Indiana Shareholder Agreements — An Overview In Indiana, shareholder agreements are legally binding contracts that outline the rights, responsibilities, and obligations of shareholders in a corporation. These agreements provide a framework for the relationship between shareholders and help to prevent disputes and ensure corporate governance runs smoothly. A shareholder agreement typically covers various aspects such as the shareholders' roles and responsibilities, voting rights, profit distribution, share transfer restrictions, and dispute resolution mechanisms. It helps set clear expectations and guidelines for shareholders' behavior, making it an essential document for any Indiana corporation. Different Types of Indiana Shareholder Agreements: 1. Voting Agreements: This type of agreement outlines the shareholders' voting rights and procedures. It may include provisions regarding voting percentages required for specific decisions, appointment of board members, or other corporate matters. 2. Buy-Sell Agreements: Buy-sell agreements dictate how shares can be bought or sold within the corporation. It establishes a process for shareholders to sell their shares and provides mechanisms for the corporation or other shareholders to buy those shares. 3. Rights of First Refusal Agreements: These agreements give existing shareholders the first opportunity to purchase shares that a shareholder intends to sell. It ensures that existing shareholders have the first right to acquire the shares before they are offered to third parties. 4. Employment Agreements: In some cases, shareholder agreements may include provisions related to employment within the corporation. These provisions define the roles, responsibilities, and compensation of shareholders who are also involved in the day-to-day operations of the company. 5. Confidentiality Agreements: Shareholder agreements often include confidentiality provisions to protect sensitive corporate information. This ensures that shareholders do not disclose or misuse confidential information obtained through their involvement in the corporation. 6. Non-Compete Agreements: Non-compete clauses may be included in shareholder agreements to prevent shareholders from engaging in similar business activities that could compete with the corporation. This protects the corporation's interests and prevents conflicts of interest. 7. Shareholder Dispute Resolution Agreements: These agreements establish processes for resolving disputes among shareholders, such as mediation or arbitration. They provide a mechanism for resolving conflicts without resorting to costly litigation. Indiana shareholder agreements are crucial for defining the relationship between shareholders and establishing the corporate governance framework. While there are several types of shareholder agreements, the specific content and provisions can vary depending on the individual circumstances and needs of the corporation. It is advisable to seek legal counsel to ensure that an Indiana shareholder agreement is tailored to meet the specific requirements of the corporation and fully compliant with Indiana state laws.

