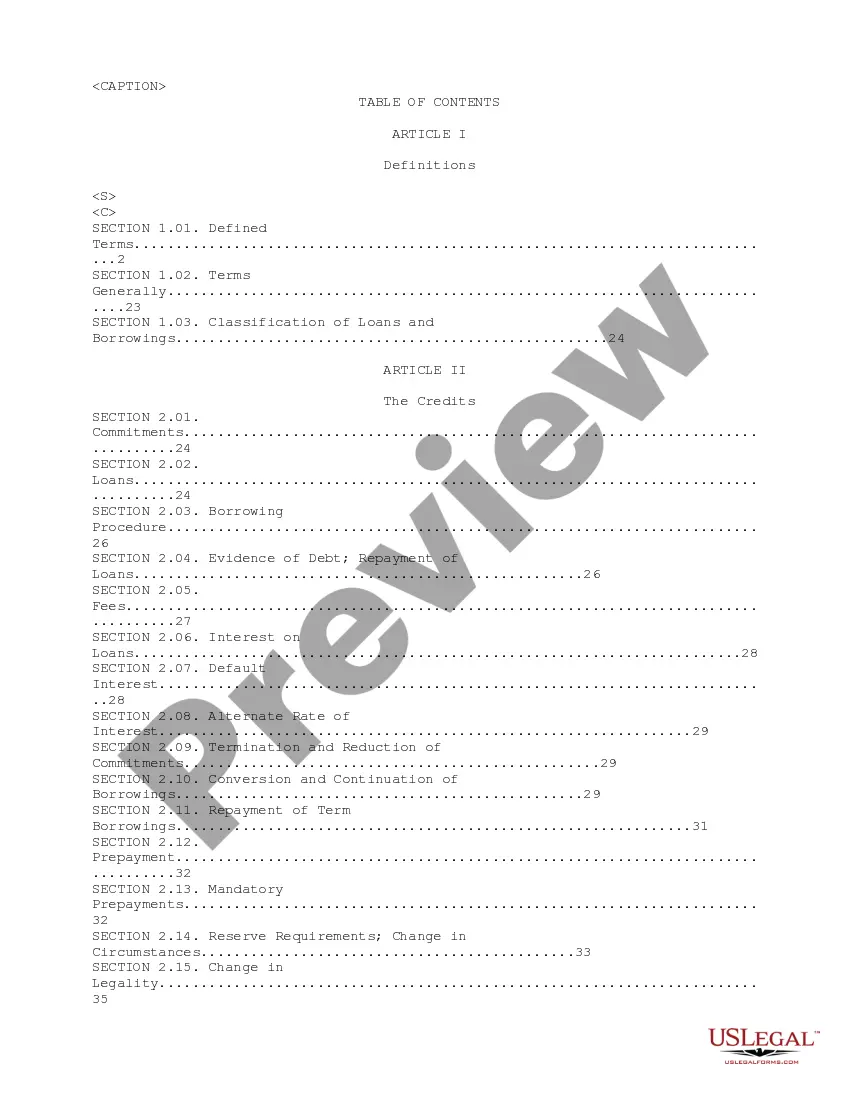

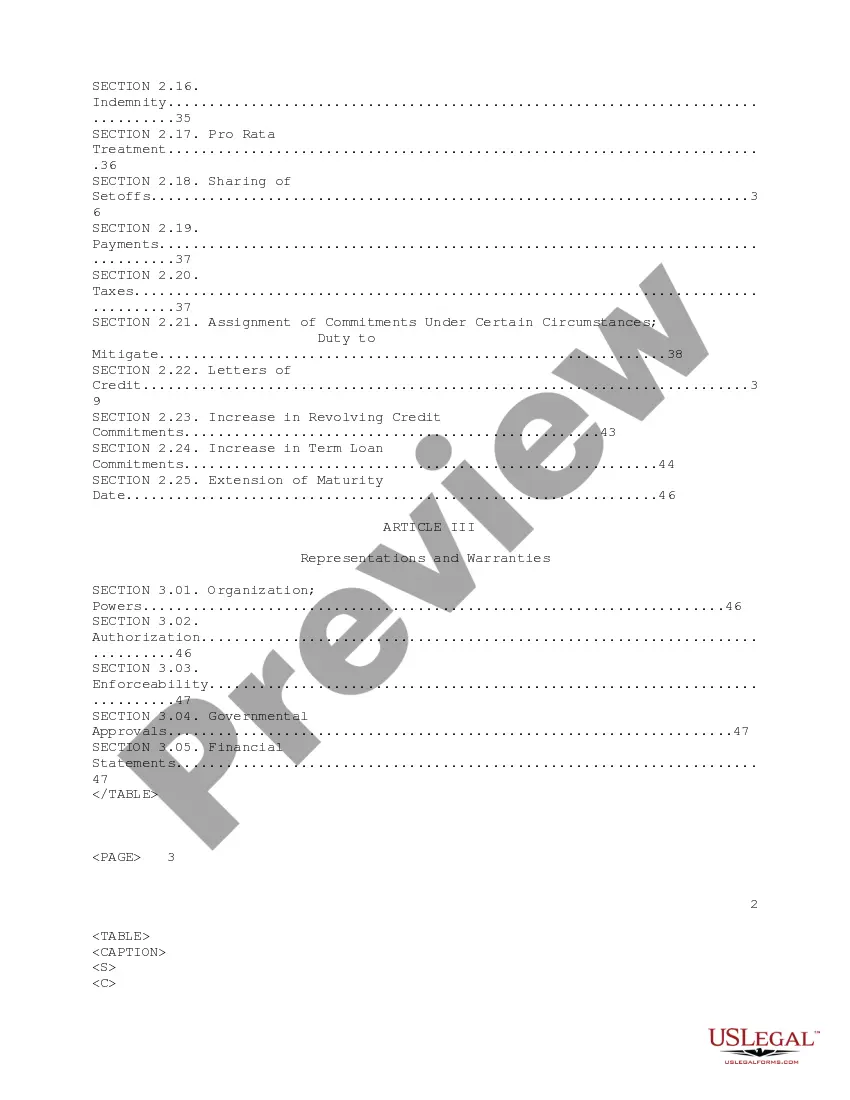

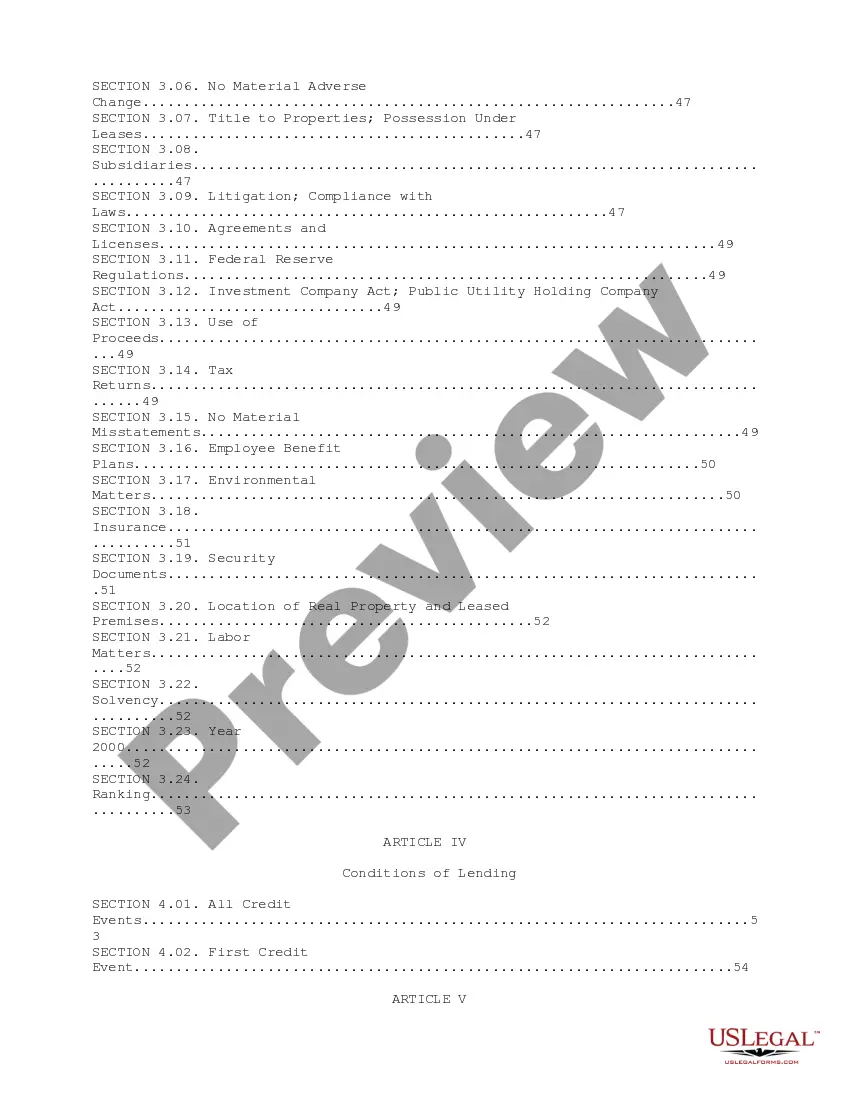

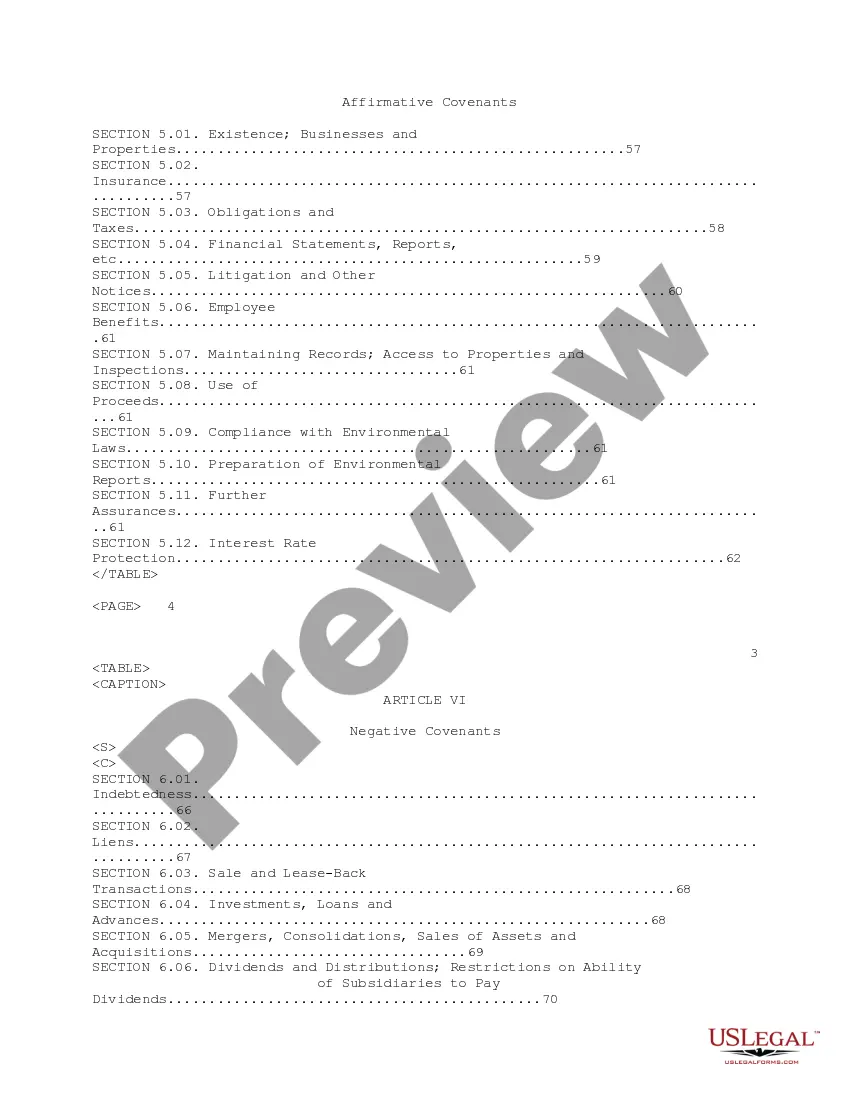

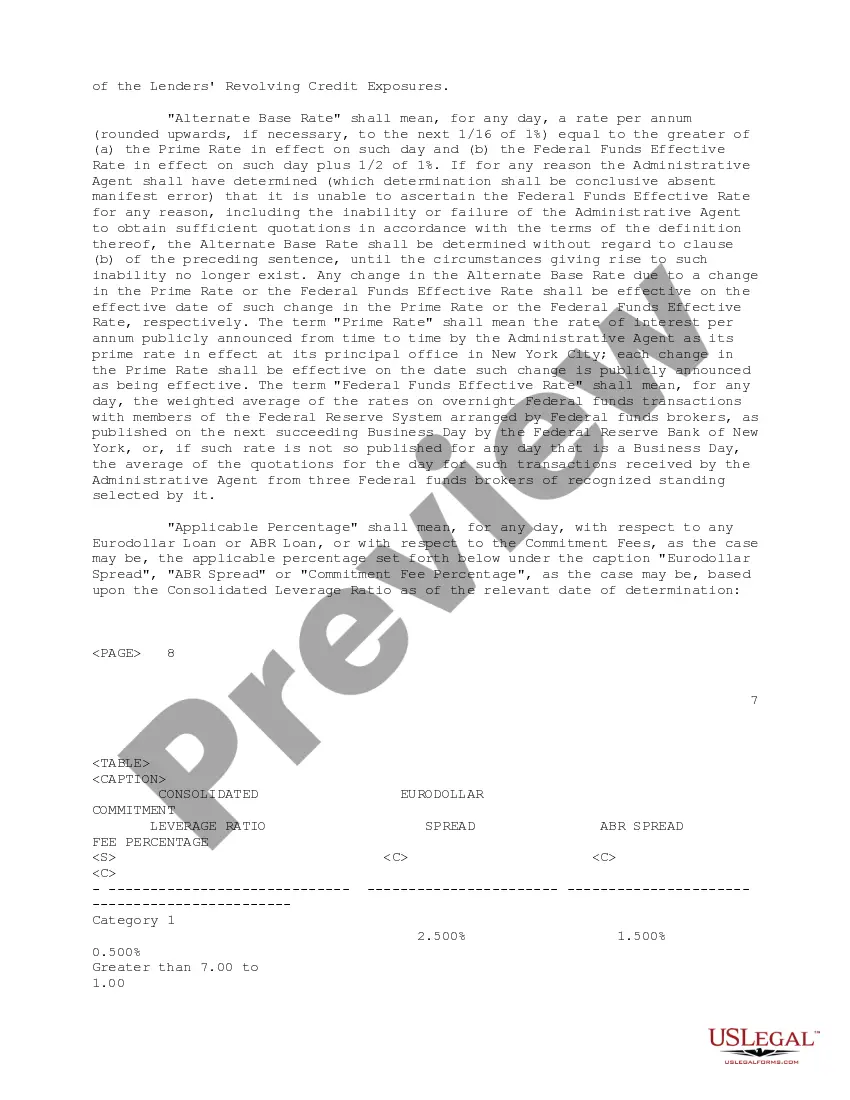

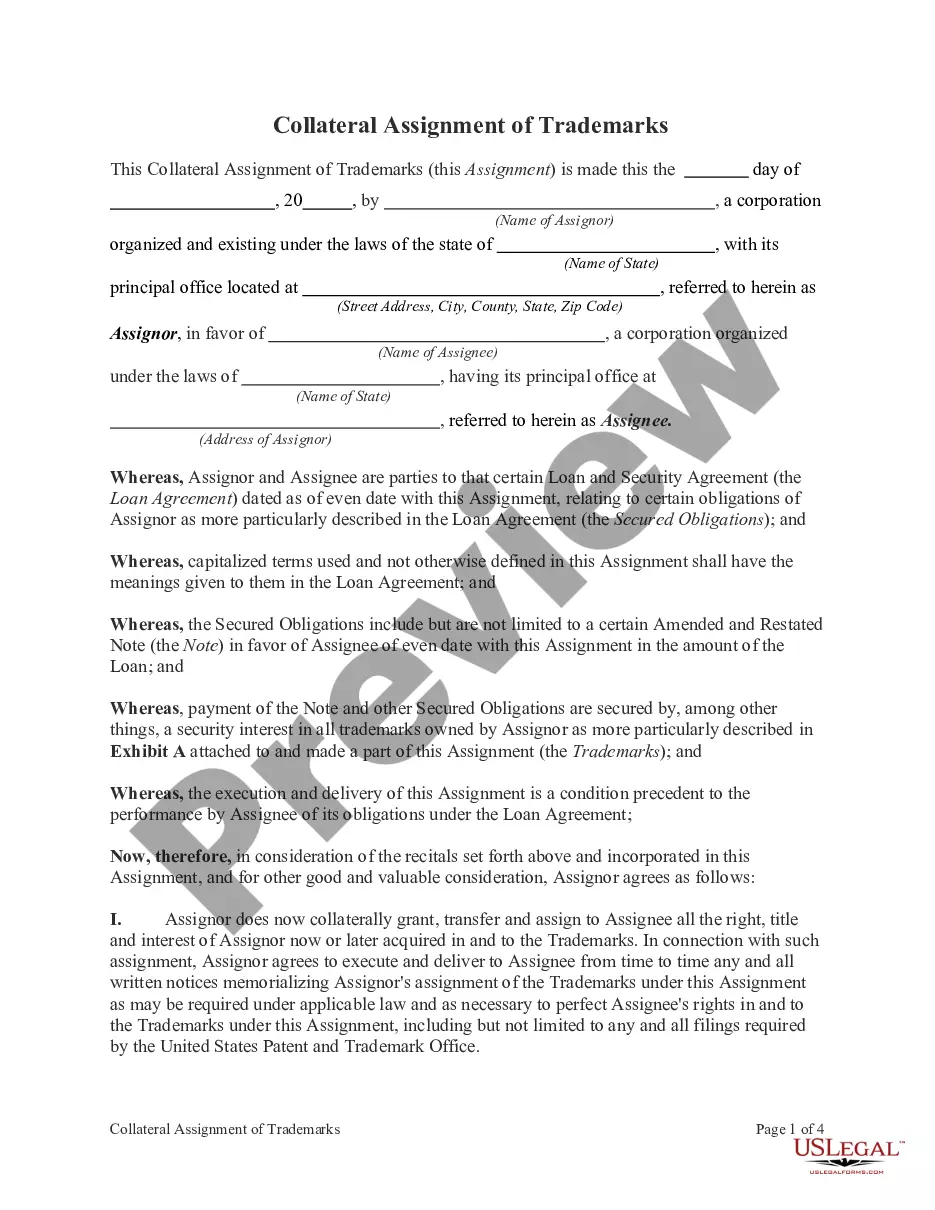

The Indiana Credit Agreement regarding the extension of credit is a legal document that outlines the terms and conditions of a credit arrangement between a lender and a borrower in the state of Indiana. This agreement is crucial in establishing a clear understanding between both parties and in protecting their respective rights and