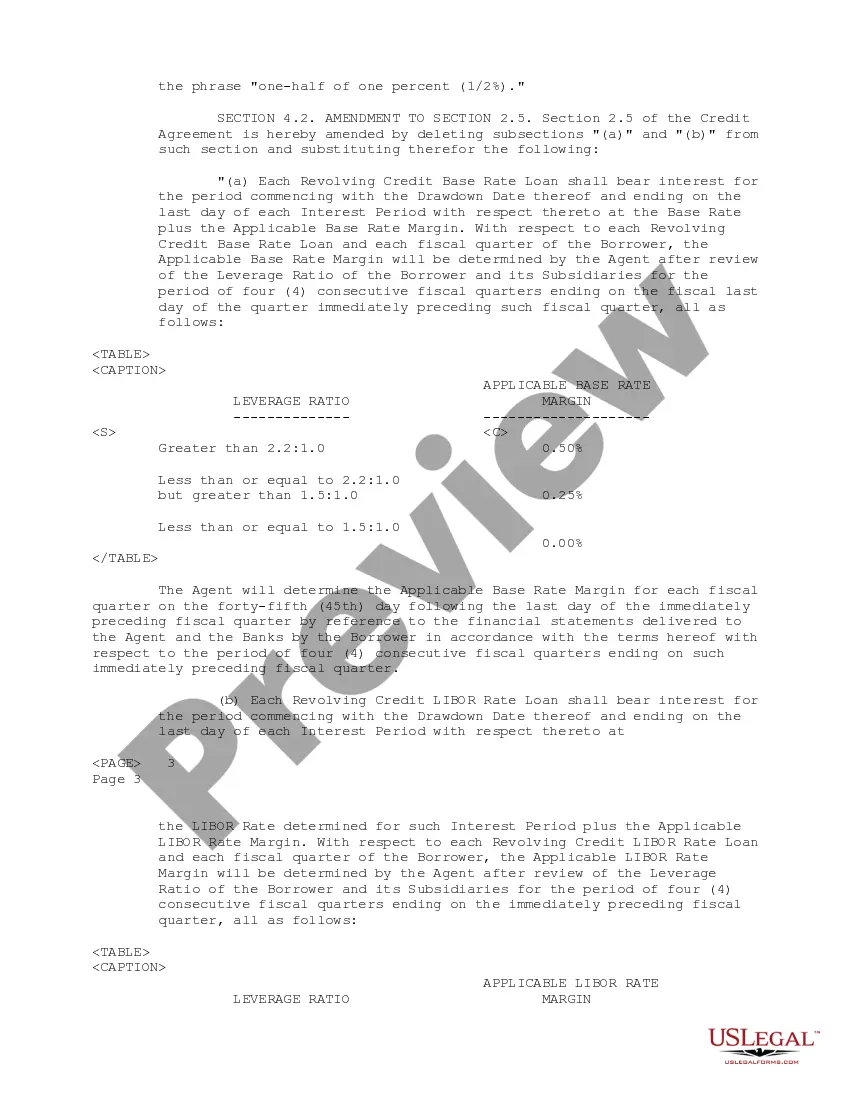

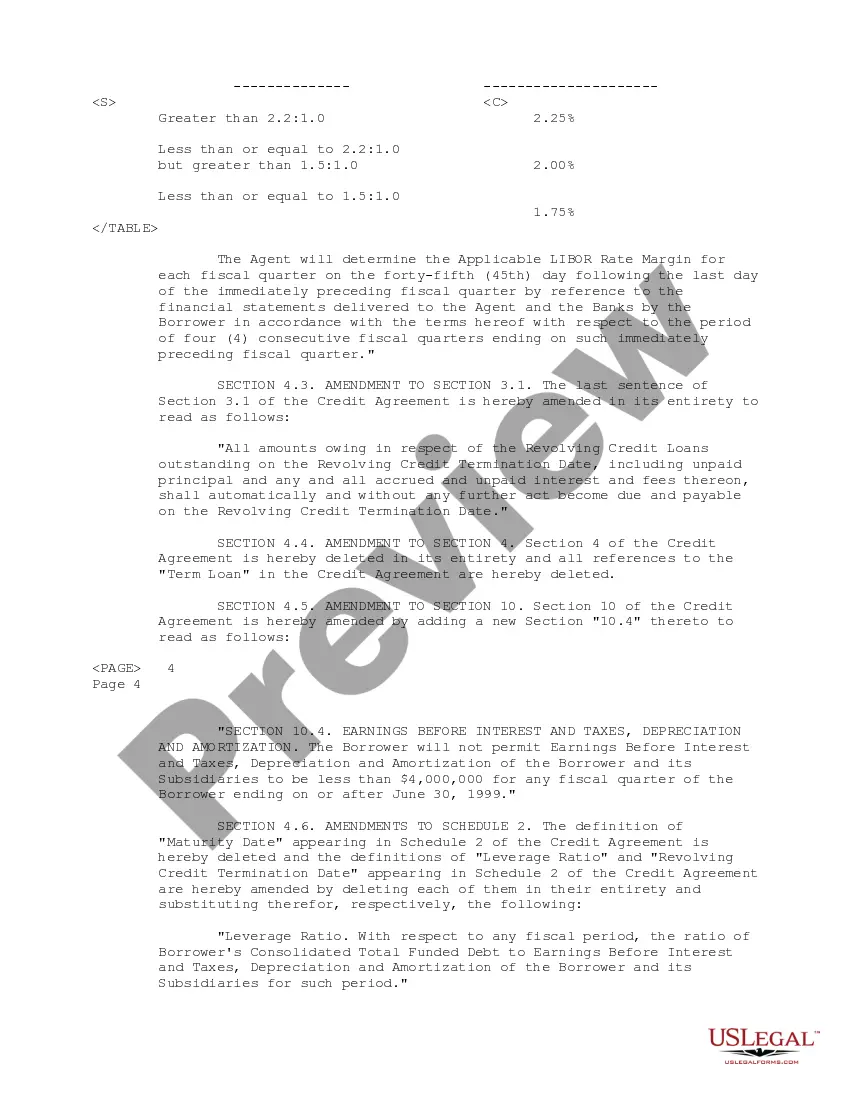

The Indiana Fourth Amendment to Amended Restated Credit Agreement, also known as the Fourth Amendment Agreement, is a legally binding document that outlines the modifications made to the existing credit agreement between Ray tel Medical Corp, Bank Boston, N.A., and Banquet Paribus. This amendment is specific to the state of Indiana and is designed to address any changes or updates required to the original agreement. Keywords: Indiana Fourth Amendment, Amended Restated Credit Agreement, Ray tel Medical Corp, Bank Boston, N.A., Banquet Paribus, modification, agreement updates, legal document, state-specific amendments. The Fourth Amendment Agreement serves numerous purposes, primarily addressing any modifications that need to be made to the original credit agreement in response to evolving business needs and market conditions. It allows the parties involved to negotiate and implement changes while ensuring compliance with Indiana state laws and regulations. Some potential variations or categories of Indiana Fourth Amendment to Amended Restated Credit Agreement between Ray tel Medical Corp, Bank Boston, N.A., and Banquet Paribus may include: 1. Interest Rate Modification: This amendment may involve changes in interest rates associated with the credit agreement. It could be a revision to the current interest rate or the introduction of a new interest rate structure. 2. Extension of Credit Terms: An amendment could be made to extend the credit terms set forth in the original agreement. This modification may allow for a longer repayment period or the introduction of new conditions for availing credit. 3. Collateral Adjustments: The Fourth Amendment could address changes related to the collateral required for the credit facility. It may specify adjustments to the types of collateral accepted or the valuation of existing collateral. 4. Additional Borrowing Capacity: This amendment could allow for an increase or adjustment in the borrowing capacity granted to Ray tel Medical Corp. It may increase the credit limit or modify the conditions for accessing additional funds. 5. Expansion of Financial Covenants: The Fourth Amendment may introduce new or modify existing financial covenants imposed on the borrowing party, such as debt-to-equity ratios, minimum liquidity requirements, or other financial performance metrics. It is important to note that the specific amendments within the Indiana Fourth Amendment to Amended Restated Credit Agreement between Ray tel Medical Corp, Bank Boston, N.A., and Banquet Paribus will vary depending on the circumstances and needs of the involved parties. The content and nature of the amendments will be determined through negotiations and agreements made between the parties involved and in accordance with applicable laws. Disclaimer: This response is intended for informational purposes only and should not be construed as legal advice. It is advisable to consult with qualified professionals and relevant legal counsel when dealing with credit agreements and amendments.