Indiana Shareholder Agreements - An Overview

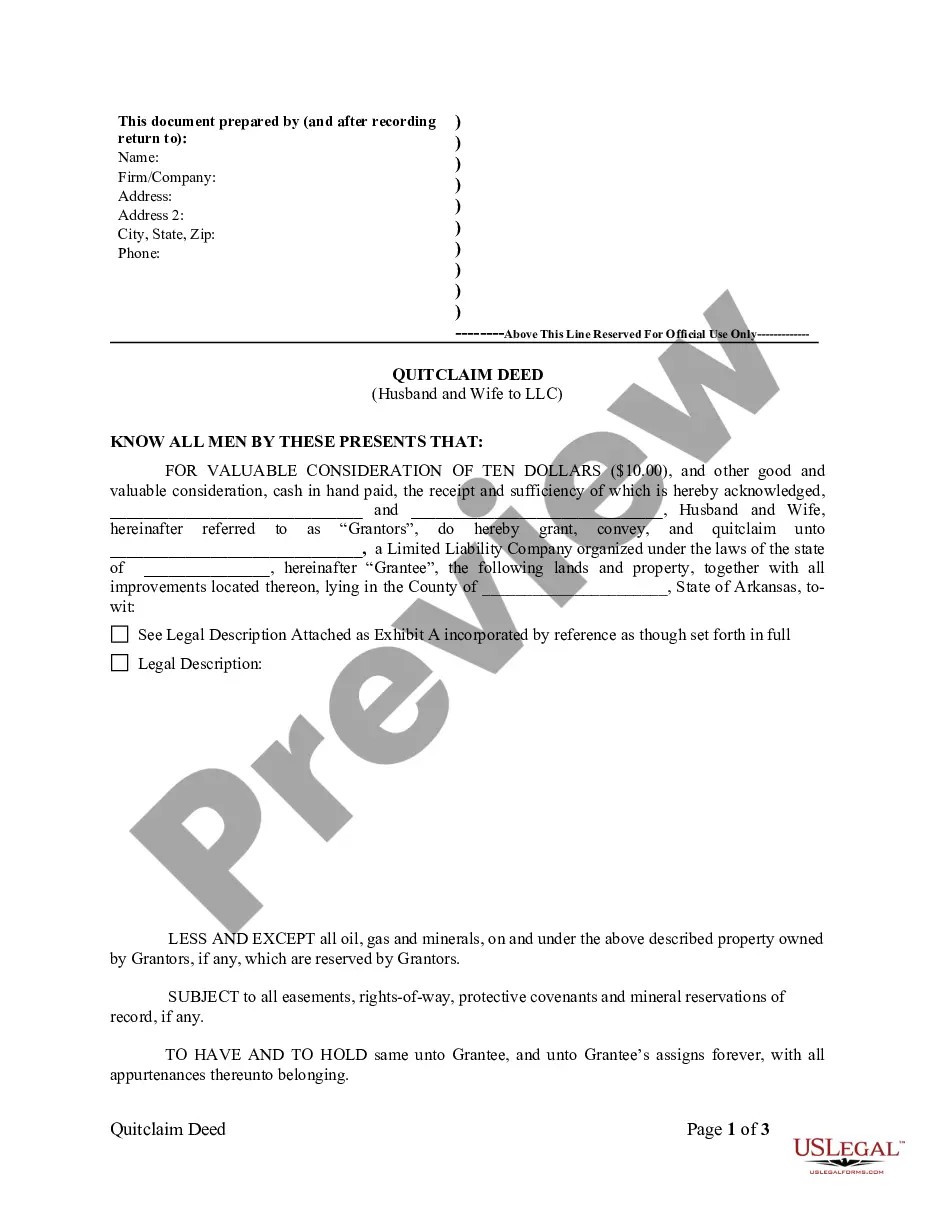

Description

How to fill out Indiana Shareholder Agreements - An Overview?

You may devote time on the Internet looking for the authorized record template which fits the federal and state needs you need. US Legal Forms supplies a large number of authorized varieties which are analyzed by specialists. It is simple to obtain or print the Indiana Shareholder Agreements - An Overview from our service.

If you already have a US Legal Forms profile, you are able to log in and then click the Down load switch. After that, you are able to complete, edit, print, or indicator the Indiana Shareholder Agreements - An Overview. Every authorized record template you purchase is the one you have forever. To obtain an additional version of the acquired kind, proceed to the My Forms tab and then click the related switch.

If you work with the US Legal Forms website initially, stick to the straightforward directions under:

- Initial, make sure that you have selected the correct record template to the state/town of your choice. Browse the kind information to make sure you have picked out the correct kind. If offered, use the Preview switch to look throughout the record template as well.

- If you want to find an additional variation in the kind, use the Research discipline to get the template that suits you and needs.

- After you have found the template you desire, click Get now to continue.

- Find the costs plan you desire, key in your qualifications, and sign up for an account on US Legal Forms.

- Full the transaction. You can utilize your bank card or PayPal profile to pay for the authorized kind.

- Find the structure in the record and obtain it to the product.

- Make modifications to the record if required. You may complete, edit and indicator and print Indiana Shareholder Agreements - An Overview.

Down load and print a large number of record layouts making use of the US Legal Forms website, which provides the largest variety of authorized varieties. Use professional and status-specific layouts to tackle your small business or person requirements.