Indiana Investment - Grade Bond Optional Redemption (with a Par Call)

Description

How to fill out Investment - Grade Bond Optional Redemption (with A Par Call)?

It is possible to invest hours on-line searching for the authorized papers design that suits the federal and state needs you need. US Legal Forms gives 1000s of authorized kinds which are examined by pros. You can actually download or print the Indiana Investment - Grade Bond Optional Redemption (with a Par Call) from your assistance.

If you currently have a US Legal Forms profile, it is possible to log in and click the Down load button. Following that, it is possible to full, edit, print, or indication the Indiana Investment - Grade Bond Optional Redemption (with a Par Call). Every single authorized papers design you purchase is the one you have forever. To obtain one more duplicate of any obtained form, proceed to the My Forms tab and click the related button.

If you work with the US Legal Forms site the very first time, keep to the straightforward guidelines under:

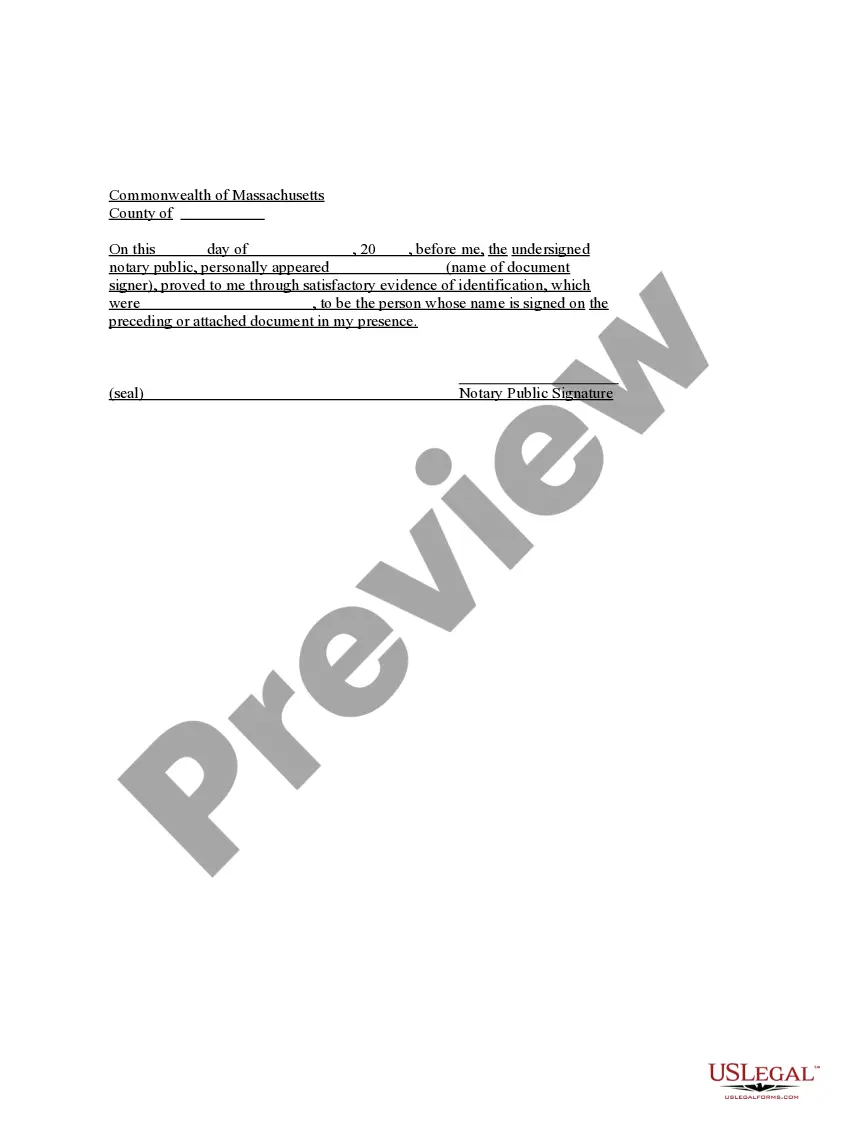

- First, ensure that you have chosen the correct papers design to the state/city that you pick. See the form description to ensure you have chosen the appropriate form. If accessible, utilize the Preview button to look through the papers design as well.

- If you would like get one more edition of the form, utilize the Lookup field to get the design that meets your requirements and needs.

- Upon having located the design you need, just click Acquire now to move forward.

- Select the prices strategy you need, key in your credentials, and register for your account on US Legal Forms.

- Total the purchase. You should use your Visa or Mastercard or PayPal profile to purchase the authorized form.

- Select the formatting of the papers and download it to your product.

- Make adjustments to your papers if necessary. It is possible to full, edit and indication and print Indiana Investment - Grade Bond Optional Redemption (with a Par Call).

Down load and print 1000s of papers templates utilizing the US Legal Forms Internet site, that offers the most important variety of authorized kinds. Use specialist and condition-certain templates to take on your business or individual needs.

Form popularity

FAQ

A bond redemption is the full repayment of the principal amount (the amount you invested) and any interest owed to date.

Redemption is the buying back of something. You might try for redemption by attempting to buy back a bike you sold, or you might attempt to buy back your soul after you steal someone else's bike.

Callable or redeemable bonds are bonds that can be redeemed or paid off by the issuer prior to the bonds' maturity date. When an issuer calls its bonds, it pays investors the call price (usually the face value of the bonds) together with accrued interest to date and, at that point, stops making interest payments.

Optional Redemption On or after the Par Call Date, the Company may redeem the notes, in whole or in part, at any time and from time to time, at a redemption price equal to 100% of the principal amount of the notes being redeemed plus accrued and unpaid interest thereon to the redemption date.

In many cases, calculating the gain or loss on a bond redemption is fairly simple. If you take the redemption proceeds and subtract what you originally paid for the bond, then the difference will tell you the answer. If it's positive, then you have a gain.

The redemption value is stated as a percentage of face value. For example, a $1000 bond redeemable at 105 is redeemed at 105% of $1000 = $1050. Bonds can be freely bought and sold.