The Indiana Plan of Reorganization between Ingenuity Capital Trust and Firsthand Funds involves a structured financial agreement aimed at reorganizing the operations or assets of a company based in the state of Indiana. This strategic alliance between Ingenuity Capital Trust and Firsthand Funds allows them to collaborate and leverage their resources to maximize growth, improve performance, and optimize financial outcomes. Under the Indiana Plan of Reorganization, the two entities work together to create a comprehensive roadmap for restructuring or repositioning the company's operations, finances, and overall business strategy. This involves a detailed analysis of the company's current situation, identifying areas of improvement, and formulating a plan to address them. In order to achieve these objectives, the Indiana Plan of Reorganization may include various components, such as: 1. Financial Restructuring: This entails reviewing and potentially refinancing the company's existing debt, optimizing its capital structure, and negotiating with creditors or investors to restructure financial obligations. This may involve debt consolidation, debt-for-equity swaps, or securing additional capital. 2. Operational Efficiencies: The plan aims to enhance the company's operational efficiency by identifying areas for cost reduction, improving productivity, streamlining processes, and implementing best practices. This may involve workforce adjustments, reevaluating supply chains, or investing in new technologies. 3. Strategic Partnerships or Alliances: The Indiana Plan of Reorganization may involve forging strategic partnerships, collaborations, or alliances with other organizations or entities to leverage synergies, expand market reach, or gain access to new technologies or resources. These partnerships can lead to joint ventures, cross-selling initiatives, or co-marketing campaigns. 4. Asset Reorganization: If needed, the plan may include divestitures or acquisitions of assets to optimize the company's portfolio, focusing on core competencies or entering new markets. Asset sales might be utilized to generate funds for debt reduction or to free up resources for strategic investments. 5. Legal Considerations: The Indiana Plan of Reorganization typically involves addressing any legal and regulatory issues of the company, ensuring compliance, and resolving any outstanding litigation. This may require engaging legal counsel and reaching agreements to settle disputes or outstanding legal matters. Different types of Indiana Plan of Reorganization between Ingenuity Capital Trust and Firsthand Funds could vary depending on the specific needs and circumstances of the company involved. These plans are tailored to address the unique challenges, financial situations, and strategic goals of individual companies. Hence, the details and strategies involved in each plan can differ significantly. In summary, the Indiana Plan of Reorganization between Ingenuity Capital Trust and Firsthand Funds is a comprehensive strategy designed to restructure and reposition a company in Indiana for improved financial performance and growth. It encompasses various financial, operational, and strategic initiatives to enhance the company's competitiveness and create long-term value.

Indiana Plan of Reorganization between Ingenuity Capital Trust and Firsthand Funds

Description

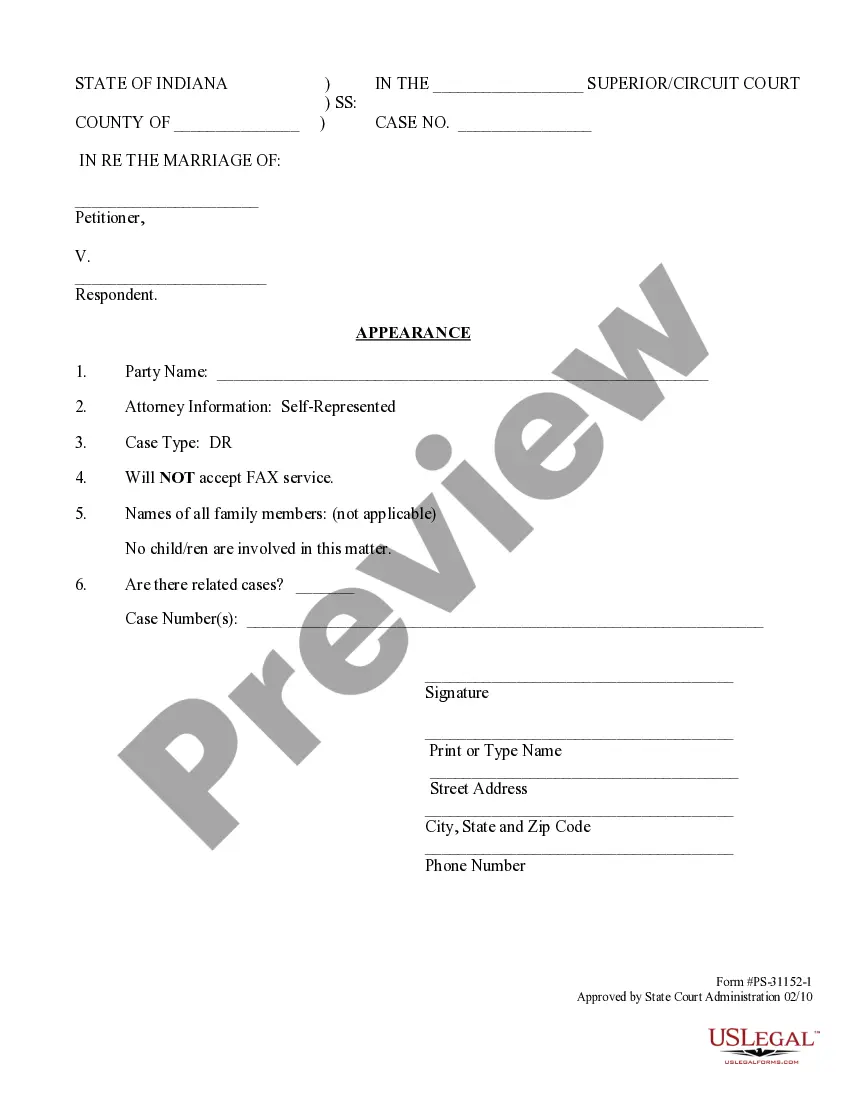

How to fill out Indiana Plan Of Reorganization Between Ingenuity Capital Trust And Firsthand Funds?

You can invest hrs online trying to find the lawful papers format that suits the federal and state needs you require. US Legal Forms offers a huge number of lawful varieties that are reviewed by experts. It is simple to download or print the Indiana Plan of Reorganization between Ingenuity Capital Trust and Firsthand Funds from the support.

If you currently have a US Legal Forms accounts, you can log in and click on the Obtain button. Following that, you can complete, edit, print, or indication the Indiana Plan of Reorganization between Ingenuity Capital Trust and Firsthand Funds. Each and every lawful papers format you acquire is the one you have forever. To get yet another version of the obtained kind, check out the My Forms tab and click on the corresponding button.

If you work with the US Legal Forms internet site for the first time, adhere to the straightforward instructions listed below:

- Initial, ensure that you have chosen the right papers format to the state/metropolis of your choice. Browse the kind explanation to ensure you have chosen the appropriate kind. If available, take advantage of the Review button to look from the papers format as well.

- If you would like get yet another variation of your kind, take advantage of the Search field to discover the format that meets your requirements and needs.

- When you have identified the format you need, click Acquire now to proceed.

- Select the pricing strategy you need, type in your references, and sign up for your account on US Legal Forms.

- Total the financial transaction. You should use your credit card or PayPal accounts to fund the lawful kind.

- Select the formatting of your papers and download it for your device.

- Make changes for your papers if needed. You can complete, edit and indication and print Indiana Plan of Reorganization between Ingenuity Capital Trust and Firsthand Funds.

Obtain and print a huge number of papers web templates utilizing the US Legal Forms site, which provides the greatest variety of lawful varieties. Use professional and express-particular web templates to deal with your small business or individual requires.