Indiana Proposal to ratify the prior grant of options to each directors to purchase common stock

Description

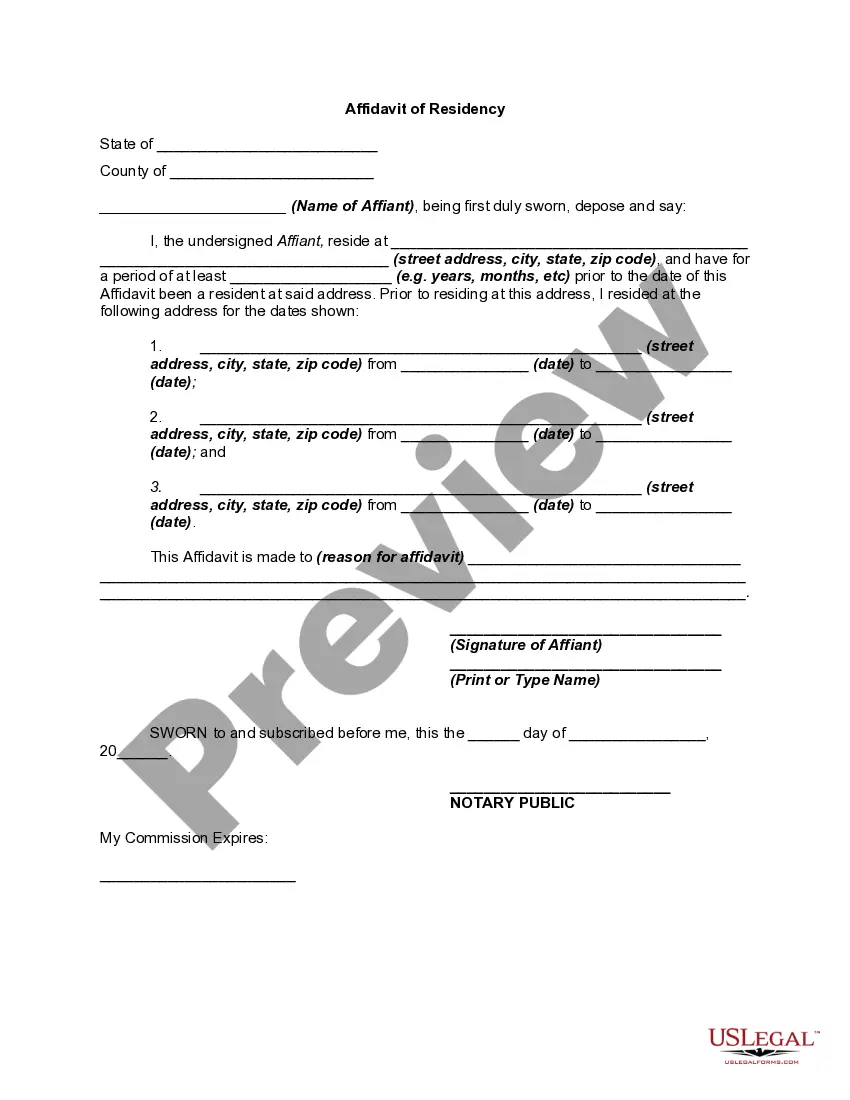

How to fill out Proposal To Ratify The Prior Grant Of Options To Each Directors To Purchase Common Stock?

