Indiana Pump Installation And Repair Services Contract - Self-Employed

Description

How to fill out Indiana Pump Installation And Repair Services Contract - Self-Employed?

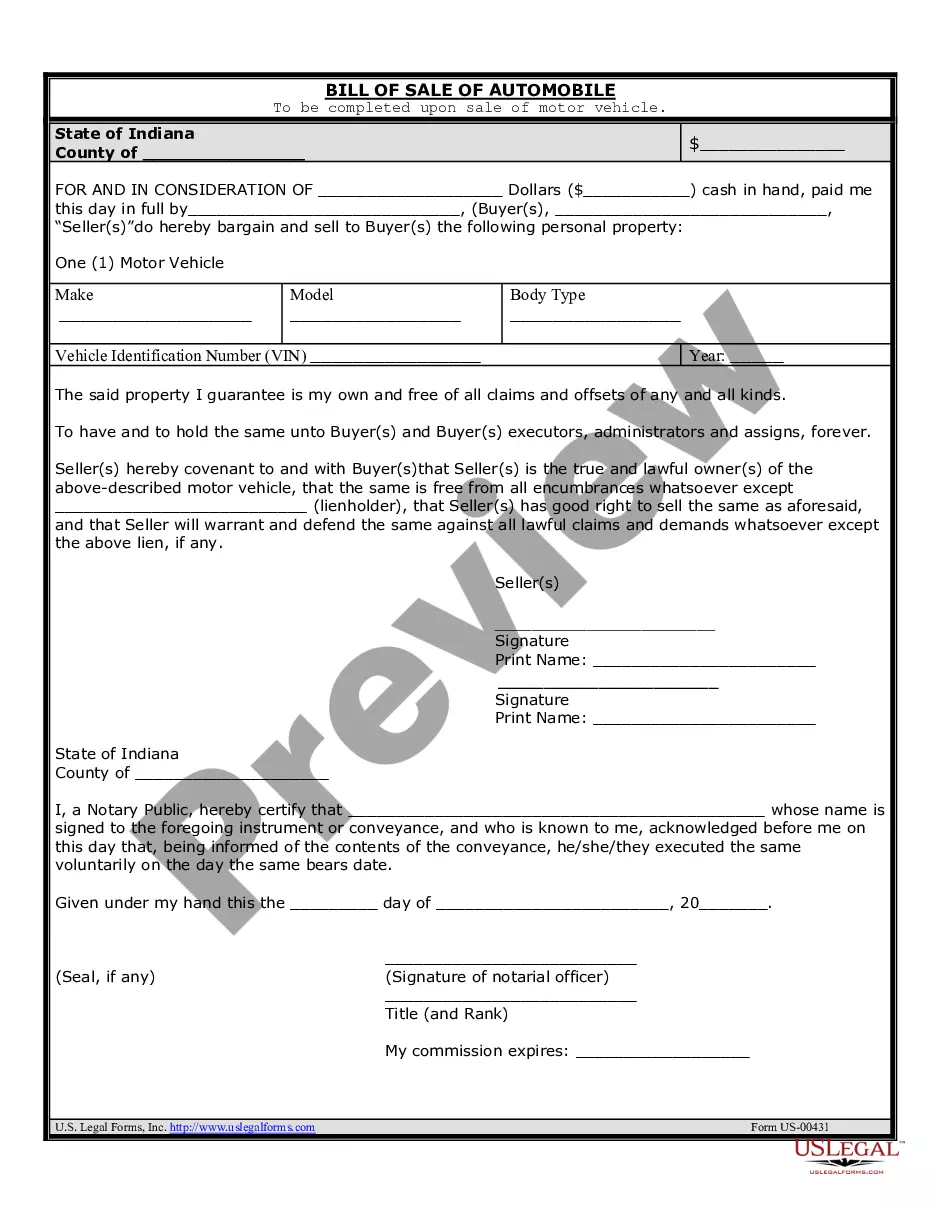

Finding the right legal file web template can be a have difficulties. Of course, there are a lot of themes available online, but how would you obtain the legal kind you require? Use the US Legal Forms internet site. The assistance gives 1000s of themes, like the Indiana Pump Installation And Repair Services Contract - Self-Employed, that you can use for company and private demands. All of the kinds are checked by experts and satisfy federal and state specifications.

When you are already authorized, log in for your accounts and click the Acquire key to have the Indiana Pump Installation And Repair Services Contract - Self-Employed. Make use of accounts to check with the legal kinds you may have ordered previously. Visit the My Forms tab of the accounts and obtain another duplicate in the file you require.

When you are a new consumer of US Legal Forms, listed here are easy directions so that you can comply with:

- First, ensure you have chosen the proper kind for the area/region. You may look over the form using the Preview key and browse the form explanation to make sure this is the best for you.

- In the event the kind is not going to satisfy your needs, use the Seach field to discover the appropriate kind.

- When you are sure that the form is proper, select the Get now key to have the kind.

- Select the rates prepare you need and type in the essential info. Make your accounts and buy an order with your PayPal accounts or charge card.

- Opt for the file format and down load the legal file web template for your product.

- Total, revise and printing and indication the attained Indiana Pump Installation And Repair Services Contract - Self-Employed.

US Legal Forms is definitely the greatest catalogue of legal kinds where you can find numerous file themes. Use the company to down load expertly-produced papers that comply with express specifications.

