Indiana Purchase of common stock for treasury of company

Description

How to fill out Purchase Of Common Stock For Treasury Of Company?

Choosing the right legal document design can be quite a battle. Obviously, there are a variety of web templates available on the net, but how would you find the legal form you require? Utilize the US Legal Forms web site. The services delivers 1000s of web templates, such as the Indiana Purchase of common stock for treasury of company, that you can use for enterprise and personal requires. Each of the forms are checked out by specialists and meet state and federal specifications.

Should you be currently listed, log in for your account and click on the Obtain switch to obtain the Indiana Purchase of common stock for treasury of company. Make use of your account to check through the legal forms you may have acquired formerly. Check out the My Forms tab of the account and obtain another backup from the document you require.

Should you be a brand new end user of US Legal Forms, listed below are straightforward instructions so that you can stick to:

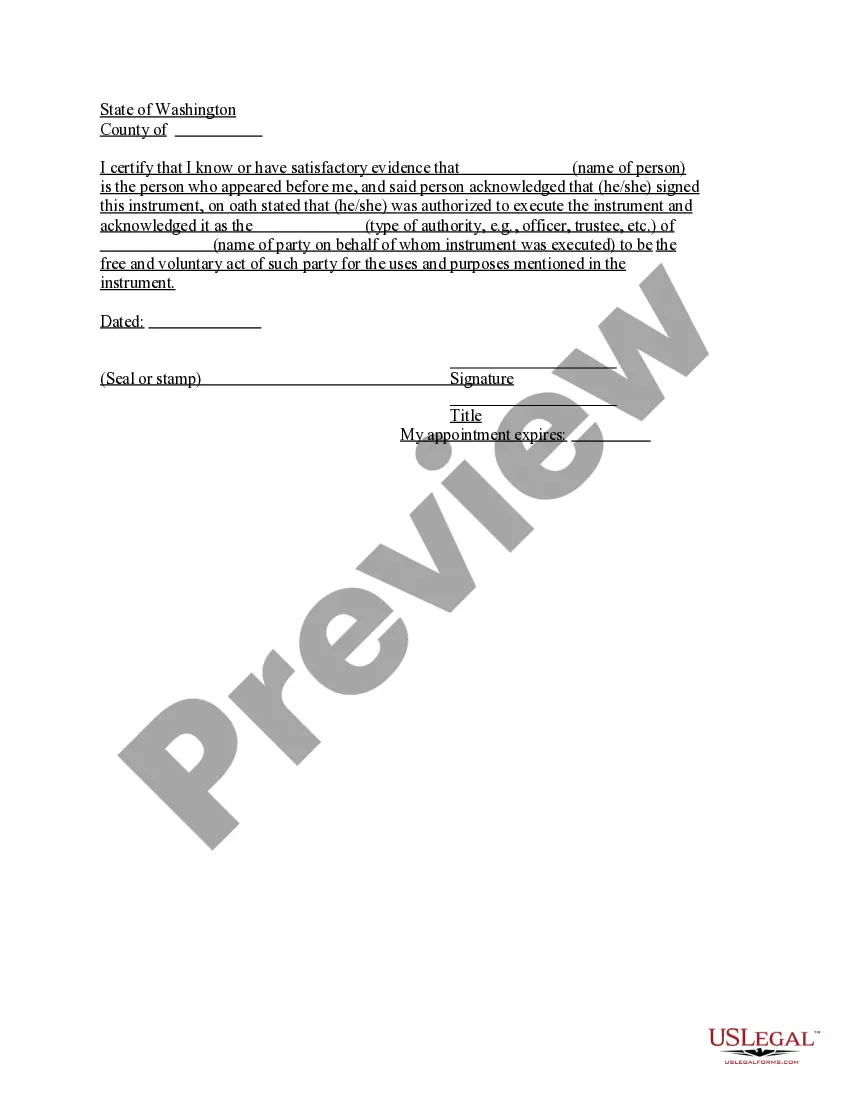

- Very first, make sure you have chosen the right form for your area/region. You are able to look through the form while using Preview switch and read the form description to ensure it will be the right one for you.

- When the form will not meet your expectations, utilize the Seach area to obtain the appropriate form.

- Once you are positive that the form is suitable, select the Get now switch to obtain the form.

- Select the costs program you want and enter the essential details. Make your account and pay money for your order using your PayPal account or credit card.

- Pick the submit format and obtain the legal document design for your gadget.

- Complete, change and printing and signal the received Indiana Purchase of common stock for treasury of company.

US Legal Forms is the biggest collection of legal forms for which you can discover different document web templates. Utilize the service to obtain expertly-produced documents that stick to state specifications.

Form popularity

FAQ

When treasury stock is purchased, the number of shares issued remains unchanged, but the number of shares outstanding decreases. When treasury stock is purchased, the Treasury Stock account is debited for the number of shares purchased times the purchase price per share.

The benefits to having treasury stock for a company include limiting outside ownership as well as having stock in reserve to issue to the public in the future in case capital needs to be raised.

Accounting for Redemptions on the Corporation's Books Debit the treasury stock account for the amount the company paid for the redemption. Credit the company's cash account for any payments already made to the shareholder. Credit accounts receivable for any future payment obligations.

Section 23-1-52-1 - Required records (a) A corporation shall keep as permanent records minutes of all meetings of its shareholders and board of directors, a record of all actions taken by the shareholders or board of directors without a meeting, and a record of all actions taken by a committee of the board of directors ...

Treasury Stock is a contra equity item. It is not reported as an asset; rather, it is subtracted from stockholders' equity. The presence of treasury shares will cause a difference between the number of shares issued and the number of shares outstanding.

What is Treasury Stock? Treasury stock, or reacquired stock, is the previously issued, outstanding shares of stock which a company repurchased or bought back from shareholders. The reacquired shares are then held by the company for its own disposition.

Retirement of Treasury Stock FAQs The journal entry to record the acquisition and retirement includes debits to the capital stock account for the stock's par value (or its equivalent) and the capital in excess of par account (or its equivalent) for the amount of claims created in excess of the par value.

What is the Treasury Stock Method? The treasury stock method is a way for companies to calculate how many additional shares may be generated from outstanding in-the-money warrants and options. The new additional shares are then used in calculating the company's diluted earnings per share (EPS).