responsibilities. Keywords: Indiana, Credit Agreement, extension of credit, terms and conditions, lender, borrower, legal document, rights, responsibilities. There are different types of Indiana Credit Agreements regarding the extension of credit, including: 1. Secured Credit Agreement: This type of agreement involves the borrower providing collateral to secure the credit being extended. In the event of default, the lender has the right to seize the collateral to recover the outstanding amount. 2. Unsecured Credit Agreement: Unlike a secured agreement, an unsecured credit agreement does not require collateral. The lender extends credit based solely on the borrower's creditworthiness and trustworthiness. However, in the event of default, the lender's recourse is limited, making it a riskier arrangement for the lender. 3. Revolving Credit Agreement: This agreement allows the borrower to access a specific credit limit repeatedly. It is commonly used for credit cards or lines of credit, where the borrower can utilize the funds, repay them, and access them again, within the approved limit. 4. Term Credit Agreement: In contrast to a revolving agreement, a term credit agreement provides a fixed amount of credit for a specific duration. The borrower is obligated to repay the borrowed amount, along with any interest, within the agreed-upon timeframe. 5. Personal Credit Agreement: This type of credit agreement is entered into by individuals for personal use, such as financing a car, education expenses, or home repairs. The terms and conditions of a personal credit agreement may vary depending on the borrower's credit history and financial situation. 6. Commercial Credit Agreement: This agreement caters to businesses and organizations that require credit for various purposes, such as purchasing inventory, expanding operations, or investing in capital equipment. The terms and conditions of a commercial credit agreement are typically more complex and tailored to the specific needs of the business. It is essential for both lenders and borrowers in Indiana to thoroughly understand the terms and conditions stated in the Credit Agreement regarding the extension of credit. Seeking legal advice is highly recommended ensuring compliance with state laws and regulations while protecting the rights and interests of both parties involved.

