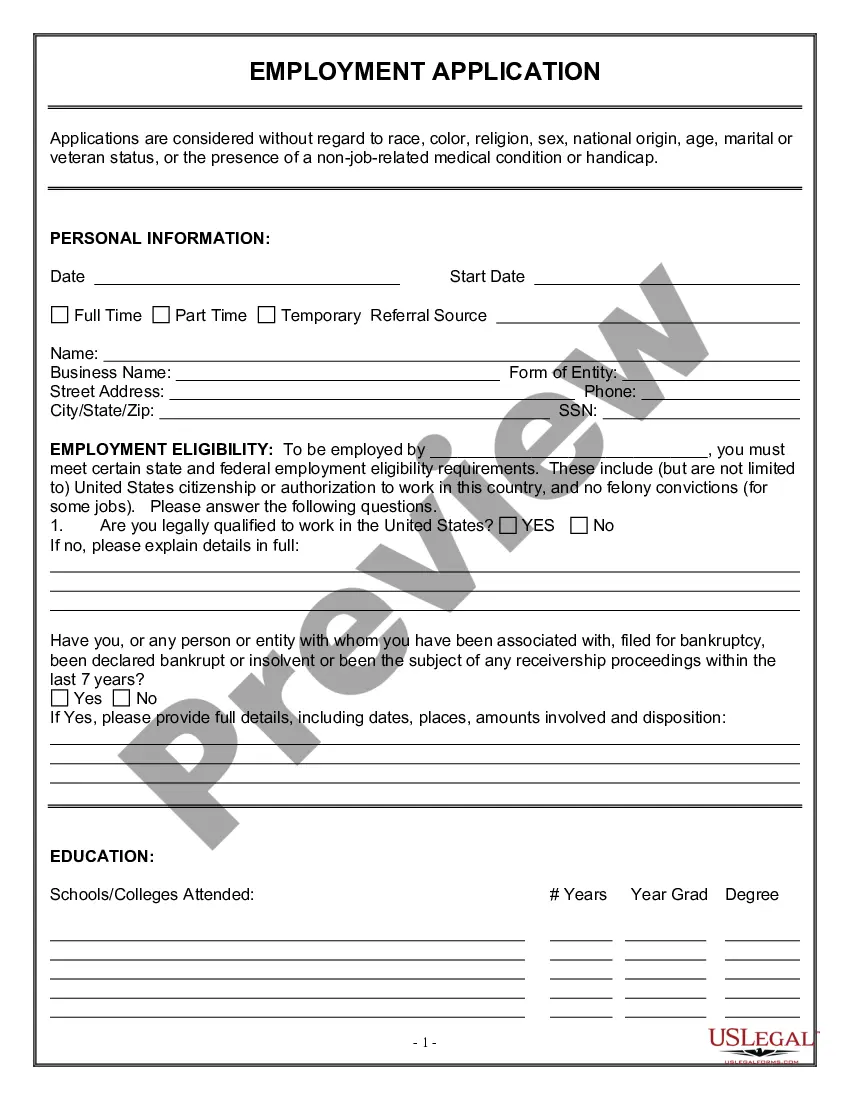

How to fill out Indiana Promissory Note?

If you want to comprehensive, download, or produce legal record themes, use US Legal Forms, the biggest collection of legal kinds, that can be found online. Utilize the site`s simple and easy hassle-free research to obtain the paperwork you will need. Different themes for enterprise and specific reasons are categorized by categories and suggests, or keywords. Use US Legal Forms to obtain the Indiana Promissory Note in just a few mouse clicks.

Should you be currently a US Legal Forms client, log in to your profile and click the Acquire button to have the Indiana Promissory Note. You can even entry kinds you formerly acquired from the My Forms tab of your respective profile.

If you work with US Legal Forms initially, follow the instructions under:

- Step 1. Be sure you have chosen the form for that right metropolis/country.

- Step 2. Make use of the Preview method to look over the form`s content material. Never forget about to read the information.

- Step 3. Should you be unhappy using the kind, use the Research field on top of the monitor to get other models of the legal kind format.

- Step 4. After you have located the form you will need, click the Buy now button. Pick the rates strategy you favor and put your credentials to sign up for the profile.

- Step 5. Method the purchase. You can utilize your bank card or PayPal profile to accomplish the purchase.

- Step 6. Pick the structure of the legal kind and download it on your own product.

- Step 7. Full, modify and produce or indication the Indiana Promissory Note.

Each and every legal record format you acquire is yours eternally. You have acces to each and every kind you acquired within your acccount. Go through the My Forms segment and decide on a kind to produce or download again.

Compete and download, and produce the Indiana Promissory Note with US Legal Forms. There are many professional and state-particular kinds you can utilize for the enterprise or specific needs.

Form popularity

FAQ

A promissory note must include the date of the loan, the loan amount, the names of both the lender and borrower, the interest rate on the loan, and the timeline for repayment. Once the document is signed by both parties, it becomes a legally binding contract.

Promissory notes have set terms, or repayment periods, ranging from a few months to several years. Even legitimate promissory notes involve risks: competition, bad management or severe market conditions can impact the issuer's ability to carry out its promise to pay interest and principal to note buyers.

?A promissory note is basically an IOU,? says Bill Maurer, director of the Institute for Money, Technology and Financial Inclusion at the University of California, Irvine. ?It's a written statement of a promise to pay a specific sum of money by a specific time. Think of it as an IOU that's legally enforceable.?

A promissory note is a written promise by one party to make a payment of money at a date in the future. Although potentially issued by financial institutions, other organizations or individuals can use promissory notes to confirm the agreed terms of a loan. In short, a promissory note allows anyone to act as a lender.

A promissory note must include the date of the loan, the loan amount, the names of both the lender and borrower, the interest rate on the loan, and the timeline for repayment. Once the document is signed by both parties, it becomes a legally binding contract.

A promissory note is not something that an appraiser is often required to value. However, when the situation does arise, the calculation seems fairly simple. The standard formula should be simple, calculating the interest accrued added to the outstanding principal amount.

If you are the holder of a promissory note, you may be able to sell the note for cash. However, you will be selling the note for less than the face value. Generally, a note buyer will discount the note by 10 to 35 percent.

Fair market value for a promissory note is determined by calculating the present value of the expected payments on the note.