Indiana Utilization by a REIT of Partnership Structures in Financing Five Development Projects In the state of Indiana, Real Estate Investment Trusts (Rests) have been effectively utilizing partnership structures to finance their development projects. These partnership structures provide several benefits, including enhanced funding opportunities, risk mitigation, and tax advantages. 1. Limited Partnership (LP): One type of partnership structure commonly utilized by Rests in Indiana is the LP. In this structure, the REIT acts as the general partner, responsible for managing the project's operations, while limited partners provide investment capital. This allows the REIT to raise funds from multiple investors and allocate returns according to the partnership agreement. 2. Limited Liability Partnership (LLP): Another type of partnership structure is the LLP, providing liability protection to the REIT. In an LLP, the REIT and its partners enjoy limited liability, shielding them from personal liability against project-related risks and debts. This structure promotes investor confidence and encourages participation in development projects. 3. Limited Liability Company (LLC): Rests in Indiana may also choose to establish an LLC partnership structure for development project financing. An LLC combines aspects of a corporation and a partnership, offering flexibility in management and taxation. This structure allows the REIT to attract both individual and institutional investors while providing limited liability to all members. 4. Joint Ventures (JV's): In some cases, a REIT may enter into joint ventures with other entities, such as developers or construction firms, to finance their development projects. Joint ventures allow for shared responsibilities, risks, and profits, fostering collaboration and expertise pooling. This partnership structure often enables Rests to access specialized knowledge and resources beyond their capabilities. 5. Public-Private Partnerships (PPP): Rests in Indiana may engage in public-private partnerships, collaborating with government entities at various levels to finance development projects. Public-private partnerships leverage both public and private resources, expertise, and capital to accomplish shared objectives such as infrastructure development, affordable housing initiatives, or urban revitalization. These partnerships often involve long-term contracts and revenue-sharing arrangements. By utilizing these partnership structures, Rests in Indiana can efficiently finance their development projects while diversifying risks and maximizing potential returns. These arrangements provide access to additional capital, expertise, and shared liability, making them advantageous for both the Rests and their partners. This approach demonstrates the adaptability and innovation of Indiana Rests in leveraging partnerships to propel economic growth and community development. Keywords: Indiana, utilization, REIT, partnership structures, financing, development projects, limited partnership, limited liability partnership, limited liability company, joint ventures, public-private partnerships, funding opportunities, risk mitigation, tax advantages, investment capital, liability protection, flexibility, collaboration, expertise pooling, shared responsibilities, infrastructure development, affordable housing initiatives, urban revitalization.

Indiana Utilization by a REIT of partnership structures in financing five development projects

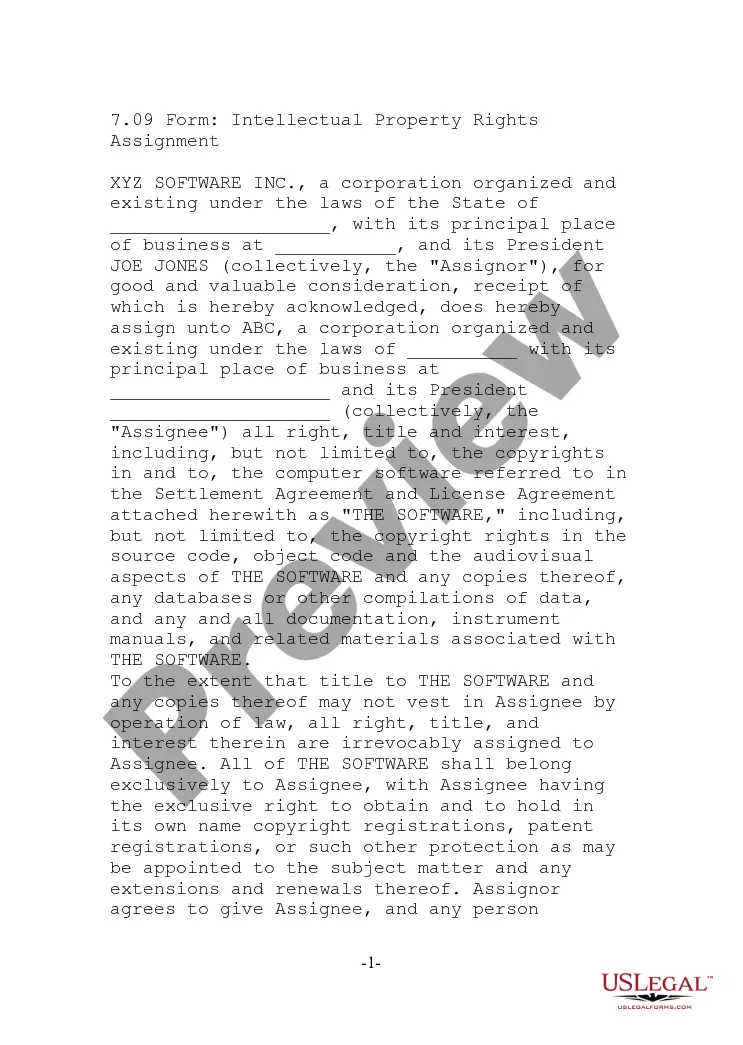

Description

How to fill out Indiana Utilization By A REIT Of Partnership Structures In Financing Five Development Projects?

Choosing the best authorized papers web template could be a have difficulties. Naturally, there are tons of layouts available on the Internet, but how do you obtain the authorized type you want? Make use of the US Legal Forms internet site. The support provides a huge number of layouts, for example the Indiana Utilization by a REIT of partnership structures in financing five development projects, that you can use for business and personal requires. Each of the types are inspected by professionals and satisfy state and federal specifications.

When you are currently registered, log in for your accounts and click on the Obtain key to have the Indiana Utilization by a REIT of partnership structures in financing five development projects. Utilize your accounts to appear throughout the authorized types you may have bought earlier. Visit the My Forms tab of your accounts and acquire one more copy from the papers you want.

When you are a brand new user of US Legal Forms, listed here are easy guidelines that you should comply with:

- First, make sure you have selected the proper type for the city/region. You may look through the shape making use of the Preview key and read the shape explanation to guarantee it is the best for you.

- In the event the type will not satisfy your requirements, make use of the Seach field to find the correct type.

- Once you are certain the shape is proper, go through the Get now key to have the type.

- Choose the costs prepare you need and type in the required info. Make your accounts and buy the order with your PayPal accounts or charge card.

- Choose the document formatting and acquire the authorized papers web template for your product.

- Full, change and print out and sign the obtained Indiana Utilization by a REIT of partnership structures in financing five development projects.

US Legal Forms is the biggest library of authorized types where you can see numerous papers layouts. Make use of the company to acquire appropriately-made paperwork that comply with express specifications.