Indiana Terms of Class One Preferred Stock

Description

How to fill out Terms Of Class One Preferred Stock?

Are you presently within a situation the place you will need paperwork for both organization or individual reasons just about every working day? There are a variety of authorized record web templates available on the Internet, but locating types you can depend on is not straightforward. US Legal Forms provides a large number of develop web templates, just like the Indiana Terms of Class One Preferred Stock, which are published in order to meet federal and state needs.

When you are previously acquainted with US Legal Forms internet site and get a merchant account, merely log in. Next, you are able to acquire the Indiana Terms of Class One Preferred Stock web template.

If you do not offer an profile and want to begin to use US Legal Forms, abide by these steps:

- Find the develop you want and make sure it is to the correct city/county.

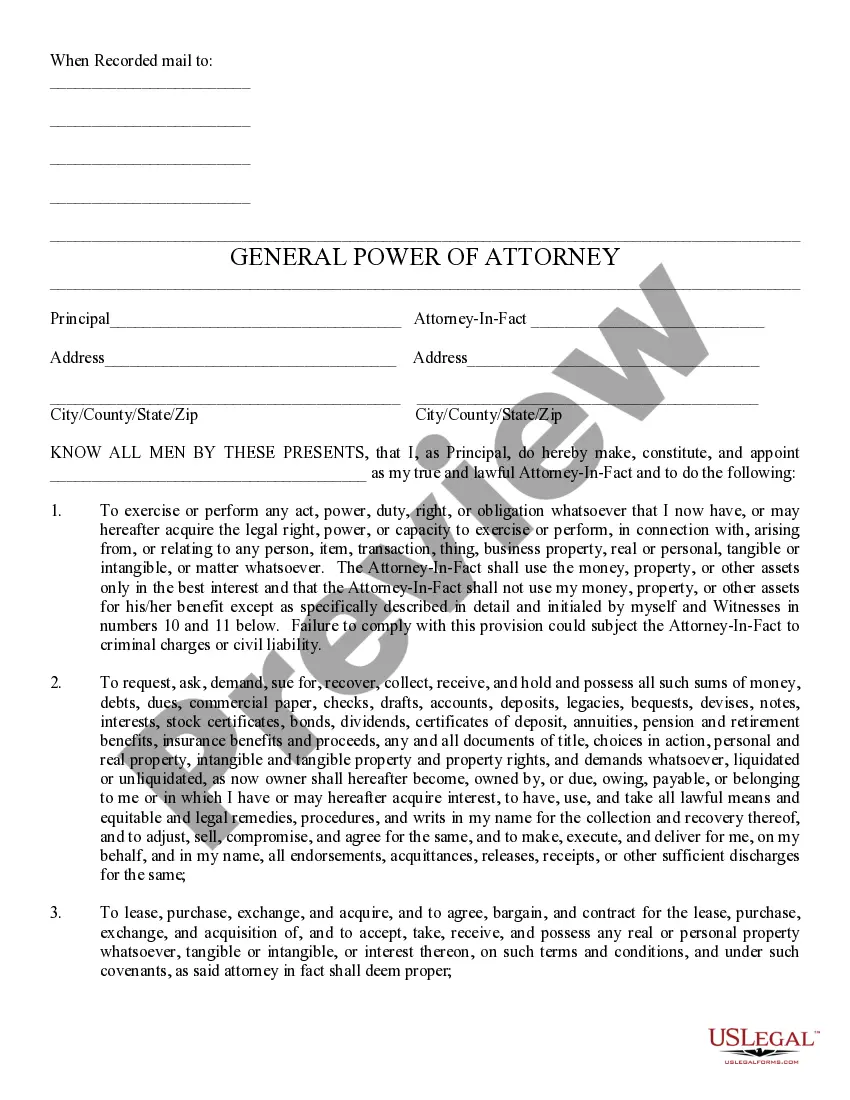

- Use the Preview key to examine the form.

- Look at the outline to ensure that you have selected the appropriate develop.

- In the event the develop is not what you`re searching for, use the Research field to get the develop that suits you and needs.

- Once you obtain the correct develop, just click Acquire now.

- Select the costs plan you desire, fill out the required info to make your money, and purchase your order using your PayPal or charge card.

- Decide on a handy file structure and acquire your backup.

Discover all the record web templates you possess bought in the My Forms menus. You can get a further backup of Indiana Terms of Class One Preferred Stock whenever, if needed. Just click the essential develop to acquire or print out the record web template.

Use US Legal Forms, one of the most comprehensive selection of authorized types, to save lots of efforts and prevent faults. The assistance provides professionally produced authorized record web templates which can be used for an array of reasons. Generate a merchant account on US Legal Forms and commence generating your way of life a little easier.

Form popularity

FAQ

Preferred typically have no voting rights, whereas common stockholders do. Preferred stockholders may have the option to convert shares to common shares but not vice versa. Preferred shares may be callable where the company can demand to repurchase them at par value.

In normal parlance, only equity shareholders get a right to vote while preference shareholders have no right to cast a vote in the matters of the company. The reason behind this is that equity shareholders are owners of the company, in a sense, thus, their opinion is important in the company's decision making. Can Preference Shareholders Get Voting Rights? - India Law Offices indialawoffices.com ? legal-articles ? voting... indialawoffices.com ? legal-articles ? voting...

The Series D Preferred Stock has preference over the firm's common stock for the payment of dividends. Any dividends declared on the preferred stock will be payable quarterly in arrears.

The preemptive right cushions the investor's loss if a new round of common stock is issued at a lower price than the preferred stock owned by the investor. In this case, the owner of preferred stock has the right to convert the shares to a larger number of common shares, offsetting the loss in share value. Preemptive Rights: Some Shareholders Get First Dibs on New ... investopedia.com ? terms ? preemptiveright investopedia.com ? terms ? preemptiveright

Without the voting rights, preferred stockholders are not considered owners of the company. Common shareholders, on the other hand, own a percentage of the company depending on how many shares they own. Preferred Stockholder Rights | Study.com study.com ? academy ? lesson ? preferred-stockh... study.com ? academy ? lesson ? preferred-stockh...

Common stock Most publicly traded companies issue two types of stock: common stock and preferred stock. Common stock typically comes with voting rights, while preferred stock does not. The Shareholder Voting Process and Rights Explained - SoFi sofi.com ? learn ? content ? shareholder-vot... sofi.com ? learn ? content ? shareholder-vot...

The significant advantage to preferred stock is they typically have a specified dividend rate which could be comparable to what bonds are paying at the time.