Indiana Proposed Merger with the Grossman Corporation: A Comprehensive Analysis Introduction: The Indiana Proposed merger with the Grossman Corporation has attracted significant attention in the business world. This article provides a detailed description of this potential merger, outlining the key aspects, benefits, potential challenges, and implications for both entities involved. Keywords: Indiana, proposed merger, Grossman Corporation Description of Indiana Proposed Merger with the Grossman Corporation: The Indiana Proposed merger refers to the potential combination of two prominent entities: Indiana, a well-established corporation based in Indiana, and the Grossman Corporation, a leading organization operating in a related industry. This merger aims to leverage the strengths and resources of both companies, creating a more formidable presence in the market. Benefits of the Proposed Merger: 1. Synergies: By merging, Indiana and the Grossman Corporation would be able to pool their resources, expertise, and customer bases, leading to the creation of synergistic opportunities. Such synergies could result in increased operational efficiencies, reduced costs, and enhanced revenue generation. 2. Market Expansion: The merger could open doors to new markets for both companies. By combining their market reach and distribution channels, Indiana and the Grossman Corporation may gain a competitive advantage and tap into previously untapped segments. 3. Diversification: Through the merger, both entities would diversify their product/service offerings. This diversification could help them hedge against market fluctuations and enhance their competitiveness in a rapidly evolving business environment. 4. Enhanced Financial Strength: A merger with the Grossman Corporation could provide Indiana with access to additional financial resources, enabling strategic investments, research and development (R&D) activities, and potential expansion plans. This infusion of capital could bolster the financial position of both companies and enhance their long-term growth prospects. Challenges and Considerations: 1. Cultural Integration: Merging two organizations brings forth the challenge of aligning cultures, work ethics, and management styles. Indiana and the Grossman Corporation would need to invest considerable effort in managing this integration process to ensure a smooth transition. 2. Regulatory Approvals: Proposed mergers often require regulatory approvals to ensure compliance with antitrust regulations and prevent monopoly situations. Indiana and the Grossman Corporation would need to navigate through these regulatory frameworks, which may involve lengthy processes and scrutiny from regulatory authorities. Implications of the Proposed Merger: 1. Workforce Impact: The merger may result in the need for restructuring and potential workforce reduction. Indiana and the Grossman Corporation would need to carefully plan and execute any personnel changes to minimize negative impacts on employees and maintain staff morale. 2. Competitive Landscape: The merger would lead to a more formidable entity in the market, potentially altering the competitive landscape of the industry. Competitors may need to reassess their strategies to respond to the enhanced capabilities and market position of the merged organization. Types of Indiana Proposed Merger with the Grossman Corporation: While there may not be variations in the "types" of the Indiana Proposed merger with the Grossman Corporation, it is important to highlight potential scenarios such as a full merger, partial acquisition, or strategic partnership. The final structure and details of the merger would be subject to negotiation and agreement between the respective companies' boards and stakeholders. In conclusion, the Indiana Proposed merger with the Grossman Corporation presents a significant opportunity for both entities to leverage their strengths, drive market expansion, and enhance their financial positions. However, challenges such as cultural integration and regulatory approvals must be carefully addressed. The implications of this merger extend beyond the companies involved, potentially reshaping the competitive landscape.

