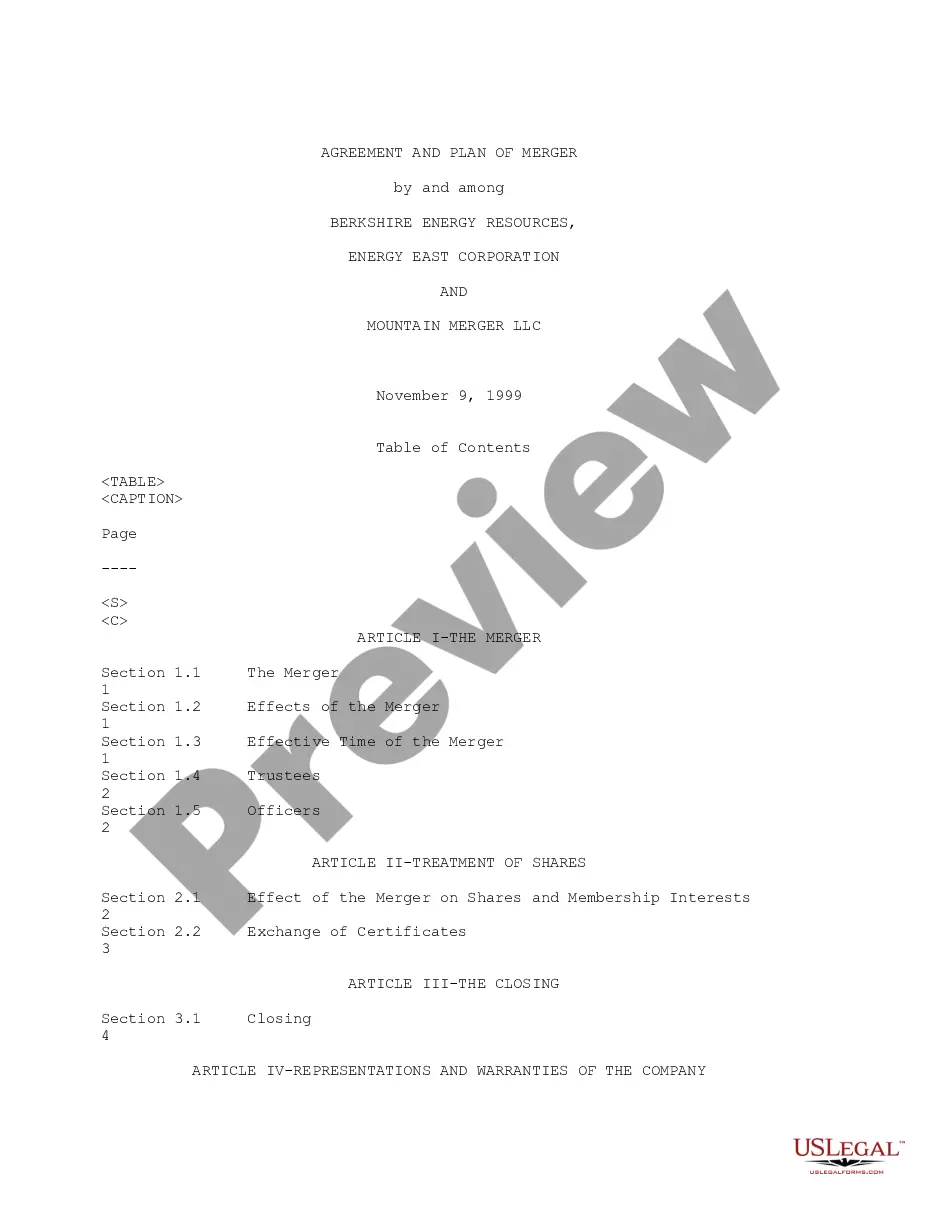

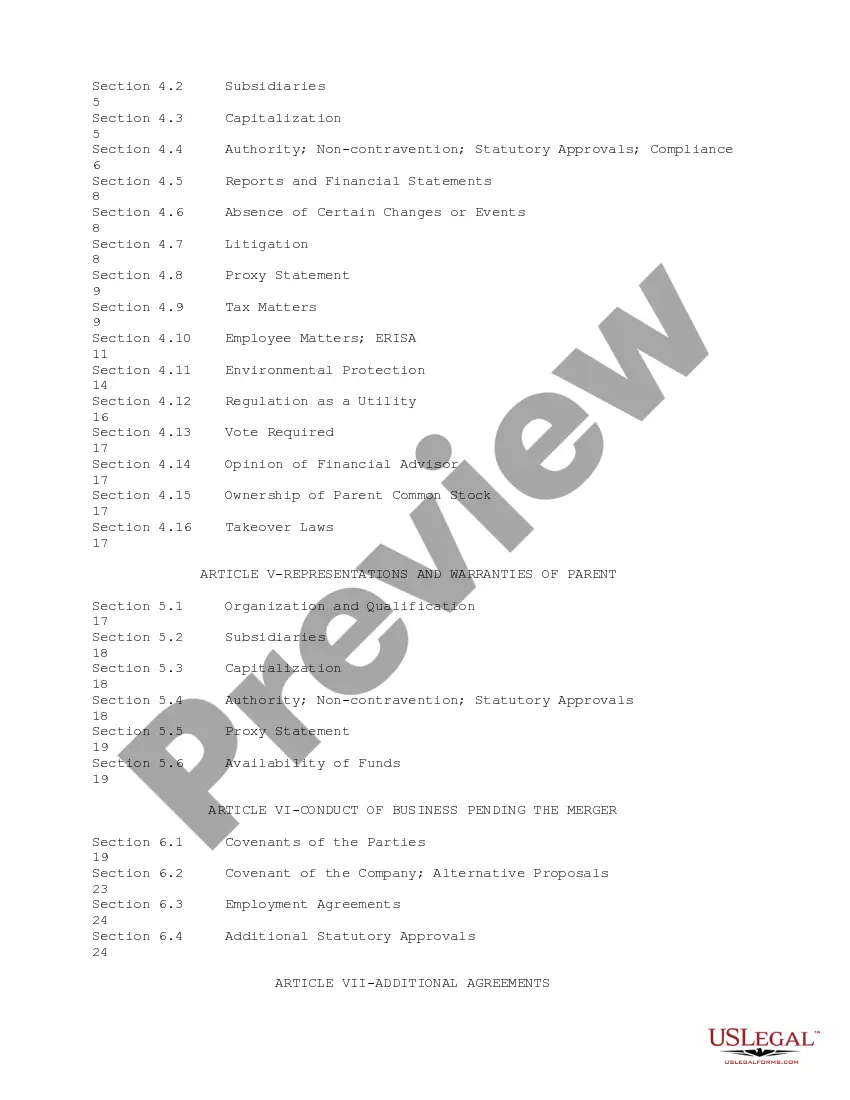

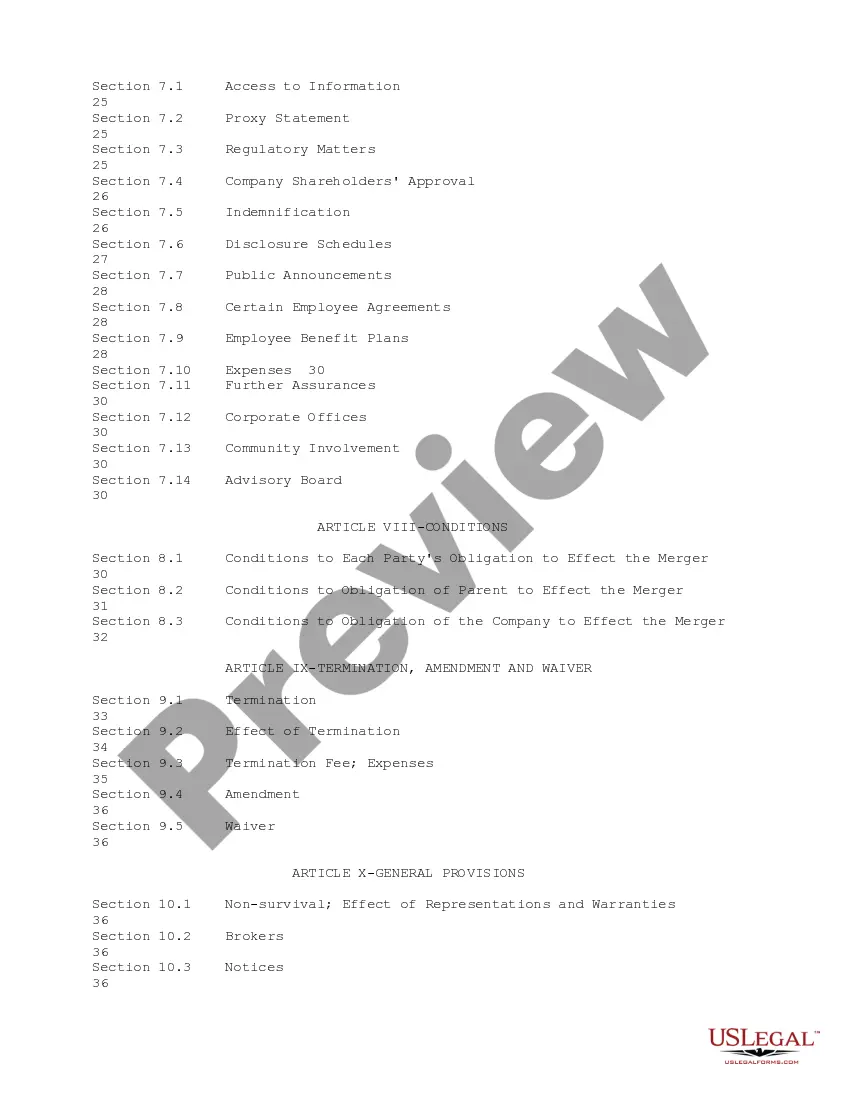

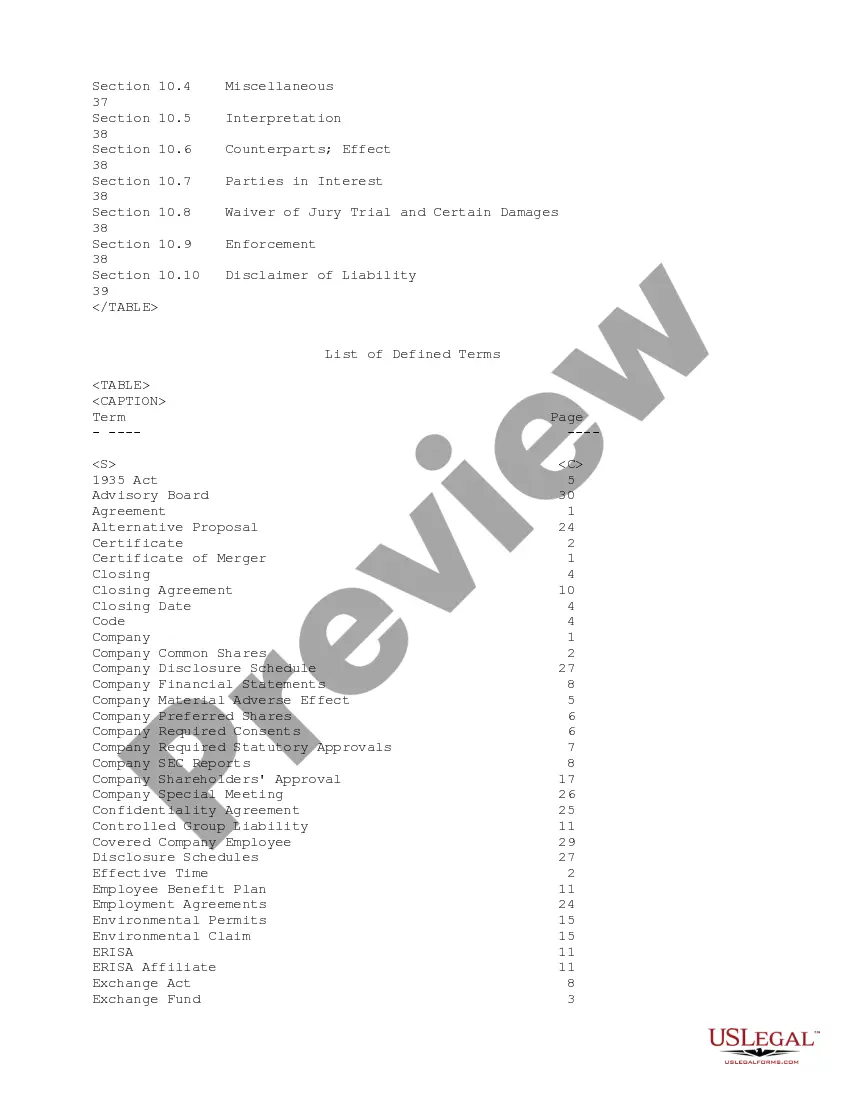

Indiana Plan of Merger between Berkshire Energy Resources, Energy East Corporation and Mountain Merger, LLC

Description

How to fill out Plan Of Merger Between Berkshire Energy Resources, Energy East Corporation And Mountain Merger, LLC?

You are able to invest time online looking for the authorized papers template that fits the state and federal demands you will need. US Legal Forms gives a huge number of authorized forms which can be examined by experts. You can easily obtain or produce the Indiana Plan of Merger between Berkshire Energy Resources, Energy East Corporation and Mountain Merger, LLC from my assistance.

