Indiana Stockholders Agreement between Schick Technologies, Inc., David Schick, Allen Schick, and Greystone Funding Corp

Description

How to fill out Stockholders Agreement Between Schick Technologies, Inc., David Schick, Allen Schick, And Greystone Funding Corp?

Are you presently in a placement where you will need files for sometimes business or personal reasons virtually every working day? There are tons of legal record themes available online, but discovering ones you can depend on is not effortless. US Legal Forms gives a large number of develop themes, like the Indiana Stockholders Agreement between Schick Technologies, Inc., David Schick, Allen Schick, and Greystone Funding Corp, which are created to fulfill state and federal specifications.

When you are already knowledgeable about US Legal Forms internet site and possess your account, just log in. Afterward, you are able to download the Indiana Stockholders Agreement between Schick Technologies, Inc., David Schick, Allen Schick, and Greystone Funding Corp web template.

Should you not come with an profile and want to start using US Legal Forms, follow these steps:

- Get the develop you require and make sure it is for the appropriate metropolis/county.

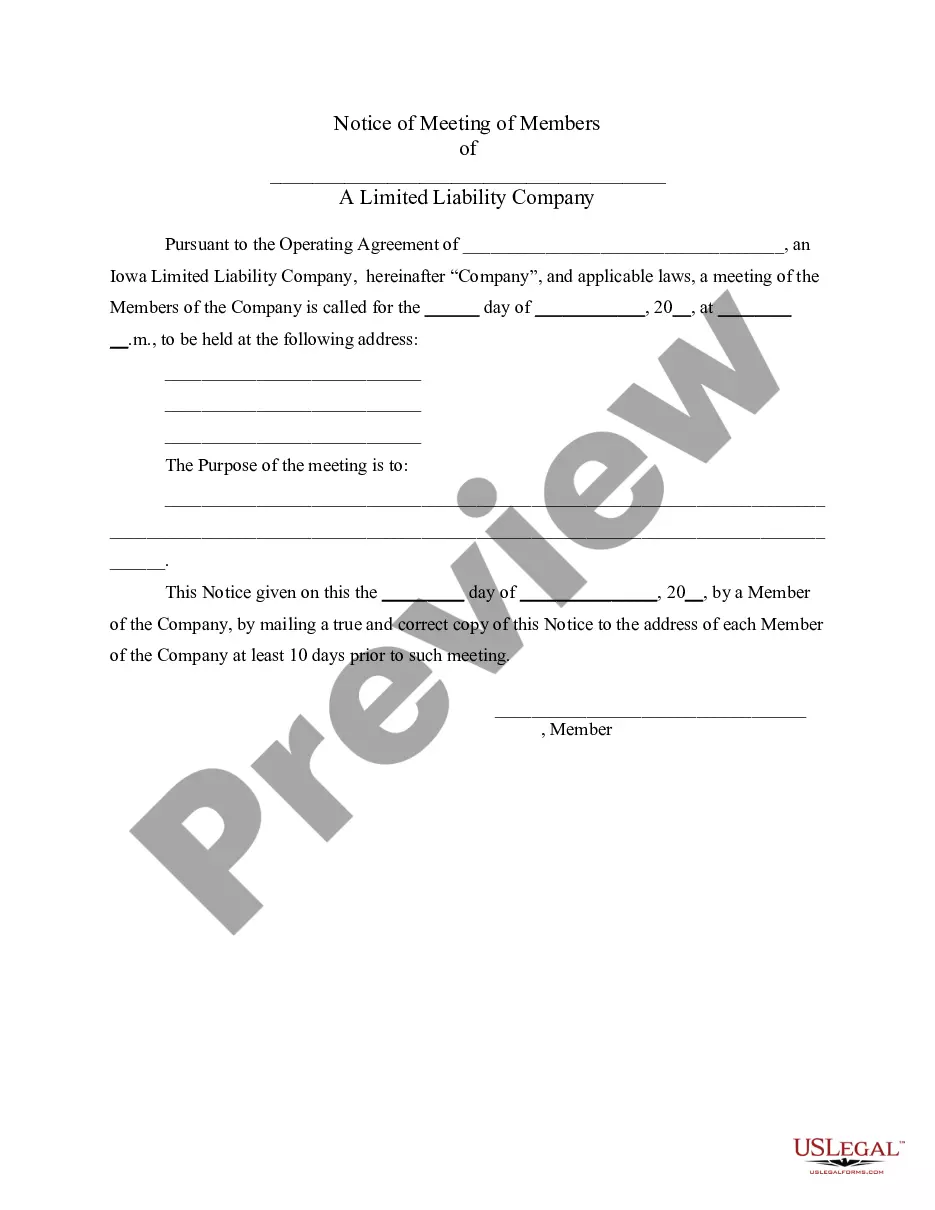

