Indiana Employee Stock Ownership Plan of Franklin Savings Bank - Detailed

Description

How to fill out Employee Stock Ownership Plan Of Franklin Savings Bank - Detailed?

Are you currently in a place where you will need files for sometimes enterprise or specific functions almost every day time? There are a lot of lawful papers web templates accessible on the Internet, but discovering versions you can rely isn`t effortless. US Legal Forms offers a large number of type web templates, much like the Indiana Employee Stock Ownership Plan of Franklin Savings Bank - Detailed, that happen to be published to meet state and federal demands.

In case you are previously knowledgeable about US Legal Forms website and possess your account, merely log in. After that, you can acquire the Indiana Employee Stock Ownership Plan of Franklin Savings Bank - Detailed web template.

Unless you provide an bank account and want to begin using US Legal Forms, abide by these steps:

- Find the type you require and make sure it is to the right area/county.

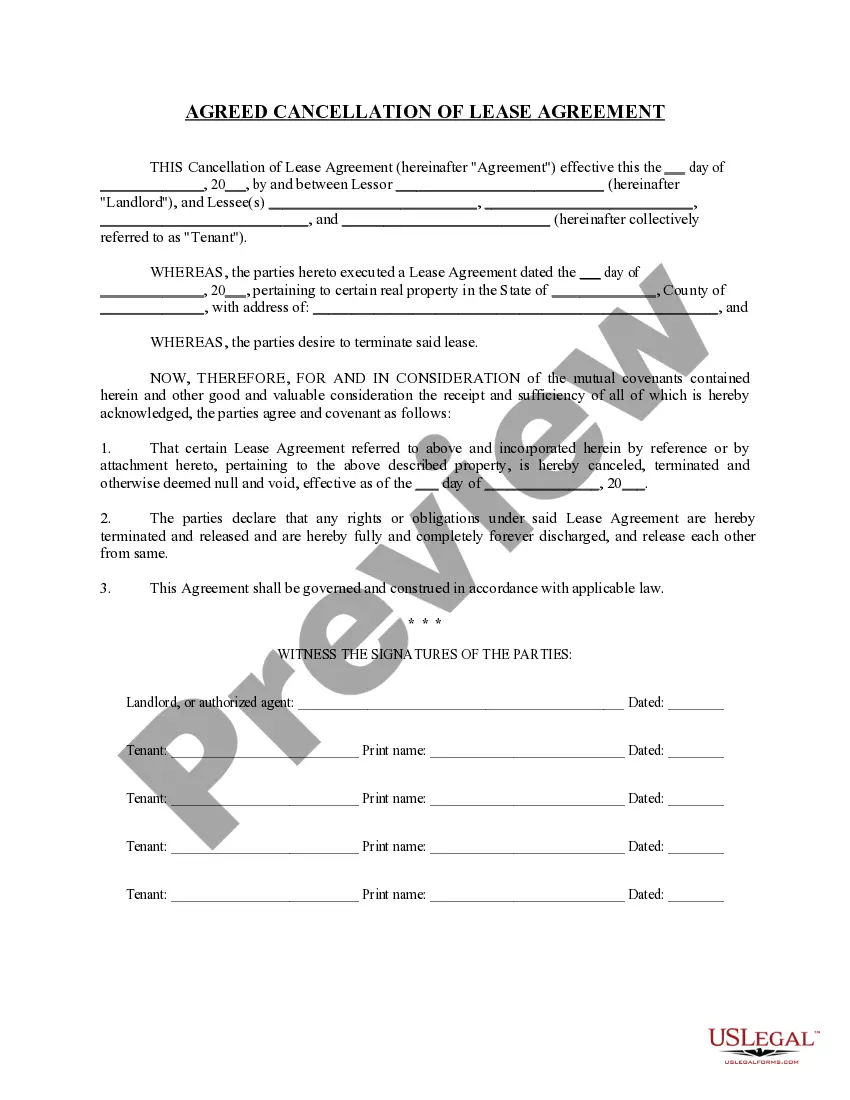

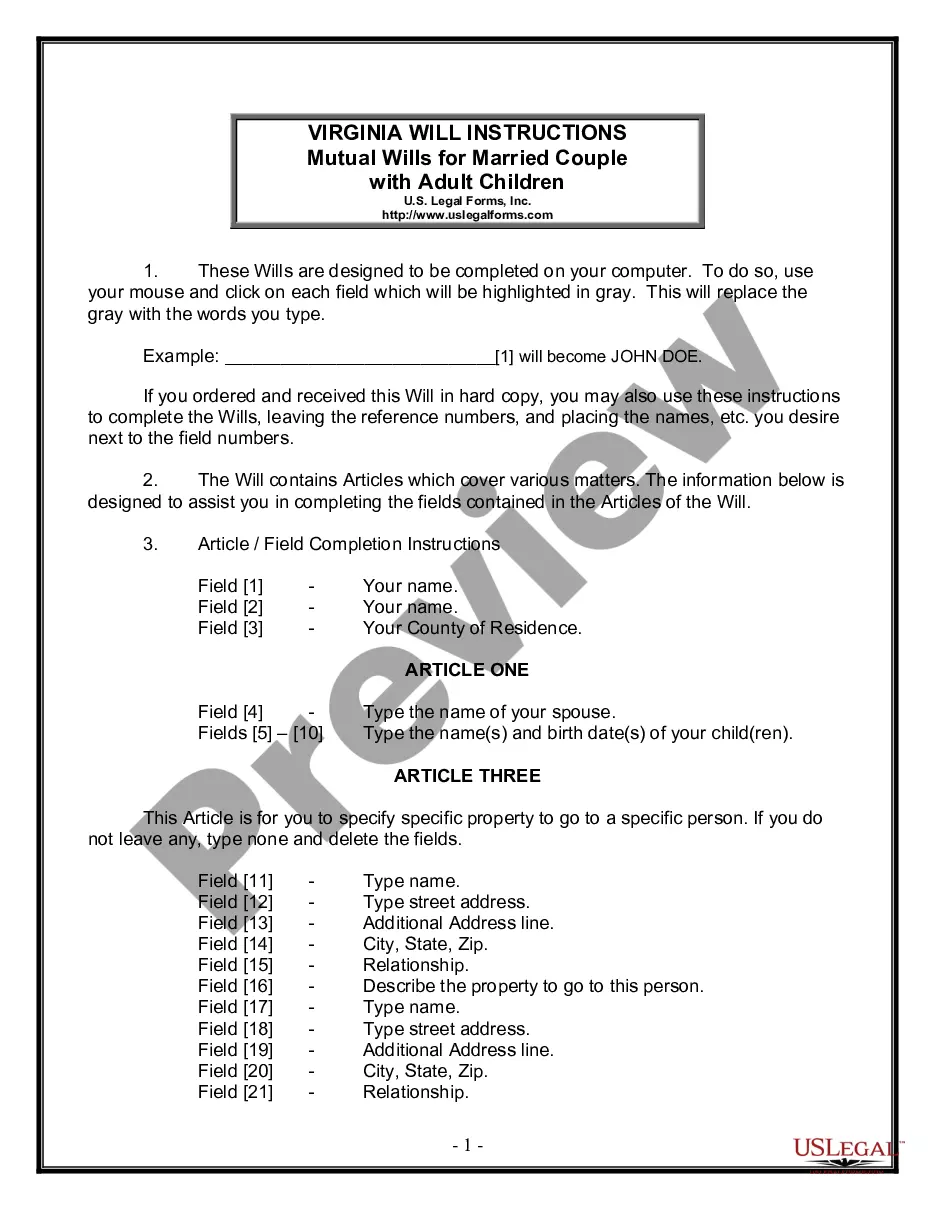

- Make use of the Review key to analyze the form.

- Read the description to actually have chosen the correct type.

- In case the type isn`t what you are seeking, make use of the Lookup area to obtain the type that suits you and demands.

- If you discover the right type, click on Purchase now.

- Select the costs plan you desire, fill out the necessary information to generate your money, and pay for the transaction making use of your PayPal or Visa or Mastercard.

- Pick a handy document file format and acquire your copy.

Find every one of the papers web templates you may have bought in the My Forms menu. You can obtain a extra copy of Indiana Employee Stock Ownership Plan of Franklin Savings Bank - Detailed at any time, if possible. Just go through the necessary type to acquire or printing the papers web template.

Use US Legal Forms, the most extensive variety of lawful varieties, to save efforts and stay away from errors. The services offers appropriately created lawful papers web templates which you can use for a range of functions. Make your account on US Legal Forms and start making your way of life a little easier.

