The Indiana Sub-Advisory Agreement of Berger and Berman Management, Inc. is a legally binding contract between Berger and Berman Management, Inc. and a third-party sub-advisor located in the state of Indiana. This agreement outlines the terms and conditions of the sub-advisory relationship and sets forth the responsibilities, rights, and obligations of both parties involved. Berger and Berman Management, Inc., a prominent investment management firm, offers various types of sub-advisory agreements tailored to specific client needs and investment strategies. These agreements may include but are not limited to: 1. Equity Sub-Advisory Agreement: This type of sub-advisory agreement focuses on managing equity-based investments on behalf of clients. It stipulates the specific responsibilities and guidelines for the sub-advisor in relation to selecting, monitoring, and executing equity-related investment decisions. 2. Fixed Income Sub-Advisory Agreement: This agreement concentrates on managing fixed income assets like bonds and securities. It outlines the sub-advisor's responsibilities and parameters for evaluating, selecting, and monitoring fixed income investments to achieve the client's investment goals. 3. Multi-Asset Sub-Advisory Agreement: This type of sub-advisory agreement covers a broader investment spectrum, including various asset classes such as equities, fixed income, and alternative investments. It defines the sub-advisor's role in allocating and rebalancing assets across different investment categories to optimize portfolio performance. 4. Alternative Investment Sub-Advisory Agreement: This agreement focuses on managing alternative investment strategies, including hedge funds, private equity, or real estate investments. It outlines the sub-advisor's responsibilities, risk management procedures, and investment selection criteria within the alternative investment space. Regardless of the specific type of Indiana Sub-Advisory Agreement, all agreements will typically define the sub-advisor's compensation structure, reporting requirements, and termination provisions. It may also specify any confidentiality obligations, compliance with applicable laws and regulations, and the standard of care expected from the sub-advisor. Berger and Berman Management, Inc. ensures that each Indiana Sub-Advisory Agreement is tailored to meet the unique needs of its clients, taking into account their investment objectives, risk tolerance, and desired level of involvement in the investment decision-making process. These agreements provide a transparent framework for the sub-advisor-client relationship, fostering trust and alignment of interests.

Indiana Sub-Advisory Agreement of Neuberger and Berman Management, Inc.

Description

How to fill out Indiana Sub-Advisory Agreement Of Neuberger And Berman Management, Inc.?

Choosing the right authorized record design can be quite a struggle. Needless to say, there are a variety of themes accessible on the Internet, but how can you obtain the authorized form you need? Utilize the US Legal Forms internet site. The support delivers a large number of themes, such as the Indiana Sub-Advisory Agreement of Neuberger and Berman Management, Inc., that can be used for enterprise and personal needs. Each of the varieties are checked out by professionals and meet state and federal demands.

If you are already registered, log in to the profile and then click the Down load option to find the Indiana Sub-Advisory Agreement of Neuberger and Berman Management, Inc.. Make use of your profile to check throughout the authorized varieties you have ordered previously. Check out the My Forms tab of your own profile and obtain yet another copy of the record you need.

If you are a new user of US Legal Forms, listed here are simple instructions for you to stick to:

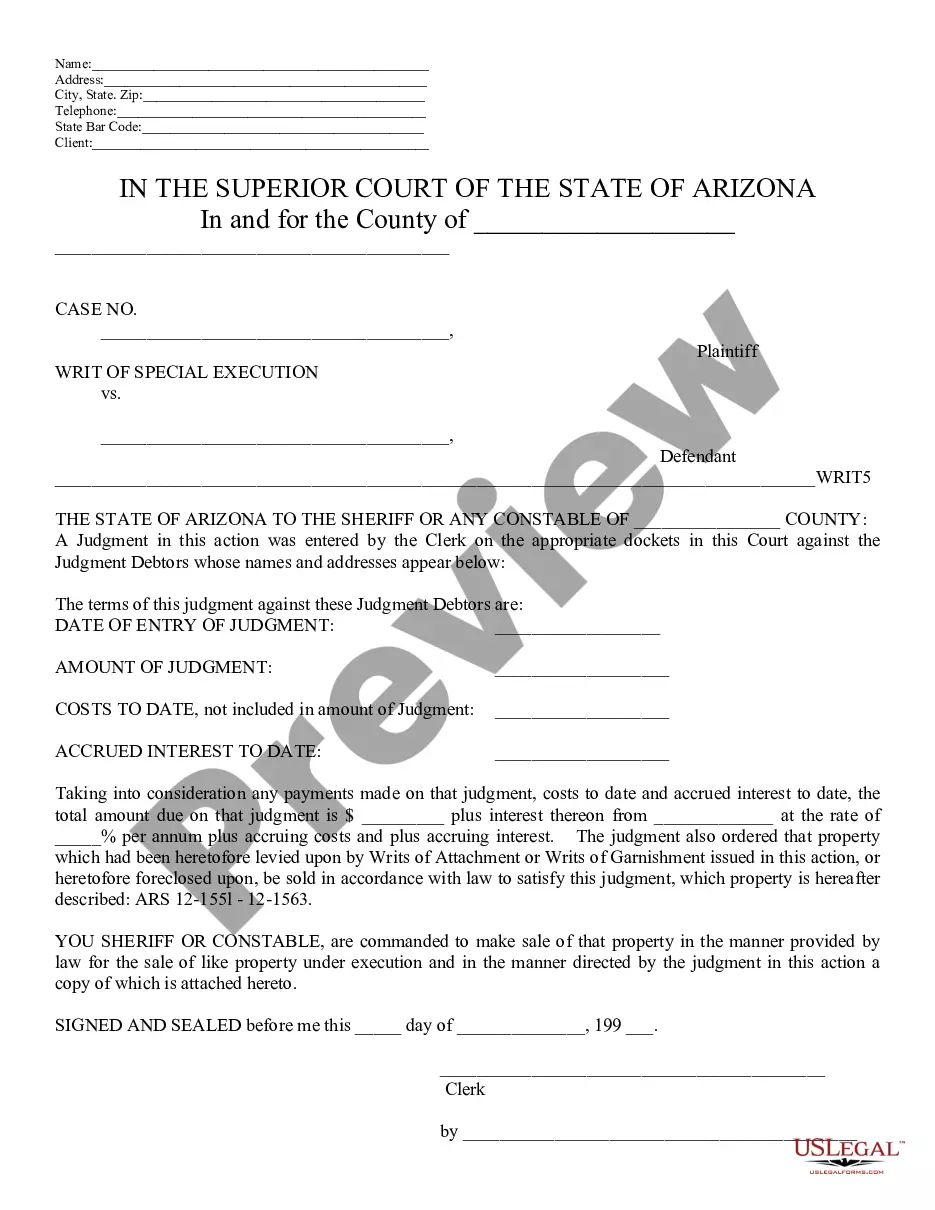

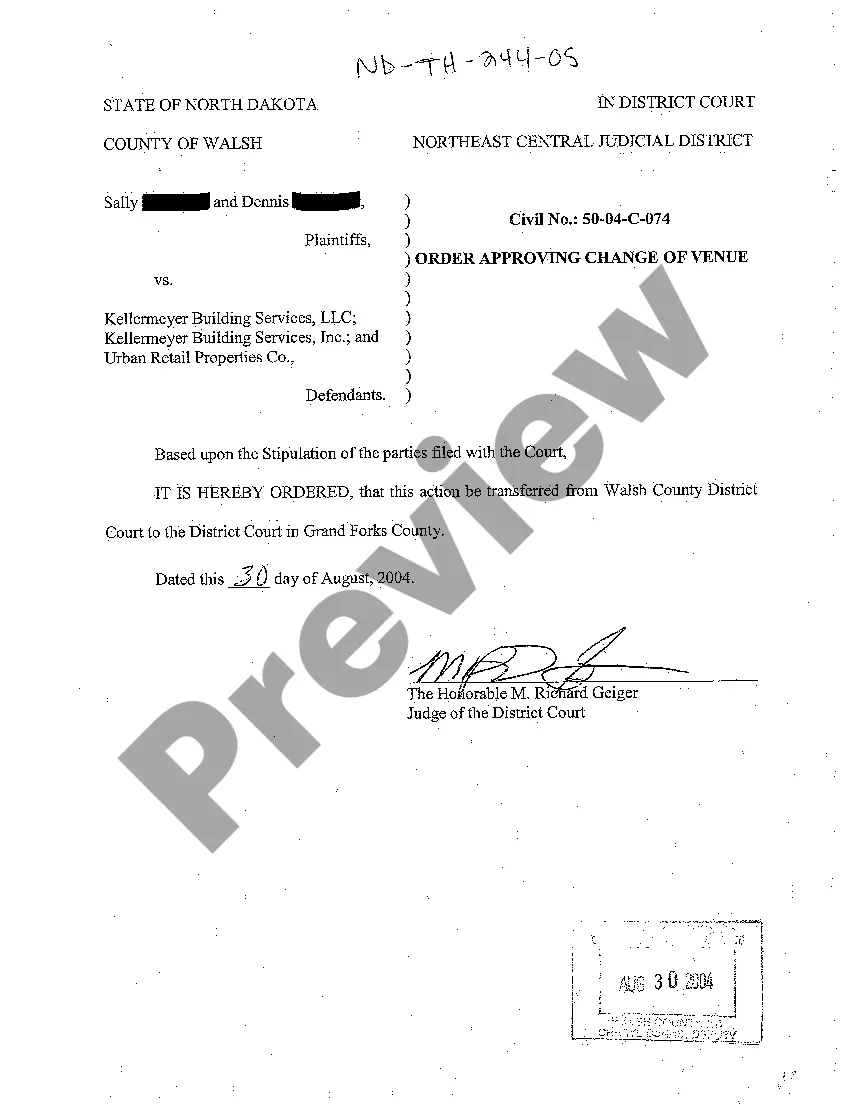

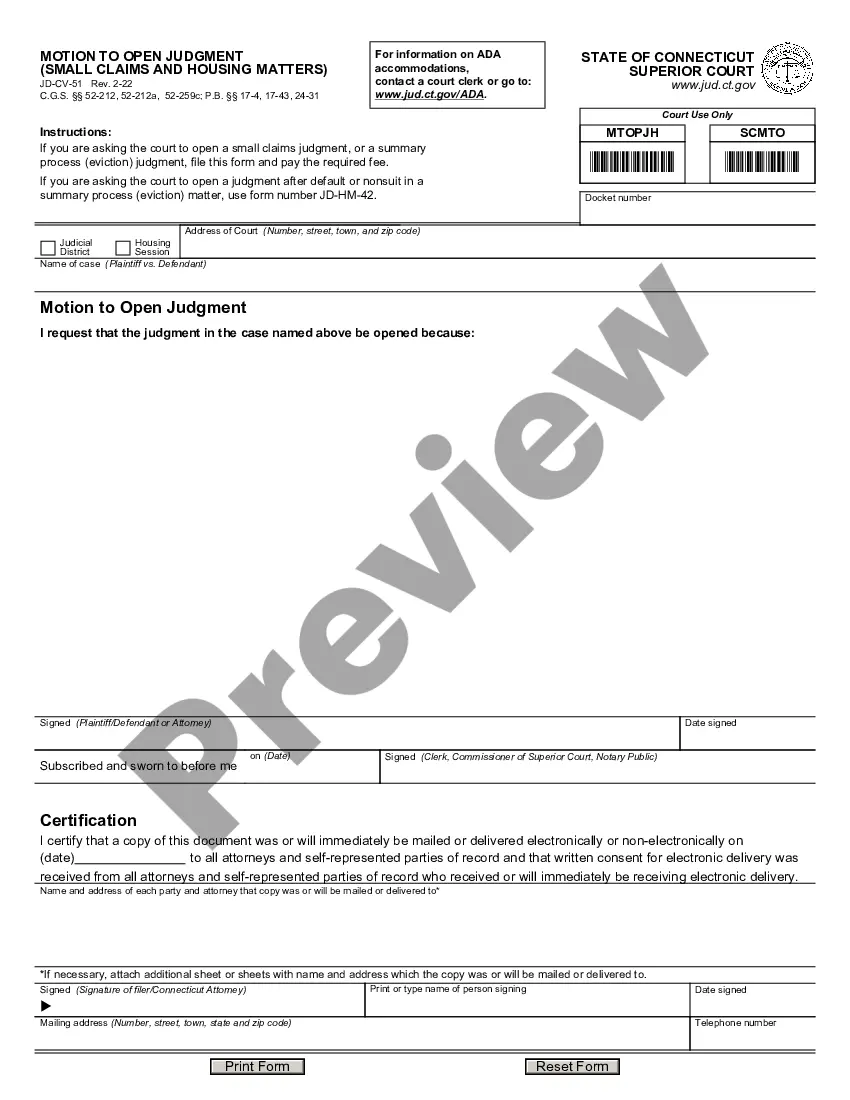

- Very first, make sure you have selected the proper form for your city/state. You may look over the form utilizing the Preview option and look at the form information to make certain it will be the best for you.

- In the event the form does not meet your needs, make use of the Seach industry to find the right form.

- Once you are sure that the form is acceptable, click on the Get now option to find the form.

- Opt for the costs program you need and enter the necessary details. Build your profile and pay for your order making use of your PayPal profile or credit card.

- Select the file file format and obtain the authorized record design to the device.

- Total, revise and print and sign the attained Indiana Sub-Advisory Agreement of Neuberger and Berman Management, Inc..

US Legal Forms is definitely the most significant local library of authorized varieties in which you can find a variety of record themes. Utilize the service to obtain expertly-made paperwork that stick to status demands.

Form popularity

FAQ

Neuberger Berman BD LLC is a registered broker-dealer and member FINRA/SIPC.

Neuberger Berman Group LLC has chosen J.P. Morgan Clearing Corp.

Joseph V. Amato serves as President of Neuberger Berman Group LLC and Chief Investment Officer of Equities. He is a member of the firm's Board of Directors and its Audit Committee. His responsibilities also include overseeing the firm's Fixed Income and hedge fund businesses.