Indiana Fourth Amendment to Amended Restated Credit Agreement between Raytel Medical Corp, Bank Boston, N.A. and Banque Paribas

Description

How to fill out Indiana Fourth Amendment To Amended Restated Credit Agreement Between Raytel Medical Corp, Bank Boston, N.A. And Banque Paribas?

Discovering the right legitimate document web template can be quite a have difficulties. Obviously, there are a variety of web templates accessible on the Internet, but how would you find the legitimate form you require? Make use of the US Legal Forms site. The assistance provides a huge number of web templates, including the Indiana Fourth Amendment to Amended Restated Credit Agreement between Raytel Medical Corp, Bank Boston, N.A. and Banque Paribas, that you can use for company and personal requires. All the varieties are examined by professionals and fulfill state and federal specifications.

When you are presently listed, log in for your accounts and click on the Obtain switch to have the Indiana Fourth Amendment to Amended Restated Credit Agreement between Raytel Medical Corp, Bank Boston, N.A. and Banque Paribas. Make use of your accounts to search throughout the legitimate varieties you possess acquired in the past. Check out the My Forms tab of your respective accounts and have one more copy in the document you require.

When you are a brand new user of US Legal Forms, listed below are easy instructions that you should adhere to:

- First, make sure you have selected the appropriate form to your city/county. You are able to check out the shape making use of the Review switch and read the shape information to make sure this is basically the best for you.

- In case the form fails to fulfill your requirements, use the Seach discipline to discover the appropriate form.

- When you are positive that the shape is suitable, click the Get now switch to have the form.

- Select the rates prepare you would like and enter the required information. Build your accounts and pay money for the order with your PayPal accounts or bank card.

- Pick the file structure and down load the legitimate document web template for your gadget.

- Comprehensive, modify and produce and signal the obtained Indiana Fourth Amendment to Amended Restated Credit Agreement between Raytel Medical Corp, Bank Boston, N.A. and Banque Paribas.

US Legal Forms will be the biggest local library of legitimate varieties for which you will find various document web templates. Make use of the company to down load expertly-manufactured papers that adhere to express specifications.