Indiana Writ of Execution

Description

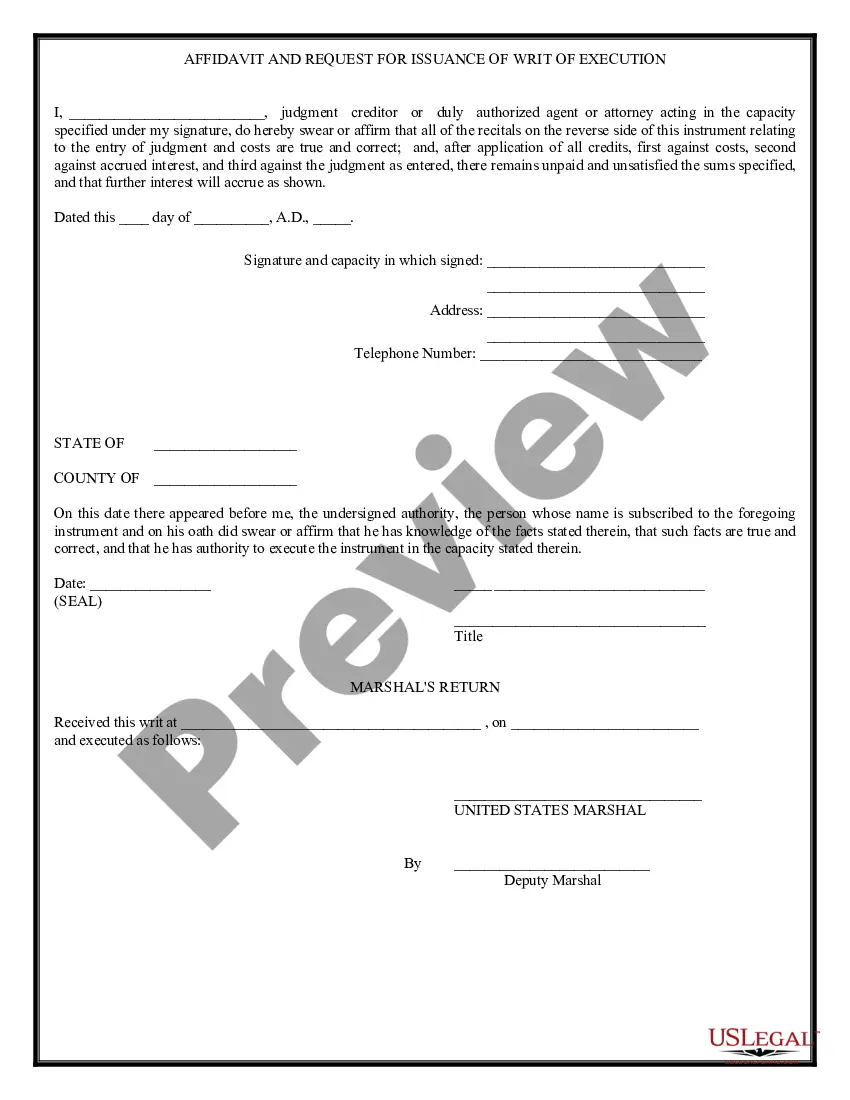

How to fill out Writ Of Execution?

US Legal Forms - one of many biggest libraries of legitimate kinds in the United States - offers a variety of legitimate file themes it is possible to down load or printing. Utilizing the website, you may get 1000s of kinds for organization and individual uses, categorized by types, states, or keywords and phrases.You can find the most recent variations of kinds much like the Indiana Writ of Execution in seconds.

If you already possess a monthly subscription, log in and down load Indiana Writ of Execution from the US Legal Forms collection. The Down load button will show up on each and every type you view. You gain access to all in the past delivered electronically kinds in the My Forms tab of your respective profile.

If you would like use US Legal Forms initially, listed below are simple guidelines to help you get started:

- Make sure you have picked out the best type for your city/area. Click on the Preview button to review the form`s content material. Look at the type outline to ensure that you have chosen the appropriate type.

