The Indiana Proposal to Approve Annual Incentive Compensation Plan aims to outline a comprehensive strategy to incentivize employees and acknowledge their contributions towards achieving company goals. This plan serves as a crucial mechanism for motivating and rewarding employees in a manner that aligns with organizational objectives. By implementing this proposal, businesses can strive towards a productive and engaged workforce, ultimately leading to overall success and growth. Key elements of the Indiana Proposal to Approve Annual Incentive Compensation Plan include: 1. Performance-based Compensation: The plan emphasizes rewarding employees based on their individual and team performance. By linking compensation directly to measurable goals or targets, businesses can ensure that employees are driven to enhance their productivity and contribute to the overall success of the organization. 2. Clear Performance Metrics: The proposal defines specific and transparent metrics against which employees' performance will be evaluated. This ensures that the evaluation process is fair and objective, fostering a sense of trust and transparency within the workforce. 3. Employee Engagement and Retention: The annual incentive compensation plan aims to improve employee satisfaction and retention rates by providing an attractive financial reward system. By acknowledging employees' hard work and dedication, companies can increase their loyalty and reduce turnover rates. 4. Flexibility and Customization: The Indiana proposal recognizes the importance of tailoring the incentive compensation plan to fit the unique needs and goals of each company. It allows businesses to customize the plan to align with their specific industry, organizational culture, and strategic objectives, ensuring maximum effectiveness. 5. Communication and Education: The proposal emphasizes the importance of clear communication and education about the annual incentive compensation plan to ensure that employees have a comprehensive understanding of its purpose, structure, and benefits. This facilitates employee buy-in and encourages active participation in achieving objectives. Different types of Indiana Proposal to Approve Annual Incentive Compensation Plans may include: 1. Sales Incentive Compensation Plan: Tailored specifically for sales teams, this plan focuses on incentivizing and rewarding sales representatives based on their individual and collective sales performance. It aims to drive sales growth and revenue generation. 2. Team-based Incentive Compensation Plan: This plan encourages collaboration and teamwork, incentivizing groups or departments to achieve shared goals. It rewards team achievements and fosters a sense of camaraderie and cooperation among employees. 3. Performance-based Incentive Compensation Plan: Designed to motivate and reward employees based on their individual performance and contributions, this plan recognizes exceptional performers and encourages continuous improvement and skill development. 4. Profit-sharing Incentive Compensation Plan: This plan involves sharing a portion of the company's profits with employees based on predefined criteria. It aligns employee compensation with the organization's overall financial success, encouraging employees to actively contribute to profitability. By implementing the Indiana Proposal to Approve Annual Incentive Compensation Plan, Indiana-based businesses can establish a robust system for motivating, engaging, and retaining their employees while aligning their efforts with the broader organizational goals.

