Indiana First Meeting Minutes of Shareholders

Description

How to fill out First Meeting Minutes Of Shareholders?

Choosing the right lawful document template could be a struggle. Of course, there are plenty of layouts available online, but how will you get the lawful kind you will need? Make use of the US Legal Forms internet site. The services gives thousands of layouts, such as the Indiana First Meeting Minutes of Shareholders, which you can use for enterprise and personal demands. All the varieties are checked out by specialists and meet up with federal and state demands.

Should you be previously listed, log in in your profile and click on the Download option to have the Indiana First Meeting Minutes of Shareholders. Make use of your profile to search from the lawful varieties you may have acquired previously. Check out the My Forms tab of your respective profile and have yet another version from the document you will need.

Should you be a whole new consumer of US Legal Forms, listed below are easy recommendations for you to stick to:

- Initial, make sure you have selected the correct kind for your personal town/area. You are able to check out the form while using Preview option and study the form outline to ensure it is the right one for you.

- In case the kind will not meet up with your needs, utilize the Seach area to obtain the proper kind.

- Once you are certain the form is acceptable, click the Purchase now option to have the kind.

- Opt for the rates prepare you want and enter the essential details. Build your profile and pay money for the transaction making use of your PayPal profile or credit card.

- Pick the document formatting and obtain the lawful document template in your system.

- Full, modify and printing and signal the acquired Indiana First Meeting Minutes of Shareholders.

US Legal Forms will be the most significant local library of lawful varieties for which you can see numerous document layouts. Make use of the service to obtain appropriately-produced paperwork that stick to express demands.

Form popularity

FAQ

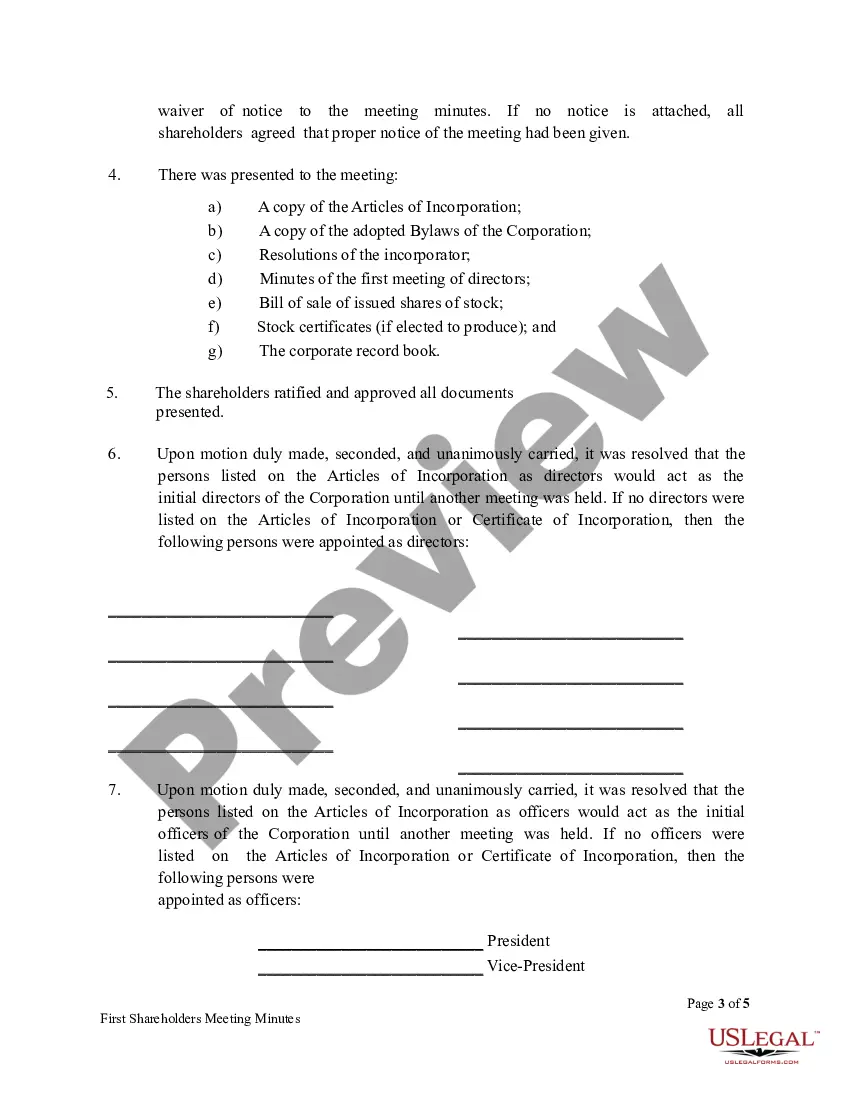

As for content, in general, your S corporation's meeting minutes should contain the following information: date and place of the meeting. who was present and who was absent from the meeting. details about the matters discussed at the meeting. results of votes taken, if any.