Form popularity

FAQ

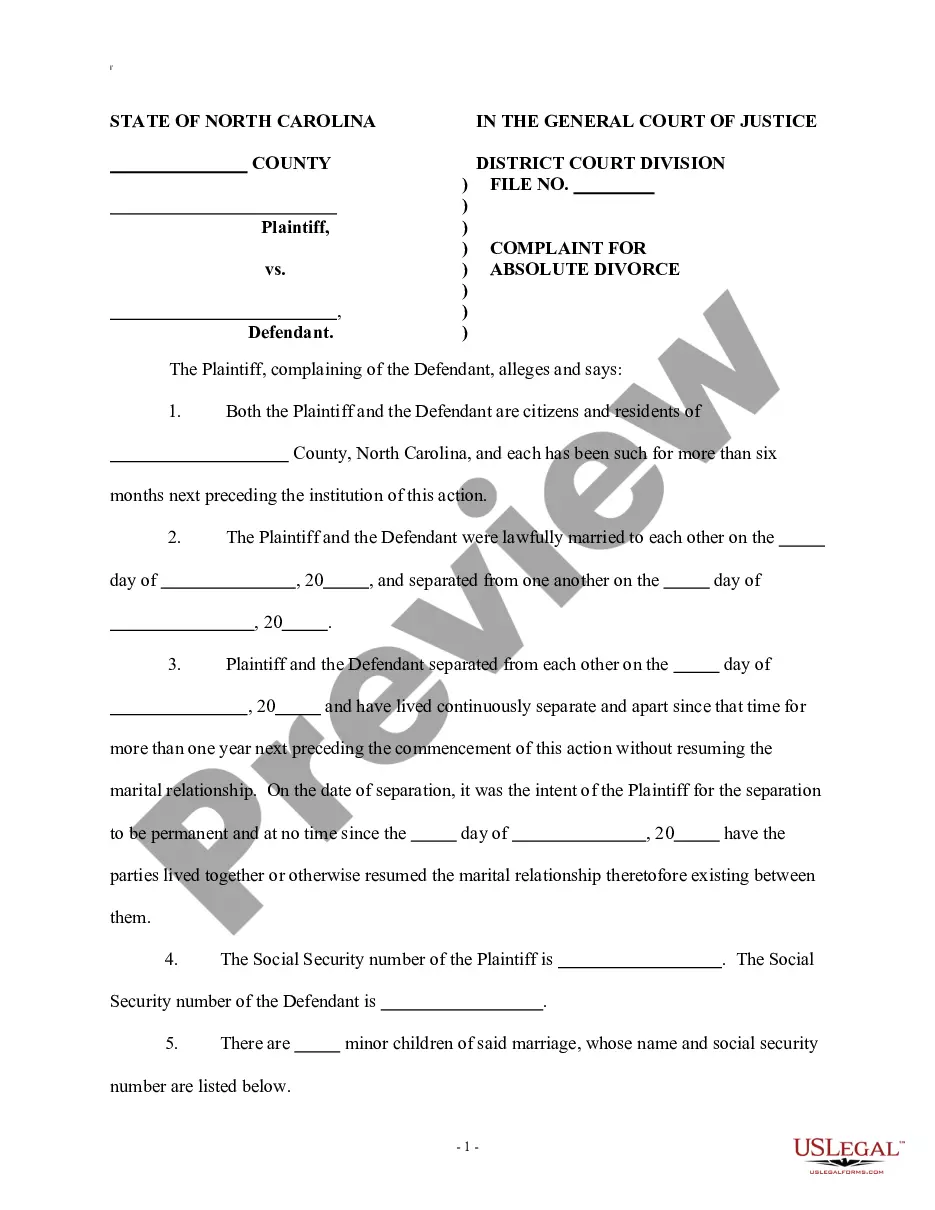

Simply put, being an independent contractor is one way to be self-employed. Being self-employed means that you earn money but don't work as an employee for someone else.

A 1099 employee is a US self-employed worker that reports their income to the IRS on a 1099 tax form. Freelancers, gig workers, and independent contractors are all considered 1099 employees.

The law does not require you to complete a contract with your self-employed or freelance workers - a verbal contract can exist even when there is nothing in writing.

If you are an independent contractor, then you are self-employed. The earnings of a person who is working as an independent contractor are subject to self-employment tax. To find out what your tax obligations are, visit the Self-Employed Individuals Tax Center.

employed person does not work for a specific employer who pays them a consistent salary or wage. Selfemployed individuals, or independent contractors, earn income by contracting with a trade or business directly.

Subcontractor vs Independent contractor is a difference in an employment relationship with a laborer. Independent contractors are employed and paid directly by the employer while subcontractors are employed by an independent contractor and are paid by them.

Independent contractors and subcontractors are both considered self-employed by the IRS. Both are responsible for making quarterly tax payments including self-employment tax.

Contractors can also be self-employed, but they perform tasks on a contractual basis, rather than selling any products or rolling, bookable services. For example, a plumber would work for a client according to an agreed, one-off contract.

Independent contractors are self-employed workers who provide services for an organisation under a contract for services. Independent contractors are not employees and are typically highly skilled, providing their clients with specialist skills or additional capacity on an as needed basis.

A 'self-employed contractor' is a person who is genuinely in business for themselves (ie s/he takes responsibility for the success or failure of the business) and is neither an employee nor a worker.