Indiana Authorization to Purchase Corporation's Outstanding Common Stock In Indiana, an Authorization to Purchase Corporation's Outstanding Common Stock is a legal action taken by a corporation to acquire its own shares of common stock from existing shareholders. This process involves obtaining prior approval from the board of directors and complying with the relevant provisions of the Indiana Business Corporation Law. Various types of Authorization to Purchase Corporation's Outstanding Common Stock may exist under Indiana law, each with its own specific conditions and requirements. One type of Authorization to Purchase Corporation's Outstanding Common Stock in Indiana is the General Authorization. This allows a corporation to buy back its common stock without any specific limitations or restrictions. The board of directors has the authority to execute this type of purchase, subject to compliance with applicable regulations, shareholder agreements, and any internal policies adopted by the corporation. Another type of Authorization to Purchase Corporation's Outstanding Common Stock is known as the Specific Authorization. Under this arrangement, a corporation is permitted to repurchase a predetermined number or percentage of its outstanding common stock. This specific repurchase authorization can have limitations in terms of timing, quantity, or price, and is usually granted for a particular purpose, such as stock option plans, employee incentive programs, or to boost market confidence. Indiana's law also recognizes the concept of Conditional Authorization to Purchase Corporation's Outstanding Common Stock. This type of authorization imposes certain conditions or triggers for the buyback to occur. For example, a condition could be the achievement of specific financial targets or approval of a subsequent corporate action. Conditional authorizations provide flexibility to corporations and are often used to align the stock repurchases with the company's strategic objectives or anticipated events. In all cases, an Indiana Authorization to Purchase Corporation's Outstanding Common Stock must adhere to relevant legal requirements and follow a fair valuation process. The corporation must ensure that the repurchase does not exceed limits imposed by state law and maintain accurate documentation of the stock purchase transactions. Additionally, corporations must be mindful of any potential implications regarding securities laws, tax regulations, and fiduciary duties owed to shareholders during the buyback process. In summary, Indiana Authorization to Purchase Corporation's Outstanding Common Stock includes various types such as General Authorization, Specific Authorization, and Conditional Authorization. Each type has its own characteristics and is subject to compliance with legal regulations, internal policies, and shareholder agreements. These authorizations enable corporations to repurchase their own common stock, providing flexibility in managing capital structure and aligning with strategic objectives.