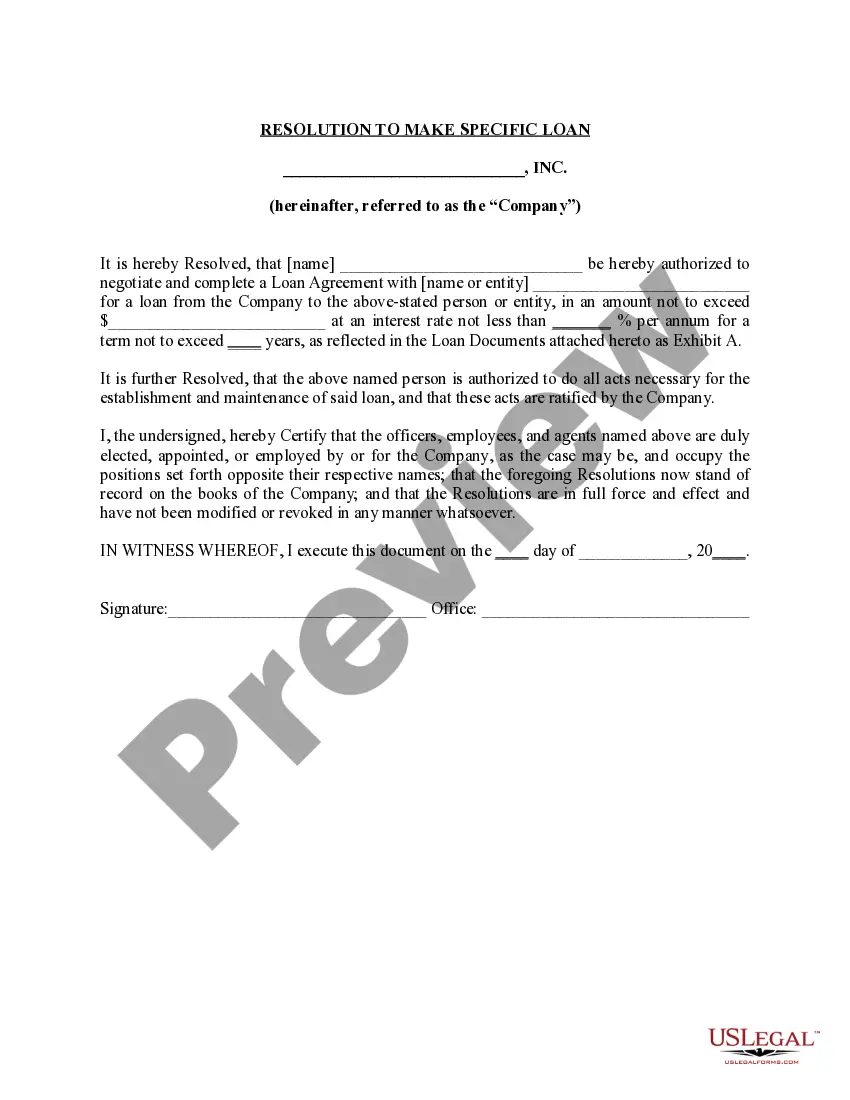

Are you presently in a placement where you need paperwork for either organization or person uses just about every day time? There are plenty of legal file templates available on the net, but finding kinds you can rely on is not straightforward. US Legal Forms gives thousands of type templates, much like the Indiana Proposal to ratify the prior grant of options to each directors to purchase common stock, that are created to meet federal and state requirements.

When you are previously acquainted with US Legal Forms web site and have an account, just log in. After that, you may download the Indiana Proposal to ratify the prior grant of options to each directors to purchase common stock format.

Unless you have an profile and want to begin using US Legal Forms, follow these steps:

- Obtain the type you will need and ensure it is for your correct metropolis/county.

- Take advantage of the Preview option to review the shape.

- Look at the outline to actually have chosen the appropriate type.

- If the type is not what you`re searching for, use the Research discipline to obtain the type that fits your needs and requirements.

- When you obtain the correct type, just click Acquire now.

- Select the costs plan you would like, complete the required information and facts to make your money, and purchase an order making use of your PayPal or Visa or Mastercard.

- Decide on a handy document file format and download your duplicate.

Locate all the file templates you have purchased in the My Forms food selection. You may get a additional duplicate of Indiana Proposal to ratify the prior grant of options to each directors to purchase common stock anytime, if possible. Just click the required type to download or print the file format.

Use US Legal Forms, probably the most considerable assortment of legal kinds, in order to save time and steer clear of mistakes. The services gives appropriately produced legal file templates which you can use for a variety of uses. Make an account on US Legal Forms and begin making your life easier.

Form popularity

FAQ

A credit restricted felon is anyone who is: (1) at least 21 years old and has been convicted of child molesting involving sexual intercourse or deviate sexual conduct involving a child under 12; (2) convicted of child molest resulting in serious bodily injury or death; or.

Indiana Code Section 23-0.5-2-13 requires LLCs to submit a biennial business entity report to the Secretary of State every other year. You can file online for a $31 fee or by mail for a $50 fee.