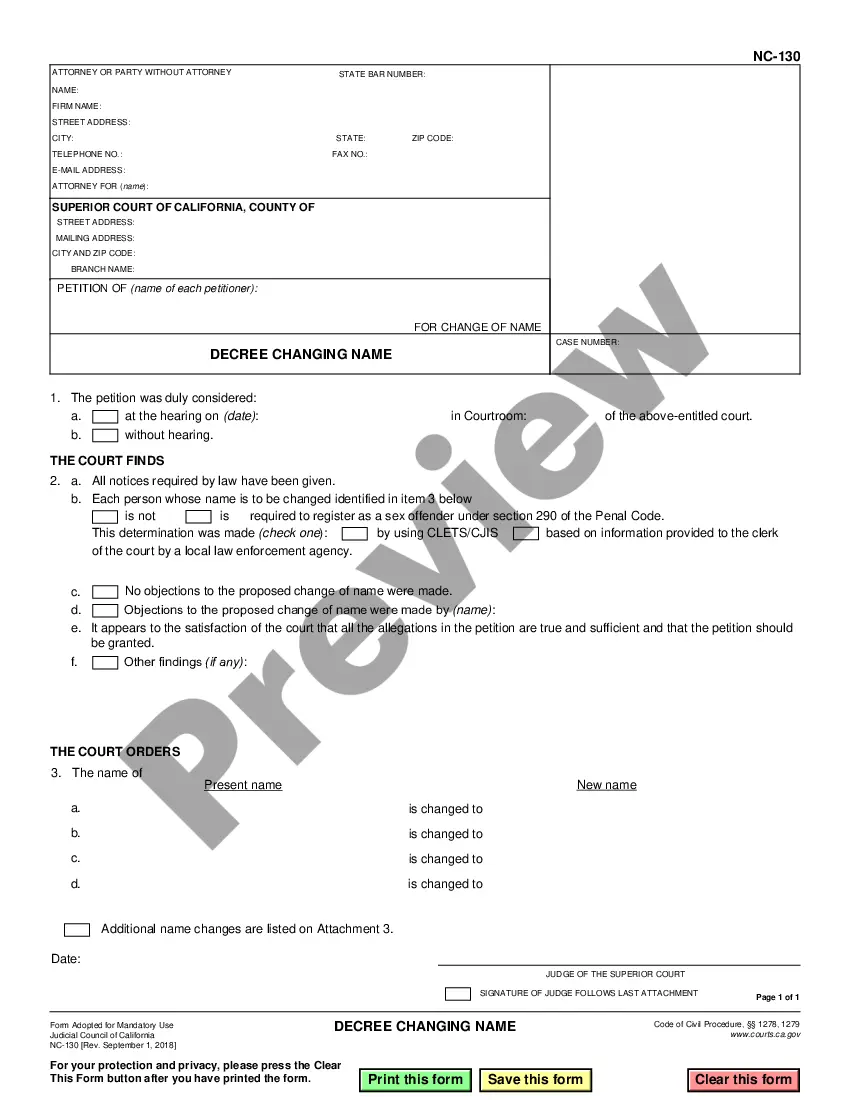

Indiana Credit Agreement regarding extension of credit

Description

How to fill out Indiana Credit Agreement Regarding Extension Of Credit?

US Legal Forms - one of many biggest libraries of legitimate varieties in the United States - offers a variety of legitimate record web templates it is possible to acquire or print out. While using web site, you can find thousands of varieties for enterprise and person uses, sorted by categories, states, or keywords and phrases.You will find the most recent types of varieties much like the Indiana Credit Agreement regarding extension of credit in seconds.

If you already have a registration, log in and acquire Indiana Credit Agreement regarding extension of credit through the US Legal Forms library. The Download option will appear on each type you view. You get access to all in the past downloaded varieties within the My Forms tab of your own account.

In order to use US Legal Forms the very first time, here are simple instructions to get you started out:

- Make sure you have picked out the correct type to your metropolis/state. Select the Review option to review the form`s articles. See the type explanation to ensure that you have selected the correct type.

- In case the type doesn`t satisfy your requirements, make use of the Look for discipline towards the top of the screen to find the one who does.

- Should you be pleased with the form, validate your decision by clicking the Acquire now option. Then, select the prices strategy you favor and provide your qualifications to sign up on an account.

- Approach the deal. Make use of bank card or PayPal account to complete the deal.

- Select the structure and acquire the form in your system.

- Make adjustments. Load, revise and print out and indication the downloaded Indiana Credit Agreement regarding extension of credit.

Every template you included in your bank account does not have an expiry day and is the one you have for a long time. So, if you want to acquire or print out an additional version, just go to the My Forms segment and click in the type you want.

Gain access to the Indiana Credit Agreement regarding extension of credit with US Legal Forms, one of the most comprehensive library of legitimate record web templates. Use thousands of skilled and state-distinct web templates that meet your organization or person needs and requirements.

