Indiana Recovery Services Contract - Self-Employed

Description

How to fill out Indiana Recovery Services Contract - Self-Employed?

US Legal Forms - one of several greatest libraries of legal forms in the United States - gives a wide array of legal file layouts you can acquire or print out. Utilizing the web site, you may get 1000s of forms for company and person reasons, categorized by classes, states, or search phrases.You will find the newest models of forms much like the Indiana Recovery Services Contract - Self-Employed in seconds.

If you already possess a monthly subscription, log in and acquire Indiana Recovery Services Contract - Self-Employed through the US Legal Forms library. The Acquire option can look on each kind you perspective. You have access to all in the past saved forms inside the My Forms tab of your respective profile.

If you want to use US Legal Forms for the first time, here are straightforward directions to get you started:

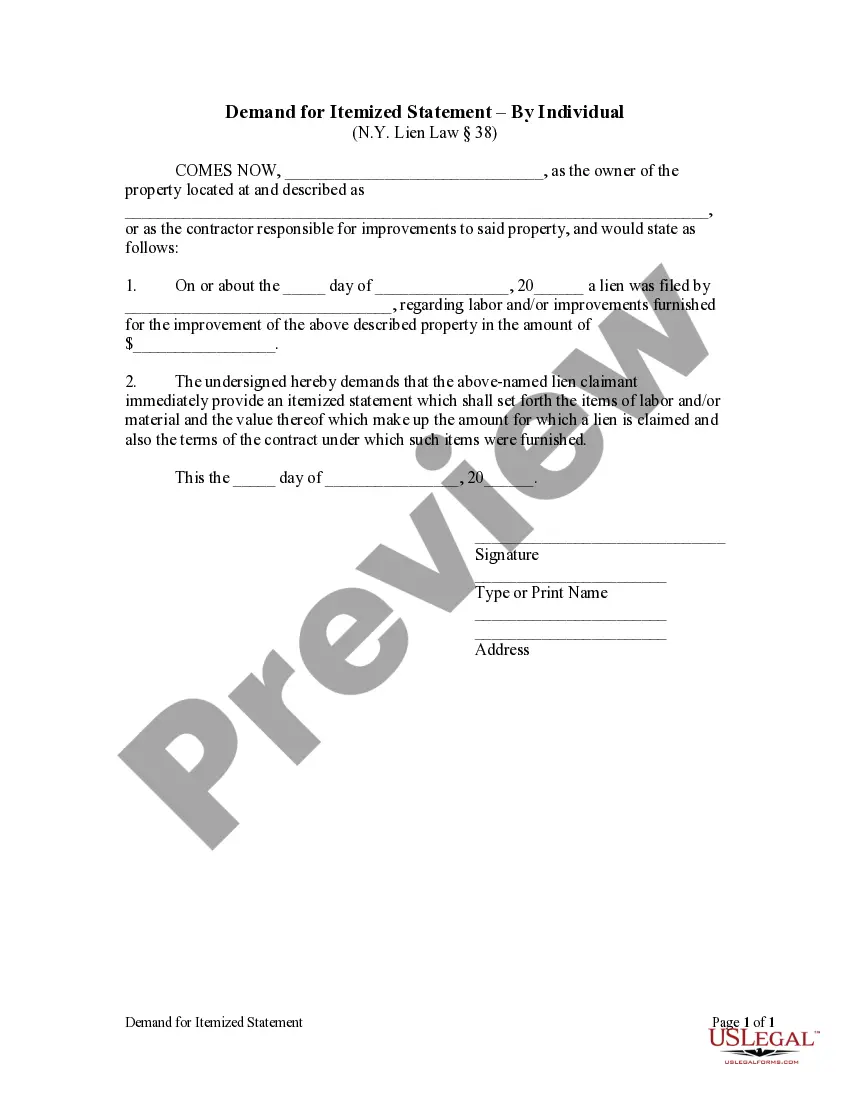

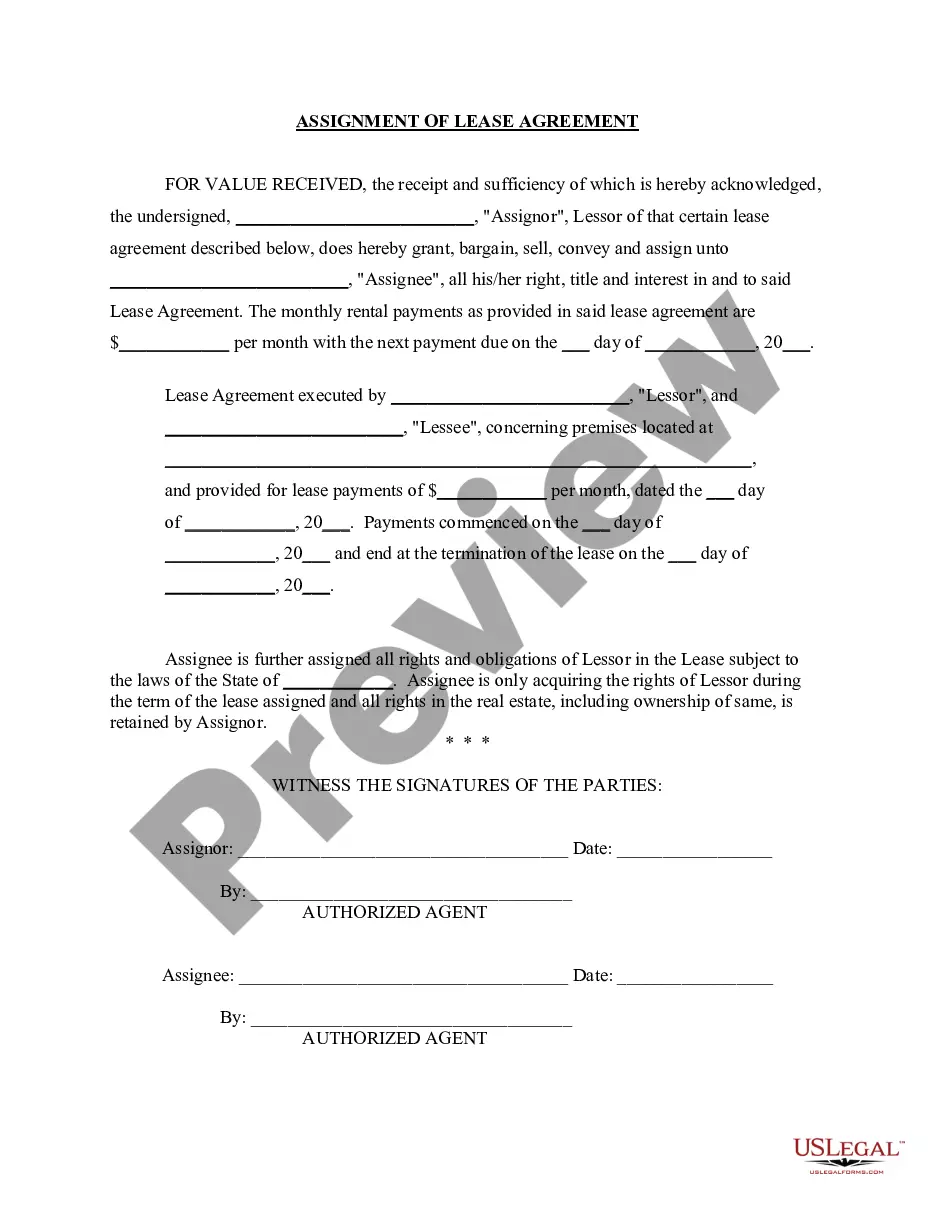

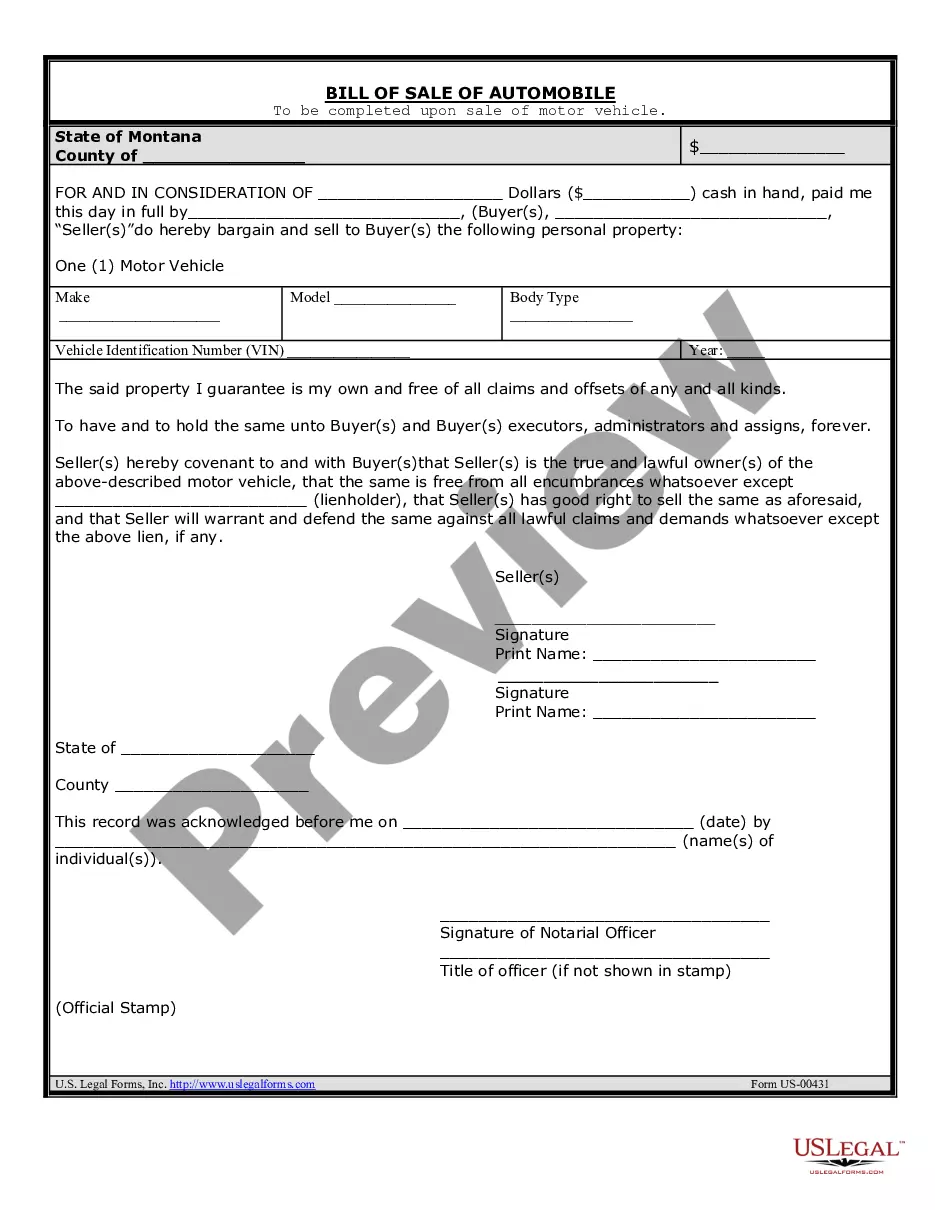

- Be sure to have selected the correct kind for your area/county. Select the Preview option to examine the form`s articles. Browse the kind description to actually have chosen the right kind.

- If the kind does not match your needs, use the Research discipline near the top of the monitor to discover the one who does.

- In case you are happy with the shape, validate your selection by clicking on the Purchase now option. Then, pick the pricing strategy you like and provide your credentials to sign up to have an profile.

- Process the transaction. Make use of charge card or PayPal profile to perform the transaction.

