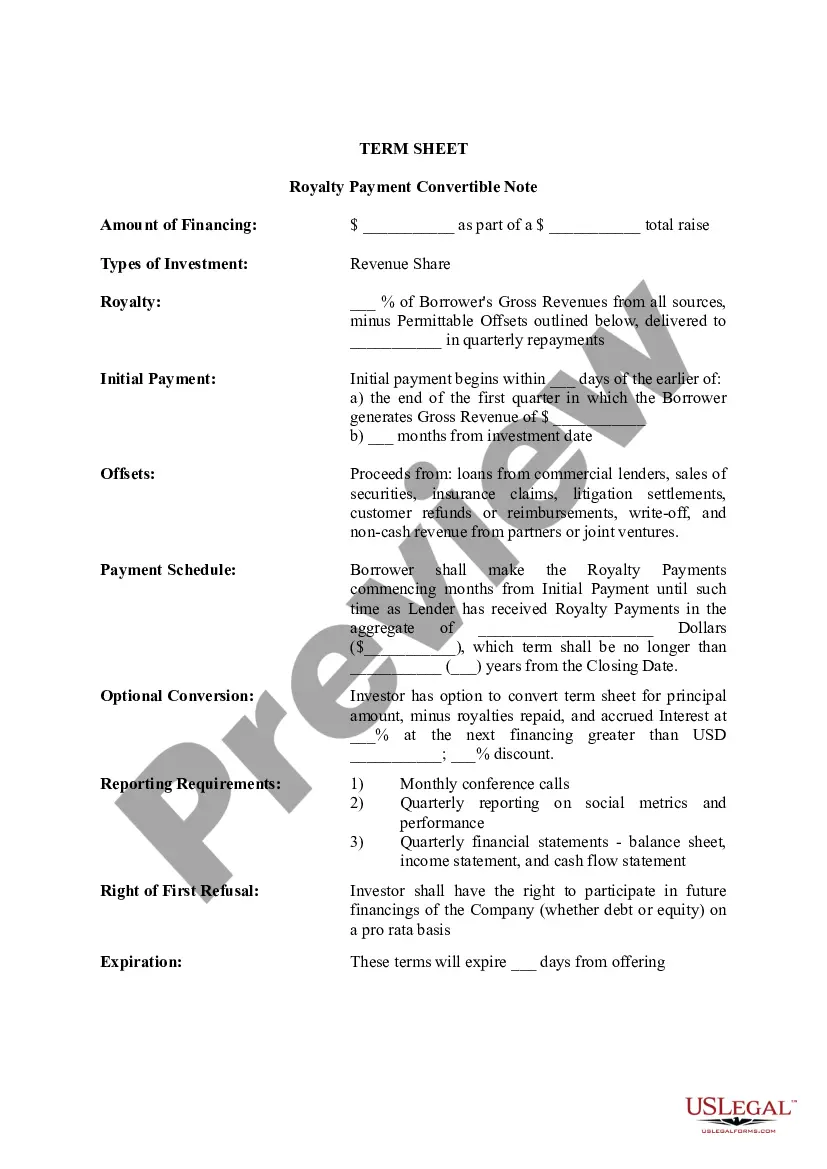

Indiana Term Sheet - Royalty Payment Convertible Note

Description

How to fill out Term Sheet - Royalty Payment Convertible Note?

Choosing the best legal record web template can be a have a problem. Naturally, there are plenty of web templates available on the net, but how do you discover the legal kind you need? Make use of the US Legal Forms internet site. The support gives thousands of web templates, for example the Indiana Term Sheet - Royalty Payment Convertible Note, that can be used for business and personal requirements. All the kinds are checked out by specialists and meet state and federal requirements.

If you are previously authorized, log in in your account and click on the Acquire switch to find the Indiana Term Sheet - Royalty Payment Convertible Note. Make use of your account to look throughout the legal kinds you possess acquired previously. Go to the My Forms tab of your respective account and acquire yet another backup of your record you need.

If you are a whole new end user of US Legal Forms, here are easy directions that you should adhere to:

- First, ensure you have chosen the correct kind for the city/state. You may look over the form utilizing the Review switch and look at the form explanation to make sure this is the best for you.

- If the kind fails to meet your expectations, make use of the Seach field to obtain the correct kind.

- Once you are sure that the form is acceptable, select the Acquire now switch to find the kind.

- Select the pricing prepare you need and type in the needed information. Design your account and pay money for the transaction making use of your PayPal account or Visa or Mastercard.

- Opt for the document formatting and acquire the legal record web template in your system.

- Comprehensive, change and print out and indication the attained Indiana Term Sheet - Royalty Payment Convertible Note.

US Legal Forms is the largest library of legal kinds where you can find numerous record web templates. Make use of the service to acquire professionally-created paperwork that adhere to status requirements.

Form popularity

FAQ

Common provisions of a convertible debt financing include: The interest rate. Usually somewhere between 4% and 8%. The maturity date. Usually 12?24 months. A mandatory conversion paragraph. ... An optional conversion paragraph. ... A change of control provision. ... A conversion discount. ... A valuation cap. ... An amendment provision.

Typical terms of convertible notes are: interest rate, maturity date, conversion provisions, a conversion discount, and a valuation cap.

Convertible Notes are loans ? so they are recorded on the Balance Sheet of a company as a liability when they are made. Depending on the debt's maturity date, they can either be shown as a current liability (loans maturing within 12 months) or as a Long-term liability (loans maturing over 12 months).

In recent years, SAFEs have become the most common convertible instrument due to their relative simplicity. Like convertible notes, SAFEs convert into stock in a future priced round. Unlike convertible notes, they are not debt and do not require the company to pay back the investment with interest.

Discount. The discount rate, typically 15% to 25% percent, gets applied to the per-share price of the new investor. For example, let's say your convertible note had a 20% discount and the new investors are paying $1 per share. The convertible note investor will convert at $0.80 per share.

Calculating post-money valuation Post-money valuation = Pre-money valuation + Size of investment. ... Share price = New investment amount / # of new shares received. ... Post-money valuation / total # of shares post-investment = New investment amount / # of new shares received.

Although it is customary to forego a term sheet, in some cases it may be required if the parties need to negotiate certain terms. It can be advantageous to use a term sheet for the company to easily summarize the terms of the notes for potential other investors purchasing a convertible note.