Indiana Nonqualified Stock Option Plan of MNX Carriers, Inc.

Description

How to fill out Nonqualified Stock Option Plan Of MNX Carriers, Inc.?

If you wish to full, obtain, or printing authorized file themes, use US Legal Forms, the most important variety of authorized varieties, which can be found on the web. Use the site`s simple and easy convenient look for to find the files you want. Numerous themes for organization and individual reasons are sorted by classes and says, or key phrases. Use US Legal Forms to find the Indiana Nonqualified Stock Option Plan of MNX Carriers, Inc. in just a handful of mouse clicks.

If you are already a US Legal Forms buyer, log in for your accounts and click on the Obtain button to get the Indiana Nonqualified Stock Option Plan of MNX Carriers, Inc.. You can also entry varieties you previously downloaded inside the My Forms tab of your accounts.

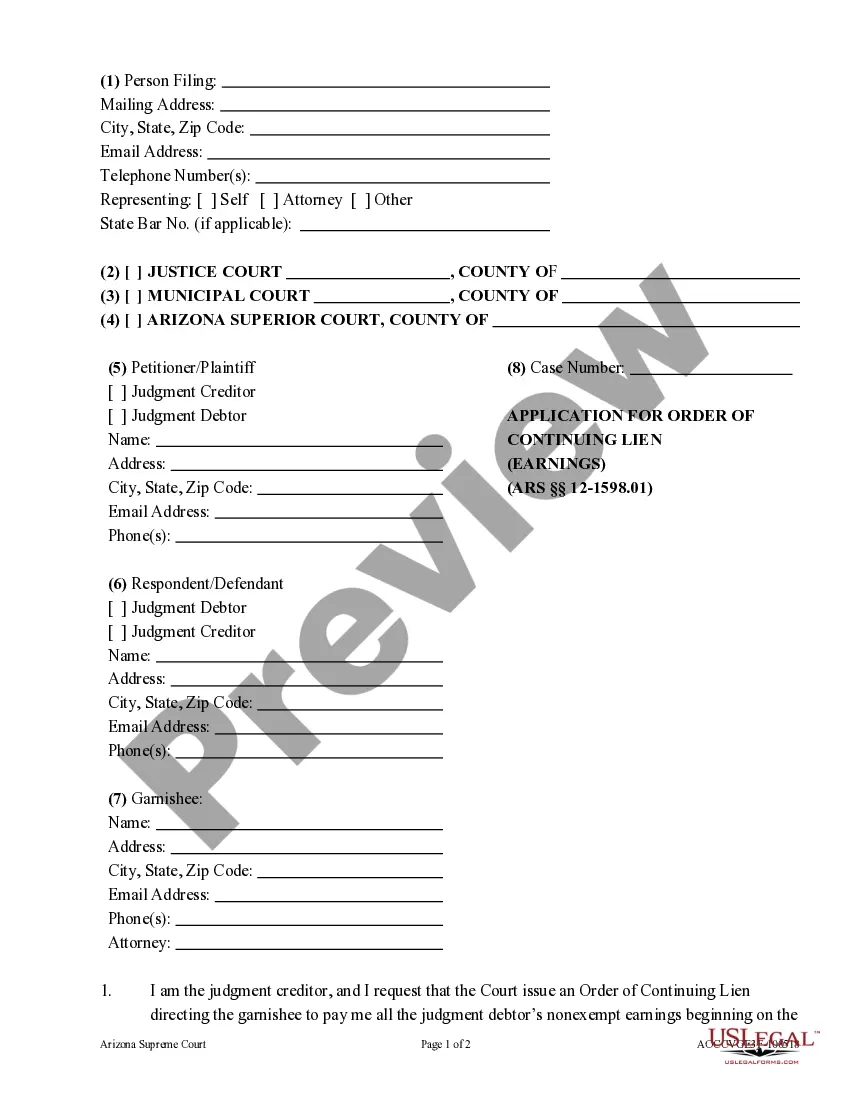

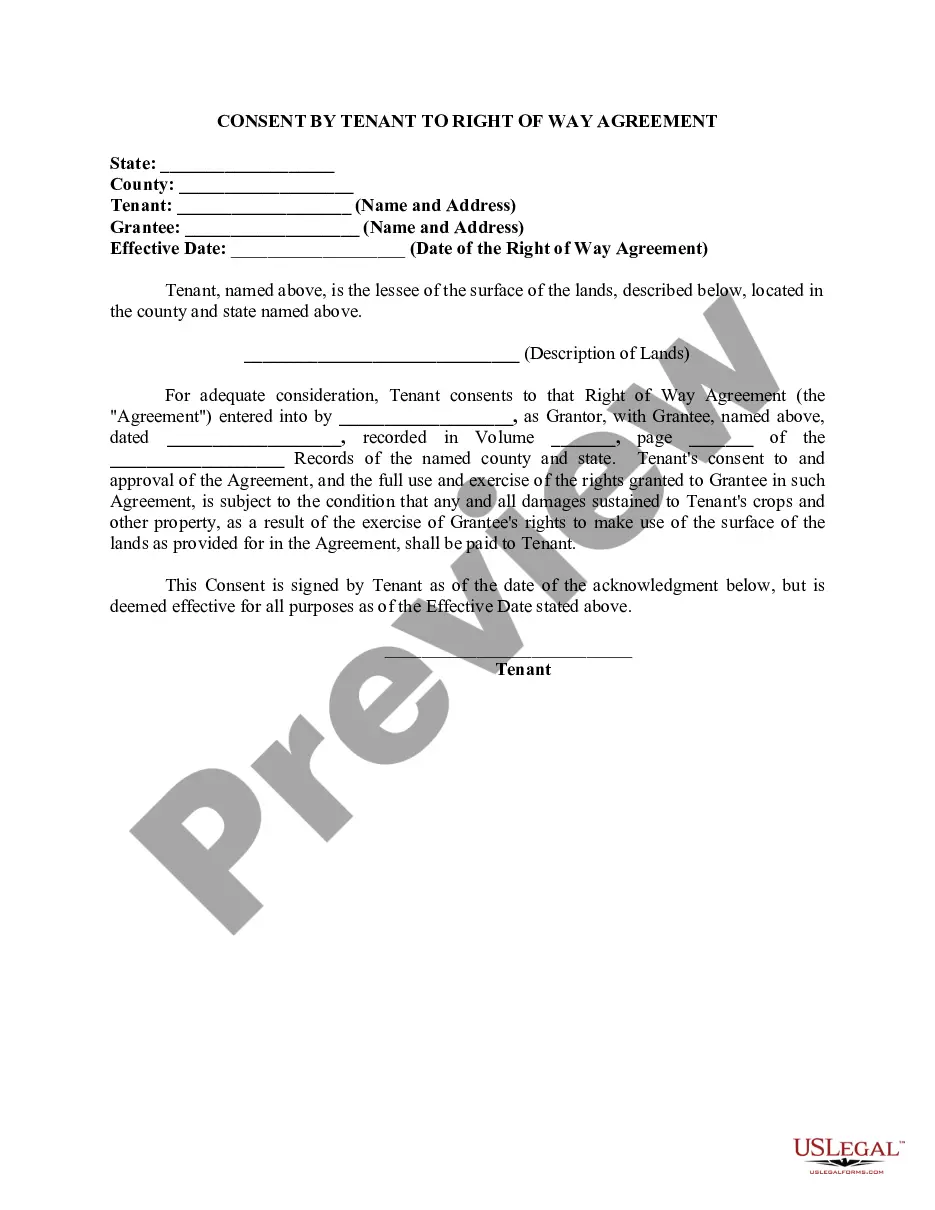

If you use US Legal Forms the very first time, refer to the instructions listed below:

- Step 1. Be sure you have chosen the form for your appropriate area/nation.

- Step 2. Use the Preview option to look through the form`s content. Don`t overlook to see the explanation.

- Step 3. If you are unsatisfied together with the form, make use of the Lookup discipline on top of the display to find other versions of the authorized form web template.

- Step 4. After you have discovered the form you want, select the Purchase now button. Choose the prices strategy you favor and add your credentials to sign up on an accounts.

- Step 5. Process the deal. You can use your credit card or PayPal accounts to perform the deal.

- Step 6. Choose the formatting of the authorized form and obtain it on your gadget.

- Step 7. Full, revise and printing or signal the Indiana Nonqualified Stock Option Plan of MNX Carriers, Inc..

Every single authorized file web template you buy is your own eternally. You may have acces to each form you downloaded within your acccount. Go through the My Forms portion and pick a form to printing or obtain again.

Contend and obtain, and printing the Indiana Nonqualified Stock Option Plan of MNX Carriers, Inc. with US Legal Forms. There are thousands of expert and condition-distinct varieties you can utilize to your organization or individual requirements.

