The Indiana Stock Exchange Agreement and Plan of Reorganization by Benson International, Inc., Multimedia K.I.D. Intelligence in Education, Ltd., and Stockholders is a comprehensive and legally binding agreement governing the merger and reorganization of these entities. This agreement outlines the terms and conditions under which the stock exchange will take place, ensuring a smooth transition and maximizing the value for the respective stockholders. Key elements and provisions of the Indiana Stock Exchange Agreement and Plan of Reorganization may include: 1. Merger and Reorganization: The agreement will outline the specific details of the merger and reorganization process, combining the assets, operations, and stock of Benson International, Inc. and Multimedia K.I.D. Intelligence in Education, Ltd. This ensures a seamless integration of resources and operations to create a stronger combined entity. 2. Stock Exchange Ratio: The agreement will establish the exchange ratio at which the stockholders of Benson International, Inc. and Multimedia K.I.D. Intelligence in Education, Ltd. will receive shares in the newly formed company. The exchange ratio may be determined based on various factors such as the relative value of the companies, their financial performance, and market conditions. 3. Valuation and Consideration: The agreement will specify the valuation methodologies used to determine the value of the companies involved. It may include considerations such as the book value, market value, or a combination of both. The agreed-upon valuation will govern the exchange of stock and other consideration that stockholders will receive. 4. Board and Management Structure: The agreement will outline the composition of the board of directors and management team of the newly merged company. It will address the appointment process, qualifications, and responsibilities of the directors and officers to ensure effective corporate governance and decision-making. 5. Conditions Precedent: The agreement may include conditions that must be fulfilled before the stock exchange and reorganization can take place. Typical conditions precedent may involve obtaining necessary regulatory approvals, securing consent from key stakeholders, and completing due diligence investigations to ensure the accuracy of financial and operating information. 6. Representations and Warranties: The agreement will include representations and warranties made by the participating entities regarding their respective businesses, financial condition, and legal compliance. These ensure that all parties have provided accurate and complete information, protecting the interests of the stockholders and mitigating the risk of any future disputes. Different types of Indiana Stock Exchange Agreement and Plan of Reorganization within the context of Benson International, Inc., Multimedia K.I.D. Intelligence in Education, Ltd., and stockholders may include variations based on the specific circumstances of the transaction. For example, there could be specific agreements for different classes of stockholders, or distinct agreements based on the nature of the industries involved, such as a technology-focused stock exchange agreement or an education sector-focused agreement. In conclusion, the Indiana Stock Exchange Agreement and Plan of Reorganization by Benson International, Inc., Multimedia K.I.D. Intelligence in Education, Ltd., and Stockholders is a legally binding document that outlines the terms and conditions of the merger and reorganization process. It encompasses various aspects such as stock exchange ratios, valuation, board and management structure, and other conditions precedent. Different versions of this agreement may exist to cater to specific circumstances and stakeholders involved in the transaction.

Indiana Stock Exchange Agreement and Plan of Reorganization by Jenkon International, Inc., Multimedia K.I.D. Intelligence in Education, Ltd., and Stockholders

