The Indiana Term Sheet for Potential Investment in a Company is a crucial document that outlines the key terms and conditions of a proposed investment by an investor or group of investors in a company located in the state of Indiana. This legal document serves as a preliminary agreement and acts as a framework for further negotiations between the parties involved. The Indiana Term Sheet typically contains several essential components, including the following: 1. Investment Amount: This section specifies the total amount of investment that the investor is willing to provide to the company. It outlines both the initial investment and any subsequent tranches or rounds of funding. 2. Valuation: The term sheet defines the pre-money valuation of the company, which is the estimate of its worth before the investment is made. This valuation is essential for determining the investor's ownership stake and can influence the terms of the investment deal. 3. Equity Stake: This section outlines the percentage of the company's equity that the investor will receive in exchange for their investment. The term sheet may also contain provisions for potential dilution of this ownership stake in subsequent financing rounds. 4. Board Representation: In some cases, the term sheet may specify whether the investor will have the right to appoint a representative to the company's board of directors. This provision gives the investor a say in the company's strategic decision-making processes. 5. Liquidation Preference: The liquidation preference clause defines the order in which the proceeds from a company's sale or liquidation will be distributed. It protects the investor's investment by ensuring they receive their initial investment amount before other stakeholders. 6. Conversion Rights: When the company undergoes a future financing round, the term sheet may include provisions regarding the investor's ability to convert their preferred shares into common shares. This provision allows the investor to participate in potential future upside. 7. Anti-Dilution Protection: The term sheet may include provisions to protect the investor against potential dilution of their ownership stake in the company. This protection ensures that the investor's equity stake doesn't suffer significant dilution if the company issues additional shares at a lower valuation. Different types of Indiana Term Sheets for Potential Investment in a Company can vary based on the specific terms and conditions negotiated between the parties. These variations may include different investment amounts, equity stakes, liquidation preferences, or board representation rights. It is crucial for both the company and the investor to carefully review and negotiate these terms to align their interests and set the foundation for a successful investment partnership. In conclusion, the Indiana Term Sheet for Potential Investment in a Company is a critical document that outlines the key terms and conditions of an investment deal. It covers various aspects such as investment amount, equity stake, valuation, board representation, liquidation preference, conversion rights, and anti-dilution protection. Different types of term sheets may exist based on the negotiated terms.

Indiana Term Sheet for Potential Investment in a Company

Description

How to fill out Term Sheet For Potential Investment In A Company?

Are you presently in the placement in which you require documents for both business or specific reasons almost every working day? There are a variety of legal papers layouts available online, but discovering versions you can rely on isn`t simple. US Legal Forms provides a large number of form layouts, like the Indiana Term Sheet for Potential Investment in a Company, which can be composed in order to meet state and federal specifications.

If you are presently acquainted with US Legal Forms website and possess a merchant account, simply log in. Next, you can acquire the Indiana Term Sheet for Potential Investment in a Company format.

Unless you offer an account and need to begin using US Legal Forms, follow these steps:

- Find the form you want and ensure it is for your appropriate metropolis/region.

- Use the Review button to check the form.

- Read the outline to actually have selected the right form.

- In case the form isn`t what you`re looking for, utilize the Lookup discipline to discover the form that suits you and specifications.

- Once you obtain the appropriate form, click Acquire now.

- Opt for the costs strategy you desire, fill in the required info to make your money, and purchase the transaction utilizing your PayPal or credit card.

- Decide on a handy paper formatting and acquire your duplicate.

Find each of the papers layouts you may have purchased in the My Forms menu. You may get a extra duplicate of Indiana Term Sheet for Potential Investment in a Company anytime, if needed. Just select the necessary form to acquire or print out the papers format.

Use US Legal Forms, by far the most considerable selection of legal varieties, to save time as well as prevent errors. The service provides appropriately manufactured legal papers layouts which can be used for an array of reasons. Produce a merchant account on US Legal Forms and commence making your daily life easier.

Form popularity

FAQ

There are several key elements that should be included in any contract for investments, including: Identification of the parties involved. Objectives of the investment. Investment amount and payment terms. Duration and termination clauses. Confidentiality and non-disclosure provisions. Dispute resolution and governing law.

What should be included in an investment proposal? Describe your company. ... State the problem. ... Give out your solution. ... Show market research. ... Display your traction. ... Define your goals. ... Present your team. ... Reveal your financials, if advisable.

But no matter who the investor is, a term sheet will always contain six key components, including: A valuation. An estimate of what a company is worth as an investment opportunity. ... Securities being issued. ... Board rights. ... Investor protections. ... Dealing with shares. ... Miscellaneous provisions.

A term sheet is a nonbinding agreement outlining the basic terms and conditions under which an investment will be made. Term sheets are most often associated with start-ups. Entrepreneurs find that this document is crucial to attracting investors, such as venture capitalists (VC) with capital to fund enterprises.