Form popularity

FAQ

NSOs vs. RSUs NSOs give you the option to buy stock, but you might decide to never exercise them if the company's valuation falls below your strike price. In comparison, restricted stock units (RSUs) are actual shares that you acquire as they vest. You don't have to pay to exercise RSUs; you simply receive the shares.

As with other types of stock options, when you're granted NSOs, you're getting the right to buy a set number of shares at a fixed price, also called the strike price, grant price, or exercise price. A company's 409A valuation or fair market value (FMV) determines the strike price of an option.

If eligibility and holding period requirements are met, the bargain element is taxed as a capital gain to the employee. For non-qualified stock options, the bargain element is treated as ordinary income to the employee.

Profits made from exercising qualified stock options (QSO) are taxed at the capital gains tax rate (typically 15%), which is lower than the rate at which ordinary income is taxed. Gains from non-qualified stock options (NQSO) are considered ordinary income and are therefore not eligible for the tax break.

A stock option may be worth exercising if the current stock price (also known as the fair market value or FMV*) is more than the exercise price.

As with other types of stock options, when you're granted NSOs, you're getting the right to buy a set number of shares at a fixed price, also called the strike price, grant price, or exercise price. A company's 409A valuation or fair market value (FMV) determines the strike price of an option.

Non-qualified stock options give employees the right, within a designated timeframe, to buy a set number of shares of their company's shares at a preset price. It may be offered as an alternative form of compensation to workers and also as a means to encourage their loyalty with the company. 1?

The tax catch is that when you exercise the options to purchase stock (but not before), you have taxable income equal to the difference between the stock price set by the option and the market price of the stock. In tax lingo, that's called the compensation element.