If you already possess a US Legal Forms account, you can log in and click on the Download switch. Afterward, you can comprehensive, change, produce, or signal the Indiana Plan of Merger between Berkshire Energy Resources, Energy East Corporation and Mountain Merger, LLC. Each authorized papers template you purchase is yours eternally. To get one more backup of any purchased form, check out the My Forms tab and click on the corresponding switch.

If you work with the US Legal Forms website for the first time, adhere to the straightforward instructions below:

- Very first, be sure that you have selected the right papers template for the region/metropolis of your liking. Browse the form outline to ensure you have selected the proper form. If offered, make use of the Review switch to check with the papers template too.

- If you would like discover one more edition of your form, make use of the Lookup area to get the template that meets your needs and demands.

- When you have discovered the template you desire, simply click Get now to proceed.

- Find the prices strategy you desire, enter your accreditations, and sign up for a free account on US Legal Forms.

- Complete the purchase. You should use your credit card or PayPal account to cover the authorized form.

- Find the file format of your papers and obtain it for your system.

- Make modifications for your papers if possible. You are able to comprehensive, change and signal and produce Indiana Plan of Merger between Berkshire Energy Resources, Energy East Corporation and Mountain Merger, LLC.

Download and produce a huge number of papers web templates using the US Legal Forms site, that offers the largest collection of authorized forms. Use expert and express-specific web templates to tackle your small business or person needs.