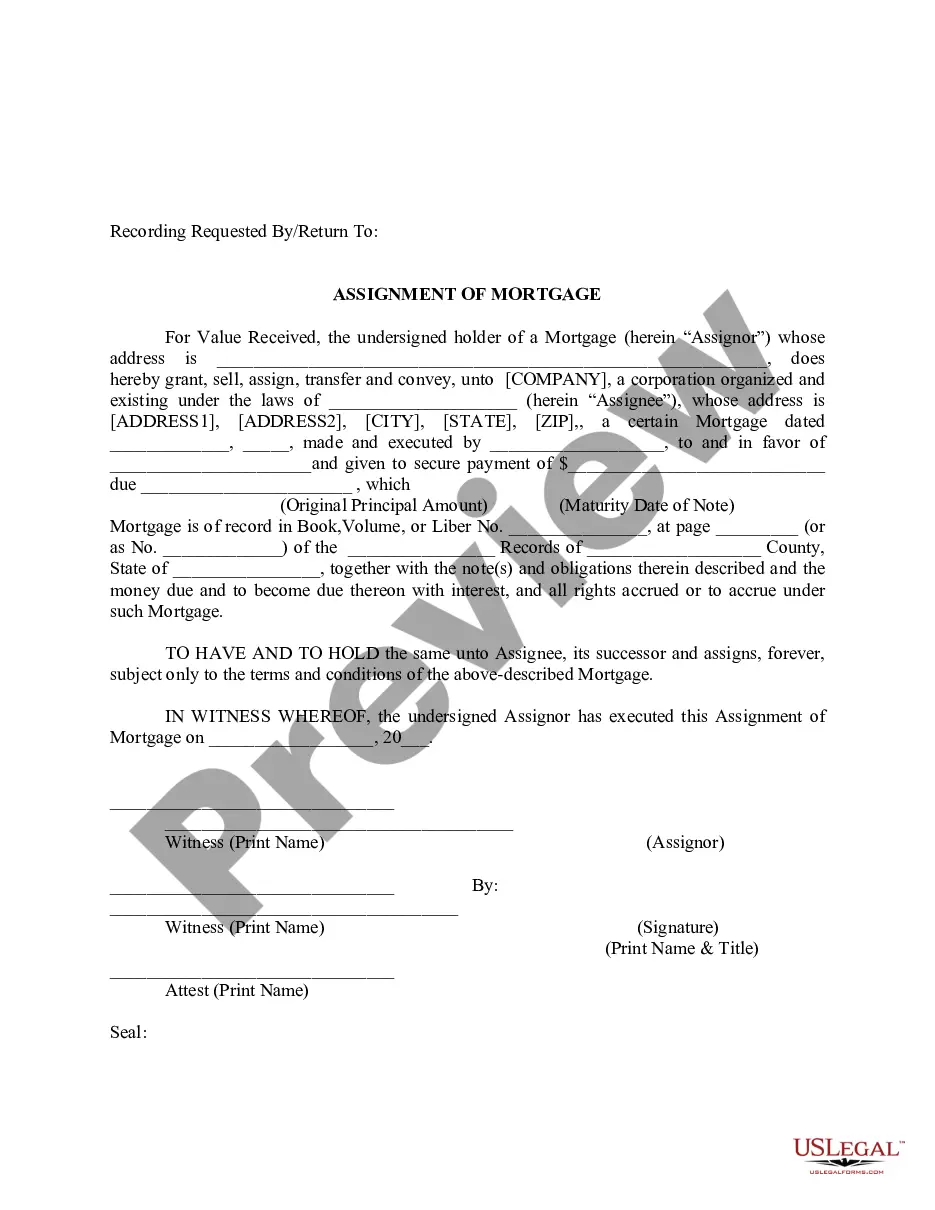

Indiana Pricing Agreement

Description

How to fill out Pricing Agreement?

If you want to total, obtain, or print legitimate papers web templates, use US Legal Forms, the most important assortment of legitimate forms, which can be found on-line. Make use of the site`s simple and easy hassle-free research to get the files you will need. Different web templates for company and person functions are categorized by types and states, or keywords. Use US Legal Forms to get the Indiana Pricing Agreement in a few click throughs.

Should you be already a US Legal Forms customer, log in to your profile and click on the Acquire button to find the Indiana Pricing Agreement. You may also entry forms you in the past delivered electronically in the My Forms tab of the profile.

If you work with US Legal Forms for the first time, refer to the instructions beneath:

- Step 1. Be sure you have chosen the form for that right town/region.

- Step 2. Take advantage of the Review solution to look over the form`s information. Don`t forget about to see the explanation.

- Step 3. Should you be unhappy with the type, utilize the Research field at the top of the monitor to locate other versions of the legitimate type design.

- Step 4. After you have found the form you will need, go through the Get now button. Select the rates program you prefer and add your credentials to register to have an profile.

- Step 5. Method the financial transaction. You can use your charge card or PayPal profile to accomplish the financial transaction.

- Step 6. Pick the file format of the legitimate type and obtain it on your product.

- Step 7. Complete, modify and print or indication the Indiana Pricing Agreement.

Each and every legitimate papers design you get is yours for a long time. You possess acces to each and every type you delivered electronically in your acccount. Go through the My Forms section and pick a type to print or obtain once again.

Contend and obtain, and print the Indiana Pricing Agreement with US Legal Forms. There are thousands of skilled and condition-distinct forms you may use to your company or person demands.

Form popularity

FAQ

Indiana Retirement Taxes Social Security and Railroad Retirement benefits are exempt. All other retirement income is taxed at the flat 3.23% Indiana income tax rate. There will be no tax on military retirement benefits beginning in 2022.

Effective January 1, 2023, the Indiana state withholding rate has been reduced to 3.15%.

What is the Indiana personal exemption? Individuals are allowed a $1,000 exemption on their adjusted gross income tax return. In addition, an individual can claim a second $1,000 exemption for the individual's spouse, if filing a joint return.

What is an Advance Pricing Agreement (APA)? An APA is an agreement between a tax payer and tax authority determining the transfer pricing methodology for pricing the tax payer's international transactions for future years.

Residents of Indiana are taxed at a flat state income rate of 3.23%. That means no matter how much you make, you're taxed at the same rate. All counties in Indiana impose their own local income tax rates in addition to the state rate that everyone must pay. Indiana counties' local tax rates range from 0.50% to 2.90%.

The Advance Pricing Agreement (APA) programme was introduced in India through Finance Act, 2012 with a view to fulfil the objectives of tax certainty and double taxation avoidance - two key focus areas of the CBDT for several years now.

Residents of Indiana are taxed at a flat state income rate of 3.23%. That means no matter how much you make, you're taxed at the same rate. All counties in Indiana impose their own local income tax rates in addition to the state rate that everyone must pay. Indiana counties' local tax rates range from 0.50% to 2.90%.