Indiana Proposal to approve annual incentive compensation plan

Description

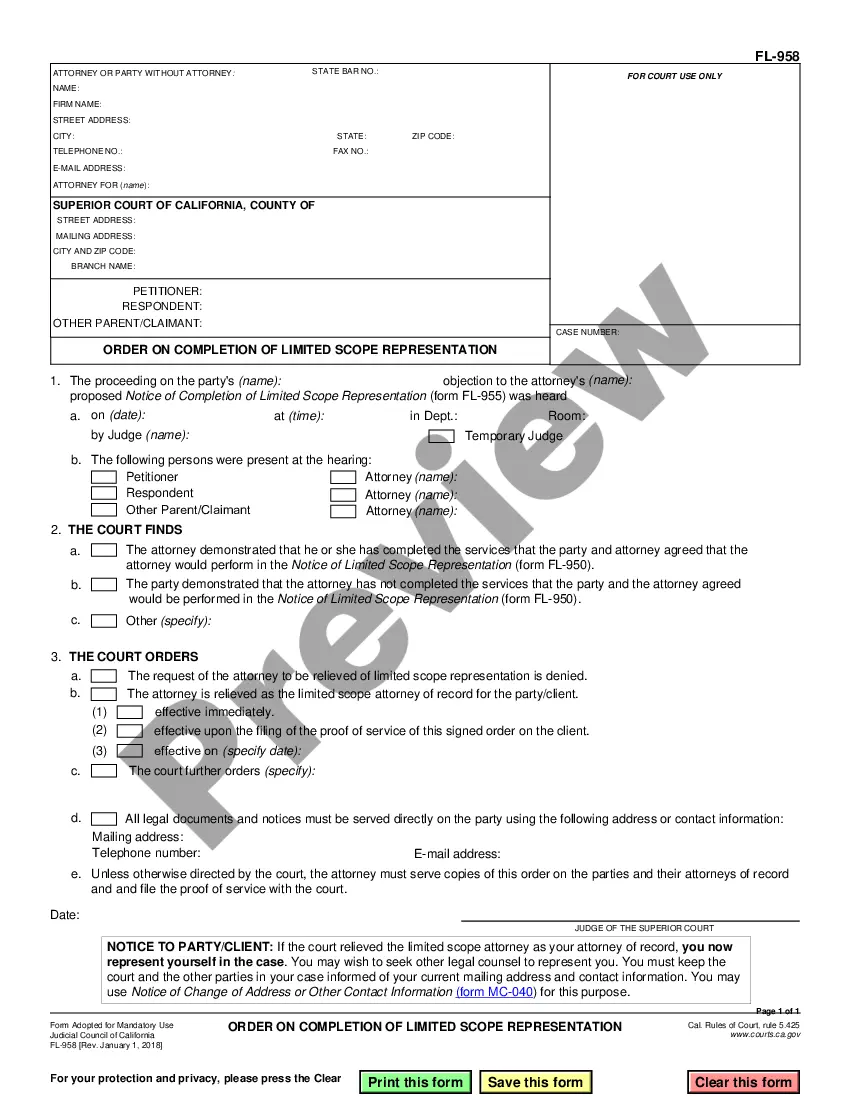

How to fill out Indiana Proposal To Approve Annual Incentive Compensation Plan?

You can devote hours online trying to find the authorized record design that suits the federal and state needs you need. US Legal Forms offers a huge number of authorized types that happen to be analyzed by pros. You can actually acquire or print the Indiana Proposal to approve annual incentive compensation plan from our support.

If you have a US Legal Forms profile, it is possible to log in and then click the Acquire button. After that, it is possible to total, revise, print, or indicator the Indiana Proposal to approve annual incentive compensation plan. Every single authorized record design you get is your own property permanently. To get one more duplicate associated with a obtained form, visit the My Forms tab and then click the corresponding button.

If you use the US Legal Forms internet site the very first time, adhere to the easy instructions under:

- Initial, be sure that you have chosen the correct record design for your county/city of your choosing. Look at the form description to make sure you have chosen the proper form. If available, use the Preview button to look throughout the record design at the same time.

- If you want to find one more variation in the form, use the Search discipline to discover the design that suits you and needs.

- After you have located the design you need, click on Purchase now to proceed.

- Select the pricing plan you need, enter your references, and register for an account on US Legal Forms.

- Total the financial transaction. You can utilize your bank card or PayPal profile to purchase the authorized form.

- Select the format in the record and acquire it to your device.

- Make adjustments to your record if necessary. You can total, revise and indicator and print Indiana Proposal to approve annual incentive compensation plan.

Acquire and print a huge number of record web templates using the US Legal Forms web site, which provides the most important assortment of authorized types. Use professional and express-distinct web templates to tackle your company or personal needs.

Form popularity

FAQ

For example, the employer may offer health insurance, dental insurance, life insurance, short- and long-term disability insurance and vision insurance. Employee retirement plans, like 401(k) plans, are another common form of indirect compensation. Equity-based programs are another compensation offering.

Structured incentive pay is set by specific sales or production goals and paid to employees at a percentage or flat rate. For example, you set a goal for $50,000 in sales for the fiscal year. If you reach that goal, you give each employee a bonus equaling 2% of their annual salary.

For example, a manager agrees to give everyone working on a certain marketing account a $500 bonus if they can complete all deliverables and get client approval by the end of the week.

A good example of a monetary incentive is a sales-based incentive. Sales-based incentive compensation is ideal for employees who are responsible for talking to customers and closing sales. Employers often structure these incentive plans as a percentage, like 5% of all the deals each sales rep closes.

Incentive compensation is a form of variable compensation in which a salesperson's (or other employee's) earnings are directly tied to the amount of product they sell, the success of their team, or the organization's success.

The purpose of an Incentive Compensation Plan is to motivate and reward key employees for accomplishing individual performance goals established in ance with the business targets of the organization and Company.

An incentive pay plan is a 'bonus' pay over and above their hourly wage that an associate can attain if they meet certain pre-set requirements or criteria. Incentive pay can be productivity based, quality based, safety based, etc.

An annual incentive plan is a plan for compensation that is earned and paid based upon the achievement of performance goals over a one-year period. These plans motivate performance and align executives' work with the company's short-term performance goals.