Indiana Ratification of Sale of Stock refers to a legal document that formalizes the validation and acknowledgment of the sale and transfer of stock ownership in a corporation based in Indiana. This agreement ensures that the sale of stock adheres to the proper legal procedures and that the transaction is officially recognized by all parties involved. The Indiana Ratification of Sale of Stock serves as concrete evidence of the buyer's ownership rights and outlines the terms and conditions of the stock sale. It is a crucial document that provides legal protection to both the buyer and the seller, as well as the corporation itself. This ratification typically includes essential details such as the names and addresses of the involved parties, the date of the stock sale, the number of shares sold, and the agreed-upon purchase price. It also highlights any conditions or contingencies associated with the sale, including warranties and representations made by the seller. The Indiana Ratification of Sale of Stock can be categorized into different types based on specific circumstances or additional provisions required. These variations ensure that the document can cater to a wide range of stock sale scenarios. Some types of Indiana Ratification of Sale of Stock include: 1. Standard Ratification: This is the most common type and involves a straightforward transfer of stock ownership between two parties, ensuring all necessary legal requirements are met. 2. Conditional Ratification: This type involves the inclusion of specific conditions or terms that must be fulfilled by either the buyer or seller for the sale to be finalized. These conditions could relate to payment terms, obtaining regulatory approvals, or meeting certain performance indicators. 3. Cross-border Ratification: In cases where the buyer or seller is located outside of Indiana, this type of ratification addresses any additional legal and compliance considerations related to international stock transfers. 4. Corporate Ratification: When a corporation itself is involved in the sale of its own stock, this type of ratification outlines the internal processes, approvals, and shareholder notifications required to facilitate the sale. It is important to note that the specific requirements and provisions of the Indiana Ratification of Sale of Stock may vary depending on the unique circumstances of the transaction. To ensure compliance and legal validity, it is advisable to seek the assistance of legal professionals familiar with Indiana corporate laws and regulations.

Indiana Ratification of Sale of Stock

Description

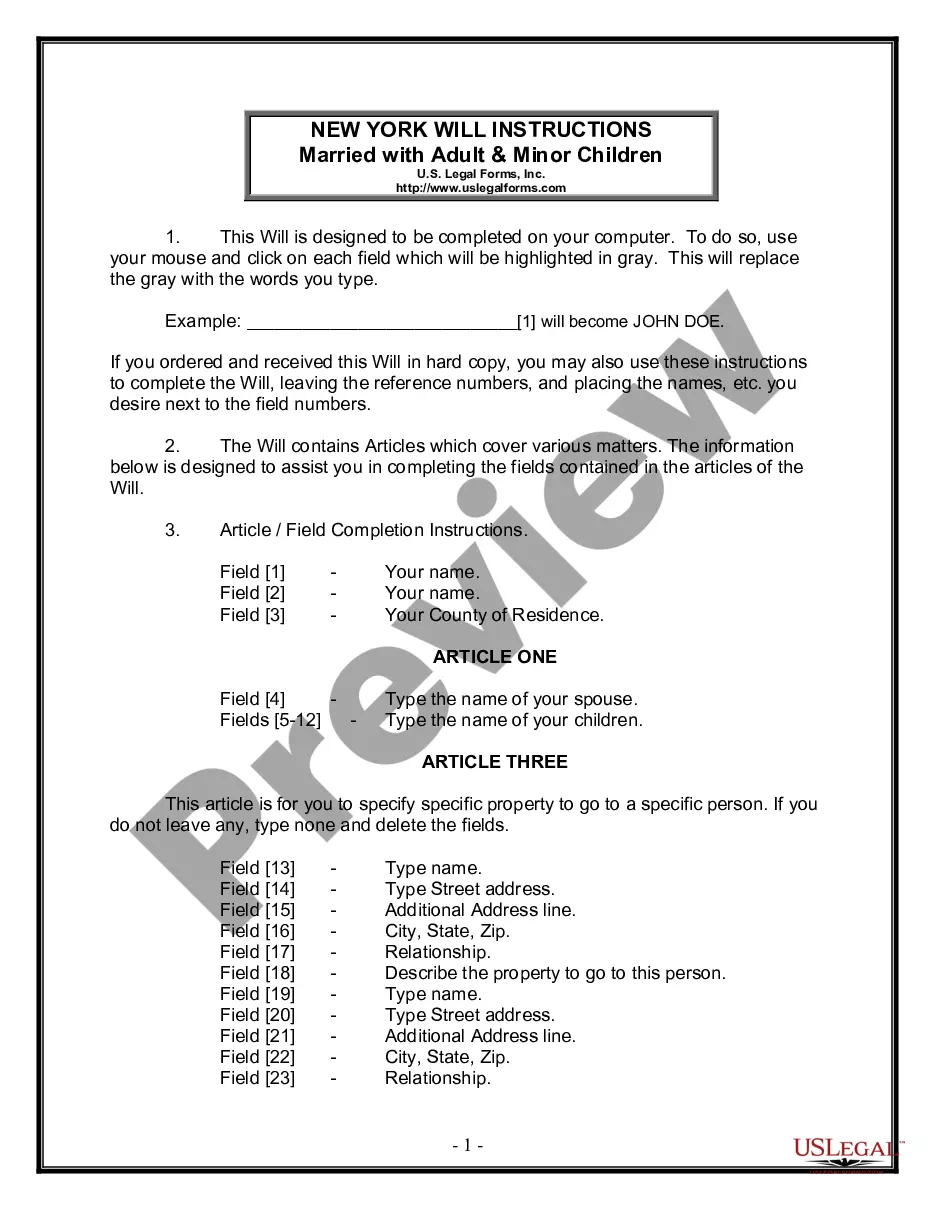

How to fill out Indiana Ratification Of Sale Of Stock?

Are you within a situation where you require files for both organization or individual uses almost every day? There are plenty of authorized document themes available on the Internet, but locating ones you can rely on isn`t simple. US Legal Forms offers 1000s of kind themes, such as the Indiana Ratification of Sale of Stock, which are written to fulfill federal and state demands.

If you are already knowledgeable about US Legal Forms internet site and also have an account, simply log in. Following that, it is possible to down load the Indiana Ratification of Sale of Stock design.

Should you not have an bank account and need to begin using US Legal Forms, follow these steps:

- Find the kind you want and ensure it is to the proper city/region.

- Take advantage of the Preview switch to check the form.

- Look at the information to ensure that you have chosen the appropriate kind.

- In the event the kind isn`t what you`re seeking, take advantage of the Look for area to find the kind that meets your requirements and demands.

- When you obtain the proper kind, just click Buy now.

- Opt for the pricing plan you desire, fill out the necessary information and facts to make your bank account, and pay for the order with your PayPal or Visa or Mastercard.

- Choose a handy paper structure and down load your version.

Find every one of the document themes you possess purchased in the My Forms menu. You may get a more version of Indiana Ratification of Sale of Stock anytime, if necessary. Just click on the needed kind to down load or printing the document design.

Use US Legal Forms, probably the most comprehensive variety of authorized varieties, in order to save time as well as stay away from errors. The support offers professionally produced authorized document themes which can be used for a selection of uses. Create an account on US Legal Forms and start producing your lifestyle a little easier.