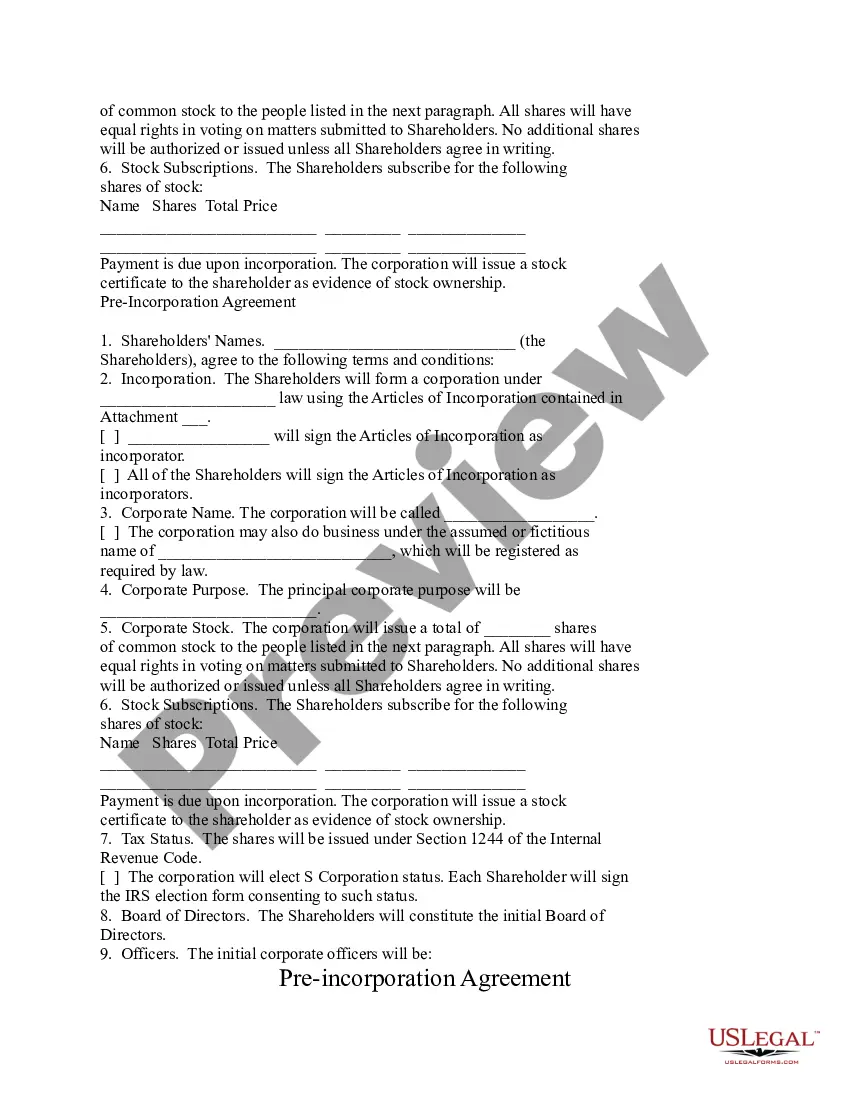

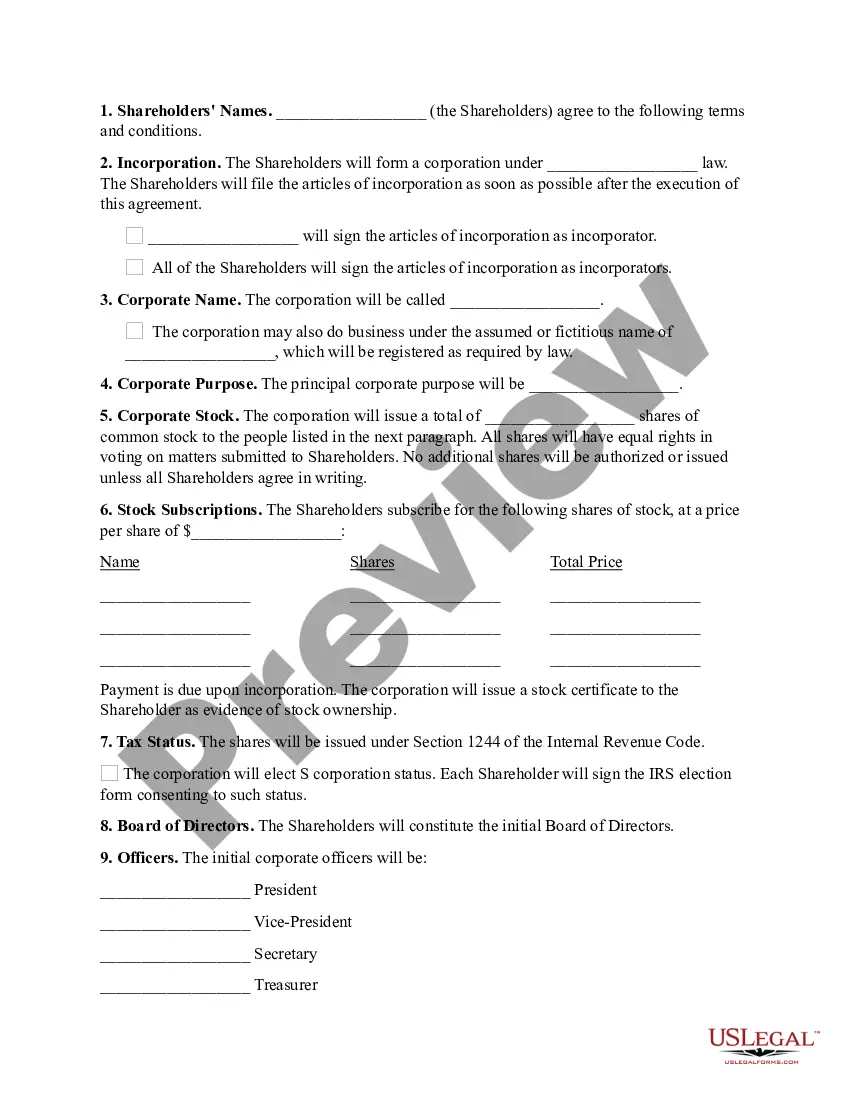

Indiana PRE Incorporation Agreement refers to a legal document that outlines the preliminary agreement between individuals or entities who are intending to establish a corporation in the state of Indiana. This agreement is drafted and signed before the formal incorporation process begins and serves as a blueprint for the future operation of the corporation. By detailing specific terms and conditions, the Indiana PRE Incorporation Agreement helps to avoid misunderstandings, conflicts, and uncertainties that may arise during the incorporation process. The primary purpose of the Indiana PRE Incorporation Agreement is to establish the rights, roles, and responsibilities of the future shareholders and directors of the corporation. It outlines key provisions such as the purpose and objectives of the corporation, its capital structure, decision-making processes, management framework, and any other important terms that the parties wish to include. There are different types of Indiana PRE Incorporation Agreements, which can vary depending on the specific needs and intentions of the parties involved. Some common types include: 1. Basic PRE Incorporation Agreement: This is a simple agreement that outlines the basic terms and conditions of incorporating the corporation. It typically covers essential aspects such as the purpose of the corporation, initial share allocation, and general management structure. 2. Detailed PRE Incorporation Agreement: This type of agreement provides a more comprehensive and detailed framework for the future corporation. It may include additional provisions such as restrictions on the transfer of shares, non-compete clauses, dispute resolution mechanisms, and specific obligations of the shareholders and directors. 3. Financial PRE Incorporation Agreement: This agreement focuses on financial aspects, such as capital contributions, ownership percentages, profit distributions, and fundraising strategies. It lays out the financial obligations and expectations of the parties involved, ensuring transparency and clarity. 4. Intellectual Property PRE Incorporation Agreement: If the corporation will rely heavily on intellectual property assets, this type of agreement defines the ownership, use, and protection of such assets. It may cover patents, trademarks, copyrights, trade secrets, and technology licenses. It is important to note that the specific terms and types of Indiana PRE Incorporation Agreements may vary depending on the unique circumstances of each corporation. Engaging a qualified attorney experienced in Indiana corporate law is crucial to ensure the agreement reflects the intentions and protects the interests of all parties involved.

