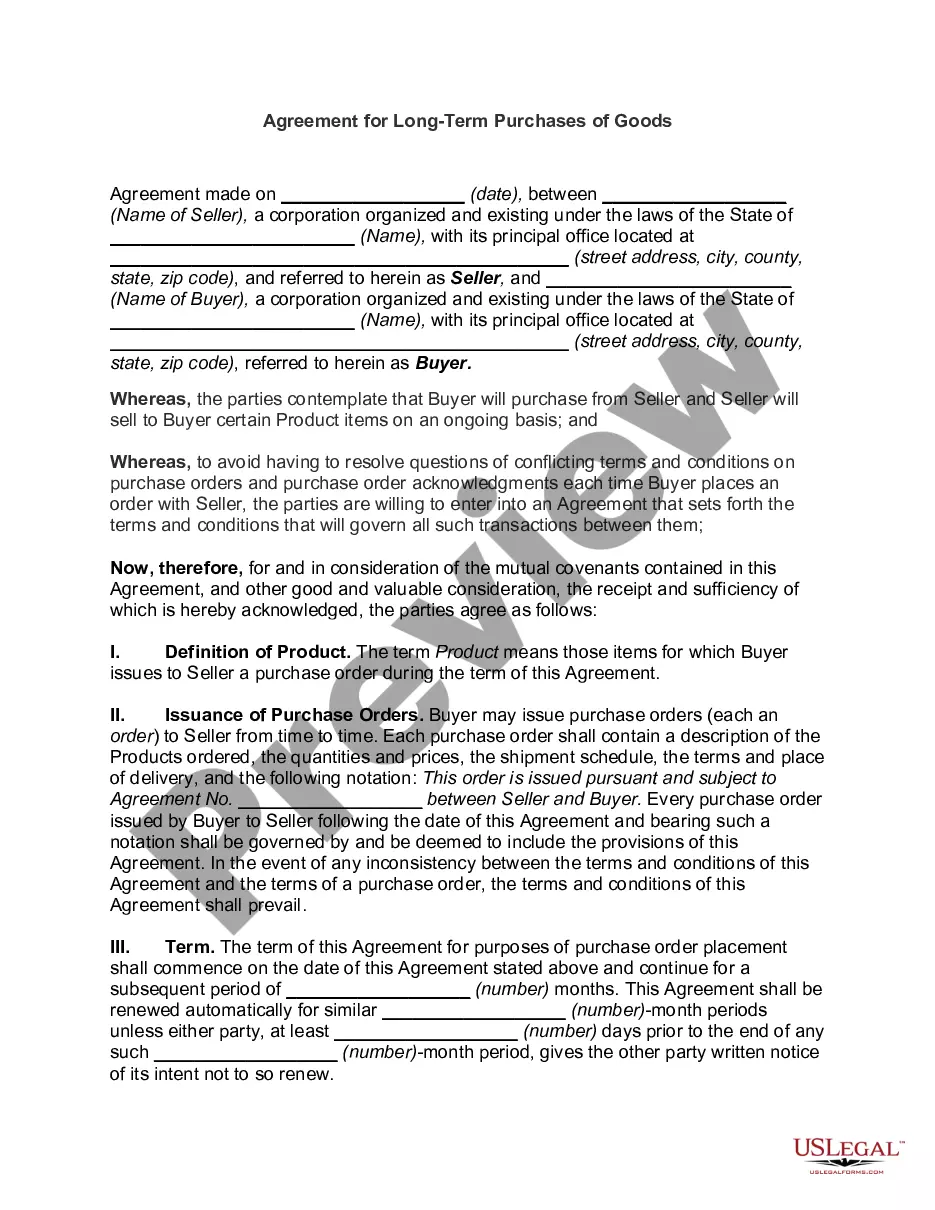

Indiana Sample Common Shares Purchase Agreement between Visible Genetics, Inc. and Investors

Description

How to fill out Sample Common Shares Purchase Agreement Between Visible Genetics, Inc. And Investors?

Finding the right authorized file design can be quite a have difficulties. Naturally, there are tons of layouts available on the net, but how do you get the authorized type you want? Take advantage of the US Legal Forms site. The service gives a huge number of layouts, like the Indiana Sample Common Shares Purchase Agreement between Visible Genetics, Inc. and Investors, which you can use for organization and private needs. All of the varieties are checked by professionals and satisfy federal and state demands.

When you are presently signed up, log in to your account and then click the Obtain key to find the Indiana Sample Common Shares Purchase Agreement between Visible Genetics, Inc. and Investors. Make use of your account to appear through the authorized varieties you possess bought previously. Proceed to the My Forms tab of your own account and have yet another backup from the file you want.

When you are a brand new user of US Legal Forms, allow me to share basic recommendations that you should adhere to:

- Very first, ensure you have chosen the right type for the town/region. You can look through the form while using Review key and browse the form explanation to make certain this is basically the best for you.

- In case the type fails to satisfy your requirements, take advantage of the Seach field to discover the appropriate type.

- When you are certain the form is acceptable, click the Acquire now key to find the type.

- Choose the costs program you want and enter the needed information and facts. Create your account and purchase the order using your PayPal account or credit card.

- Select the submit formatting and obtain the authorized file design to your system.

- Total, edit and produce and sign the obtained Indiana Sample Common Shares Purchase Agreement between Visible Genetics, Inc. and Investors.

US Legal Forms will be the greatest catalogue of authorized varieties for which you can discover different file layouts. Take advantage of the company to obtain appropriately-manufactured papers that adhere to state demands.

Form popularity

FAQ

The Shareholder's Agreement is generally used to resolve disputes between the corporation and the Shareholder. The Share Purchase Agreement, on the other hand, is a document that justifies the exchange of shares held by the Buyer and Seller.

A stock purchase agreement typically includes the following information: Your business name. The name and mailing address of the entity buying shares in your company's stocks. The par value (essentially the sale price) of the stocks being sold. The number of stocks the buyer is purchasing.

A SPA should specify the sale price for the shares, specify the currency and timescale for the sale, and list any other conditions like staged payments. Usually, payment is made in cash, although sometimes the buyer may offer the seller some of its shares, or issue loan notes to the seller.

A SPA should specify the sale price for the shares, specify the currency and timescale for the sale, and list any other conditions like staged payments. Usually, payment is made in cash, although sometimes the buyer may offer the seller some of its shares, or issue loan notes to the seller.

Scope of a share purchase agreement The parties to the agreement. Information on the company selling shares. Purchase price of the shares. Title. Timetable for completion. Warranties. Restrictions following completion. Confidentiality requirements.

How to draft a purchase agreement Name and contact information for buyer and seller. The address of the property being sold. The price to be paid for the property. The date of transfer. Disclosures. Contingencies. Signatures.

Stock purchase agreements (SPAs) are legally binding contracts between shareholders and companies. Also known as share purchase agreements, these contracts establish all of the terms and conditions related to the sale of a company's stocks.