- When the type does not satisfy your demands, utilize the Research field towards the top of the display to get the the one that does.

- When you are satisfied with the form, confirm your decision by simply clicking the Acquire now button. Then, pick the rates strategy you want and offer your qualifications to sign up to have an profile.

- Process the purchase. Make use of your credit card or PayPal profile to perform the purchase.

- Find the formatting and down load the form in your system.

- Make alterations. Fill up, modify and printing and indicator the delivered electronically Indiana Writ of Execution.

Each template you added to your money does not have an expiration date and is your own property forever. So, in order to down load or printing an additional version, just visit the My Forms segment and then click around the type you need.

Get access to the Indiana Writ of Execution with US Legal Forms, probably the most extensive collection of legitimate file themes. Use 1000s of expert and status-distinct themes that satisfy your business or individual demands and demands.

Form popularity

FAQ

To collect money from the other side's bank account or their paycheck, you first need a filed Writ of Execution from the court. This tells the sheriff to go to the other side's bank or employer and have them give the sheriff money from the other side's bank account or paycheck to give to you.

A writ of attachment demands the creditor's property prior to the outcome of a trial or judgment, whereas a writ of execution directs law enforcement to begin the transfer of property as the result of the conclusion of a legal judgment.

Seizure of Person or Property (A)Ancillary Remedies to Assist in Enforcement of Judgment. ? (4) Effective September 1, 2020, a writ of attachment for a person expires one hundred eighty (180) days after it is issued and the expiration date shall appear on the face of the writ.