Indiana Proposed merger with the Grossman Corporation

Description

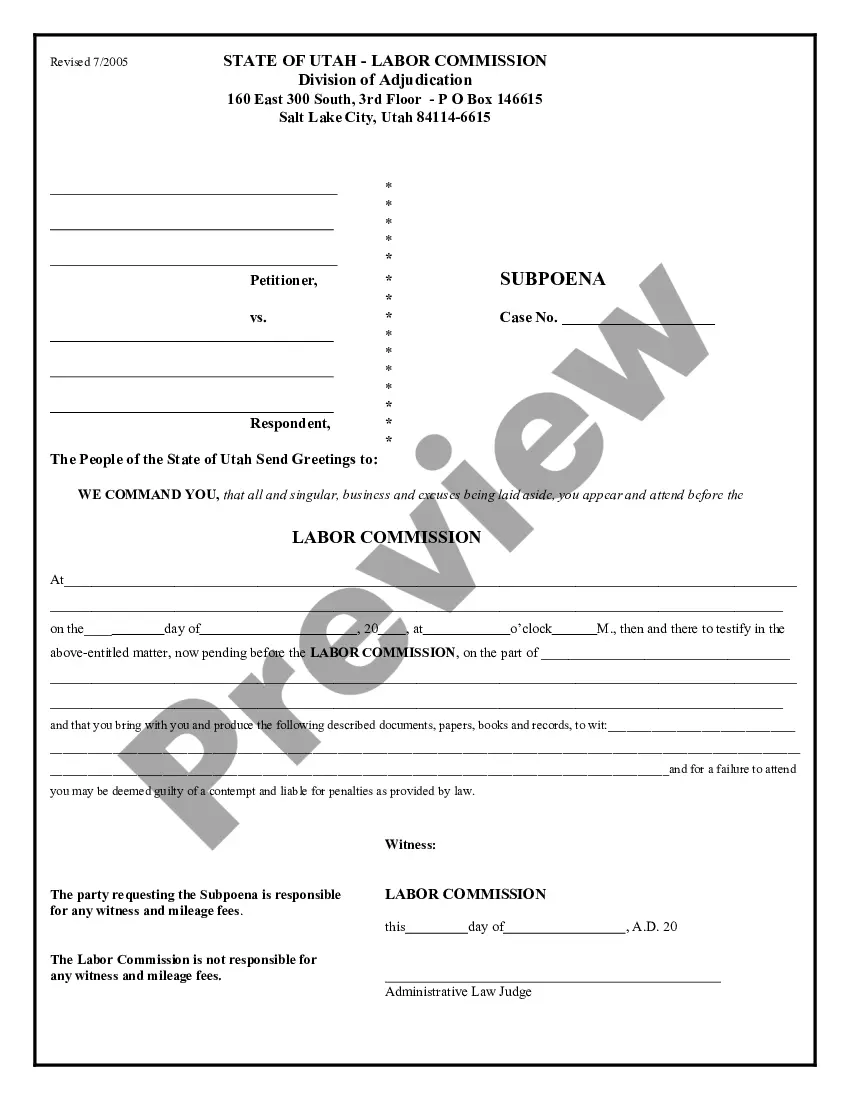

How to fill out Indiana Proposed Merger With The Grossman Corporation?

Choosing the right legitimate record format can be quite a have difficulties. Obviously, there are plenty of layouts available on the Internet, but how would you find the legitimate develop you want? Take advantage of the US Legal Forms internet site. The service gives thousands of layouts, including the Indiana Proposed merger with the Grossman Corporation, which you can use for enterprise and personal demands. All the forms are examined by professionals and satisfy state and federal needs.

If you are presently signed up, log in for your account and click on the Obtain key to get the Indiana Proposed merger with the Grossman Corporation. Utilize your account to search through the legitimate forms you may have purchased formerly. Check out the My Forms tab of your respective account and have yet another duplicate from the record you want.

If you are a whole new user of US Legal Forms, allow me to share easy instructions so that you can follow:

- Very first, make certain you have chosen the correct develop to your town/area. You may check out the form using the Preview key and read the form description to guarantee this is the best for you.

- When the develop is not going to satisfy your preferences, make use of the Seach industry to discover the right develop.

- Once you are certain the form is suitable, go through the Acquire now key to get the develop.

- Pick the pricing plan you desire and type in the needed details. Make your account and pay money for an order using your PayPal account or Visa or Mastercard.

- Select the data file structure and obtain the legitimate record format for your gadget.

- Complete, change and printing and signal the acquired Indiana Proposed merger with the Grossman Corporation.

US Legal Forms will be the greatest library of legitimate forms in which you will find a variety of record layouts. Take advantage of the service to obtain appropriately-created paperwork that follow express needs.