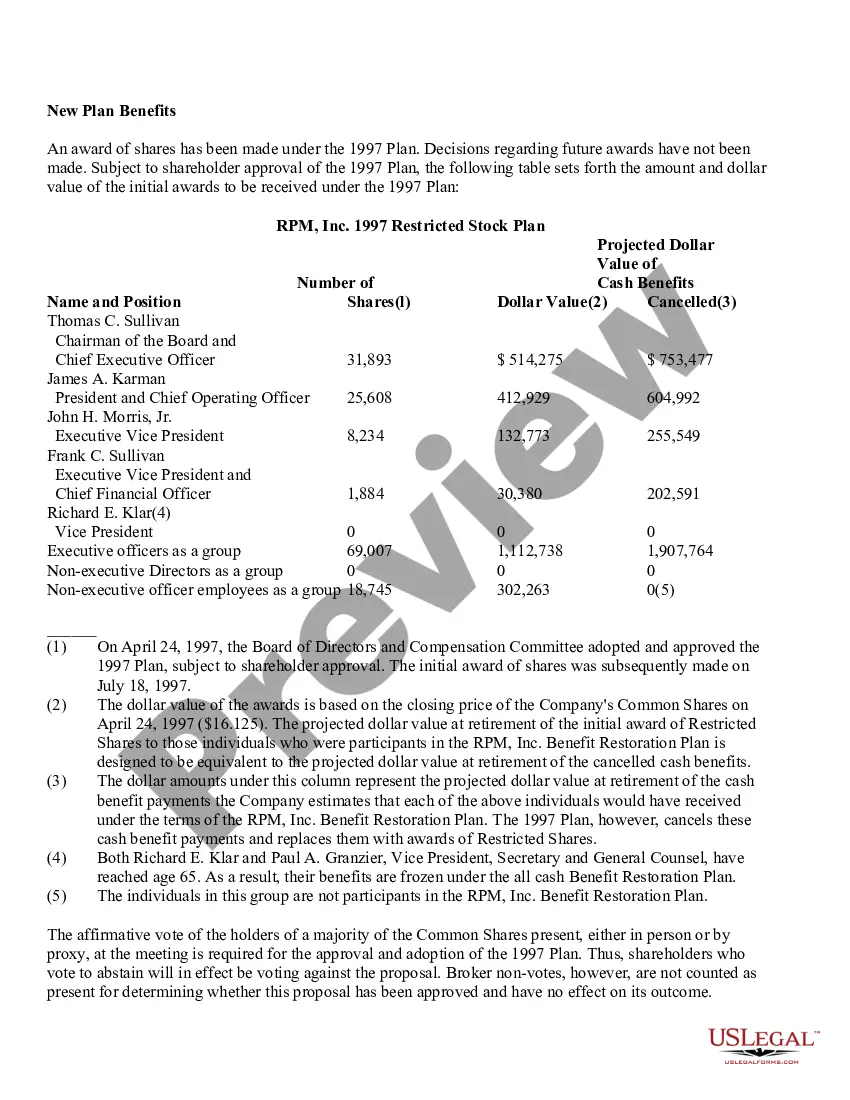

The Indiana Adoption of Restricted Stock Plan is a comprehensive employee compensation initiative implemented by RPM, Inc., a leading corporation operating in Indiana. This plan aims to offer a valuable incentive to eligible employees by granting them individually customized restricted stock awards. Under this program, eligible employees are given the opportunity to receive shares of RPM, Inc.'s stock as part of their compensation package. These shares, referred to as restricted stock, are awarded to employees subject to specific conditions and restrictions set forth by the plan. The primary purpose of these restrictions is to align the interests of RPM, Inc.'s employees with the long-term success and growth of the company. The Indiana Adoption of Restricted Stock Plan encompasses various types of restricted stock awards, tailored to meet different employee needs and positions within RPM, Inc. These types of awards include: 1. Time-based Restricted Stock: Employees receiving this type of award are granted a specific number of shares based on their length of service or tenure with the company. The shares are typically subject to a vesting period, during which they are restricted and cannot be sold or transferred. 2. Performance-based Restricted Stock: This category of restricted stock is granted to employees based on the achievement of predetermined performance goals or metrics. The awards are tied to key performance indicators, such as financial targets, market share growth, or individual performance objectives. Once earned, the shares may become fully vested or subject to further performance conditions. 3. Promotional or Retention Restricted Stock: These awards are often given to employees who are being promoted or whose valuable skills and expertise are critical for RPM, Inc.'s future growth. These grants serve as retention incentives to encourage talented individuals to remain with the company and contribute to its success over the long term. To maintain the integrity of the program and ensure compliance with regulatory requirements, the Indiana Adoption of Restricted Stock Plan incorporates guidelines regarding share pricing, transferability, taxation, and forfeiture provisions. These guidelines protect both the interests of RPM, Inc. and the participating employees. Overall, the Indiana Adoption of Restricted Stock Plan serves as a strategic tool for attracting, motivating, and retaining talented employees within RPM, Inc. By offering employees an ownership stake in the company, this plan fosters a culture of shared accountability and aligns employees' interests with the overall success of the corporation.

Indiana Adoption of Restricted Stock Plan of RPM, Inc.

Description

How to fill out Indiana Adoption Of Restricted Stock Plan Of RPM, Inc.?

Discovering the right lawful record format could be a battle. Of course, there are a variety of templates available online, but how would you find the lawful develop you need? Make use of the US Legal Forms internet site. The services gives a large number of templates, for example the Indiana Adoption of Restricted Stock Plan of RPM, Inc., that can be used for business and private demands. All of the types are checked by experts and meet federal and state demands.

If you are presently listed, log in for your bank account and then click the Acquire option to get the Indiana Adoption of Restricted Stock Plan of RPM, Inc.. Make use of bank account to look throughout the lawful types you might have acquired formerly. Check out the My Forms tab of your respective bank account and have an additional copy in the record you need.

If you are a brand new customer of US Legal Forms, listed here are basic recommendations so that you can stick to:

- Very first, make certain you have chosen the correct develop for your personal metropolis/county. It is possible to look over the form making use of the Review option and look at the form information to guarantee this is basically the right one for you.

- If the develop fails to meet your expectations, use the Seach industry to find the appropriate develop.

- Once you are sure that the form is proper, click the Purchase now option to get the develop.

- Opt for the pricing prepare you would like and enter in the necessary details. Create your bank account and purchase the order with your PayPal bank account or credit card.

- Pick the data file format and acquire the lawful record format for your product.

- Comprehensive, change and printing and indication the received Indiana Adoption of Restricted Stock Plan of RPM, Inc..

US Legal Forms will be the largest collection of lawful types that you can see numerous record templates. Make use of the service to acquire skillfully-manufactured files that stick to condition demands.