Board of Directors (or ?the Board?) and shareholder minutes and written consents are your official, legal records of what was discussed at Board and shareholder meetings and of their decisions.

One of the most important topics that a first shareholder meeting goes over is the issuance of shares. The value of shares is agreed upon, the value of any assets being exchanged for shares is agreed upon, and and shareholders are issued shares with a bill of sale or certificate of stock.

How to write meeting minutes reports Make an outline. Prior to the meeting, create an outline by picking or designing a template. ... Include factual information. ... Write down the purpose. ... Record decisions made. ... Add details for the next meeting. ... Be concise. ... Consider recording. ... Edit and proofread.

What should be recorded in meeting minutes? The minutes should include corporation details like the name of the corporation and the names of the chairperson and secretary of the meeting. The meeting place and time should also be found somewhere in the minutes, along with the names of the shareholders.

The minutes of the first board meeting of a limited company are a written record of the proceedings of the very first meeting held by the directors.

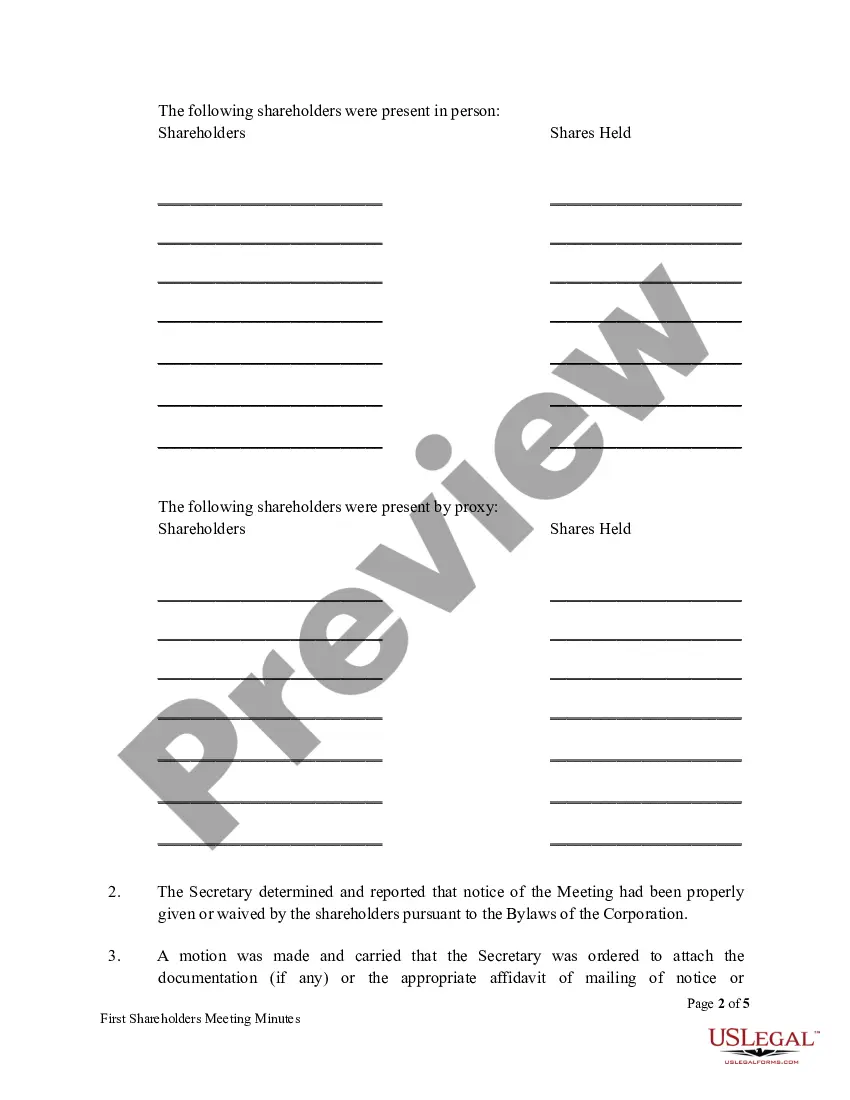

Taking Attendance Prepare a list of shareholders who were present and those who were not present. Take a roll call of all shareholders present in the meeting. Record the names and signatures of the shareholders present in the meeting. Ask for proxies for any shareholders who are not present.