Indiana Investment Agreement is a legally binding contract established between an investor and an entity within the state of Indiana that outlines the terms and conditions of an investment. This agreement provides a comprehensive framework that governs the investor's rights, obligations, and potential returns associated with the investment. The Indiana Investment Agreement helps protect both parties by clearly defining the roles, responsibilities, and expectations for the duration of the investment. It serves as a critical tool for facilitating smooth and mutually beneficial investment transactions within the state. Key elements contained within the Indiana Investment Agreement include: 1. Investment Terms: The agreement outlines the precise details of the investment, including the amount of investment, payment schedule, and any relevant milestones or conditions associated with the investment. 2. Rights and Obligations: The agreement clearly outlines the rights and obligations of both the investor and the entity receiving the investment. This may include rights to specific financial information, decision-making powers, and responsibilities associated with the investment. 3. Conditions Precedent: The agreement may include certain conditions that must be met before the investment is considered valid. These conditions often include regulatory approval, successful due diligence, or achievement of specific performance targets. 4. Investor Protections: The agreement incorporates provisions designed to protect the investor's interests, such as provisions for confidentiality, non-compete agreements, and dispute resolution mechanisms. 5. Returns and Exit Strategy: Indiana Investment Agreements typically address the potential returns on investment and outline the process for exit or divestment, including any predetermined mechanisms for profit sharing, buyouts, or sale of shares. Different types of Indiana Investment Agreements can be categorized based on the nature of investment or the specific business sector. Some common types may include: 1. Equity Investment Agreement: This agreement involves the purchase of equity or shares in a company, providing the investor with partial ownership and potential profit-sharing opportunities. 2. Loan Agreement: This type of agreement involves lending money to an entity in exchange for periodic interest payments and eventual repayment of the principal amount. 3. Joint Venture Agreement: This agreement is established when two or more parties combine resources, expertise, and investments to pursue a specific business opportunity or project within Indiana. 4. Licensing or Royalty Agreement: In cases where intellectual property or patents are involved, investors may enter into licensing or royalty agreements to grant usage rights to the entity in exchange for ongoing royalty payments. Indiana Investment Agreements are crucial for fostering investment activities, attracting capital, and providing a framework for economic growth and development within the state. These agreements provide a clear understanding of the rights, responsibilities, and expectations of all parties involved, ensuring a fair and transparent investment environment.

