The Indiana Complex Will is a legal document designed to provide financial protection and estate planning for individuals who wish to ensure the well-being of their children. Specifically, it establishes a Max Credit Shelter Marital Trust to Children, a strategic trust arrangement that maximizes the use of estate tax exemptions while safeguarding the financial security of the children. The Max Credit Shelter Marital Trust to Children is aptly named, as it combines two important components of estate planning: the credit shelter trust and the marital trust. This type of trust is often used by couples who want to ensure that their assets are preserved for the benefit of their children while also providing for the surviving spouse. The credit shelter trust, also known as a bypass trust or a family trust, aims to fully utilize the estate tax exemption available to an individual upon their death. In the state of Indiana, this exemption is subject to change based on federal law and regulations. By placing a portion of their assets into this trust, individuals can shield those assets from estate taxes, thus reducing the potential tax burden on their estate. Simultaneously, the marital trust, also referred to as the TIP (Qualified Terminable Interest Property) trust, provides financial support and assurance for the surviving spouse. Assets included in this trust are held for the benefit of the surviving spouse during their lifetime, ensuring their well-being. However, the assets cannot be subject to estate taxes until the death of the surviving spouse. The Max Credit Shelter Marital Trust to Children effectively combines these two trusts, creating a comprehensive estate planning solution. By utilizing this trust arrangement, individuals can provide for the surviving spouse while also securing their children's financial future. It is important to note that the Indiana Complex Will — Max. Credit Shelter Marital Trust to Children can be tailored to meet individual needs and preferences. As such, there may be variations or additional types of these trusts available, depending on the specific circumstances and goals of the individual or couple. Estate planning attorneys can provide personalized advice and guidance to ensure that all applicable laws and regulations are met, while maximizing the benefits of these trusts. In conclusion, the Indiana Complex Will — Max. Credit Shelter Marital Trust to Children is a powerful vehicle for estate planning, offering a way to optimize tax exemptions, provide for a surviving spouse, and secure the financial future of children. Through careful consideration and consultation with legal professionals, individuals can create a comprehensive plan that aligns with their unique estate planning objectives.