Description

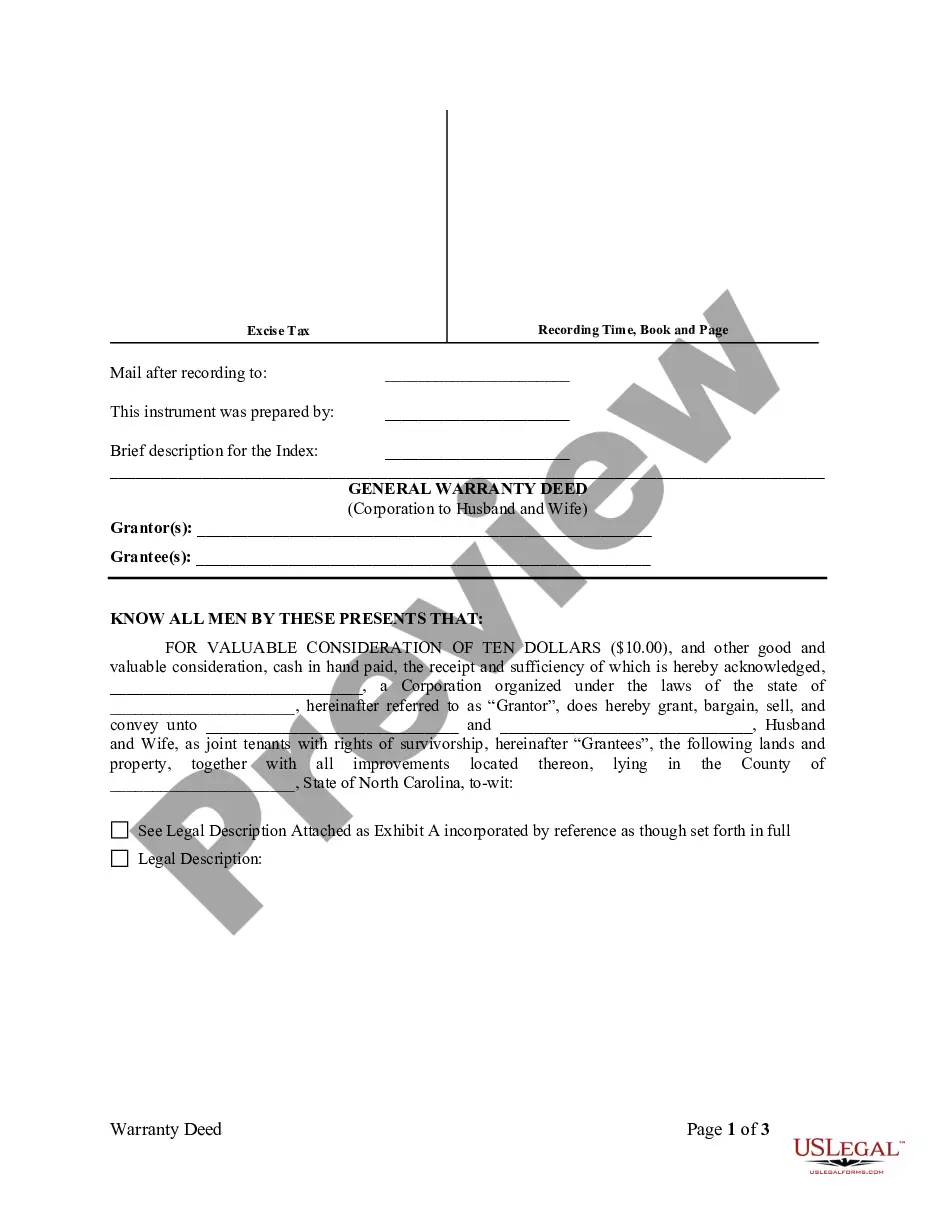

How to fill out Stock Exchange Agreement And Plan Of Reorganization By Jenkon International, Inc., Multimedia K.I.D. Intelligence In Education, Ltd., And Stockholders?

It is possible to commit time on the web looking for the lawful file template that suits the state and federal requirements you want. US Legal Forms supplies a large number of lawful varieties which are examined by pros. It is simple to acquire or print out the Indiana Stock Exchange Agreement and Plan of Reorganization by Jenkon International, Inc., Multimedia K.I.D. Intelligence in Education, Ltd., and Stockholders from our service.

If you already possess a US Legal Forms accounts, you may log in and then click the Down load switch. After that, you may full, change, print out, or indication the Indiana Stock Exchange Agreement and Plan of Reorganization by Jenkon International, Inc., Multimedia K.I.D. Intelligence in Education, Ltd., and Stockholders. Every lawful file template you acquire is your own property eternally. To have another backup associated with a obtained kind, check out the My Forms tab and then click the corresponding switch.

If you work with the US Legal Forms web site the first time, stick to the easy instructions beneath:

- Initially, make certain you have chosen the best file template to the area/city of your choosing. See the kind explanation to ensure you have picked the appropriate kind. If accessible, utilize the Preview switch to look from the file template too.

- If you would like locate another variation of your kind, utilize the Lookup field to obtain the template that suits you and requirements.

- Upon having found the template you would like, click Buy now to carry on.

- Select the prices prepare you would like, enter your accreditations, and register for an account on US Legal Forms.

- Complete the financial transaction. You can utilize your Visa or Mastercard or PayPal accounts to fund the lawful kind.

- Select the structure of your file and acquire it to your system.

- Make modifications to your file if required. It is possible to full, change and indication and print out Indiana Stock Exchange Agreement and Plan of Reorganization by Jenkon International, Inc., Multimedia K.I.D. Intelligence in Education, Ltd., and Stockholders.

Down load and print out a large number of file themes while using US Legal Forms Internet site, which offers the biggest assortment of lawful varieties. Use specialist and status-certain themes to take on your small business or person requirements.