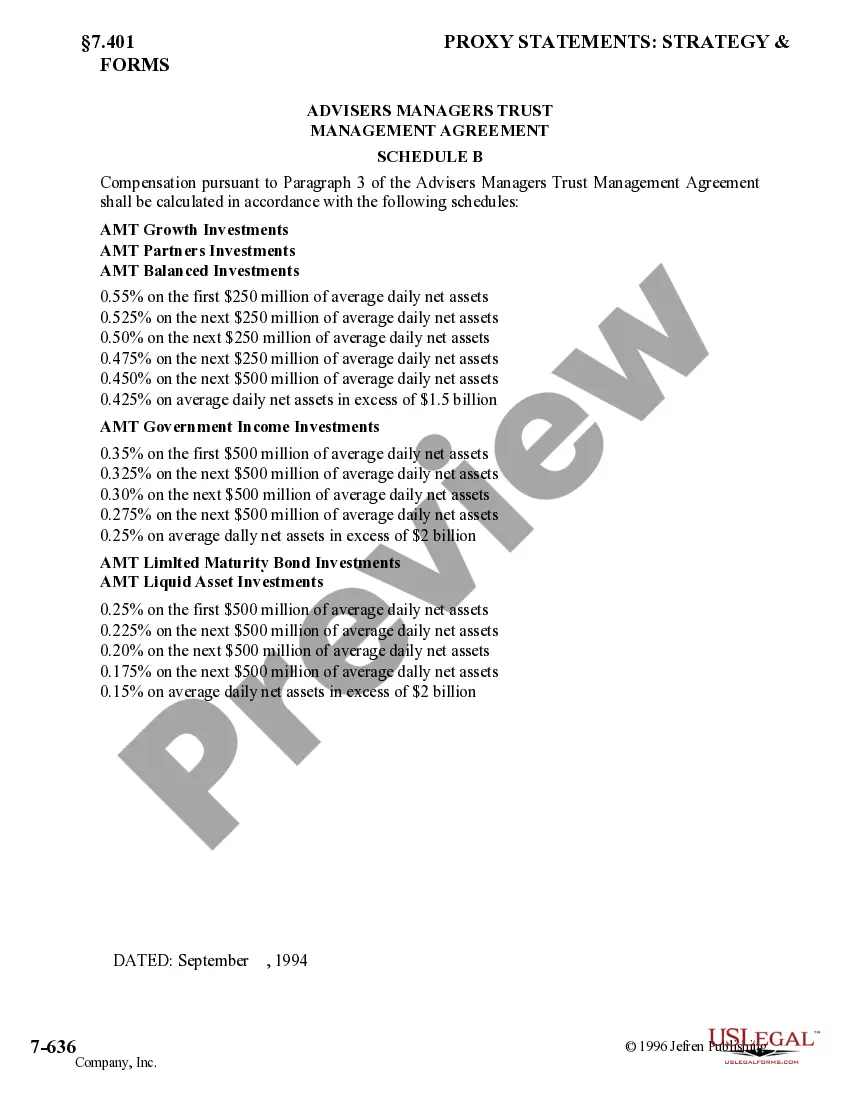

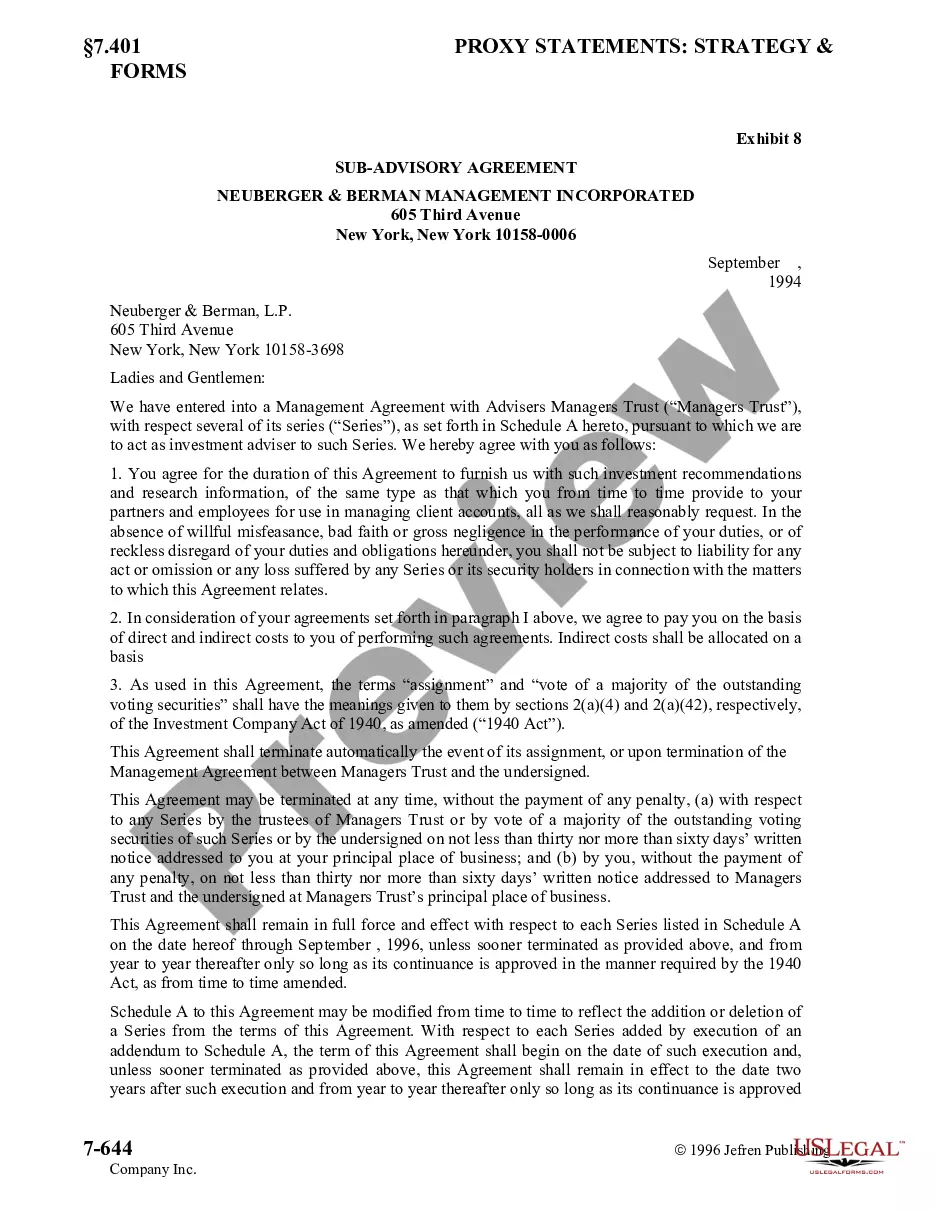

Indiana Management Agreement between Advisers Managers Trust and Neuberger and Berman Management Inc.

Description

How to fill out Management Agreement Between Advisers Managers Trust And Neuberger And Berman Management Inc.?

You are able to devote time on the Internet trying to find the legitimate papers format that fits the federal and state needs you will need. US Legal Forms supplies thousands of legitimate varieties that happen to be evaluated by specialists. It is simple to download or print out the Indiana Management Agreement between Advisers Managers Trust and Neuberger and Berman Management Inc. from my services.

If you currently have a US Legal Forms accounts, you can log in and then click the Acquire key. After that, you can comprehensive, edit, print out, or sign the Indiana Management Agreement between Advisers Managers Trust and Neuberger and Berman Management Inc.. Every legitimate papers format you get is the one you have forever. To obtain one more duplicate for any purchased develop, proceed to the My Forms tab and then click the corresponding key.

Should you use the US Legal Forms internet site for the first time, keep to the basic instructions listed below:

- Initially, make sure that you have chosen the correct papers format to the area/area of your liking. Browse the develop description to make sure you have selected the appropriate develop. If accessible, make use of the Preview key to check with the papers format at the same time.

- If you want to get one more variation of your develop, make use of the Search discipline to discover the format that meets your needs and needs.

- Once you have identified the format you would like, just click Get now to continue.

- Pick the prices prepare you would like, enter your accreditations, and register for a merchant account on US Legal Forms.

- Full the transaction. You can utilize your Visa or Mastercard or PayPal accounts to pay for the legitimate develop.

- Pick the formatting of your papers and download it for your gadget.