Form popularity

FAQ

An Employee Stock Ownership Plan (ESOP) is a form of defined contribution plan in which the investments are primarily in employer stock. A Cash Balance Plan is a defined benefit plan that defines the benefit in terms that are more characteristic of a defined contribution plan.

An ESOP is an employee benefit plan that enables employees to own part or all of the company they work for. at fair market value (unless there's a public market for the shares). So, the employee receives the value of his or her shares from the trust, usually in the form of cash.

An Employee Stock Ownership Plan (ESOP) is a tax qualified defined contribution retirement plan regulated under ERISA and the Internal Revenue Code.

What Is an Example of an ESOP? Consider an employee who has worked at a large tech firm for five years. Under the company's ESOP, they have the right to receive 20 shares after the first year, and 100 shares total after five years. When the employee retires, they will receive the share value in cash.

ESOP rules set a limit of 25% of salary as the maximum amount that can be contributed to a participant's account annually, though most companies contribute between 6-10% of salary annually. The 25% is a combined limit that includes ESOPs, 401(k)s, profit sharing, and stock bonus plans offered by the company.

An employee stock ownership plan (ESOP) is an IRC section 401(a) qualified defined contribution plan that is a stock bonus plan or a stock bonus/money purchase plan.

An ESOP is an employee benefit plan that enables employees to own part or all of the company they work for. at fair market value (unless there's a public market for the shares). So, the employee receives the value of his or her shares from the trust, usually in the form of cash.

ESOPs give the sponsoring company?the selling shareholder?and participants various tax benefits, making them qualified plans, and are often used by employers as a corporate finance strategy to align the interests of their employees with those of their shareholders.