- Pick the structure and acquire the shape on your device.

- Make adjustments. Complete, modify and print out and indicator the saved Indiana Recovery Services Contract - Self-Employed.

Every web template you included in your bank account does not have an expiry time and is your own eternally. So, if you want to acquire or print out an additional duplicate, just proceed to the My Forms portion and then click in the kind you require.

Gain access to the Indiana Recovery Services Contract - Self-Employed with US Legal Forms, one of the most substantial library of legal file layouts. Use 1000s of expert and status-particular layouts that satisfy your small business or person requirements and needs.

Form popularity

FAQ

An employee who receives a 1099 form is viewed as a contractor in the eyes of the IRS. These employees are also viewed as their own business owners; they contract out their work at a certain rate.

An independent contractor agreement is a legally binding document signed by a 1099 employee and the company that hires them. It outlines the scope of work and the terms under which that work will be completed, which goes a long way to making sure both parties are on the same page about the project from the start.

This agreement should clearly state what tasks the contractor is to perform. The agreement will also include what tasks will be performed and how much the contractor will be paid for his or her work. A contractor agreement can also help demonstrate that the person is truly an independent contractor and not an employee.

Write the contract in six stepsStart with a contract template.Open with the basic information.Describe in detail what you have agreed to.Include a description of how the contract will be ended.Write into the contract which laws apply and how disputes will be resolved.Include space for signatures.

How to write an employment contractTitle the employment contract.Identify the parties.List the term and conditions.Outline the job responsibilities.Include compensation details.Use specific contract terms.Consult with an employment lawyer.

What should be included in a Contractor Agreement?Statement of Relationship.Project Description.Payment and Billing Terms.Responsibilities of Each Party.Project Timeline and Deadlines.Termination Conditions.Nondisclosure Terms, and Confidentiality and Non-Compete Clauses.

The contract should state who pays which expenses. The contractor is usually responsible for all expenses including mileage, vehicle maintenance, and other business travel costs; work supplies and tools; licenses, fees, and permits; phone and internet expenses; and payments to employees or subcontractors.

It seems obvious, but make sure that you include in the contract the contractor's name, physical address, phone number, insurance company and account and license numbers.

What should be included in a Contractor Agreement?Statement of Relationship.Project Description.Payment and Billing Terms.Responsibilities of Each Party.Project Timeline and Deadlines.Termination Conditions.Nondisclosure Terms, and Confidentiality and Non-Compete Clauses.

How do I create an Independent Contractor Agreement?State the location.Describe the type of service required.Provide the contractor's and client's details.Outline compensation details.State the agreement's terms.Include any additional clauses.State the signing details.