- Make adjustments for your papers if needed. You are able to comprehensive, edit and sign and print out Indiana Management Agreement between Advisers Managers Trust and Neuberger and Berman Management Inc..

Acquire and print out thousands of papers web templates utilizing the US Legal Forms Internet site, that provides the greatest variety of legitimate varieties. Use skilled and condition-distinct web templates to handle your organization or personal demands.

Form popularity

FAQ

Neuberger Berman is a private, independent, employee-owned investment manager?a rare structure for a large asset management firm, almost all of which are either public or owned by other financial institutions.

With offices in 25 countries, Neuberger Berman's diverse team has over 2,400 professionals. For eight consecutive years, the company has been named first or second in Pensions & Investments Best Places to Work in Money Management survey (among those with 1,000 employees or more).

Great company to work for Neuberger Berman is an established asset management company that stands for diversity, inclusion, sustainability and work-life balance. I have learned so much during my time at Neuberger and I feel that I can take what I have learned and apply it to helping any company meet its goals.

Neuberger Berman is an experienced hedge fund solutions provider investing on behalf of institutional, high-net-worth and retail clients via registered liquid alternative funds, custom portfolios, and commingled products.

For nine consecutive years, Neuberger Berman has been named first or second in Pensions & Investment's Best Places to Work in Money Management survey (among those with 1,000 employees or more). The firm manages $436 billion in client assets as of March 31, 2023.

Neuberger Berman Trust Company N.A. offers comprehensive fiduciary and investment services for individuals and institutions.

Since 1939, Neuberger Berman has been a leader in the asset management business servicing the investment needs of institutional and individual investors. Neuberger Berman is an independent, employee majority-controlled global asset management firm.