Equity Method of Accounting The original investment is recorded on the balance sheet at cost (fair value). Subsequent earnings by the investee are added to the investing firm's balance sheet ownership stake (proportionate to ownership), with any dividends paid out by the investee reducing that amount.

How to Create an Investment Opportunity Summary? Step 1: Information About the Proposed Investment Project. One of the most important pieces of any investment report is information about your proposed investment project. ... Step 2: Market Research. ... Step 3: Financial Report. ... Step 4: Business Managers. ... Step 5: Exit Strategy.

6 Tips for Writing a Term Sheet List the terms. ... Summarize the terms. ... Explain the dividends. ... Include liquidation preference. ... Include voting agreement and closing items. ... Read, edit and prepare for signatures.

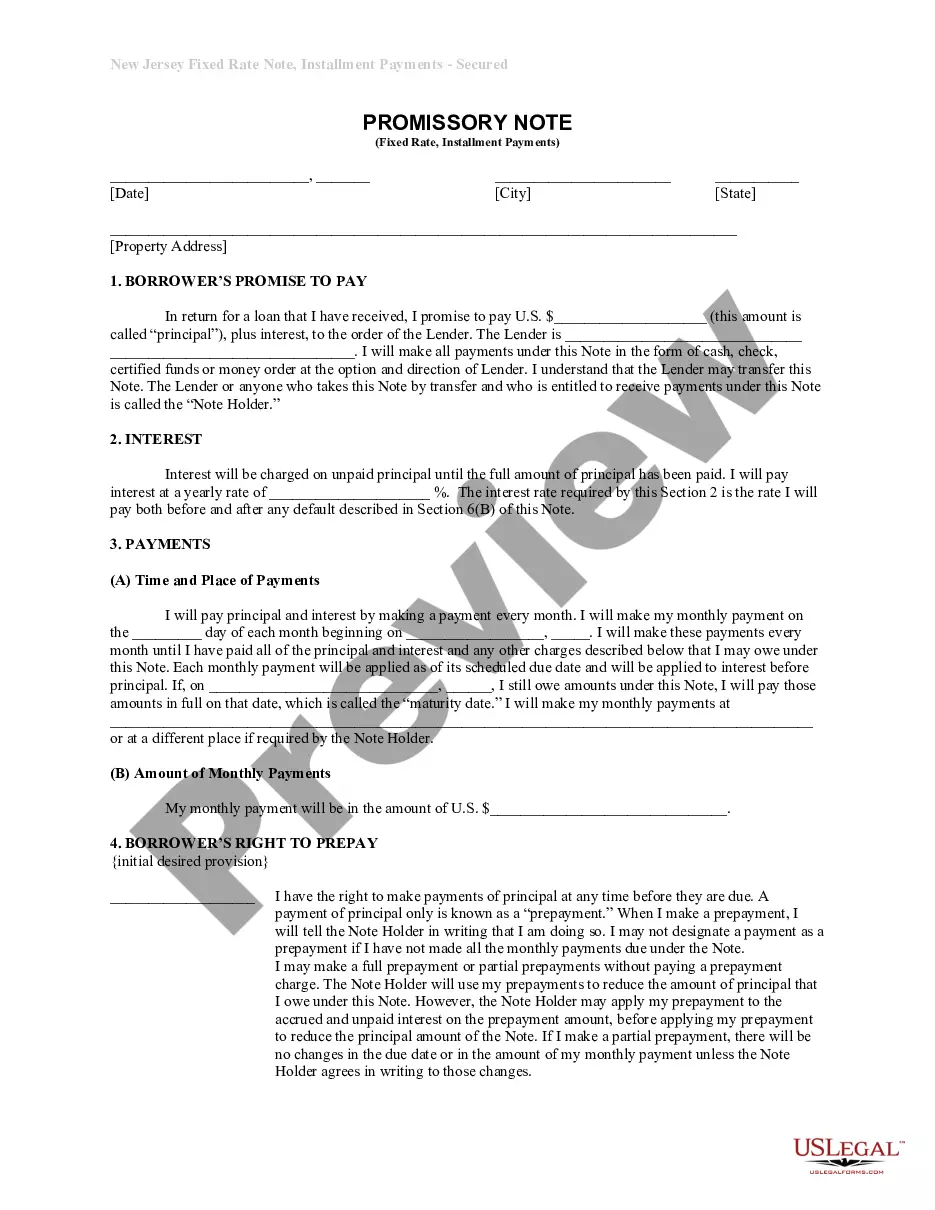

If the investment is an equity investment in a partnership or LLC, you'll need to sign the LLC operating agreement and update the members' schedule to evidence your investment. A debt investment in any structure is typically evidenced by a promissory note which is signed by you and the company.