Indiana Schedule 14D-9 - Solicitation - Recommendation Statement

Description

How to fill out Schedule 14D-9 - Solicitation - Recommendation Statement?

Are you currently in a placement where you need files for either business or person purposes almost every day time? There are tons of authorized document web templates available online, but finding ones you can depend on is not effortless. US Legal Forms offers 1000s of type web templates, such as the Indiana Schedule 14D-9 - Solicitation - Recommendation Statement, that happen to be composed to satisfy federal and state requirements.

When you are already familiar with US Legal Forms internet site and also have your account, just log in. Afterward, it is possible to down load the Indiana Schedule 14D-9 - Solicitation - Recommendation Statement template.

Should you not have an account and would like to start using US Legal Forms, adopt these measures:

- Get the type you will need and ensure it is to the appropriate metropolis/area.

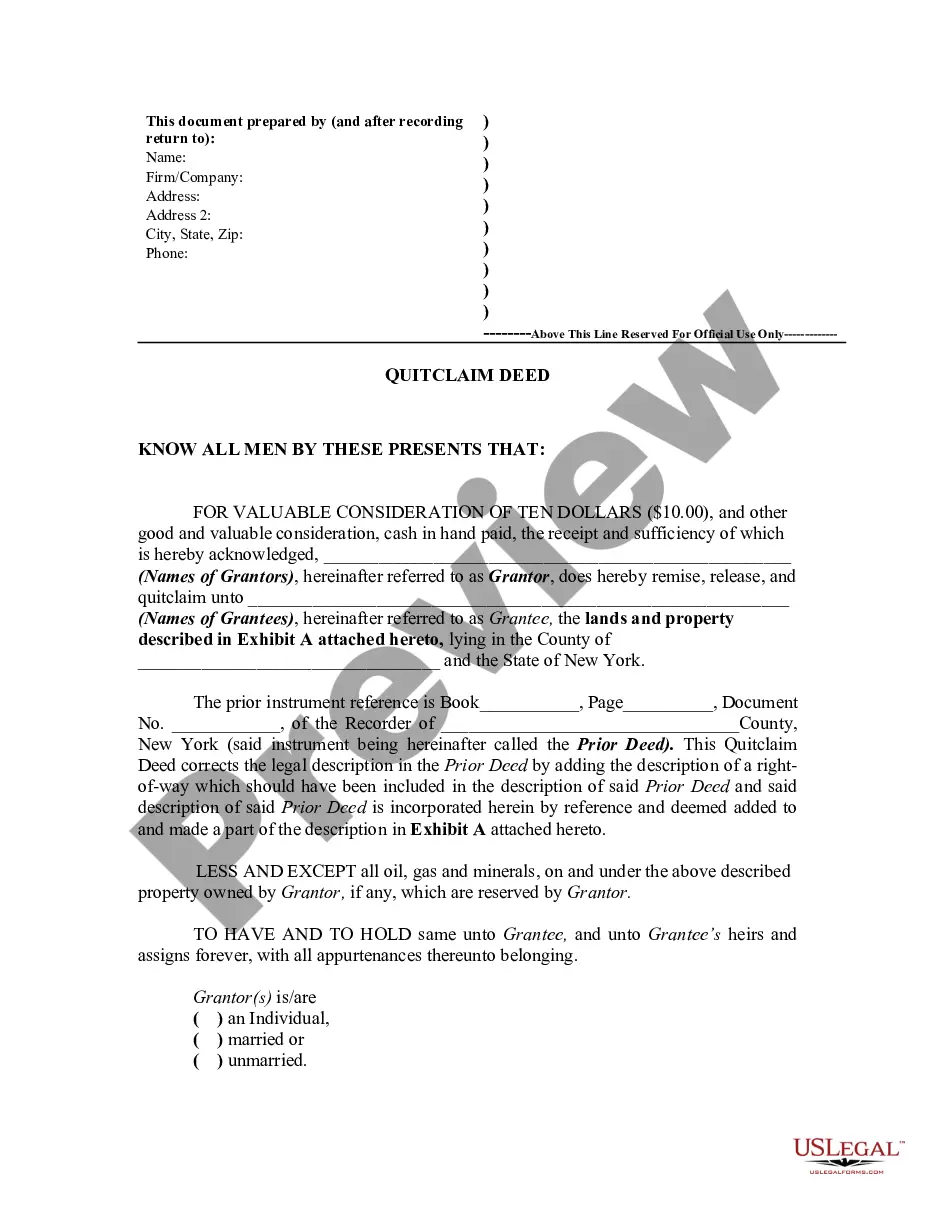

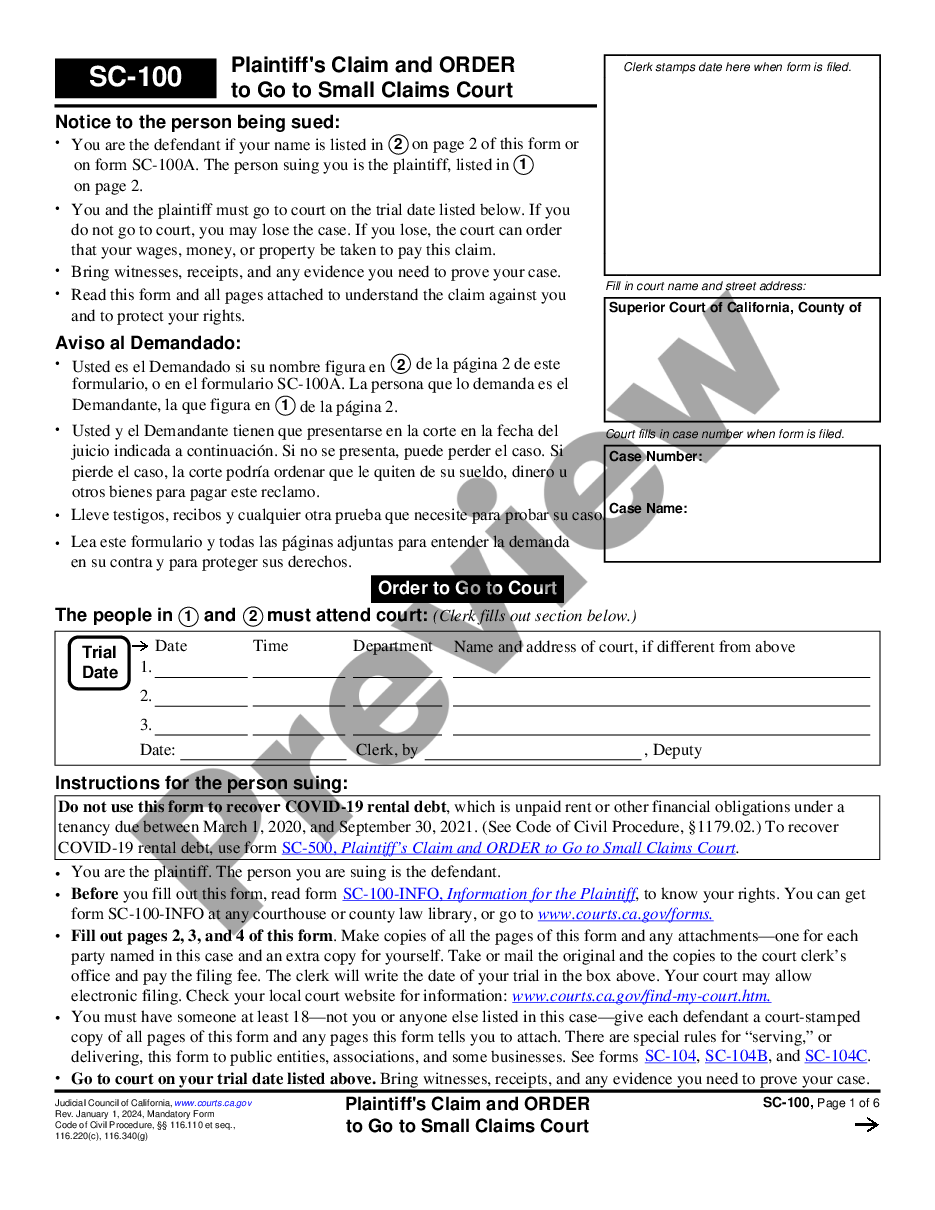

- Make use of the Review switch to examine the form.

- See the explanation to ensure that you have selected the right type.

- When the type is not what you are seeking, take advantage of the Lookup field to get the type that meets your requirements and requirements.

- Whenever you obtain the appropriate type, just click Buy now.

- Opt for the costs strategy you desire, submit the desired information to generate your bank account, and buy an order using your PayPal or Visa or Mastercard.

- Decide on a handy file file format and down load your duplicate.

Discover all the document web templates you possess bought in the My Forms menus. You can get a further duplicate of Indiana Schedule 14D-9 - Solicitation - Recommendation Statement whenever, if needed. Just click on the essential type to down load or print out the document template.

