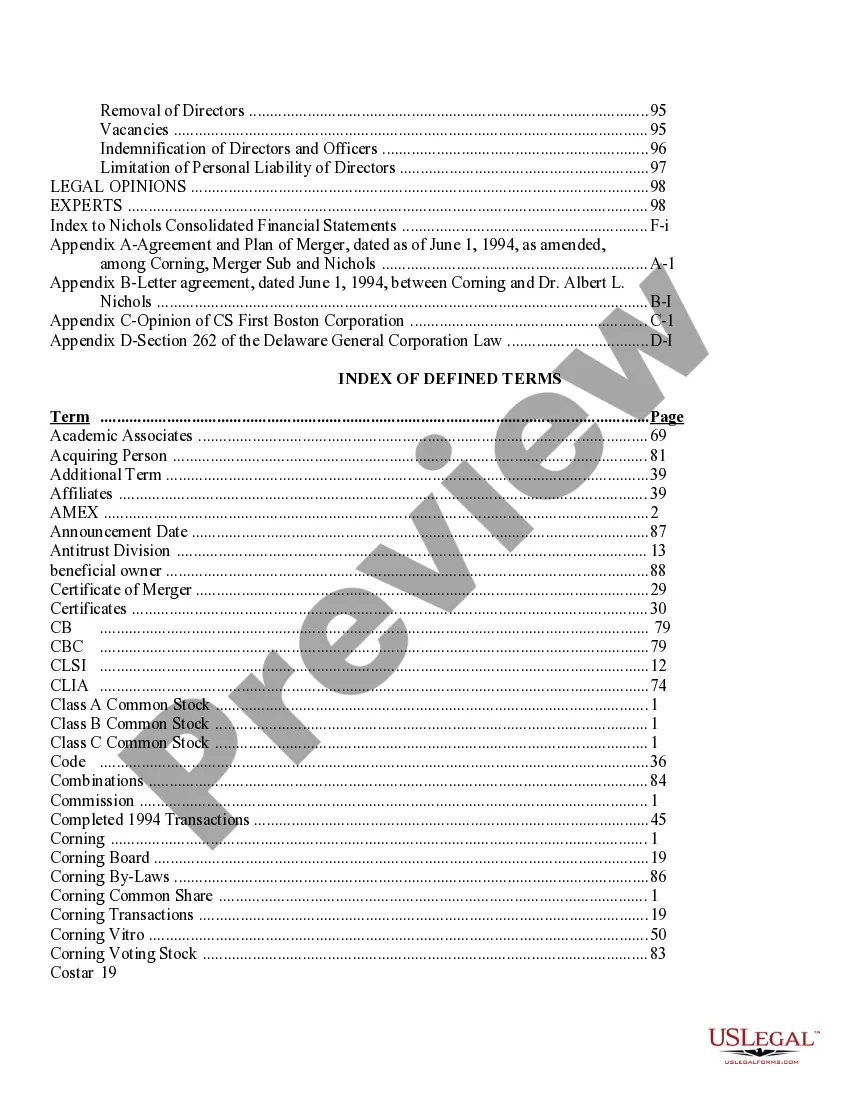

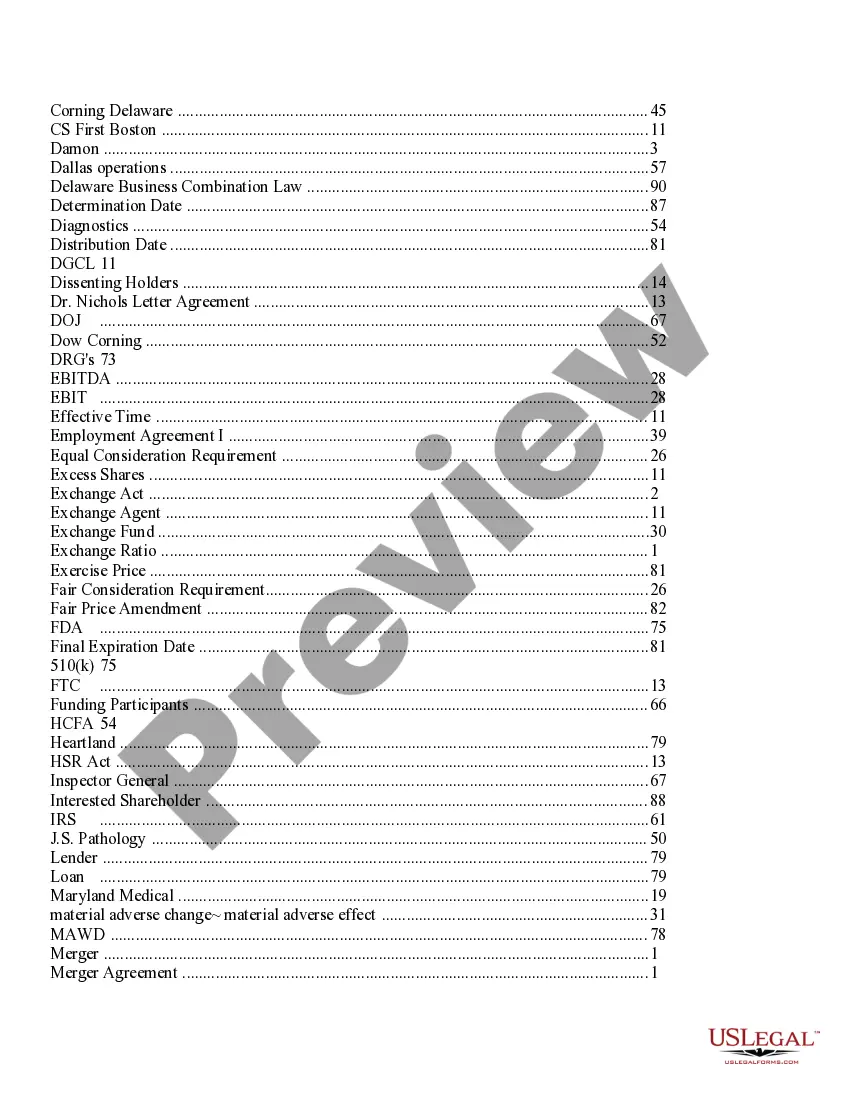

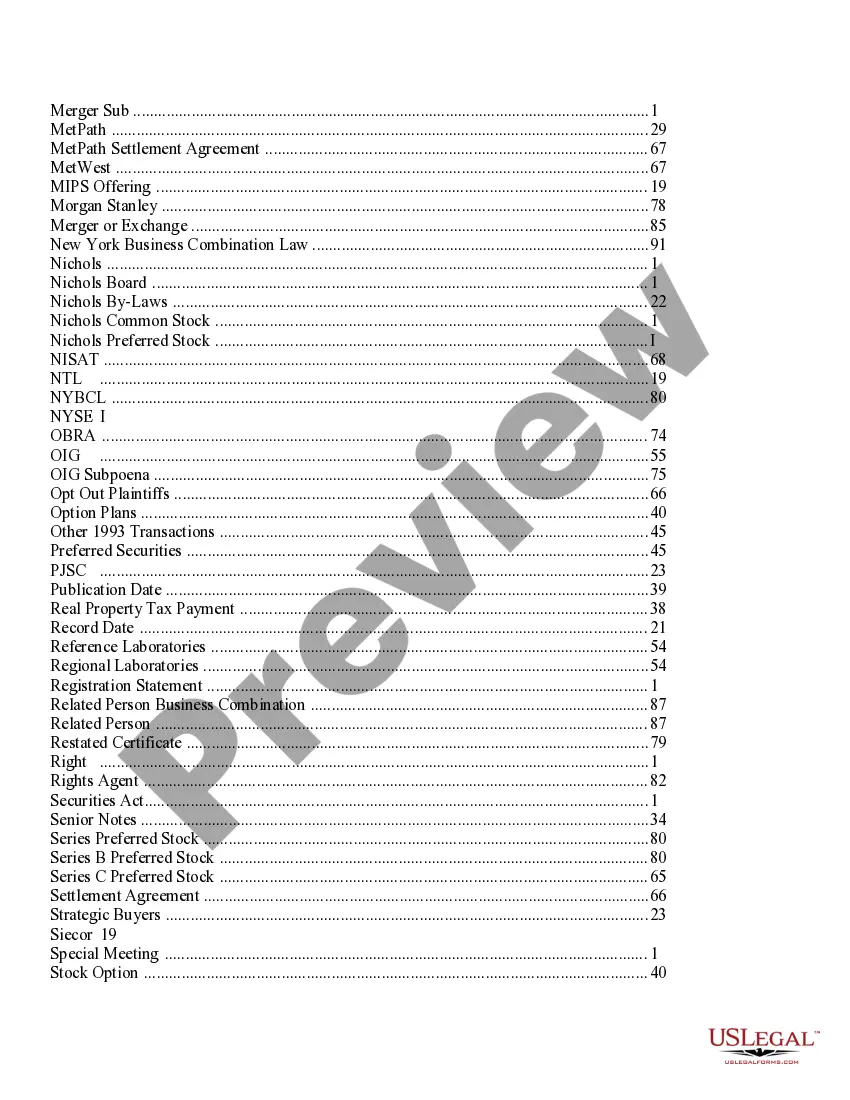

The Indiana Proxy Statement — Prospectus of Corning Incorporated without appendices is an important document that provides shareholders and potential investors with detailed information about the company's operations, financial performance, governance practices, and other relevant matters. It serves as a communication tool between the company's management and its shareholders. The Indiana Proxy Statement — Prospectus of Corning Incorporated without appendices can be categorized into different types based on their purpose and content. Some common types include: 1. Annual Proxy Statement: This type of proxy statement is typically issued on an annual basis and provides shareholders with information about the company's annual meeting of stockholders. It includes details about the meeting's agenda, voting instructions, director nominations, executive compensation, and other shareholder proposals. 2. Special Proxy Statement: A special proxy statement is issued when there are extraordinary or significant events taking place, such as mergers, acquisitions, or major corporate actions that require shareholder approval. It provides specific details about these events, explains their implications on the company and its shareholders, and outlines the voting process. 3. Proxy Statement in connection with a Tender Offer: In instances where the company makes a tender offer to its shareholders, a proxy statement is issued to provide relevant details about the offer, including the terms and conditions, reasons for the offer, and any potential