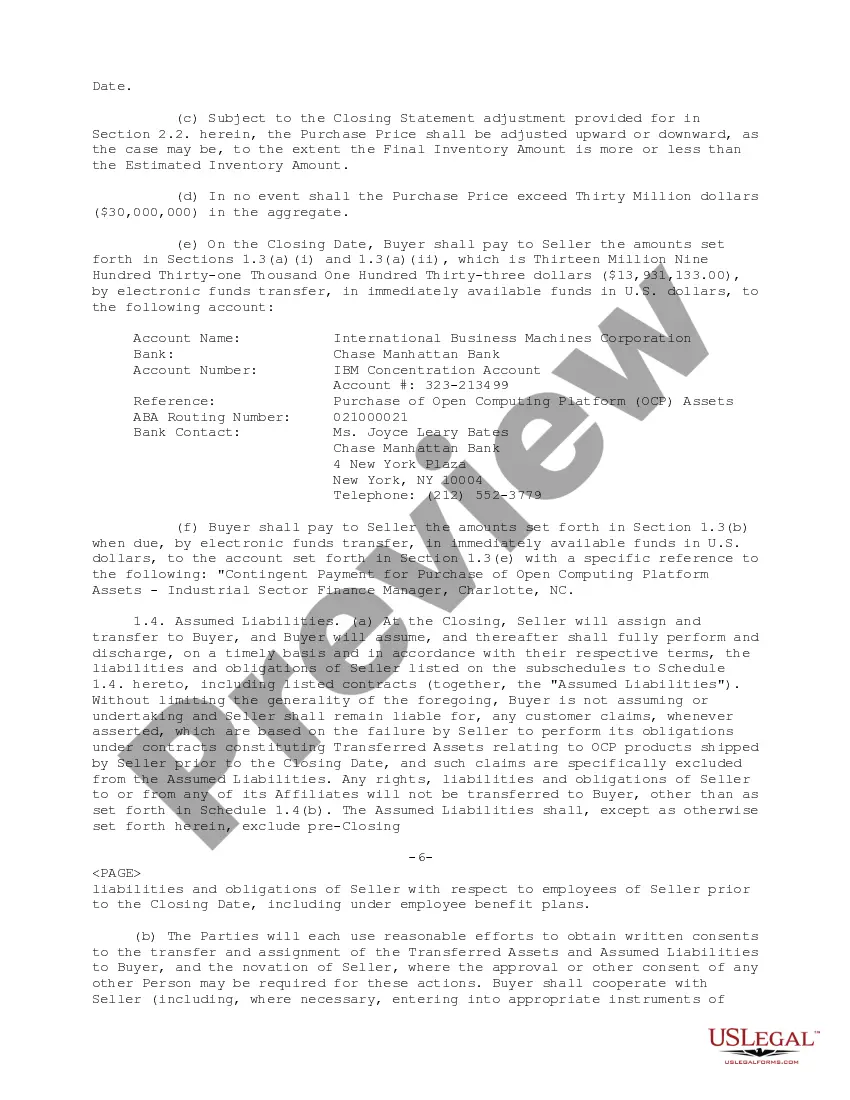

Indiana Sample Asset Purchase Agreement between Radius Corporation and International Business Machines Corporation — Sample This Indiana Sample Asset Purchase Agreement is a legally binding contract that outlines the terms and conditions of the acquisition of specified assets by Radius Corporation from International Business Machines Corporation (IBM). It provides a comprehensive framework for the transfer of assets and sets out various obligations and responsibilities of both parties involved. Under this agreement, Radius Corporation agrees to purchase certain assets from IBM located in the state of Indiana. The assets may include tangible assets, such as properties, equipment, inventory, and intellectual property rights, as well as intangible assets like patents, licenses, trademarks, and goodwill. The agreement specifies a detailed list of these assets to ensure clarity and avoid any misunderstandings. The agreement also outlines the purchase price and payment terms. It indicates the agreed-upon consideration for the assets, which may involve a lump-sum payment, installment payments, or a combination of both. The payment schedule, mode of payment, and any applicable adjustments or contingencies are clearly defined, ensuring a smooth and transparent financial transaction. Furthermore, the agreement addresses various conditions and provisions relevant to the asset purchase. These may include representations and warranties provided by IBM regarding the assets being transferred, covenants related to the use and maintenance of those assets, indemnification clauses to protect Radius Corporation from any liabilities associated with the acquired assets, and dispute resolution mechanisms. In instances where there might be multiple versions or variations of this Indiana Sample Asset Purchase Agreement, it is essential to clearly distinguish them to avoid confusion. Possible variations or types of agreements could include: 1. Indiana Sample Asset Purchase Agreement (Standard Version): This version would encompass the basic terms and conditions applicable to most asset acquisitions, providing a general framework that can be customized as per specific requirements. 2. Indiana Sample Asset Purchase Agreement (Technology Sector): This agreement would cater specifically to acquisitions within the technology sector, addressing unique considerations such as software licenses, proprietary technology transfers, and data privacy or cybersecurity obligations. 3. Indiana Sample Asset Purchase Agreement (Real Estate): This type of agreement would focus on the acquisition of real estate assets, discussing matters like property titles, environmental assessments, zoning regulations, and any other legal complexities related to real estate transactions. 4. Indiana Sample Asset Purchase Agreement (Intellectual Property): This variant would primarily concentrate on the transfer of intellectual property assets, covering aspects like the identification and transfer of patents, copyrights, trademarks, trade secrets, and any associated licensing rights or restrictions. These various versions or types of Indiana Sample Asset Purchase Agreements provide concise yet comprehensive templates that serve as a starting point for drafting customized agreements based on the nature of the assets being acquired and the specific industry or legal considerations involved.