Indiana Pre Incorporation Agreement

Description

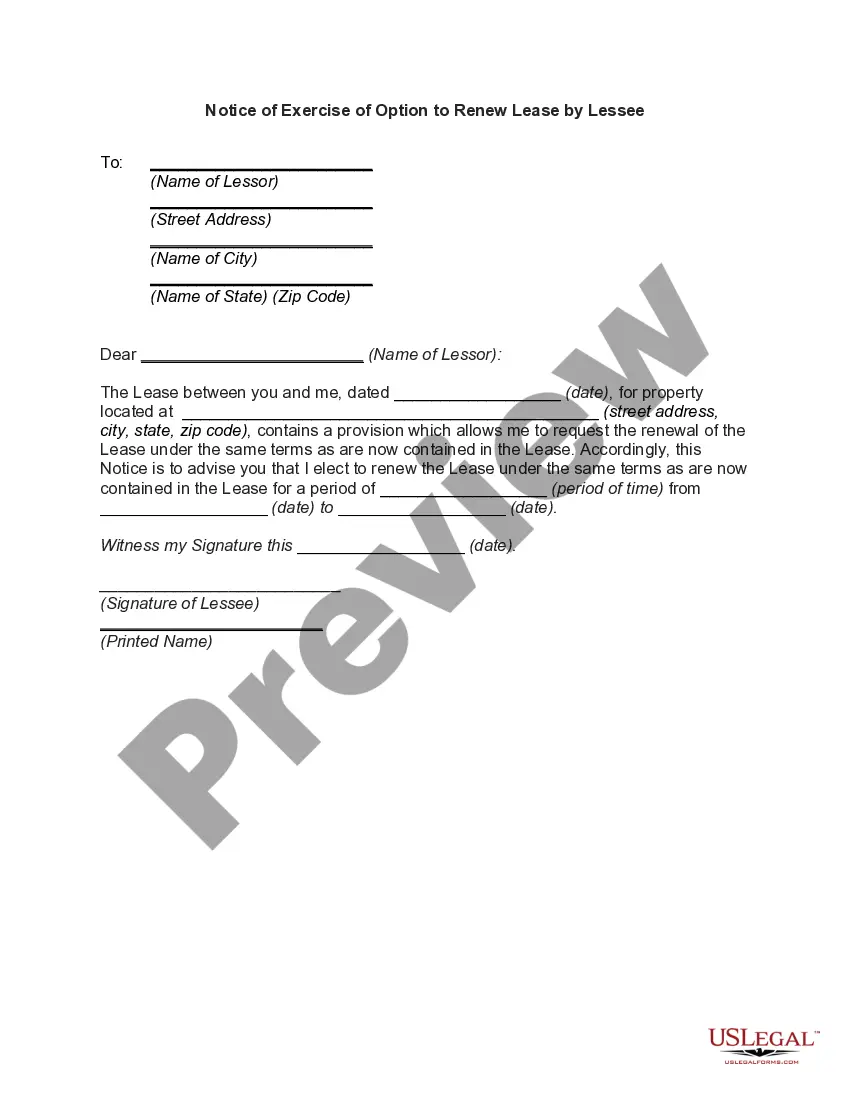

How to fill out Pre Incorporation Agreement?

You can invest time online trying to find the lawful record format which fits the federal and state needs you will need. US Legal Forms supplies thousands of lawful forms which are reviewed by experts. It is simple to down load or produce the Indiana Pre Incorporation Agreement from my support.

If you have a US Legal Forms bank account, you can log in and click the Obtain key. After that, you can total, change, produce, or signal the Indiana Pre Incorporation Agreement. Every lawful record format you purchase is your own property permanently. To obtain yet another version of the purchased form, visit the My Forms tab and click the corresponding key.

If you work with the US Legal Forms internet site for the first time, adhere to the simple recommendations listed below:

- Initially, be sure that you have selected the best record format for the region/town of your liking. Look at the form explanation to ensure you have chosen the correct form. If readily available, use the Preview key to check from the record format also.

- In order to find yet another edition from the form, use the Lookup discipline to discover the format that fits your needs and needs.

- When you have located the format you need, simply click Purchase now to proceed.

- Select the prices strategy you need, key in your accreditations, and register for your account on US Legal Forms.

- Full the deal. You should use your credit card or PayPal bank account to pay for the lawful form.

- Select the formatting from the record and down load it to your product.

- Make modifications to your record if possible. You can total, change and signal and produce Indiana Pre Incorporation Agreement.

Obtain and produce thousands of record layouts using the US Legal Forms web site, that provides the greatest selection of lawful forms. Use expert and condition-specific layouts to tackle your business or individual needs.

Form popularity

FAQ

The document required to form an LLC in Indiana is called the Articles of Organization. The information required in the formation document varies by state. Indiana's requirements include: Registered agent.

incorporation transaction3 is a transaction entered into by a person on. behalf of a corporation that does not yet exist (such person is often called the. ?promoter?4) with a party unrelated to the corporation (the ?third party?). In. other words, the corporation is not incorporated at the date of the entering ...

Business name and registration Register your business name with the county clerk where your business is located. If you are a corporation, you will also need to register with the Secretary of State.

To obtain a copy of Articles of Incorporation, go to the Indiana Secretary of State Business Page: and complete the following steps. 5. Click on Certified Copies Request - Here you will have the option to print or download your Articles free of charge.

Start a business in Indiana in 8 steps Come up with a business idea. Choose a business entity type. Determine your business model. Name your Indiana business. License and register your business in Indiana. Write your business plan. Secure business funding in Indiana. Create a business website.

Incorporate in Indiana Form and file your Indiana Articles of Incorporation. Pay the filing fee: $98 online, $100 by mail. Apply for a federal tax ID (EIN) Hold your organizational meeting and create bylaws. Open a bank account for your Indiana corporation. Register at Indiana's Department of Revenue.

Indiana Articles of Incorporation will ask you for your company's name and office address, registered agent information, authorized shares, and incorporators. Your Indiana corporation's name must include one of the following words or its abbreviation: Corporation, Incorporated, Company or Limited.

Starting an LLC in Indiana will include the following steps: #1: Choose a Name For Your Indiana LLC. #2: Choose a Registered Agent. #3: Decide Between a Multi-Member or Single-Member LLC. #4: File Your Articles of Organization. #5: Complete Other Tasks That Will Help Keep Your LLC Running.