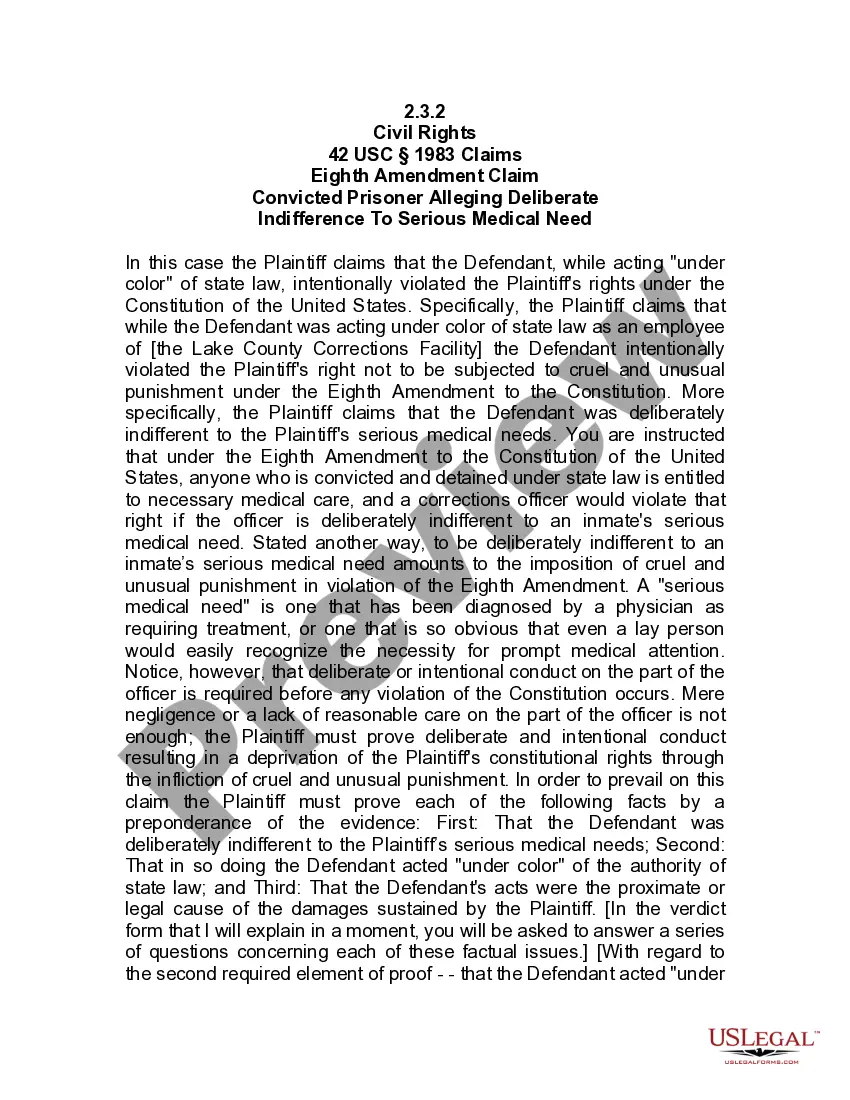

Business and Other Associations § 23-1-35-1. (3) in a manner the director reasonably believes to be in the best interests of the corporation. (3) a committee of the board of directors of which the director is not a member if the director reasonably believes the committee merits confidence.

Any defendant may appeal the interlocutory order overruling the objections and appointing appraisers in the manner that appeals are taken from final judgments in civil actions. (f) All the parties shall take notice of and be bound by the judgment in the appeal.

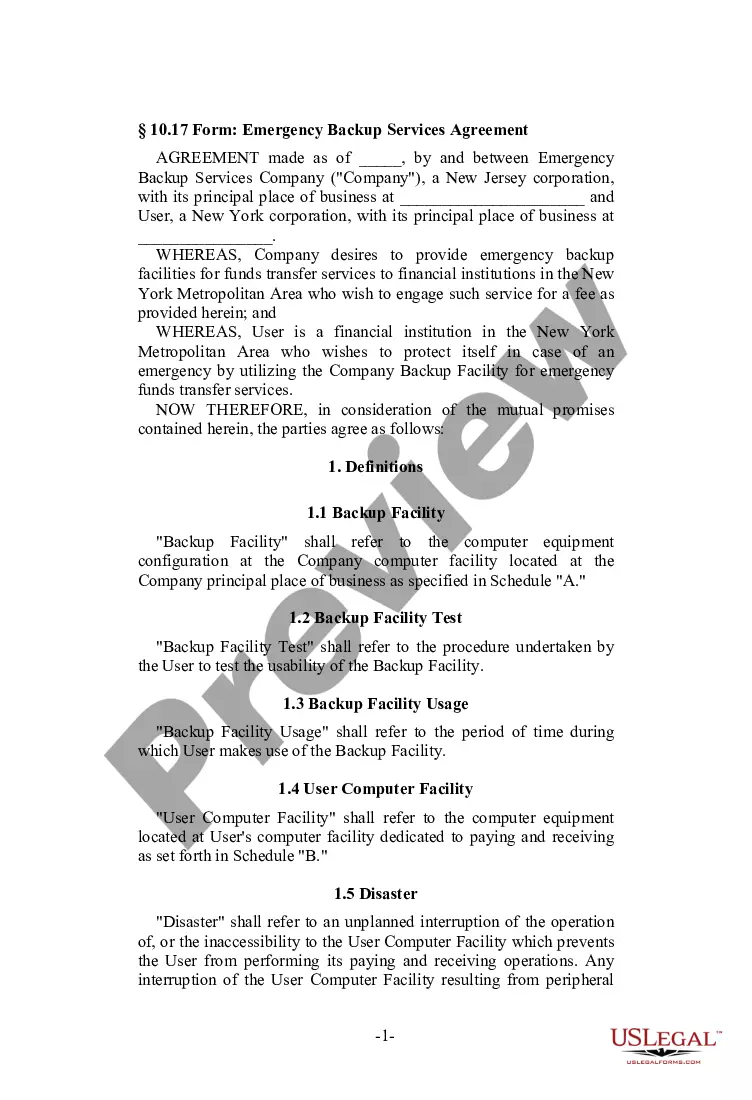

Foreign Entity Registration in Indiana; Failure to Register.

Indiana Code § 23-0.5-3-1. Permitted Names; Falsely Implying Government Agency Status or Connection :: 2022 Indiana Code :: US Codes and Statutes :: US Law :: Justia.

CHAPTER 1. Assumed Business Names. 23-15-1-1. Filing of certificate of assumed name; record; applicability entities; consistent entity indicator; notice of discontinuance of use; fees.

A Limited Liability Partnership (LLP) is formed and governed based on the Indiana Uniform Partnership Act. An LLP is considered a blend of a corporation and a partnership. Beyond the assets that were invested in the partnership, none of the partners may be held personally responsible for the actions of other parties.