Indiana Complex Will - Max. Credit Shelter Marital Trust to Children

Description

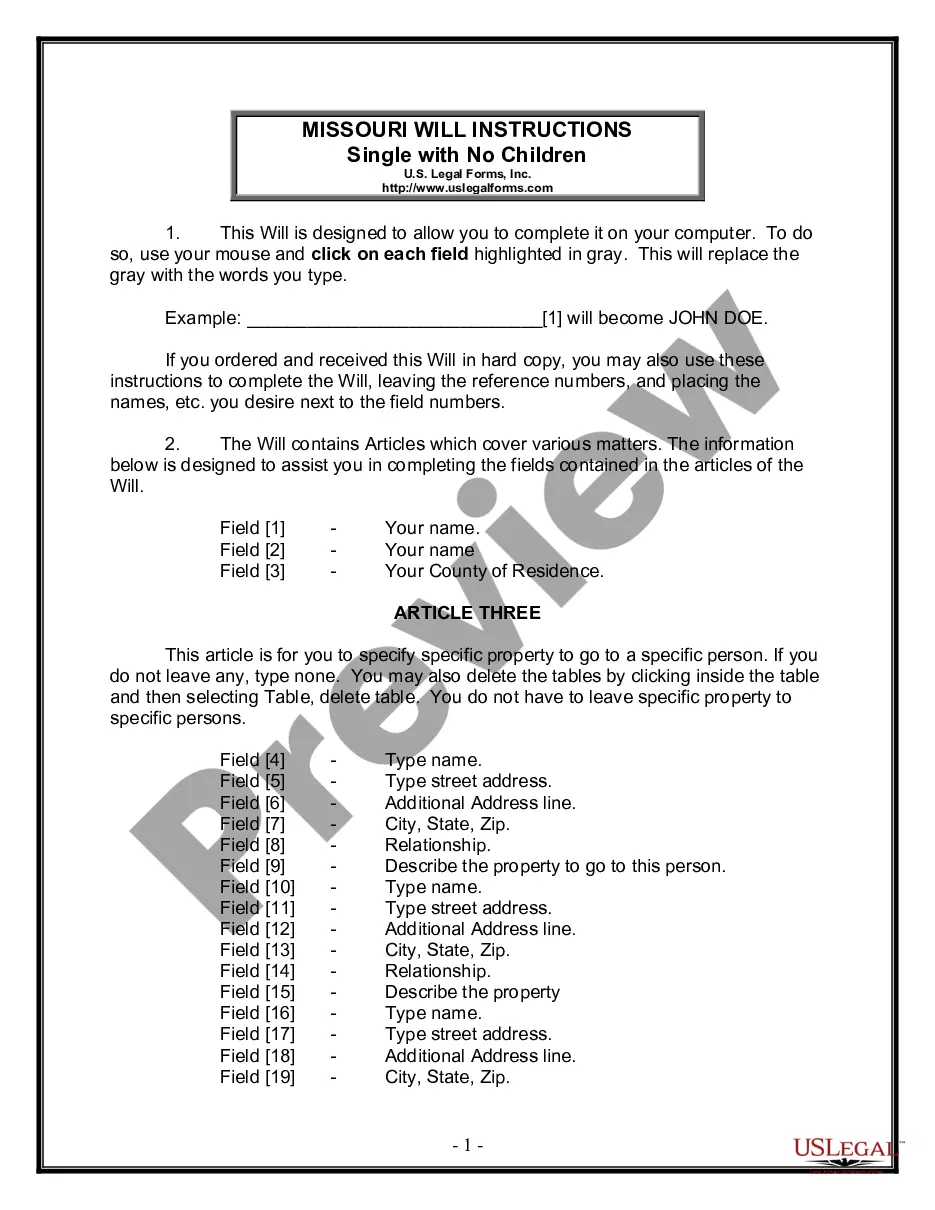

How to fill out Indiana Complex Will - Max. Credit Shelter Marital Trust To Children?

US Legal Forms - one of the greatest libraries of authorized forms in the USA - gives a variety of authorized file templates you may download or print. Utilizing the website, you can find thousands of forms for enterprise and person functions, sorted by types, says, or keywords and phrases.You can find the newest types of forms just like the Indiana Complex Will - Max. Credit Shelter Marital Trust to Children in seconds.

If you already possess a registration, log in and download Indiana Complex Will - Max. Credit Shelter Marital Trust to Children in the US Legal Forms library. The Download switch will show up on every single form you view. You have accessibility to all previously delivered electronically forms within the My Forms tab of your respective accounts.

In order to use US Legal Forms the very first time, listed below are basic directions to obtain began:

- Ensure you have chosen the best form for your town/region. Click the Review switch to analyze the form`s articles. See the form information to actually have chosen the correct form.

- If the form does not satisfy your needs, utilize the Research area on top of the monitor to discover the one who does.

- Should you be content with the shape, affirm your option by simply clicking the Acquire now switch. Then, opt for the prices strategy you like and offer your references to sign up on an accounts.

- Method the purchase. Utilize your credit card or PayPal accounts to complete the purchase.

- Choose the structure and download the shape on your own gadget.

- Make alterations. Fill out, edit and print and signal the delivered electronically Indiana Complex Will - Max. Credit Shelter Marital Trust to Children.

Each and every web template you included with your money does not have an expiration day which is yours permanently. So, if you want to download or print one more duplicate, just proceed to the My Forms portion and then click on the form you require.

Get access to the Indiana Complex Will - Max. Credit Shelter Marital Trust to Children with US Legal Forms, probably the most extensive library of authorized file templates. Use thousands of professional and status-particular templates that meet your small business or person needs and needs.

Form popularity

FAQ

Credit Shelter Trust vs Marital Trust - Is a Marital Trust the Same as a Credit Shelter Trust? No. A Marital Trust is a type of Credit Shelter Trust. You and your spouse can use a Marital Trust to pass assets to a surviving spouse, children or grandchildren.

Unlike a QTIP trust, the assets of the credit shelter trust are not included in the beneficiary's gross estate and, as a result, are not subject to estate tax at the beneficiary's death (in other words, the assets bypass the beneficiary's estate).

Credit shelter trust (CST) (also called an AB trust or a bypass trust) is a tool used by well-off married individuals to legally maximize their estate tax exemptions. The strategy involves creating two separate trusts after one spouse passes.

A Marital Trust is an irrevocable trust that allows for estate tax deferral and possibly elimination. On the other hand, a family trust is generally revocable and will not achieve the same estate tax benefits.

A credit shelter trust (CST) is a trust created after the death of the first spouse in a married couple. Assets placed in the trust are generally held apart from the estate of the surviving spouse, so they may pass tax-free to the remaining beneficiaries at the death of the surviving spouse.

Disadvantages. Irrevocability: A Credit Shelter Trust is irrevocable, which means that the grantor cannot make changes, amendments, or terminate the trust after it is established. This lack of flexibility can be a disadvantage if the grantor's wishes or circumstances change over time.

Example of a Credit Shelter Trust After the husband dies, his $6 million estate and any income it generated passes free of estate tax to his wife because it falls below the federal exemption.