risks or benefits associated with accepting or rejecting it. 4. Proxy Statement for Shareholder Proposals: This type of proxy statement contains information about proposals made by shareholders that will be voted upon during the annual meeting. It provides detailed explanations of the proposals, including their purpose, potential impacts, and any recommendations from the company's board of directors. The Indiana Proxy Statement — Prospectus of Corning Incorporated without appendices is a comprehensive document that typically covers topics such as the company's history, corporate structure, executive compensation, financial statements, risk factors, corporate governance practices, and other important disclosures required by applicable securities laws. Key keywords: Indiana Proxy Statement, Prospectus, Corning Incorporated, shareholders, investors, operations, financial performance, governance practices, annual meeting, stockholders, director nominations, executive compensation, shareholder proposals, mergers, acquisitions, tender offer, shareholder approval, risks, benefits, corporate structure, history, financial statements, risk factors, corporate governance.

Indiana Proxy Statement - Prospectus of Corning Incorporated without appendices

Description

How to fill out Indiana Proxy Statement - Prospectus Of Corning Incorporated Without Appendices?

Choosing the right lawful papers design might be a struggle. Obviously, there are a lot of layouts available on the net, but how can you get the lawful type you require? Use the US Legal Forms internet site. The service offers 1000s of layouts, including the Indiana Proxy Statement - Prospectus of Corning Incorporated without appendices, that you can use for enterprise and personal requirements. Every one of the kinds are examined by experts and meet state and federal demands.

If you are presently listed, log in for your accounts and click the Download switch to obtain the Indiana Proxy Statement - Prospectus of Corning Incorporated without appendices. Make use of your accounts to look through the lawful kinds you might have acquired earlier. Check out the My Forms tab of your respective accounts and get one more duplicate in the papers you require.

If you are a new end user of US Legal Forms, listed here are simple recommendations that you can follow:

- First, make sure you have selected the appropriate type to your metropolis/area. You are able to look over the shape using the Preview switch and browse the shape information to ensure this is the right one for you.

- When the type fails to meet your requirements, make use of the Seach discipline to find the right type.

- Once you are positive that the shape is proper, select the Acquire now switch to obtain the type.

- Opt for the rates strategy you want and enter in the essential details. Build your accounts and buy the transaction using your PayPal accounts or Visa or Mastercard.

- Opt for the data file format and down load the lawful papers design for your device.

- Complete, edit and print and sign the received Indiana Proxy Statement - Prospectus of Corning Incorporated without appendices.

US Legal Forms is definitely the greatest local library of lawful kinds for which you can see various papers layouts. Use the service to down load skillfully-created paperwork that follow express demands.