Title: Indiana Term Sheet for LLC Unit Offering Explained: Key Types and Important Details Introduction: The Indiana Term Sheet for LLC Unit Offering serves as a crucial document outlining essential details of a limited liability company (LLC) unit offering in Indiana. It specifies crucial elements related to the investment, including terms and conditions, pricing, securities offered, and more. This comprehensive guide aims to explain the importance of an Indiana Term Sheet for LLC Unit Offering, its various types, and key components that potential investors and business owners need to be aware of. 1. Indiana Term Sheet for LLC Unit Offering: The Indiana Term Sheet for LLC Unit Offering is a legal agreement used by LCS in Indiana to promote investments and raise capital from interested parties. It acts as a summary of the key terms and conditions related to the investment opportunity, providing potential investors with an overview of the proposed offering. This document ensures transparency, enabling investors to make informed decisions about their participation in the LLC. 2. Types of Indiana Term Sheet for LLC Unit Offering: a) Equity Offering Term Sheet: This type of Term Sheet outlines the details of the LLC unit offering in exchange for equity in the company. It specifies the number and type of units available for purchase, the price per unit, vesting period (if applicable), and any shareholder rights associated with the investment. b) Debt Offering Term Sheet: A Debt Offering Term Sheet applies when an LLC seeks to borrow funds rather than offering equity. It outlines the borrowing terms, such as interest rates, maturity dates, payment schedule, and any potential collateral involved. Investors interested in fixed returns and lower risk often prefer this type of offering. c) Convertible Note Term Sheet: This type of Term Sheet is utilized when an LLC offers convertible notes as an investment opportunity. It outlines the terms and conditions of the initial debt investment, including conversion rights, conversion terms, interest rates, maturity dates, and potential discounts or premium rates for conversion to equity at a future date. d) Preferred Unit Offering Term Sheet: A Preferred Unit Offering Term Sheet is applicable when an LLC offers preferred units, which grant investors certain priority rights over common unit holders. This type of offering provides investors with unique benefits, such as preferred distribution rights, preferential liquidation preferences, and priority in asset distributions. Components of an Indiana Term Sheet for LLC Unit Offering: — Purpose and background of the offering — Identification of the LL— - Offer details: type and number of units offered — Offering price per unit and minimum investment requirement — Vesting periodsapplicablebl— - Investor rights and privileges associated with the investment — Representations and warranties made by the LLC — Detailed information on the management team and key personnel — Use of proceeds: how the raised capital will be utilized — Disclosure of potential risks and limitations — Offering timeline and obligations of both parties — Confidentiality and non-disclosure clauses Conclusion: The Indiana Term Sheet for LLC Unit Offering is a crucial document that outlines key details of investment opportunities within an LLC. It helps potential investors make informed decisions and ensures transparency throughout the investment process. By providing relevant information and minimizing legal risks, this document plays a significant role in fundraising activities for Indiana-based LCS.