Indiana Authorization to purchase corporation's outstanding common stock

Description

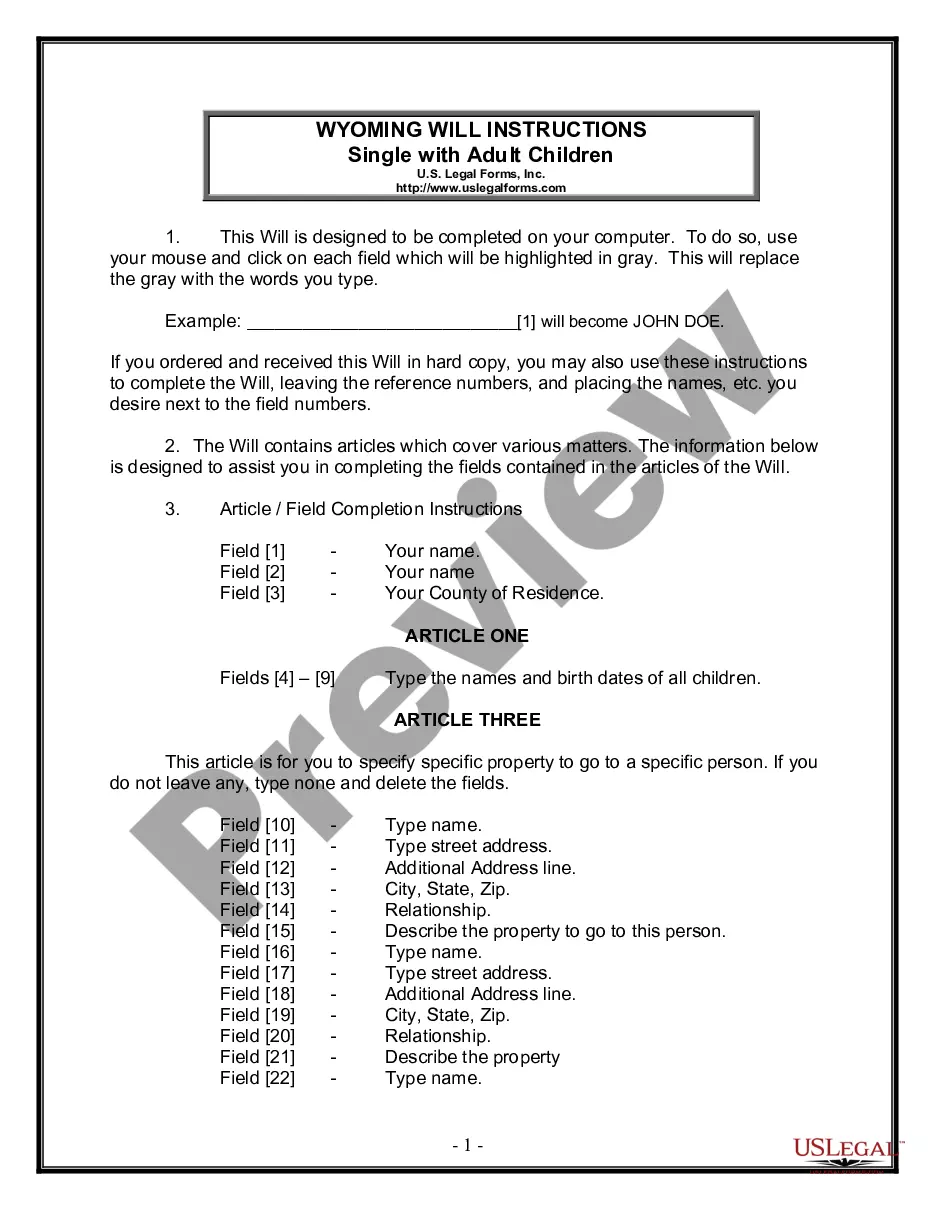

How to fill out Indiana Authorization To Purchase Corporation's Outstanding Common Stock?

Are you presently inside a situation that you require files for both enterprise or person functions just about every working day? There are a lot of authorized file web templates available online, but locating types you can trust isn`t straightforward. US Legal Forms offers thousands of type web templates, such as the Indiana Authorization to purchase corporation's outstanding common stock, that are composed in order to meet federal and state requirements.

If you are currently acquainted with US Legal Forms site and possess an account, simply log in. Following that, you can acquire the Indiana Authorization to purchase corporation's outstanding common stock design.

If you do not come with an account and need to begin to use US Legal Forms, follow these steps:

- Discover the type you want and make sure it is for your correct area/area.

- Utilize the Review option to analyze the form.

- Look at the information to ensure that you have chosen the appropriate type.

- When the type isn`t what you`re seeking, make use of the Research industry to find the type that meets your needs and requirements.

- Once you get the correct type, simply click Acquire now.

- Opt for the pricing plan you need, fill in the specified information and facts to create your money, and pay for an order utilizing your PayPal or bank card.

- Choose a convenient document format and acquire your duplicate.

Locate every one of the file web templates you have purchased in the My Forms food selection. You may get a more duplicate of Indiana Authorization to purchase corporation's outstanding common stock whenever, if necessary. Just click on the required type to acquire or printing the file design.

Use US Legal Forms, probably the most comprehensive variety of authorized types, in order to save some time and prevent faults. The services offers professionally created authorized file web templates which you can use for a selection of functions. Produce an account on US Legal Forms and initiate making your life easier.

Form popularity

FAQ

CHAPTER 1. Assumed Business Names. 23-15-1-1. Filing of certificate of assumed name; record; applicability entities; consistent entity indicator; notice of discontinuance of use; fees.

Business and Other Associations § 23-1-35-1. (3) in a manner the director reasonably believes to be in the best interests of the corporation. (3) a committee of the board of directors of which the director is not a member if the director reasonably believes the committee merits confidence.

Per the Indiana theft laws contained in Indiana Code 35-43-4-2, when someone has knowingly received or is found in possession of stolen property that is valued at $750 or more, but less than $50,000, they may be charged with a Level 6 Felony.

(a) Whenever an injury or death, for which compensation is payable under chapters 2 through 6 of this article shall have been sustained under circumstances creating in some other person than the employer and not in the same employ a legal liability to pay damages in respect thereto, the injured employee, or the injured ...

Indiana Code § 23-0.5-3-1. Permitted Names; Falsely Implying Government Agency Status or Connection :: 2022 Indiana Code :: US Codes and Statutes :: US Law :: Justia.

Section 23-1-44-8 - Right to dissent and obtain payment for shares (a) A shareholder is entitled to dissent from, and obtain payment of the fair value of the shareholder's shares in the event of, any of the following corporate actions: (1) Consummation of a plan of merger to which the corporation is a party if: (A) ...

Foreign Entity Registration in Indiana; Failure to Register.

Indiana Code Section 23-0.5-2-13 requires LLCs to submit a biennial business entity report to the Secretary of State every other year. You can file online for a $31 fee or by mail for a $50 fee.