Indiana Investment Agreement

Description

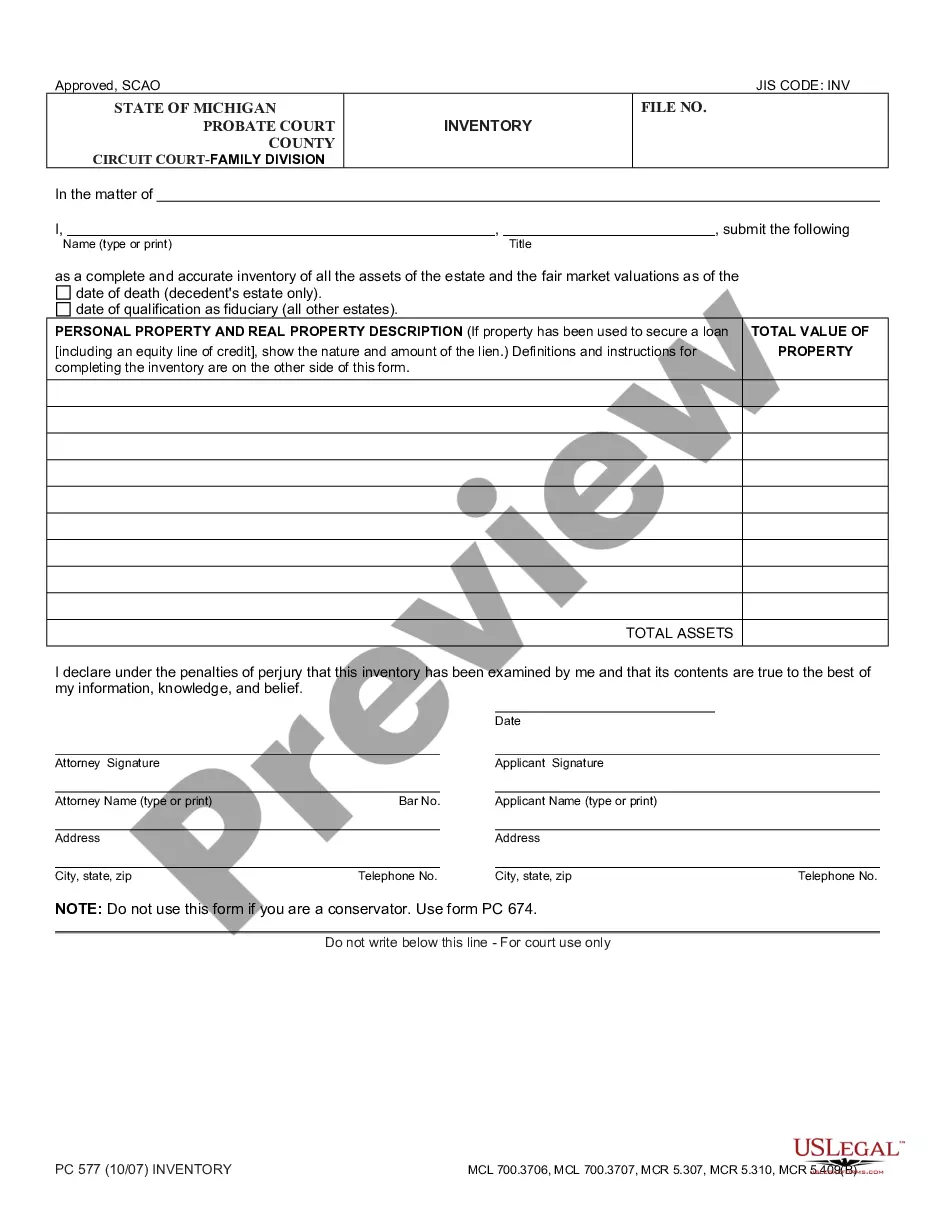

How to fill out Indiana Investment Agreement?

US Legal Forms - one of the greatest libraries of legitimate forms in America - provides an array of legitimate record web templates you can download or print. Utilizing the website, you may get a huge number of forms for company and individual uses, sorted by groups, suggests, or key phrases.You will find the newest types of forms much like the Indiana Investment Agreement within minutes.

If you have a monthly subscription, log in and download Indiana Investment Agreement from your US Legal Forms library. The Down load option can look on every develop you see. You have access to all in the past delivered electronically forms inside the My Forms tab of the accounts.

In order to use US Legal Forms initially, allow me to share basic recommendations to get you started out:

- Ensure you have chosen the best develop for your personal city/area. Click the Review option to analyze the form`s content material. Browse the develop description to actually have selected the correct develop.

- In case the develop does not fit your needs, use the Lookup discipline on top of the screen to discover the one which does.

- If you are satisfied with the shape, confirm your choice by clicking on the Get now option. Then, opt for the costs prepare you favor and offer your accreditations to register for an accounts.

- Procedure the purchase. Utilize your Visa or Mastercard or PayPal accounts to perform the purchase.

- Choose the formatting and download the shape on the device.

- Make adjustments. Fill out, change and print and signal the delivered electronically Indiana Investment Agreement.

Each and every web template you included with your account lacks an expiration date and is the one you have permanently. So, if you want to download or print one more version, just go to the My Forms segment and then click about the develop you will need.

Get access to the Indiana Investment Agreement with US Legal Forms, one of the most extensive library of legitimate record web templates. Use a huge number of expert and state-certain web templates that meet up with your organization or individual requirements and needs.

Form popularity

FAQ

An investment can refer to any mechanism used for generating future income. This includes the purchase of bonds, stocks, or real estate property, among other examples. Additionally, purchasing a property that can be used to produce goods can be considered an investment. Investment Basics Explained With Types to Invest in - Investopedia investopedia.com ? terms ? investment investopedia.com ? terms ? investment

The Basics. The basics of any legal contract or agreement should include who the parties to the agreement are, and how they can be contacted. In the case of an investor agreement, this will also include the amount being invested. What is being given of value in exchange for the investment, and the terms? Important Things To Look For In An Investment Contract alejandrocremades.com ? important-things-to-loo... alejandrocremades.com ? important-things-to-loo...

It includes common provisions, such as management fees, monitoring fees, scope of activities, and indemnification of the manager. This Standard Document has integrated notes with important explanations and drafting and negotiating tips. Investment Management Agreement | Practical Law - Thomson Reuters thomsonreuters.com ? ... thomsonreuters.com ? ...

Any purchase agreement should include at least the following information: The identity of the buyer and seller. A description of the property being purchased. The purchase price. The terms as to how and when payment is to be made. The terms as to how, when, and where the goods will be delivered to the purchaser.

Key clauses in an Investment Agreement Type of Security. Preference Shares. Hybrid Security. Clauses that ensure protection to an Investor's investment. Pre-emption right. Anti-dilution right. Clauses to ensure founder's commitment. Following are the clauses that ensure founders commitment: Investment agreements and the key clauses explained : start-up ... ipleaders.in ? investment-agreements-key-cla... ipleaders.in ? investment-agreements-key-cla...

Writing an investment contract can be simplified by examining related samples and including all the content listed below: The names and addresses of interested parties. The general investment structure. Purpose of the investment. Effective date agreed upon. Signatures by both/all parties.

executed agreement should include the basics, such as names and addresses, the amount and purpose of the investment, and each party's signatures.