Indiana Term Sheet for LLC Unit Offering

Description

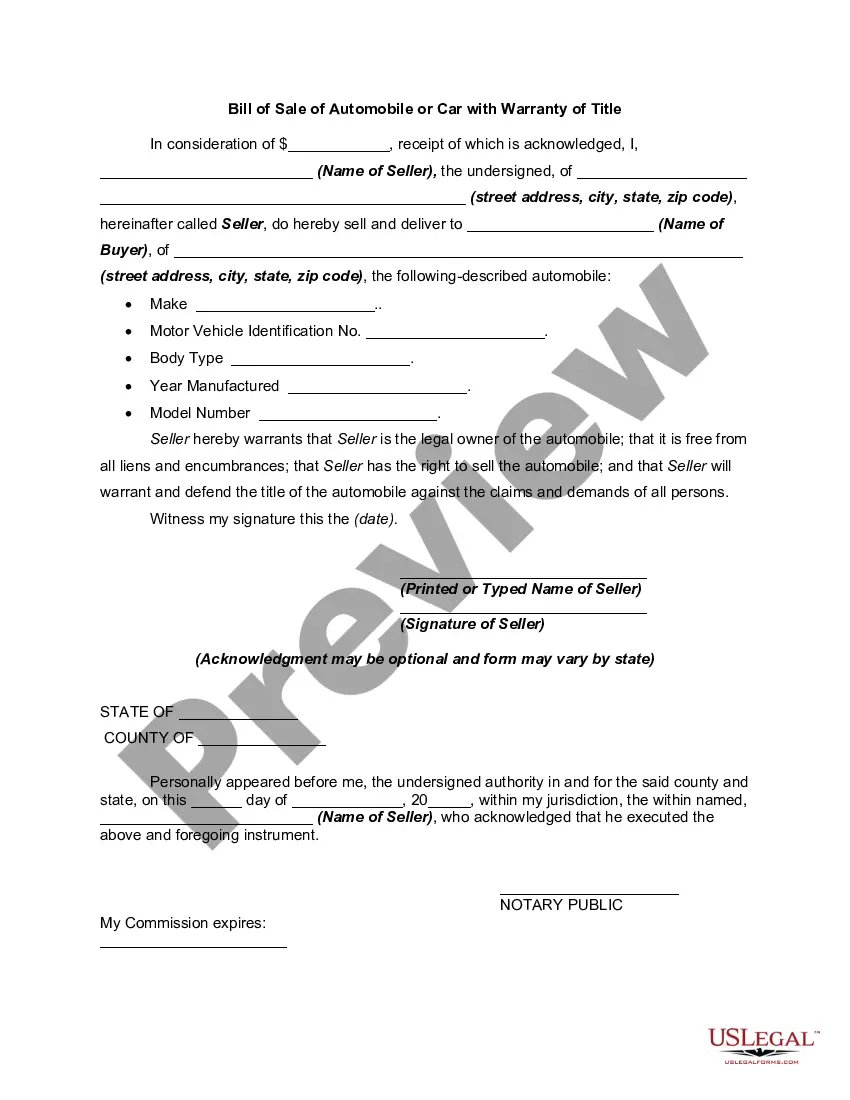

How to fill out Indiana Term Sheet For LLC Unit Offering?

If you have to total, acquire, or print lawful papers themes, use US Legal Forms, the largest selection of lawful types, which can be found on-line. Utilize the site`s easy and hassle-free look for to get the documents you want. Numerous themes for enterprise and individual reasons are sorted by classes and claims, or keywords and phrases. Use US Legal Forms to get the Indiana Term Sheet for LLC Unit Offering in a number of clicks.

In case you are currently a US Legal Forms consumer, log in for your bank account and click on the Download switch to have the Indiana Term Sheet for LLC Unit Offering. You may also gain access to types you in the past downloaded within the My Forms tab of the bank account.

If you work with US Legal Forms initially, refer to the instructions under:

- Step 1. Make sure you have selected the form for that appropriate city/land.

- Step 2. Make use of the Preview option to look through the form`s content material. Never overlook to read through the outline.

- Step 3. In case you are not happy together with the type, make use of the Look for area towards the top of the display screen to discover other models from the lawful type web template.

- Step 4. Upon having identified the form you want, click the Purchase now switch. Pick the costs program you like and add your credentials to sign up for an bank account.

- Step 5. Approach the purchase. You can utilize your Мisa or Ьastercard or PayPal bank account to finish the purchase.

- Step 6. Select the format from the lawful type and acquire it in your system.

- Step 7. Full, revise and print or indication the Indiana Term Sheet for LLC Unit Offering.

Each lawful papers web template you purchase is your own permanently. You might have acces to every type you downloaded within your acccount. Click the My Forms section and choose a type to print or acquire yet again.

Contend and acquire, and print the Indiana Term Sheet for LLC Unit Offering with US Legal Forms. There are thousands of professional and state-certain types you can use for your enterprise or individual requires.