Indiana Sample Asset Purchase Agreement between RadiSys Corporation and International Business Machines Corporation - Sample

Description

How to fill out Indiana Sample Asset Purchase Agreement Between RadiSys Corporation And International Business Machines Corporation - Sample?

US Legal Forms - one of several greatest libraries of authorized kinds in the States - offers an array of authorized papers layouts you may acquire or printing. Making use of the website, you will get 1000s of kinds for enterprise and personal functions, sorted by classes, says, or keywords and phrases.You can get the latest models of kinds just like the Indiana Sample Asset Purchase Agreement between RadiSys Corporation and International Business Machines Corporation - Sample in seconds.

If you already possess a membership, log in and acquire Indiana Sample Asset Purchase Agreement between RadiSys Corporation and International Business Machines Corporation - Sample through the US Legal Forms catalogue. The Down load button can look on every single kind you see. You get access to all in the past saved kinds within the My Forms tab of your own profile.

If you wish to use US Legal Forms for the first time, listed below are easy instructions to help you get began:

- Make sure you have picked out the proper kind for the metropolis/county. Click on the Review button to analyze the form`s content material. Browse the kind description to actually have selected the right kind.

- In the event the kind does not match your requirements, use the Research field towards the top of the display screen to find the one which does.

- Should you be pleased with the shape, confirm your choice by visiting the Acquire now button. Then, select the prices program you like and give your qualifications to sign up for the profile.

- Process the deal. Make use of bank card or PayPal profile to complete the deal.

- Choose the structure and acquire the shape on the product.

- Make changes. Load, change and printing and signal the saved Indiana Sample Asset Purchase Agreement between RadiSys Corporation and International Business Machines Corporation - Sample.

Each template you included in your money does not have an expiration date and it is yours eternally. So, if you would like acquire or printing yet another copy, just go to the My Forms area and click around the kind you require.

Get access to the Indiana Sample Asset Purchase Agreement between RadiSys Corporation and International Business Machines Corporation - Sample with US Legal Forms, probably the most substantial catalogue of authorized papers layouts. Use 1000s of expert and express-certain layouts that fulfill your organization or personal demands and requirements.