Form popularity

FAQ

Most credit agreements can be cancelled within 14 days from the day after the agreement is made. In either situation you must tell the lender that you wish to cancel. This can be done verbally or in writing (by recorded delivery if possible).

There are situations where you may no longer want the loan, or the item it financed. If there are valid reasons such as fraud or a breech of contract, you should be able to get out of the loan. If you are unable to cancel the contract, you may be forced to take other measures to get out of the loan.

Lenders must provide a full disclosure of all of the loan's terms in the credit agreement. That can include the annual interest rate (APR), how the interest is applied to outstanding balances, any fees associated with the account, the duration of the loan, the payment terms, and any consequences for late payments.

Section 61 of the Consumer Credit Act. Section 61 of the Consumer Credit Act stipulates that a credit agreement is not properly executed unless it contains all the prescribed terms and conforms to regulations made under section 60(1) of the Act, and is signed in the prescribed manner.

If you want to cancel a credit agreement you are legally entitled to do so within 14 days. For products purchased on finance this may require that you haven't used the item or if you have borrowed funds, all money owed needs to be returned along with any interest accrued.

A credit agreement is a legally binding contract between a borrower and a lender that documents all of the terms of a loan. Credits agreements are created for both individual and business loans.

Contact the lender to tell them you want to cancel - this is called 'giving notice'. It's best to do this in writing but your credit agreement will tell you who to contact and how. If you've received money already then you must pay it back - the lender must give you 30 days to do this.

Loans and credits are different finance mechanisms. While a loan provides all the money requested in one go at the time it is issued, in the case of a credit, the bank provides the customer with an amount of money, which can be used as required, using the entire amount borrowed, part of it or none at all.