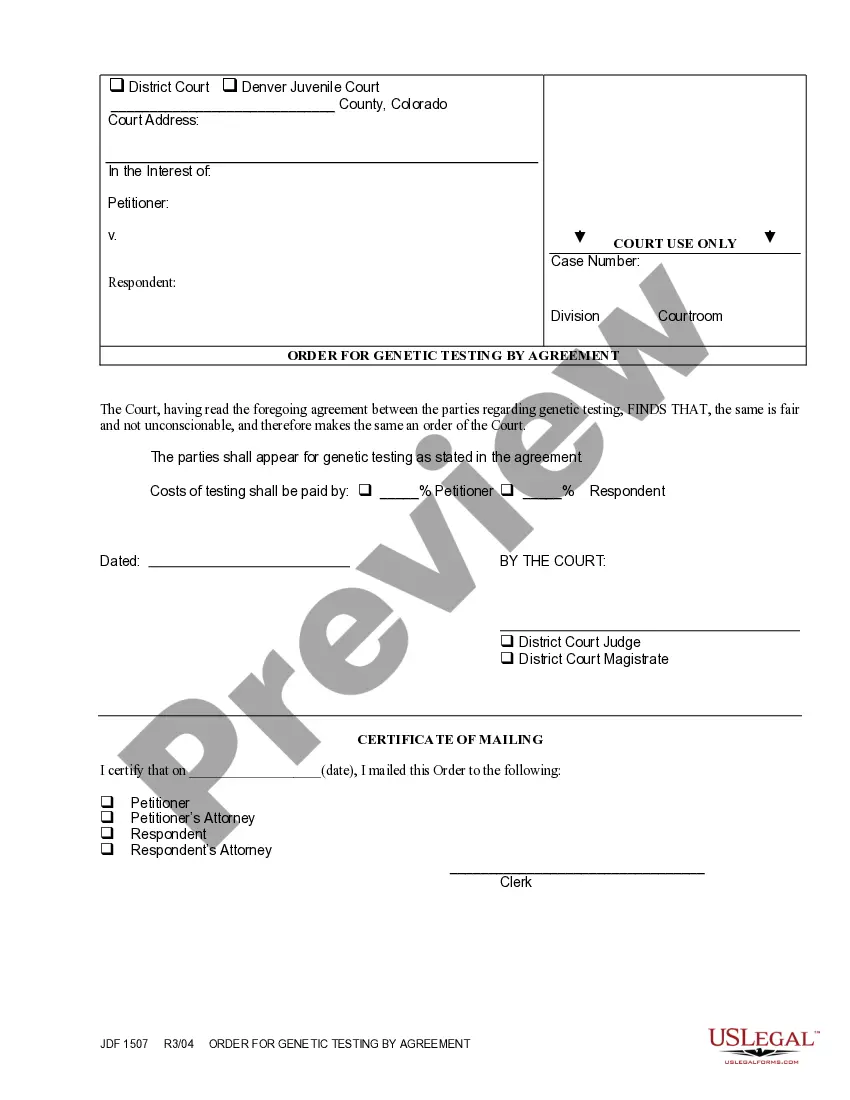

- Use the Preview button to check the form.

- Browse the description to actually have chosen the correct develop.

- In the event the develop is not what you are looking for, make use of the Look for area to discover the develop that meets your needs and specifications.

- If you find the appropriate develop, just click Get now.

- Pick the rates strategy you need, complete the necessary information to create your money, and buy the transaction with your PayPal or bank card.

- Choose a convenient data file structure and download your version.

Find all the record themes you have purchased in the My Forms food selection. You can obtain a additional version of Indiana Stockholders Agreement between Schick Technologies, Inc., David Schick, Allen Schick, and Greystone Funding Corp at any time, if needed. Just select the essential develop to download or printing the record web template.

Use US Legal Forms, by far the most extensive selection of legal forms, to conserve efforts and prevent mistakes. The support gives expertly produced legal record themes that you can use for a variety of reasons. Generate your account on US Legal Forms and start producing your daily life easier.