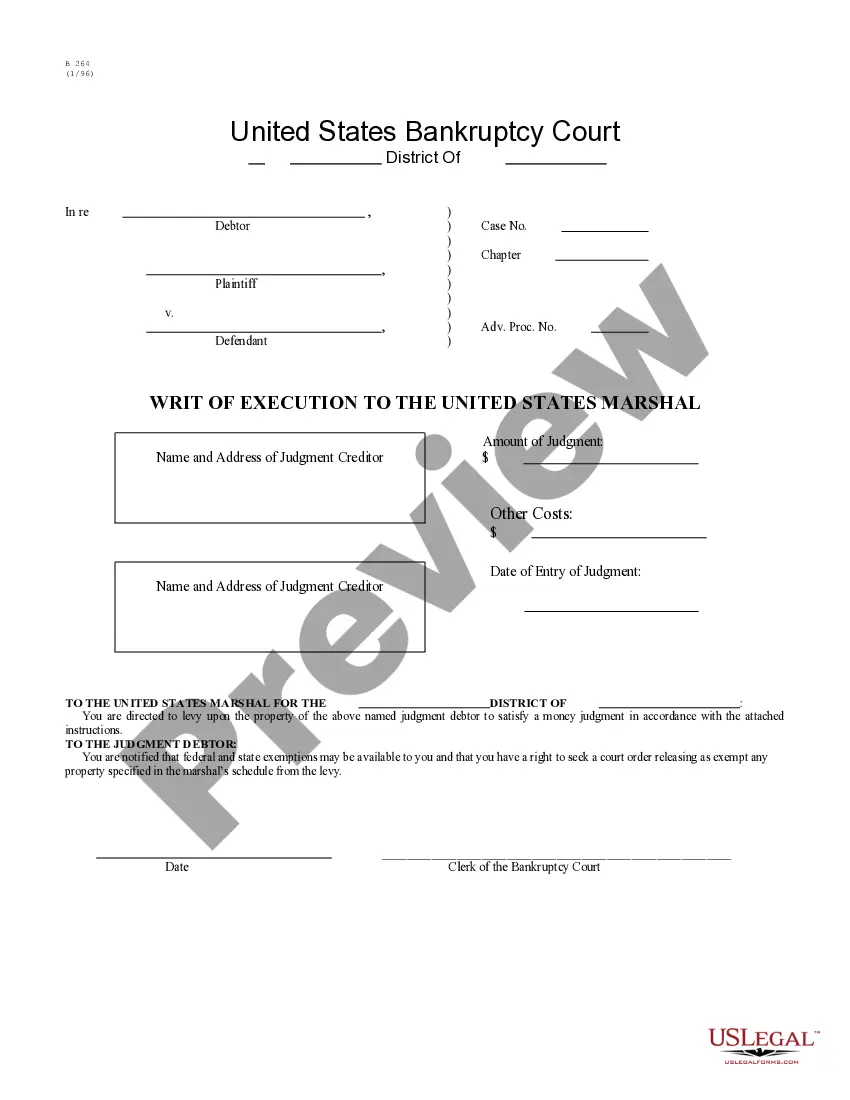

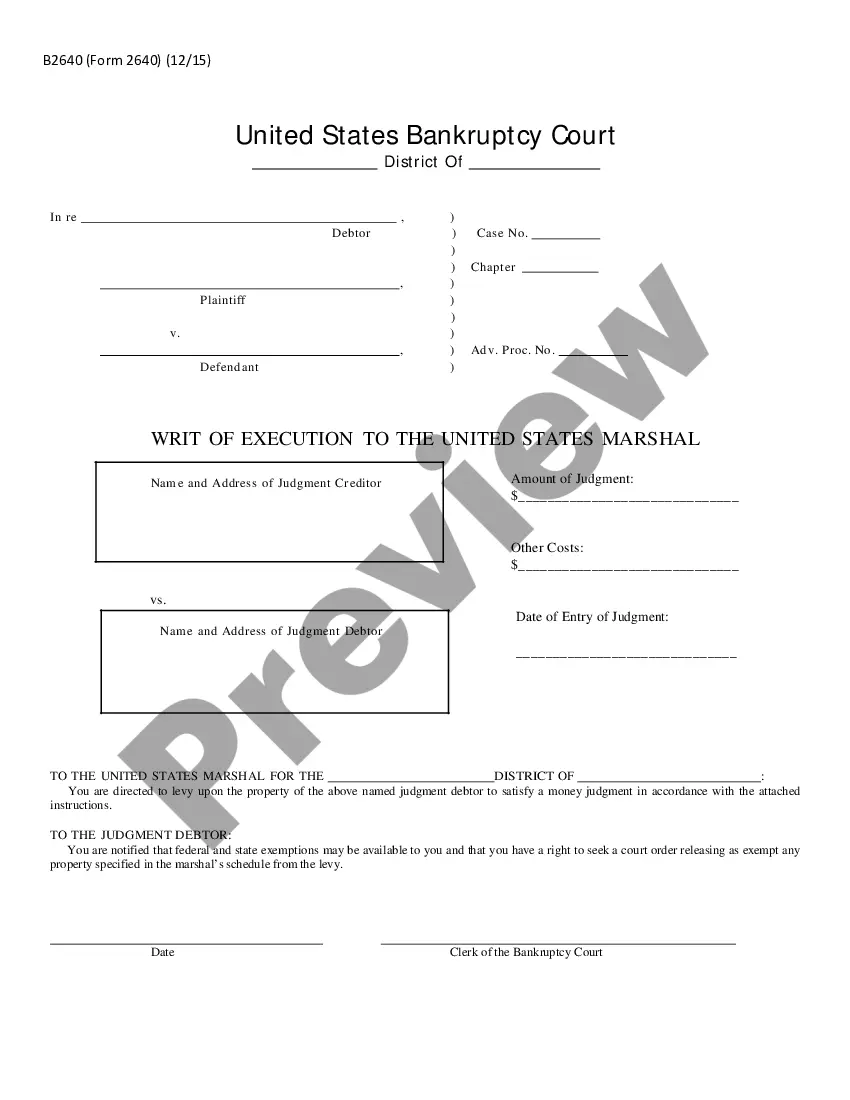

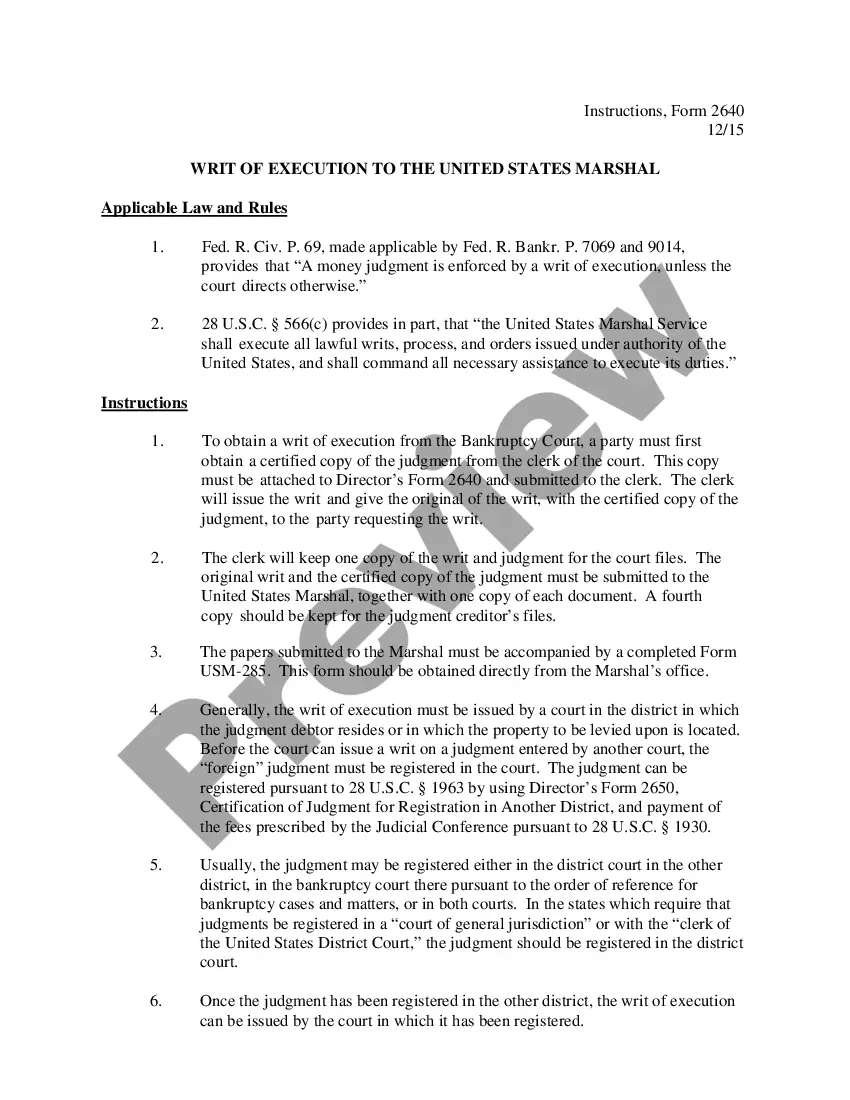

A writ of execution is a process issued by the court directing the U.S. Marshal to enforce and satisfy a judgment for payment of money. (Federal Rules of Civil Procedure 69).

A writ of attachment demands the creditor's property prior to the outcome of a trial or judgment, whereas a writ of execution directs law enforcement to begin the transfer of property as the result of the conclusion of a legal judgment.

A writ of execution is a process issued by the court directing the U.S. Marshal to enforce and satisfy a judgment for payment of money. (Federal Rules of Civil Procedure 69).

Terms: Execution of Judgment: Execution refers to an official document that directs a sheriff to take possession of a judgment debtor's property so that it either (a) may be turned over to the judgment creditor or (b) may be sold at public sale so that the proceeds may be turned over to the judgment creditor.

Federal Rule of Civil Procedure 69(a) states, ?In aid of the judgment or execution, the judgment creditor or a successor in interest whose interest appears of record may obtain discovery from any person?including the judgment debtor?as provided in these rules or by the procedure of the state where the court is located. ...