Indiana Standstill Agreement of Grossmans, Inc. - Internal agreement regarding shareholders of single company

Description

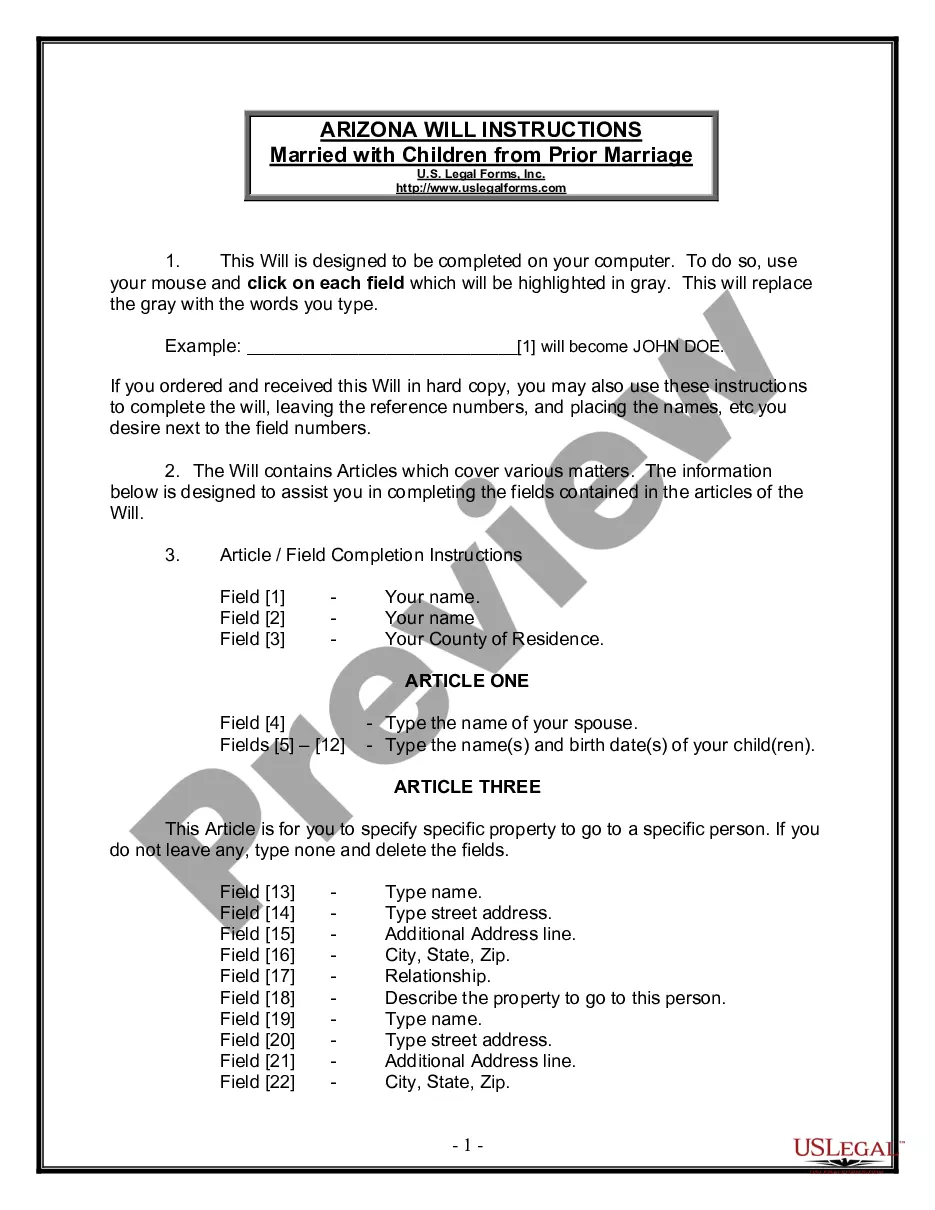

How to fill out Standstill Agreement Of Grossmans, Inc. - Internal Agreement Regarding Shareholders Of Single Company?

US Legal Forms - one of the greatest libraries of lawful types in the USA - provides an array of lawful record web templates it is possible to acquire or produce. Using the web site, you can find thousands of types for organization and specific purposes, categorized by groups, says, or keywords.You can get the latest types of types much like the Indiana Standstill Agreement of Grossmans, Inc. - Internal agreement regarding shareholders of single company in seconds.

If you already have a registration, log in and acquire Indiana Standstill Agreement of Grossmans, Inc. - Internal agreement regarding shareholders of single company from the US Legal Forms collection. The Download switch will appear on each type you view. You have access to all formerly delivered electronically types in the My Forms tab of your respective bank account.

In order to use US Legal Forms the first time, allow me to share basic directions to get you began:

- Be sure you have selected the right type to your metropolis/area. Click on the Preview switch to examine the form`s information. Browse the type information to actually have selected the right type.

- If the type does not suit your demands, make use of the Lookup industry towards the top of the monitor to obtain the one that does.

- If you are pleased with the shape, affirm your choice by visiting the Purchase now switch. Then, opt for the rates plan you favor and give your credentials to register on an bank account.

- Approach the financial transaction. Utilize your charge card or PayPal bank account to perform the financial transaction.

- Pick the structure and acquire the shape in your system.

- Make alterations. Load, edit and produce and indication the delivered electronically Indiana Standstill Agreement of Grossmans, Inc. - Internal agreement regarding shareholders of single company.

Each and every template you included with your money does not have an expiration time which is your own property eternally. So, if you wish to acquire or produce one more backup, just proceed to the My Forms section and click on about the type you will need.

Obtain access to the Indiana Standstill Agreement of Grossmans, Inc. - Internal agreement regarding shareholders of single company with US Legal Forms, probably the most considerable collection of lawful record web templates. Use thousands of specialist and state-particular web templates that meet your company or specific needs and demands.

Form popularity

FAQ

Example: if a party, in a trade agreement, commits to allowing 30% foreign ownership in domestic companies and later on decides unilaterally to allow 40%, the party can re-introduce the original level of 30% whenever it wishes (but it cannot restrict further below 30%).

A standstill agreement prevents a party from issuing proceedings during the currency of that agreement. As such a standstill agreement is a voluntary contractual arrangement between the parties to pause limitation for an agreed length of time (typically 3-6 months).

: an agreement under which litigation is forestalled between two parties. : an agreement under which a party agrees to refrain from taking further steps to acquire control of a corporation (as by additional purchases of stock)

What is a Standstill Agreement? A standstill agreement refers to a contract that contains provisions that direct how a bidder of a company can buy or sell a stock of the target company. It can effectively delay or stop the process of a hostile takeover if the parties cannot settle a friendly deal.

A standstill agreement is a contract that contains provisions that govern how a bidder of a company can purchase, dispose of, or vote stock of the target company. A standstill agreement can effectively stall or stop the process of a hostile takeover if the parties cannot negotiate a friendly deal.