Use US Legal Forms, probably the most substantial selection of authorized forms, to save efforts and stay away from mistakes. The service offers appropriately produced authorized document web templates which can be used for a range of purposes. Create your account on US Legal Forms and start creating your way of life a little easier.

Form popularity

FAQ

The term Schedule 13E-4 refers to a form that public companies were required to file with the Securities and Exchange Commission (SEC) when they made tender offers for their own securities. The form, known as an issuer tender offer statement, was required under the Securities Exchange Act of 1934.

What Is a Schedule TO-C? A schedule TO-C is filed with the Securities Exchange Commission (SEC) when any written communications take place relating to a tender offer. Schedule TO-C is a subset of the Schedule TO filing?also referred to as a tender offer statement.

Schedule 14D-9 is a filing with the Securities and Exchange Commission (SEC) when an interested party, such as an issuer, a beneficial owner of securities, or a representative of either, makes a solicitation or recommendation statement to the shareholders of another company with respect to a tender offer.

The target must file a Schedule 14D-9. Within 10 business days of the commencement of a tender offer, the target company's board of directors must disseminate a statement to its security holders disclosing the target company's position with respect to the offer.

A tender offer is only open for a limited period of time and is made to each individual security holder. That means each security holder can decide for him or herself whether to tender his or her securities. In addition, the terms of the tender offer, such as the price offered to purchase securities, are fixed.